March App-O-Rama Thoughts: Hawaiian Airlines (35,000 Miles), Discover It ($150 Cash Back), Barclays Arrival ($440 Cash Back), Chase Ink Bold Visa (50,000 UR Points), Citi AA Executive (100,000 Miles), and US Bank Olympics Flex Points ($400+ Travel Credit)

Wow, what a title. I expect my Google Search traffic to go through the roof now. Anyways, my last app-o-rama was in early November (post), how I upgraded an AMEX Hilton HHonors to an AMEX Hilton HHonors Surpass (post), and my surprise approval of an AMEX Mercedes Benz Platinum card (post). If you want to see which 19 cards I currently have open, check out this list.

Since I typically wait at least 3 months between App-O-Ramas, I am starting to plan for my next round of credit card applications. Here is what is on my mind:

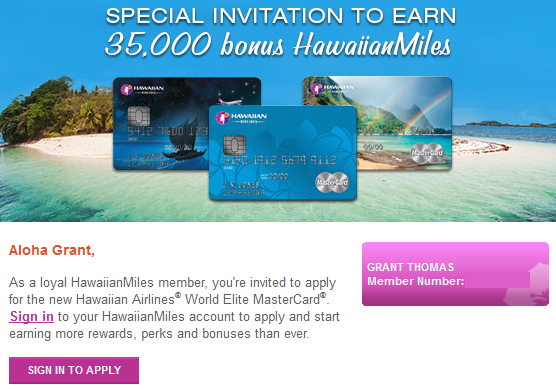

1 – Barclays Hawaiian Airlines Credit Card – 35,000 Hawaiian Airlines miles after spending $1,000 in 3 months

I’m not sure if this is a coincidence or if they were reading my mind, but I literally got this email 2 hours ago. Unfortunately (for me), this card is no longer issued by Bank of America. Barclays is now the credit card issuer. Barclays has never approved me for a card, so I have approximately a 1% chance of be approved.

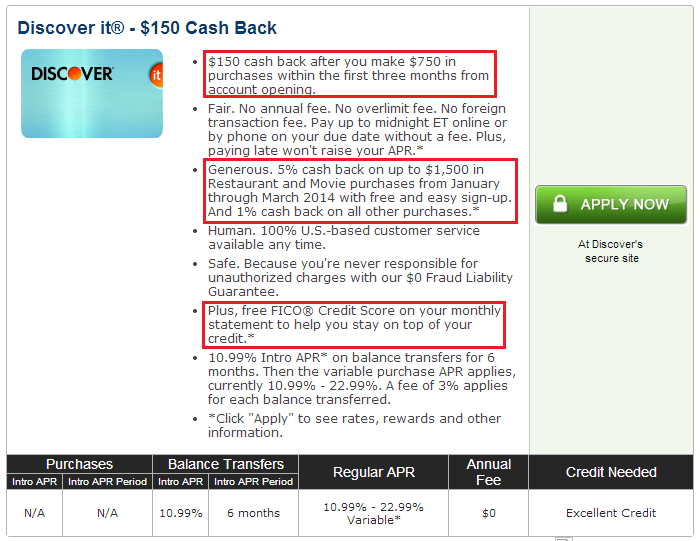

2 – Discover It Credit Card – $150 cash back after spending $750 in 3 months

I have been waiting for a decent sign up bonus of this card and I finally have a chance to get it. $750 in 3 months is so easy, I don’t even have to get out of bed to do that. This card will complete my trifecta of rotating cash back cards. I already have the Chase Freedom and Citi Dividend credit cards, so now all I need is the Discover It. Learn about all 3 cards here.

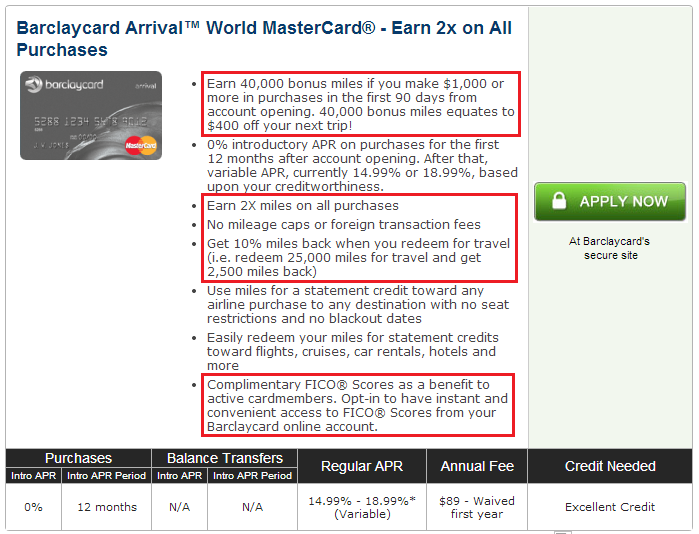

3 – Barclays Arrival Credit Card – $440 cash back (for travel) after spending $1,000 in 3 months

Another easy minimum spending requirement with a huge pay off. Too bad it is from Barclays so I have a 1% chance of getting this :(

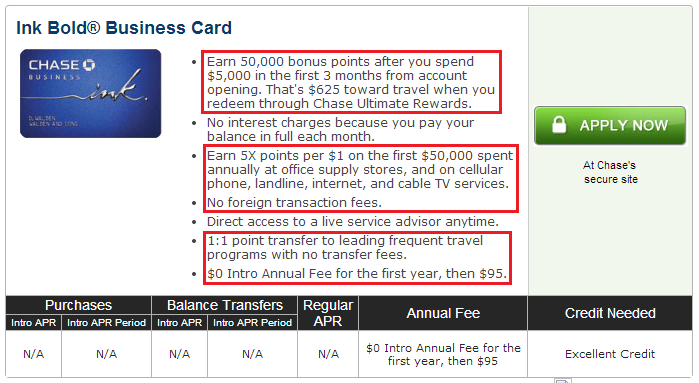

4 – Chase Ink Bold Visa Business Charge Card – 50,000 Chase Ultimate Reward Points after spending $5,000 in 3 months

I currently have 1 Chase Ink Bold but it is a MasterCard. The new ones are issued by Visa. I feel like I have a great chance to get approved for a Visa card since I have had the MasterCard since April 2012. If Chase won’t approve me for a new card, I will ask to close my MasterCard to be approved for the Visa. Actually, that would be ideal since I wouldn’t have to pay the annual fee coming up in a few months.

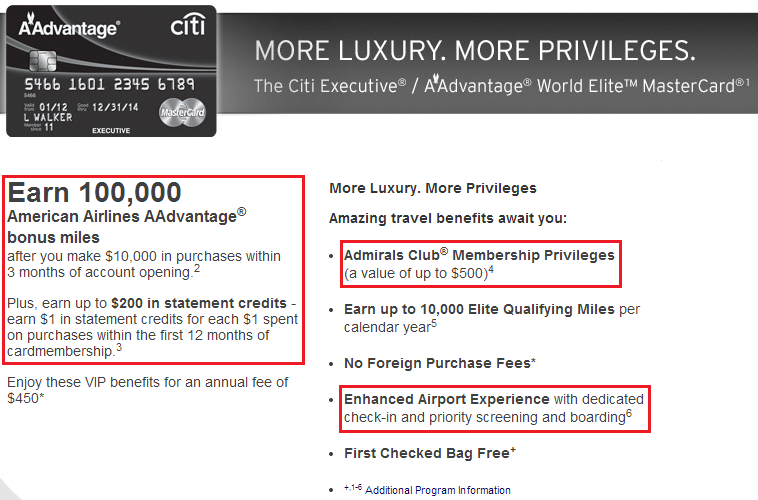

5 – Citi Executive AAdvantage Credit Card – 100,000 American Airlines miles after spending $10,000 in 3 months

This would be my biggest sign up bonus ever and the largest minimum spending ever. I currently have around 150,000 American Airlines miles, so why not add 100,000 to that? After the $200 statement credit, you are getting 110,000 AA miles + AA lounge access all for $250, that’s a crazy good deal!

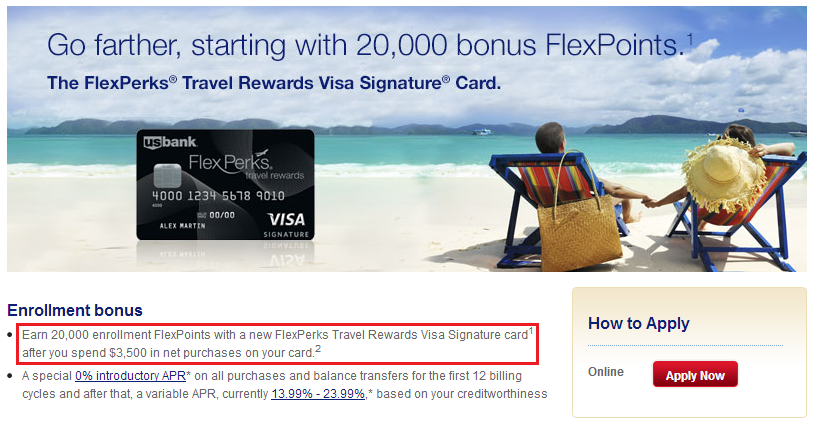

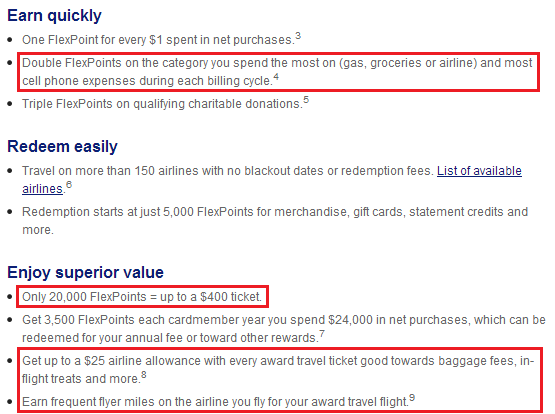

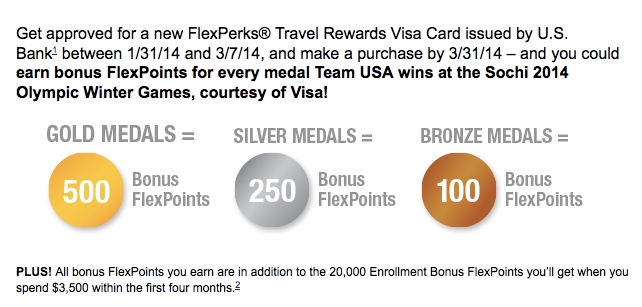

6 – US Bank Flex Points Olympics Credit Card – $400 Travel Credit after spending $3,500 in 4 months

(Hat Tip to Mommy Points). Last but not least, US Bank has their usual Olympic promo where you can receive more Flex Points the more medals US Olympians win.

Promo details:

I don’t recommend applying for all of these cards at one time. It really depends which cards you really want to get, which sign up bonus is truly “once in a lifetime”, and how much you can “spend” on credit cards each month.

If you have any questions or suggestions, please leave a comment below. Go US Olympians!

On the American card, how does the statement credit work? Since you’re spending $10K, isn’t the credit achieved via that? That one’s a bit confusing to me as I don’t understand why they would put that as part of the offer mix.

It’s essentially a $250 annual fee the first year and $450 the second year.

I don’t value the Admiral’s Club membership although I can absolutely see why others would highly value it. For guys like me, it comes down to a no-fee, spend $3K to get 50K miles (MUCH more easily accomplished and without eating up required spend to achieve bonuses on other cards) for the junior card, or lay out $250 and another $7K in spending just to get another 50K miles (which the junior offer demonstrates is worth no cost and only $3K in spend).

I think the way to look at this offer is this: Value the Admirals Club membership and apply it to the formula. I don’t think the math will work out nearly as well as all the sites are promoting unless you simply have the ability to spend like a demon and not sacrifice other card offers with required spend.

I don’t care about AA lounge access unless I’m flying AA which isn’t often. I just care about getting the most miles at the lowest price.

The Elite qualifying miles along with Admirals club were the biggest draws for me. My home airport is ORD so American can get me pretty much anywhere. The 100k bonus offer was too good to pass up, my card will be here tomorrow.

Congrats Mike. Best of luck getting the huge sign up bonus.

Then I would put that $7K (pocketing the $250) in extra spend to much better use on other cards. I think people are being hypnotized by the magic 100K threshold.

Everyone has their own preferences on which cards to get. Some might think it is a great deal while others may not.

There are currently no Amex cards in your planned app-o-rama. I don’t know what your current Amex Blue Cash card is. If it’s not the one that earns unlimited 5% cash back at drugstores and grocery stores, you should definitely sign up for it. This is such an amazing deal. Here’s the blog on which I found out about it:

http://freequentflyerbook.com/blog/2014/1/3/5-cash-back-is-back-for-now

Here’s the application link:

https://www304.americanexpress.com/credit-card/blue-cash/25330

Also, maybe try getting the 30K bonus for the Amex Enhanced Business Gold Rewards Card.

Why don’t you currently have a personal Chase card in your planned app-o-rama? If I were you, I would sign up for the British Airways Visa to get its 50K bonus.

I’m surprised you will go for 2 personal Barclays cards in one app-o-rama. Your slim chances might be better if you only applied for one of them. In your case, the Barclays Arrival would be more useful because the points are more versatile than the niche Hawaiian miles. However, because you were targeted, you might have a better shot at getting approved for the Hawaiian Miles card.

If you can get approved after signing up for all the other cards you listed above, then I recommend you sign up for a Bank of America card. The best option seems to be an Alaska Airlines card for a 40K bonus. Perhaps sign up for one personal and one business Alaska Airlines card.

You have great advice, but I already have/had most of the cards you recommend. I’m not going for the AMEX Blue Cash because I already have the BCP and I’m trying to stay under the Financial Review magnifying glass. I just got the AMEX MB Platinum card and have more MR points than I need. I got the British Airways card last year and closed it last year. I already have 1 Alaska Airlines card, but will try for another. I probably won’t apply for the Hawaiian Airline card because I still have 110,000 miles already. I will apply for the Barclays Arrival instead.

Does the Amex MB platinum give the perks as the platinum?

Exactly the same perks. americanexpress.com/platinum has all the details.

Hey Grant.. Just out of curiosity, how many cc do you plan to have opened at any given time? I’d assume you need to start closing some in order to let the clock start before you can get the bonus when you reapply say a year later? Also, how many cc do you typically apply for each app-o-rama?

Good question Victor, I’ve never churned a credit card (signed up, got the bonus, closed the card, signed up again, and gotten another sign up bonus). I think Chase doesn’t lets you churn cards, but I think Citi, Amex, B of A, and possibly others will let you. I typically go for 4 or 5 per app-o-rama, some end up being replacements for other cards from the same bank. I usually get 50-75% of the cards approved after calling recon numbers and closing cards or moving credit lines around.

At this point, most of the cards I have are ones I plan on keeping, either with a no annual fee or ones with fees that are worth the cost (typically hotel cards). I have pretty good luck on calling at month 10-11 and asking them to waive the annual fee. I then keep the card until a different card from the same bank pops up into my app-o-rama and then I typically move credit from that card to the new card.

so, when you say moving credit… do you cancel the existing card after moving the credit to the new one?

It depends how high your credit line is for the card. Most rewards card need $5,000 credit line to open a new card. If your existing card only has $5,000, then you will probably have to close the card. If it has a higher credit line, you should be able to move credit to a new card and get approved, while keeping the original card still open.

What’s the best way to use the AA miles

Flying on AA during their MileSAAver Off-peak awards to the Caribbean, Hawaii, Central/South America, Europe, South Korea, and Japan. See all the possibilities here: http://www.aa.com/i18n/disclaimers/free-ticket-award-chart.jsp

Pingback: List of Grant's Current Credit Cards