New American Express Offers and Citi Thank You Point Redemptions

Good evening everyone! I am still alive after my 16 mile hike to the bottom of the Grand Canyon and back on Sunday. My feet and legs are still killing me, but my hands and fingers are doing good enough to type this blog post. I promise I will get a trip report up soon with several pics of my time at Flagstaff Extreme Obstacle Course, Bedrock City, Bearizona Wildlife Park, and the Grand Canyon.

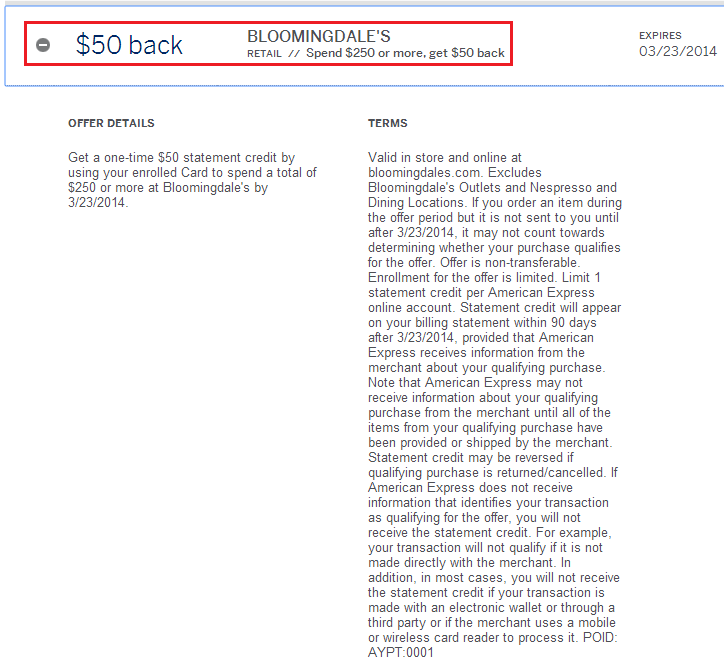

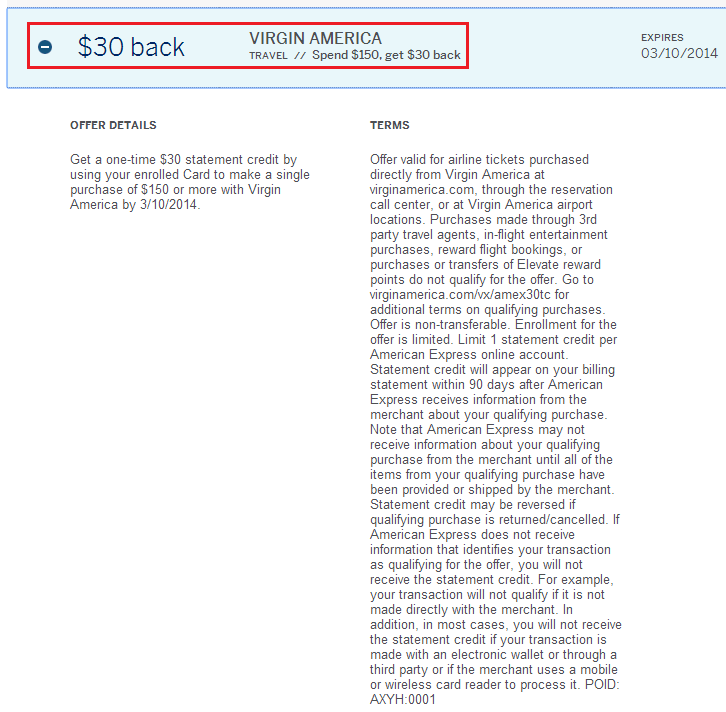

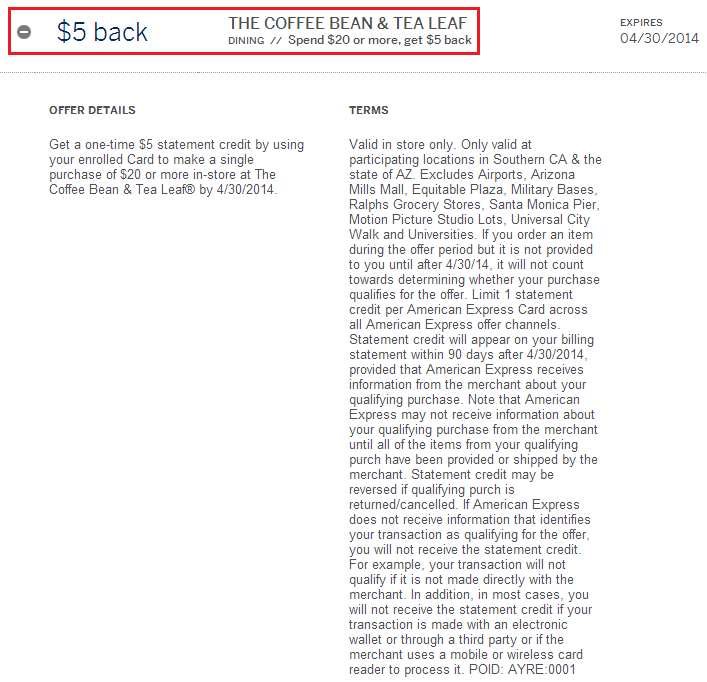

Anyways, here are some of the new (and exciting) American Express Offers For You. As always, check all of your American Express cards, even the one’s you hardly use (I’m looking at you Delta Gold card).

Here are the offers that interest me (your offers might differ):

HINT: If you see the same offer on multiple cards, make sure to open each card in its own tab so you can add the offer to each card, that was you can double, triple, quadruple, or quintuple your cash back statement credits.

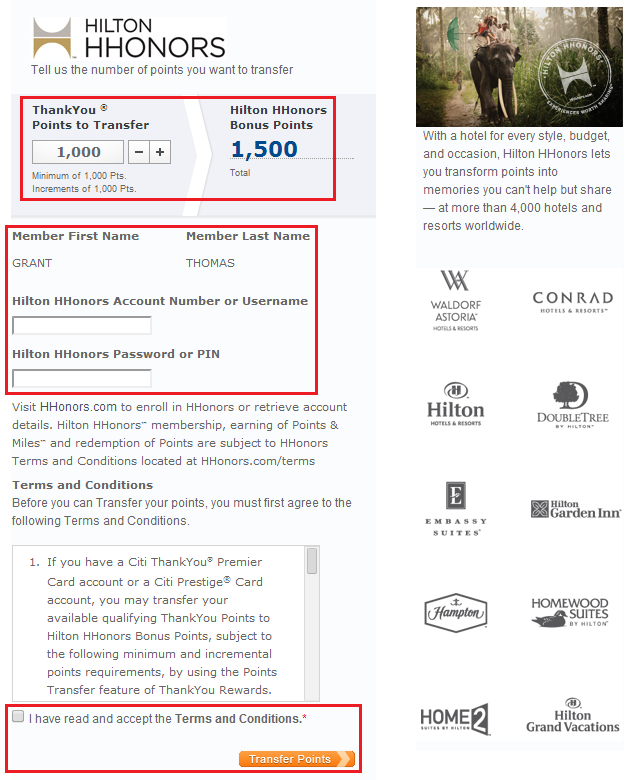

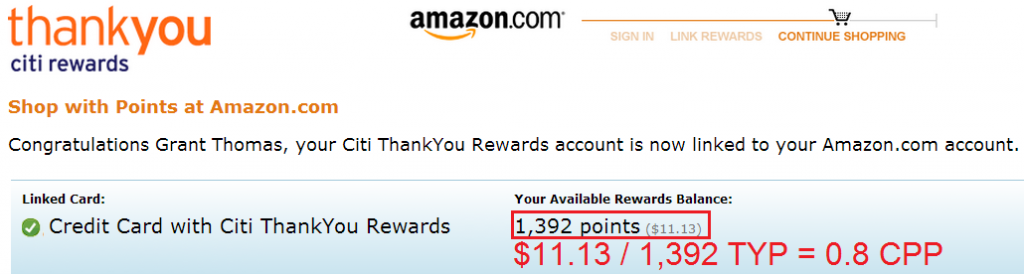

I had a few Citi Thank You Points (1,392 to be exact) in my account from my Citi Forward (pre-student, still earning 5x on restaurant card). If you have a Citi Thank You Premier card, the best redemption is for airfare, since I believe you get 1.33 cents per point. But without that card, your points are worth significantly less. Here are some options.

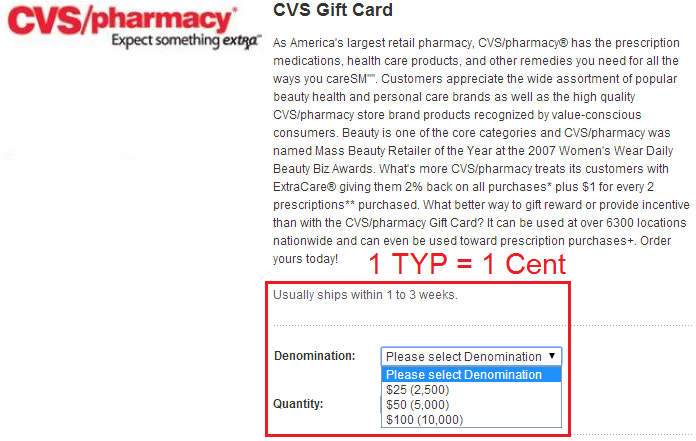

1) Redeem for most gift cards: 1 TYP = 1 Cent

2) Redeem TYPs on Amazon: 1 TYP = 0.8 Cents

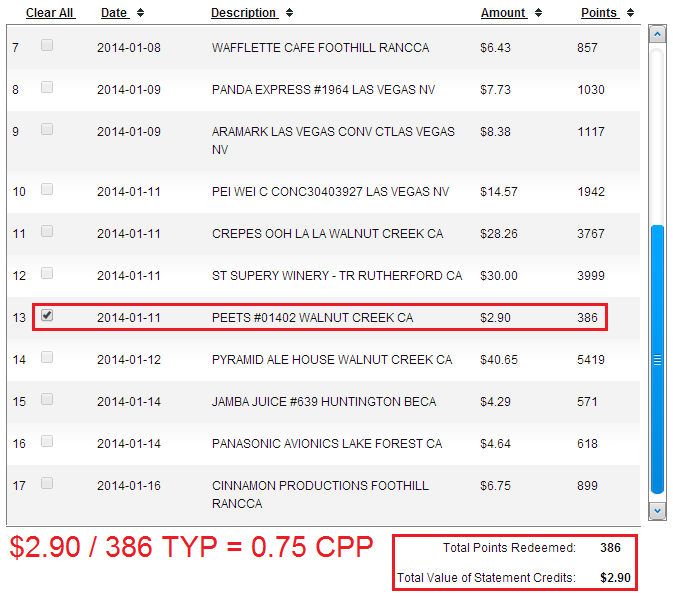

3) Redeem TYP for statement credit: 1 TYP = 0.75 Cents

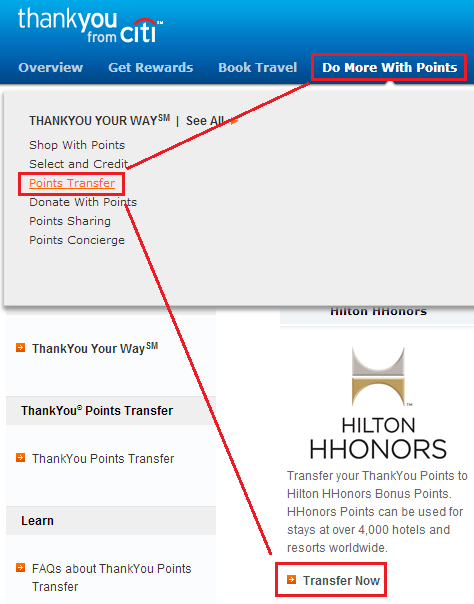

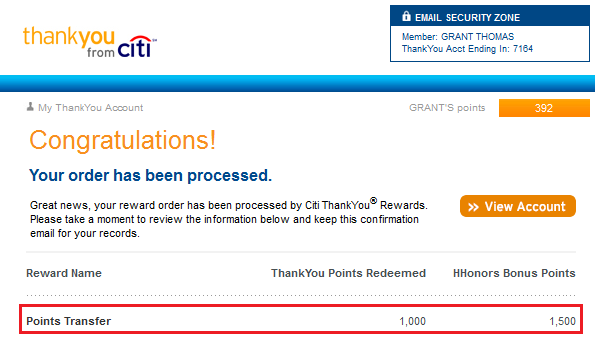

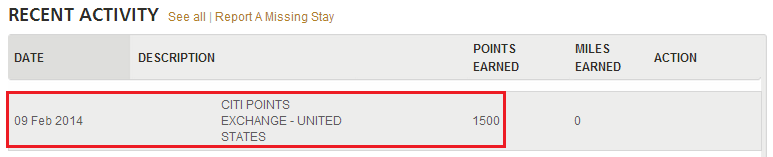

4) Convert TYPs into Hilton HHonors Points: 1 TYP = 1.5 Hilton HHonors Points

Since the TYP website is a bit complicated, follow these steps. Click Do More With Points, followed by Points Transfer, followed by Transfer Now beneath the Hilton HHonors logo.

You can convert TYP to Hilton HHonors Points in increments of 1,000 TYPs.

Your order will be processed right away and you should see the Hilton HHonors Points in your account in 2-3 business days.

It looks like the best deal is for gift cards if you can get 1 cent per TYP. If you have any questions, please leave a comment below.

P.S. Here is a sneak peak from my upcoming trip report:

Thanks Grant! I have a Citi ThankYou Preferred Card. I don’t see an option to transfer points from my Thank You into Hilton. Should I call Citi to add Hilton before I initiate a transfer?

I added an extra pic to show how to get to the TYP to HH transfer page. Hopefully that should help. If you cannot find it, calling Citi should work too.

Great! I don’t see just that one option called “Points Transfer”. I’ll call Citi to find out then.

That’s strange, hopefully TYP CS can help you out. How many TYP are you trying to convert?

I have around 1500 and my wife has 7000 TYP. Both are non transferable. Called CS and got to learn that we not eligible because we don’t have a premier card. What other options do I have to use these points?

Can you get a $15 gift card with 1,500 TYPs? Can your wife get a $20 + $50 gift card with 7,000 TYPs?

Redeeming Thank You points for a statement credit or on Amazon is a horrible idea. If you really want cash or Amazon merchandise from your Thank You points, you can redeem your Thank You points for Staples gift cards. Then, you can go through Shop Discover or Upromise (5% cash back) to Staples.com and use the Staples gift cards to buy Visa gift cards ($100 Visa gift cards for a 6.95 fee). That way, you would get 0.98 cents per Thank You point. However, with the variety of gift cards when it comes to Thank You rewards, you might as well redeem your Thank You points for a gift card you will use anyway.

If you have the Thank You Premier card and other Thank You cards, then can you transfer points from your other Thank You cards to your Thank You Premier card? Since it’s possible to do transfers like that with Chase Ultimate Rewards, I’m curious if Thank You points are similarly transferable.

It took me a few months to get more than 1,000 TYPs (5x on restaurants primarily), so I doubt I will ever get enough for a $100 Staples gift card.

All your TYP-earning cards should earn TYPs into the same TYP account. You can also transfer TYPs to another account, but I forget what the restrictions are.

How long did it take from the date you opened your card to receive Amex Offers? I opened my first ever Amex card over a month ago and I have yet to receive a single offer. Do you know how long does it take for the system to kick in? Thanks!

Great question, Laura. My latest AMEX card was my Mercedes Benz Platinum card. That took 5-7 weeks, I believe, before I started seeing a few AMEX offers. My older AMEX cards show 15-20 at a time, but my MB Plat card only shows 5 for now. It just takes time. You could try calling the number on the back of the card and seeing if they can speed up the process, but I have no experience with that option.

Thanks, Grant. I ended up calling Amex and they told me that it takes a couple of bill cycles for Amex to figure out a customer’s spending patterns. Once they do that, they start placing targeted offers in the offer tab. Looking forward to it! :)

Good to hear. Never knew that the offers were “targeted” to specific cardholders.

thank you for sharing the info about the Amex cards. Gotta love the Grand Canyon!

Hopefully you can take advantage if some if the AMEX offers. I have 5 $250 Bloomingdales gift cards coming my way…

Pardon my curiosity but are those Bloomie gift cards being gifted to others or might you have other plans in mind such as buying other merchant gift cards in store?

I’m selling them to CardPool and making a few bucks :)

Thanks for the explanation. I see on Cardpool there is currently a $7.50 net profit per card and an extra 5% if redeeming through Amazon GC. To me it seems a fairly small payoff for each of the cards in exchange for the risk of sending those cards through the mail. Do you have any suggestions on how to manage that risk or maybe you just don’t worry about it?

Send a bunch of gift cards at once. Take scans of the front and back of all the cards in case they are lost in the mail. Get signature confirmation. You earn miles/points on the purchase plus 4x UR points through a shopping portal.

You can get Ultimate Rewards points using your AE card? That sounds good. Chase points are pretty valuable. I’ll look into how this done or check out your blog for more info. Thanks!

Was reading some horror stories of people using a non Chase card in the UR portal, not getting points, calling Chase customer service to complain and getting denied. Maybe these are the exceptions and most people still can get away with using a non-Chase card? Other option is of course using a rebate program like Mr. Rebates which is giving back 6% for Bloomingdales for example. So on $1,250 that would be $75 in addition to the Cardpool net profit.

Whenever I shop through the UR portal (or any online shopping portal), I use Google Chrome in Incognito Mode. I use Chase cards and other credit cards and have always had points count for the purchase. 4x UR points are worth about 6% cash back to me, so it is a break even. Chase UR portal usually pays me quicker and I can use the points sooner.

Great tips Grant. I’ll have to try the “Incognito Mode”. Really helpful. Thanks!

Are you able to get the amex statement credit for just the main user on these deals, or is there a way to activate it to the authorized users of the card also?

I think the promos only show up on the primary cardholders account, so you can only get the deal once per enrolled card.

I’ve been able to get a separate credit for the authorized user cards. AE gives different credit card numbers for AU accounts so that might be a reason why. BofA for example will happily give you multiple AU cards but they will all have the same account number as the primary.

As a followup to my own comment, Grant is right in that it will only show up once on the primary account, but there are ways around it, using Facebook for example to get that promo to apply to your other cards, including AUs. Once you accept the offer on the primary you can go to Facebook and enroll the other AU cards. I won’t go into all the how to’s here since they are available elsewhere. You can also do this through Twitter as well, I believe, but I’m not a twitterer so not completely sure.

bloomingdales charges $5 shipping surcharge on $250 gift card. How did you manage to avoid that? If you are charged that, then effective profile is $2.50 per call when selling to cardpool.com

Yes I was charged $5 per card. You can shop through a shopping portal and earn extra miles/points/cash back. Chase UR with Ink card pays 4x for Bloomingdales purchases. Plus you earn credit card miles/points/cash back. Your actual profit is pretty slim.