This is an updated version of my previous post (thanks for feedback guys!)

Make $252 in January with your Citi Dividend Platinum Select Credit Card

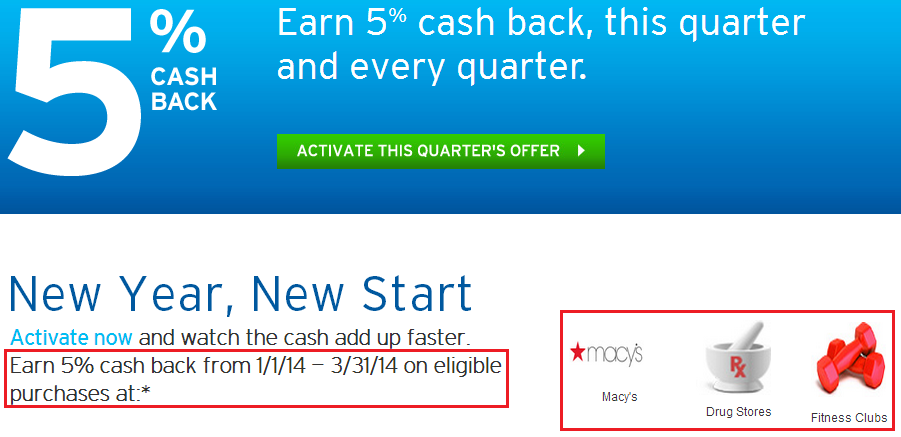

My new Citi Dividend Platinum Select credit card will come in handy in January. For that quarter, I will get 5% cash back at Macy’s, Drug Stores, and Fitness Clubs. Unlike the Discover It and Chase Freedom credit cards, there is no quarterly spending cap (like the first $1,500 spent per quarter).

The last time I checked (10 minutes ago), CVS Pharmacy’s were classified as Drug Stores.

By my calculations, if you buy 12 Vanilla Reload Cards at CVS, you will max out the $300 annual cash back limit for your card. Subtracting the activation fees of $47.40 (12 x $3.95 = $47.40), you make a net profit of $252. Not too shabby for a no annual fee card.

| # VRC | Amount | Act. Fee | Total Charge | 5% Cash Back | Cash Back – Act. Fee |

| 1 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 2 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 3 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 4 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 5 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 6 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 7 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 8 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 9 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 10 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 11 | $500.00 | $3.95 | $503.95 | $25.20 | $21.25 |

| 12 | $452.60 | $3.95 | $456.55 | $22.83 | $18.88 |

| $300.00 | $252.60 |

To learn more about the benefits of rotating cash back category credit cards, please check out this page. If you have any questions, please leave a comment below.

I wish there was a credit card that offers a category bonus for drugstores all the time.

Don’t we all… That would be awesome!

Hey Grant just wanted to make a clarification. I’ve had the Dividend card for a while, and according to their TOS, they don’t have a $1,500 per quarter limit like other cards do (Freedom, Discover It etc). What they do have is a 300 “dividend dollars” limit per year, which is essentially $1,500 of spend per quarter BUT the dividend card doesn’t have the greatest of categories each quarter (example Macys and fitness clubs which are terrible bonus categories). So you can reach that limit much earlier with a great category.

My Dividend card right now has 5% bonus categories on gas, groceries and drugstores (which is absolutely amazing since I spend most of my money on those categories.) I’ve already made $200 cashback just since october and will try to get to the $300 max by the end of the year with a few vanilla reloads.

Drugstores one is one of the best categories they have, so you could technically max out your $300 limit at drugstores with vanilla reloads in January. I would recommend at least getting close to the max for the drugstore category since they might not have good categories like that in the future.

Thank you for sharing Syed, I’m glad you have had the dividend card for a longer time and have figured out Citi’s payout scheme. I will try to purchase more than $1,500 in VRCs in January and see if I earn more than $75 in cash back. If it shows more than $75, I will probably max it out before the end of March.

Hi Grant,

How do you check which stores are classified as drug stores? I would like to check if Walgreens is in the category since we do not have CVS nearby:(

Use this link: https://www.visa.com/supplierlocator/index.jsp

Enter Walgreens as the merchant and your zipcode. Maybe I will write up a post about the merchant finder.

great! Thanks!

I’m looking forward to using my Citi Dividend card whenever Citi decides to mail it to me. Hopefully it will arrive sometime this year.

Nice! I’ll have to look at getting this card in the future. My 2 local CVS are out of VR cards right now, so I have to look to make other plays to create spend.

You can also buy $500 Visa gift cards at CVS for a bit more money.

So there is a quarterly spending cap of $6K which also happens to be a yearly cap as well, right?………….assuming there’s a $300 cash back limit.

It’s a yearly cap on cash back which could probably be reached in the first few weeks of January. Other people that have had the Citi Dividend card longer than I have, say there is no quarterly cap, just a $300 annual cash back cap.

Some really good info. Glad I found your site!

Thanks Suzy, I appreciate the comment. Happy holidays!

Do you have a link for the credit card where you get credit? Would use your link if you do.

I used to have credit card affiliate links, but unfortunately for me, am no longer allowed to by creditcards.com. I would use Frequent Milers credit card link if he has it, or just apply on Citi’s website.

I always thought that gift card puchases did not qualify for points. Thought they were seen by Citi as cash advances. Hope I am wrong.

As far as Citi knows, a $500 purchase at CVS is just another $500 purchase (be that gift cards, cold medicine, or toothbrushes). You will always get miles/points for in-store purchases. Just be careful buying gift cards online with your Citi card.

@Raul Yes, you might be right, but hoping you are wrong.

@Grant Good to know. Right, its for online gift card purchases with Citi cards.

If you are worried about cash advance fees, call Citi and have them lower your cash advance limit to $0.

Hey Grant are you familiar with citi’s blue card? I received a pre-qualified offer for one and after a little research I found they offer a preferred version of the card with 6% cash back on groceries up to $6000 a year. Down side is a $75 annual fee but did come with $150 sign up bonus to offset.

Are you sure it is from Citi? Sounds like the American Express Blue Cash Preferred credit card. I currently have that card and love the 6% cash back on grocery store purchases.

Oops ur right its an american express. Just ordered last night and can’t wait to put it to use. Any othersimilar cards u would recommend? I have citi’s dividen, chase ink, and chase freedom

I would look at the Discover It card if you are looking for cash back cards.

Almost forgot to mention it comes with a year of amazon prime after meeting minimum spending

Pingback: What's on my Mind? CES in Las Vegas, Napa Valley, San Francisco, ABC Gift Cards, 2 Free Movie Screenings, SWA Customer Service, Club Carlson Forex Fees, Citi Dividend, and Staples Easy Rebate Headaches | Travel with Grant

Thank you for sharing the info. But is there any risk buying that many Vanilla reloads? I heard that banks are getting sensitive to high balance Vanilla reloads. Is that true?

There is some risk, but if you go slow and don’t buy $5000 in one day you should be okay.

Pingback: PayPal Debit Card does not Earn Cash Back with Evolve Money | Travel with Grant

Pingback: Almost to $300 Cash Back with my Citi Dividend Credit Card | Travel with Grant

any luck with buying VRC’s at Valero using a rotating card that has 5% at gas stations for that quarter? like Chase Freedom now?

It’s worth a shot. I’ve had bad luck in SoCal finding gas stations that have gift cards larger than $100

Pingback: How to Request a Citi Dividend Cash Back Check | Travel with Grant