What’s on My Mind: US Bank FlexPerks FlexPoints, Experian Credit Score, Using Square for Restaurant Bills, Screening Exchange, and my Upcoming App-O-Rama

I know, I know, we are all devastated by the United Airlines revenue-based frequent flyer mile announcement, but hopefully some of these random credit card and news stories will take your mind off of that for a few minutes…

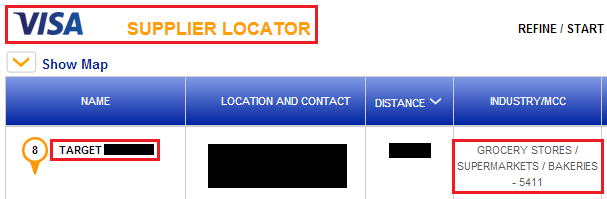

I did a little experiment last month with my US Bank FlexPerks Credit Card and Target (link). Since my credit card is a Visa and since my local Target is classified as a grocery store by Visa, I wanted to see if I could load $1,000 onto my Target AMEX with my US Bank FlexPerks Credit Card and see if it counted as a “grocery store” purchase, therefore earning 2x FlexPerks. You can use the Visa Merchant tool by reading this post.

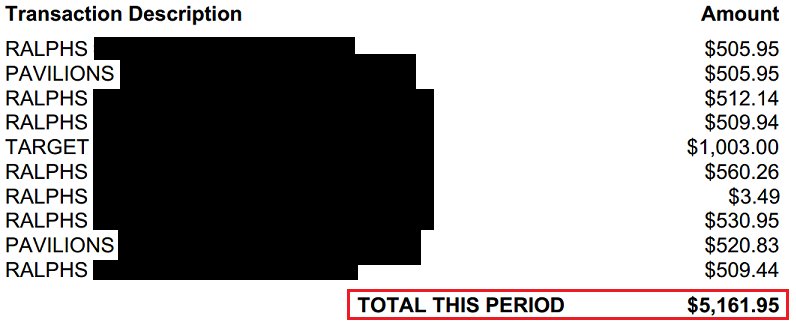

After a “few” grocery store purchases, that sounds like I bought grocery stores. Let me rephrase that. After a “few” purchases at grocery stores, I racked up $5,000+ in charges. I have mostly Ralphs and Pavillions grocery store purchases and 1 large purchase from Target (in the middle).

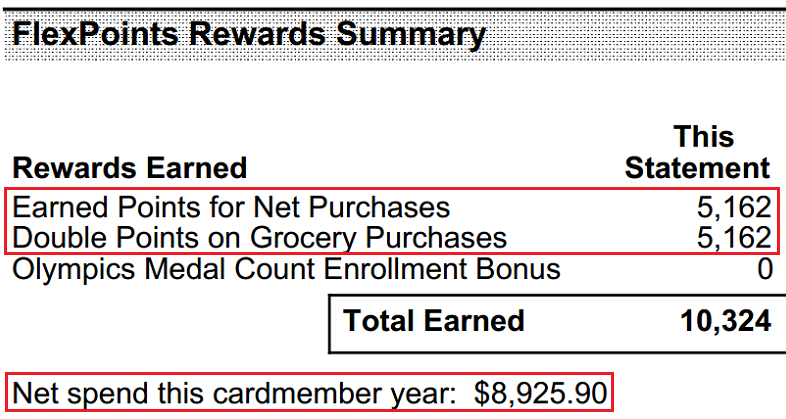

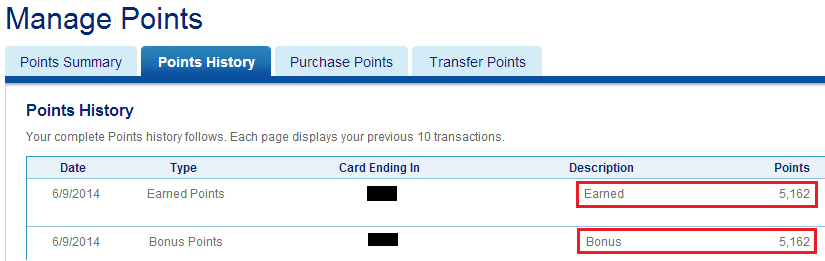

At the top of my statement, it shows that I earned 5,162 FlexPoints this month and another 5,162 Bonus FlexPoints. Since the numbers are the same, it looks like all my purchases counted as “grocery store” purchases and earned 2x. Nice!

The same thing I said above but in a different color.

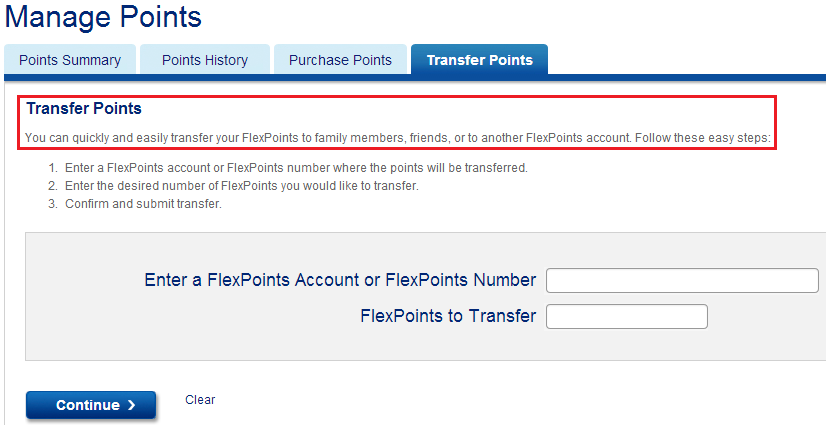

What I find interesting (hint: hack/loophole) is that you can transfer FlexPoints from your account to anyone, no strings attached. I think I hear a black market for FlexPoints coming soon…

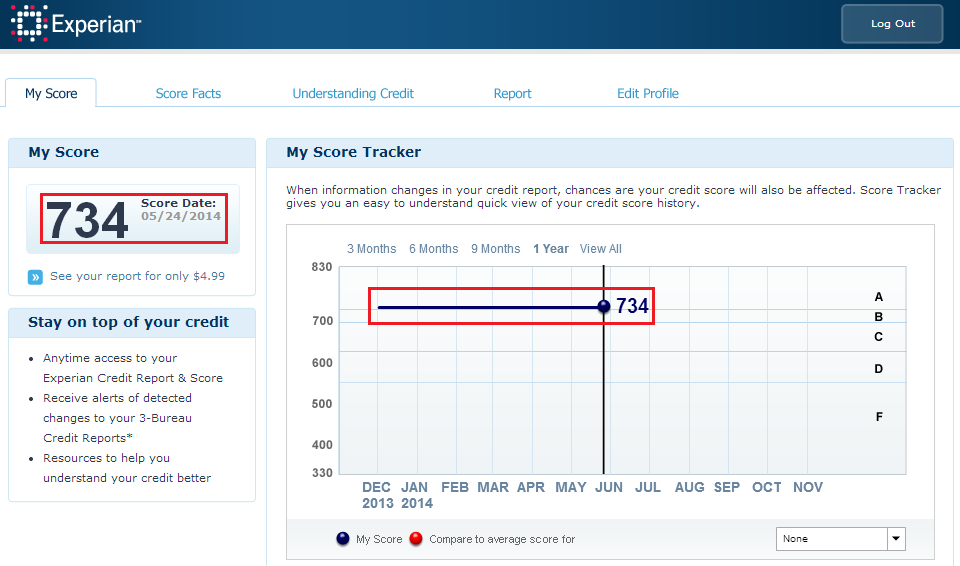

In other news, Experian is broken. At least the free Experian credit service provided by US Bank appears to be broken. Apparently, my credit score has not changed in the last 6 months even though I had a massive app-o-rama in mid March. I will nickname my credit score Superman, since it is invincible!

In other other news, I went down to San Diego this past weekend for a Miles and Points Meet Up. (Side note: where was everyone? I though all 300+ subscribers were going to show up. Sadly we had a much smaller, private dinner). Anyway, I thought it would be fun if I brought my Square card reader (free from Square) and charge everyone’s credit card myself, and then pay the whole bill with my own credit card (Chase Freedom 5x baby!)

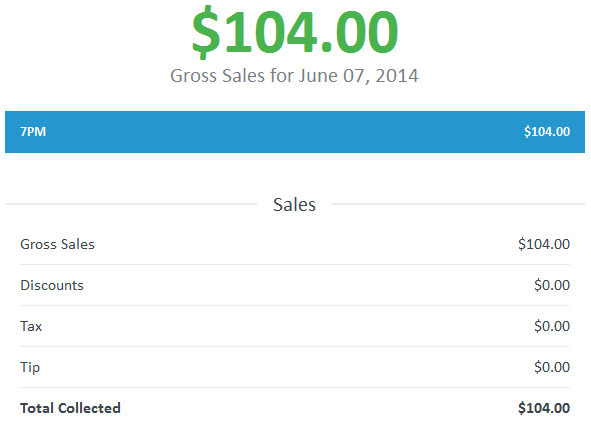

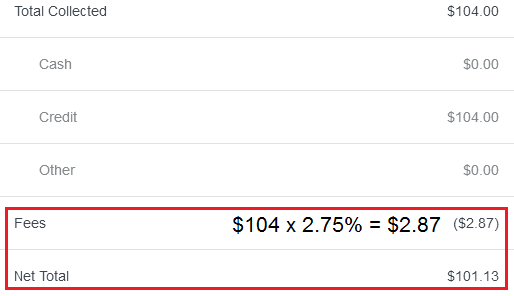

For those new to Square, you can accept any credit or debit card, Square will process the payments, and deposit the funds into your bank account the next business day. After collecting $104 from dinner, I receive a confirmation email from Square.

Square makes money by charging you 2.75% for all credit and debit card purchases (Visa, MasterCard, Discover, and AMEX) and deducts that amount from your deposit.

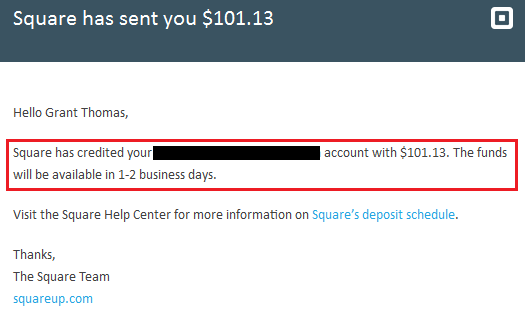

The next day, I received a confirmation email letting me know the deposit was on its way to my bank account.

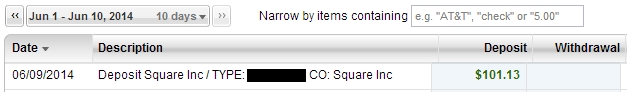

When I checked my bank on Monday morning, the deposit was there waiting for me. Who’s a good deposit? yes, you’re a good deposit. Stay. Stay!

You can actually make money using Square, assuming the credit card you use to pay the full bill earns a higher cash back rate than Square’s processing fee. For example: Chase Freedom 5% > Square 2.75% = Grant is a rich man (almost).

Another interesting thing I did last night was go to a free movie screening called Men, Women, and Children (wiki link). It is a strange film starring Adam Sandler and Jennifer Gardner as adults with children. It revolved around a few high school students and shows how social media, smart phones, and online secrets are controlling our lives. Not the best movie I have ever seen, but it was free. If you are interested in joining the Screening Exchange, click hereto learn more.

Last but not least, I am going to bed early tonight so I can get up early and go for a massive 6 card App-O-Rama in the morning. It has been 3 months since my last App-O-Rama (boy how time flies), so now it is time for my next batch of credit cards. Here is my last App-O-Rama results (5 Credit Card Applications, 4 Approvals, 3 Reconsideration Calls, 2 Business Cards, and 1 Pending Application).

Here is my list in the order of which I will apply along with the minimum spending requirements and annual fee:

- Barclays Arrival Plus ($3,000 / 3 months w/ No Annual Fee) – crossing my fingers :)

- Citi AA Exec ($10,000 / 3 months w/ $250 Annual Fee) – going for #2, need more AA

- AMEX Premier Rewards Gold ($2,000 / 3 months w/ No Annual Fee) – need more MR

- Chase SWA Plus ($2,000 / 3 months w/ $69 Annual Fee) – need more SWA

- US Bank Club Carlson Business ($2,500 / 3 months w/ $60 Annual Fee) – want 2 Club Carlson accounts so I can book back-to-back 2 night stays :)

- Bank of America Alaska Airlines ($0 minimum spending w/ $75 Annual Fee) – going for #2, need more AS

I will update you on my results, perhaps a few reconsideration call recordings, or other interesting tidbits from my App-O-Rama. Wish me luck everyone!

If you have any questions, please leave a comment below.

Glad to see you taking advantage of American Express for Target. Sorry I didn’t get back to you tweet about the best unloading schedule, it depends on if you’re getting a category bonus or not (if you’re not it’s not worth paying the $2 atm fee for example).

Are you using any other credit monitoring? I’d recommend having something that covers all three credit bureaus (use a different free service for each) that way you can work out which card issuers are pulling which bureaus and plan your credit applications to be spread out.

Goodluck with the AOR.

I am planning on using my US Bank FlexPerks Credit Card to load my AMEX Target since my Target is classified as a grocery store and earns 2x. I think the first free ATM withdraw per month is worth it, but then after that, I might just buy PayPal My Cash Cards or other One Vanilla Gift Cards.

Wish I could have gone to the gathering in San Diego. Just moved to L.A. from NYC. Any thoughts on having one in L.A.? When/Where will the next one be? I’ll try to make it.

I’ve thought about doing a meet up in LA but haven’t made any plans. Which city do you live in?

what about your 1st AA EXEC? is it still open, closed, or will be closed?

Still open, will keep it open for now.

Hi Grant,

How did you get 2 Carlson account? Did you ever book back to back room and how you tell front desk so you can stay in the same room?The US Bank Club Carlson seems very hard to get. I got the personal one but got decline on business. By the way, I just booked 2 nights (one free night) near St. Louis for only 28K points = $56 or $28/night. This card is awesome and even better if you use overseas, I know you already know but just let other know about this one.

My US Bank Club Carlson Business Credit Card is currently being processed. I just called the US Bank recon department and they said I should receive an email within the next 24-48 regarding the status of the application. Will keep you updated on the results.

As fro the back-to-back room reservations, I have never done this, but since the name on both accounts is the same, I can just let them know during check in to keep me in the same room for all 4 nights.

Hi Grant,

Thanks. I still don’t know how you get 2 Club Carlson account or you mean 2 credit cards? Can you book 2 nights then book another 2 nights for the same account?

Yes, 2 credit cards (personal and business) with each card tied to a different account.

Just curious, what spend category does visa or any cc classify a square transaction as? When you set up square, are you asked to provide the “type of business”?

I’m not sure, I think Square processes all the charges, and they probably don’t have any special category.

Well you should be able to handle getting accepted for all those apps considering you are one of the go to experts on MS. At least I’ve gotten a number of tips from you. Keep it up.

Thanks Kent, it shouldn’t be too hard, I will lay out my strategy when I figure out which cards I got approved for. Still waiting for 1-2 pending decisions.

The payment I made to you for the dinner showed up on my credit card statement as

“SQ *GRANT THOMAS”. I doubt that will be considered a bonus category, but that’s ok.

BTW, I always apply for US Bank cards first when I do an app-o-rama. They are notorious for rejecting people when they see a lot of other recent applications.

Yes that sounds right regarding the Square charge. I have pretty good luck with US Bank, but absolutely no luck with Barclays. They straight out denied me this morning, first card of my App-O-Rama. I don’t know why they hate me ;(

is there a website or something where you can put your profile info onto every travel/miles/shopping loyalty card/rebate websites all in one hit?

Are you talking about tracking your miles/points accounts and balances? Then check out Award Wallet – http://travelwithgrant.com/how-to-guides-airlines-miles-points/award-wallet/

If you are talking about having your picture show up next to comments, then check out Gravatar – http://travelwithgrant.com/how-to-guides/create-gravatar/

Grant at 2.75% for square would there be a way to to swipe a friends card and figure out a way to make the points earned worthwhile? Using say the Barkley card @ 2x per dollar. Pay bill with points earned with BB?

You could probably buy gift cards with a 5% cash back credit card and then swipe that gift card. I don’t think Square want’s to see you swiping $1,000s of dollars through their service though.

Pingback: How to Book Airfare with US Bank FlexPerks | Travel with Grant