App-O-Rama Update: 4 Approvals, 2 Recon Calls, 1 Pending Application, and a Barclays Denial

Advice: you do not need to apply for 6 credit cards at one time. You should only attempt this if your credit score is high and you have the ability to Manufacture Spend $5,000-$10,000 per month. Please proceed at your own risk/skill level.

In a nutshell, this is what happened yesterday morning when I applied for 6 cards.

- Barclays Arrival Plus Credit Card – automatically denied :(

- Citi American Airlines Executive World MasterCard – recon call approved, $5,000 credit line + $4,500 moved from Citi Dividend Credit Card.

- AMEX Premier Rewards Gold Charge Card – automatically approved (charge card, no preset credit limit).

- Chase Southwest Airlines Rapid Rewards Plus Credit Card – recon call approved, $2,000 credit line.

- US Bank Club Carlson Business Credit Card – pending, must wait 24-48 hours for results.

- Bank of America Alaska Airlines Visa Signature Credit Card – automatically approved, but for a Platinum Plus credit card with a $2,000 credit line.

Here are more details about each application and approval/denial process…

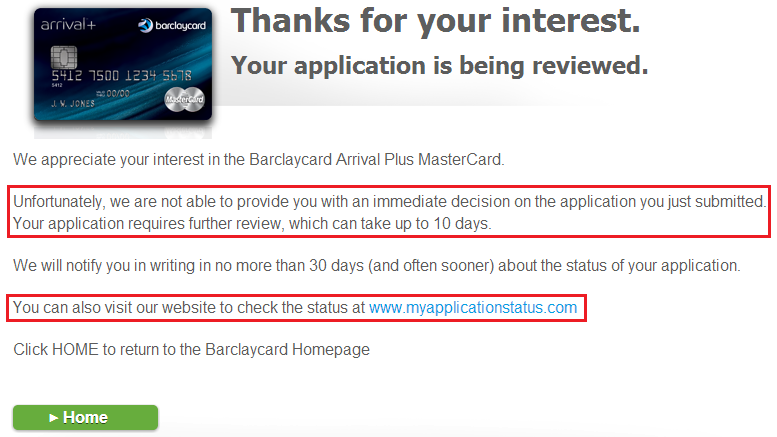

1 – Barclays Arrival Plus Credit Card – 40,000 points ($400) after spending $3,000 in 3 months, no annual fee the first year, then $89 the following years

Since I have wanted a Barclays credit card for a long time, this was my first application. I was hoping for an approval, but I have always been denied by Barclays. They do not like to see many credit inquiries on your credit report, which is why they continually deny me.

Clicking the link above bring me to this page:

After filling out my personal info, I am told that Barclays cannot approve me for a credit card. This has happened many times in the past :(

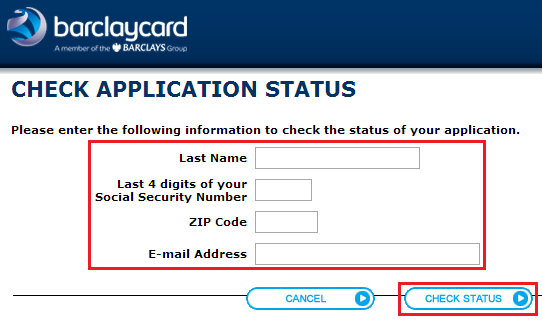

2 – Citi American Airlines Executive World MasterCard – 100,000 American Airlines miles after spending $10,000 in 3 months, $250 annual fee the first year, then $450 the following years

I applied for my first Citi AA Executive Credit Card in Mid March and have heard from many others that it is possible to get multiple cards and multiple sign up bonuses. When I applied online, Citi wants you to call them and verify some information. I was initially approved for a $5,000 credit line, but was able to move $4,500 from an existing Citi credit card (Citi Dividend Credit Card).

Here is the recon/approval call (5 mins) (Download Link):

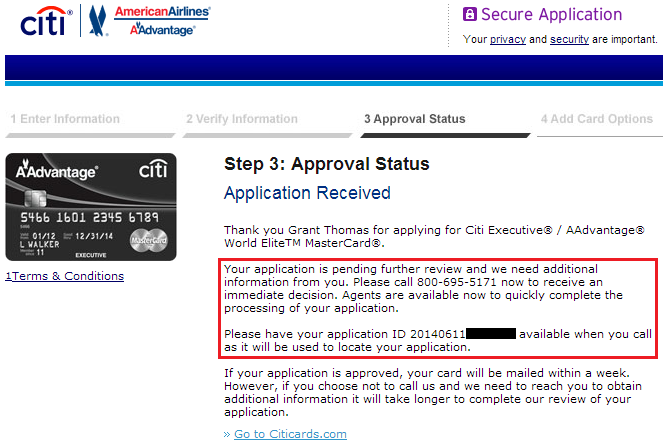

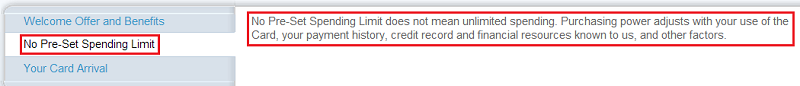

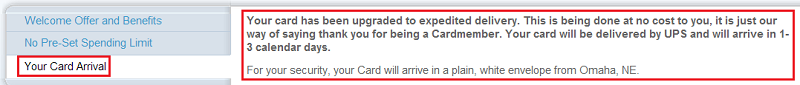

3 – AMEX Premier Rewards Gold Charge Card – 25,000 Membership Reward Points after spending $2,000 in 3 month, no annual fee the first year, then $195 the following years

I was automatically approved and since this is a charge card, there is no preset credit line. I was told that AMEX was going to send this card to me quickly via UPS Next Day Air or UPS Second Day Air.

Card Application Approval email:

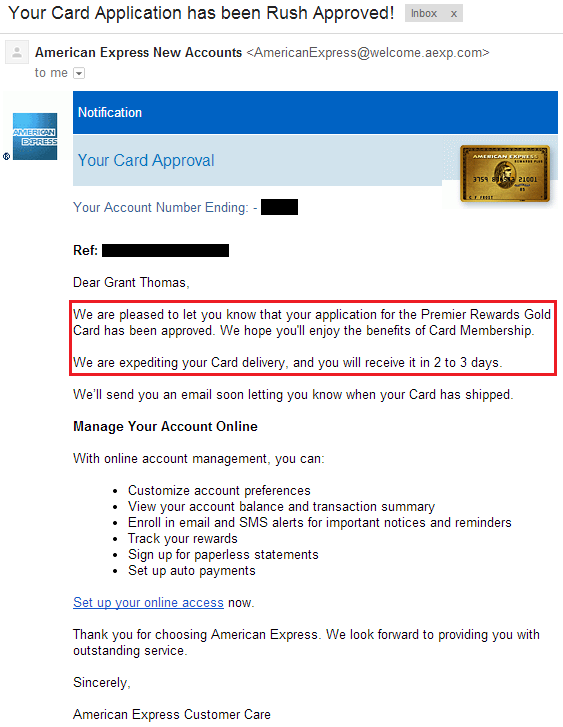

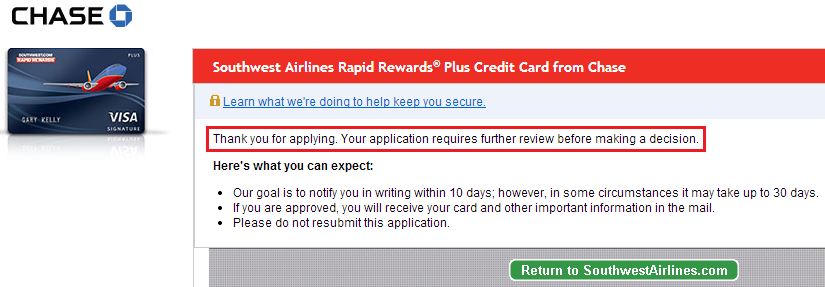

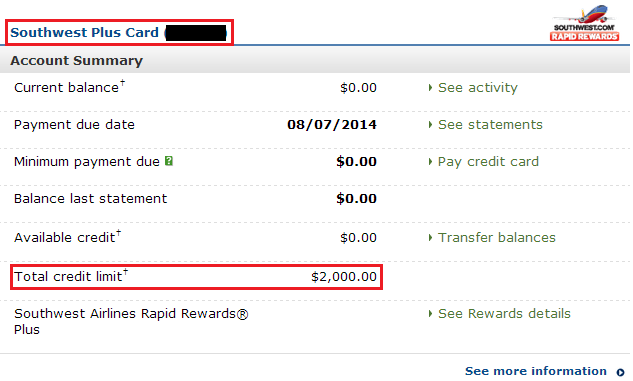

4 – Chase Southwest Airlines Rapid Rewards Plus Credit Card – 50,000 Southwest Airlines Rapid Reward Points after spending $2,000 in 3 months, $69 fee the first year, then $69 the following years

I initially received a pending application status, but was able to call Chase and they approved me for a $2,000 credit line.

Here is the first part of the recon/approval call (2 mins) (Part 1 – Download Link):

My alarm went off on my iPhone and it stopped the recording mid way, so here is the second part of the recon/approval call (1 min) (Part 2 – Download Link):

After logging into my Chase account, I was able to change the name of the approved credit card and view the details of the new card account.

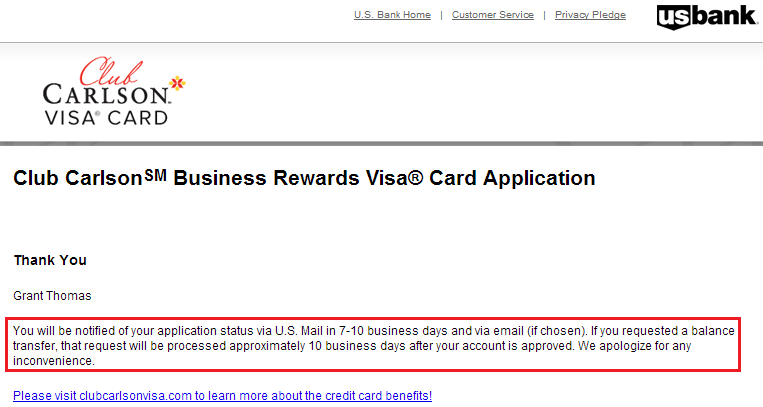

5 – US Bank Club Carlson Business Credit Card – 85,000 Club Carlson Points after spending $2,500 in 3 months, $60 annual fee the first year, then $60 the following years

I received a pending application status. I called the automated line and was told it would take 24-48 hours for a decision to be made. I found a number for the credit analyst department and was told the same thing, so I will just have to patiently wait to see what happens.

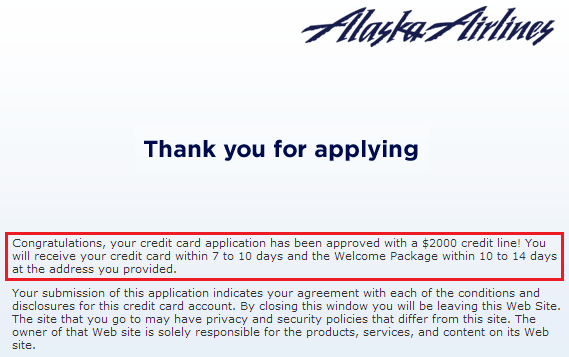

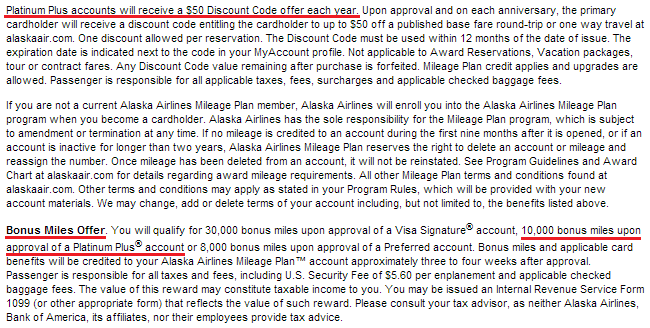

6 – Bank of America Alaska Airlines Visa Signature Credit Card – 30,000 Alaska Airlines miles on approval, $75 annual fee the first year, then $75 the following years

I applied for the Visa Signature version (30,000 Alaska Airlines miles on approval), but was only approved for a $2,000 credit limit. I called into Bank of America and was told I was only approved for a Platinum Plus credit card which offers only 10,000 miles on approval. Since the annual fee on that card is only $50, I essentially bought Alaska Airlines miles for 0.5 cents per mile. I will pay the annual fee on this card but continue using my other Alaska Airlines credit cards.

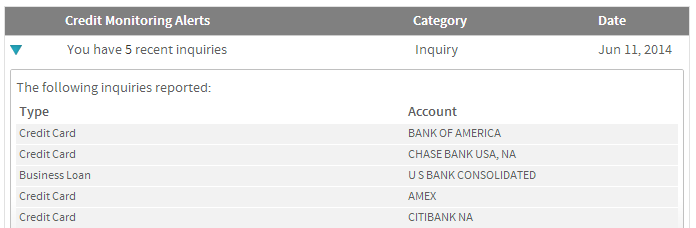

I got an email this morning from Credit Sesame regarding recent credit inquiries:

If you have any questions, please leave a comment below.

Hi Grant, I love your site. I’m pretty new to this game, but my wife and I both have very good credit scores (750) and I want to start leveraging that to earn points, MS, the whole deal.

I have two questions:

1. What are the advantages of an “App-O-Rama,” i.e. applying for 6 credit cards at once, versus applying for 1 per month over a 6-month span?

2. My wife and I currently rent an apartment and are thinking of buying a house in a year. Should we avoid this game entirely until we settle? Or is starting slowly OK?

The advantage to applying for multiple cards on the same day is so that the other banks don’t see the other credit inquiries. If the see that you apply for 1 card every month, it looks bad. But if you apply for cards at the same time, the credit inquiries don’t show up for about a day.

As for buying a house, most bloggers recommend that you don’t apply for cards for 2 years before applying for a mortgage. I have no experience with that since I still live at home, but I would say that you can probably apply for 2-3 cards throughout the year without much impact to your credit score. If you and your wife alternate getting cards every few months, I think you should be fine.

Interesting re: applying for a mortgage. Anyone else have any insight into this? Or links to posts/articles on the subject?

I think the major concern is that applying for credit cards lowers your FICO score 3-5 points per credit card application, so applying for multiple credit cards could lower your FICO score enough that you would be paying a higher interest rate on your home loan, which could end up costing more money than any benefit you received from the credit card miles.

Applying for 1-2 cards a year should not hurt much. Since most credit scores rebound to higher scores a few months after receiving the credit card, I wouldn’t worry much.

Right. I think my plan is for my wife and I to do a mini-App-o-Rama this month (I’ll apply for 3 cards from 3 different companies, she’ll apply for 2). Then in December we’re each going to apply for 1 additional card. Then hold off until after we close on a mortgage deal sometime in the March-June time frame.

That could be a good plan.

Did my first App-O-Rama this morning. What a rush! Here’s my breakdown:

1. IHG Rewards (Chase) — Instantly approved, but I’m waiting to see if I got the 80,000-point sign-up bonus instead of the standard 60,000.

2. Choice Privileges (Barclaycard) — Instantly approved. I get 8,000 points after first purchase and an additional 24,000 points after first stay in Choice hotel.

3. Citizens Bank CashBack Platinum — Pending approval, which worries me a little bit since I applied for all three cards simultaneously. I applied for this card because it’s 10% back at restaurants and 5% back on groceries/gas for 3 months. Since I’m going on a work trip for 2 weeks where I can charge all expenses and get them paid back, I figured this would give me the maximum return. Plus, after 3 months I plan to convert to the Citizens Bank Green$ense card, which pays you $0.25 per transaction (min. 10, max. 80 per month); a great card to have for my daily $1 McDonald’s iced coffee.

Congrats on your first (of many) app-o-ramas!

The sign up bonus is directly related the the credit card sign up link you used. If you used a link for 80,000 IHG Points, then you should get the 80,000 IHG Points sign up bonus. Double check the sign up bonus with the Chase rep when you call to activate the credit card.

I have never stayed at a Choice Hotel, but I am glad you got approved for a Barclays credit card (that makes one of us…)

Can you send me a link for the Citizens Bank CashBack Platinum and Citizens Bank Green$ense credit cards? I have never heard of those cards.

Any interest in an AMEX, Citi, BofA, or US Bank credit card? You might want to go for the Bank of America Alaska Airlines credit card since you get 30,000 AS miles on approval with no minimum spend :)

Here’s the info for the Citizens Bank cards: http://www.citizensbank.com/cards-and-rewards/credit-cards/credit-cards.aspx

And here’s another card that I can’t seem to find by navigating through their site, but it pops up in a Google search. This is the same card as the CashBack Platinum except it’s 10% on gas for 90 days instead of restaurants. http://www.citizensbank.com/cards-and-rewards/credit-cards/accelerator-platinum-mastercard.aspx

I do have interest in cards from all of those providers (I do already have two BoA cards). On my next go-around I’m going to be going for the Amex Blue Cash Preferred (6% back on groceries). But like I said in an earlier comment, my wife and I are going to be in the market for a new house sometime in the next year. But after that, let the games fully begin!

Thank you for the links. I can see the cash back bonus for the first 90 days as very enticing. Are you planning on making many purchases in those categories, besides your reimbursable business expenses?

I’m going to stock up on gas gift cards and will probably buy some Visa/MC gift cards at the grocery store when they offer promotions (Stop & Shop frequently offers 3x gas points). But I don’t live near a Wal Mart with a MoneyCenter so my MS options are limited.

Are you able to buy money orders with your gift cards? Does Stop and Shop sell money orders?

I haven’t looked into that yet. Will have to check.

Also, an update: I was approved for the Citizens Bank credit card. Now I’m just hoping it gets to me in time for my trip :)

I also just did an apporama on monday for citi exec aa, ink plus, barclay arrival world, spg 30k, and club carlson premier. I had the same result as you on the club carlson card (holding pattern) and I had to call recon line for ink plus (they asked why I had 3 chase cards opened at beginning of the year and I explained it was for category bonuses, i fly with SW airlines frequently). also, since my business was new and just getting started I told agent I only expected around $1500 income first year so he set credit limit at 5k.

It’s exciting to learn I can get the aa 100k offer again! So you don’t have to close the first card before you apply again?

No need to close your first AA Exec card. The rep didn’t even mention that I had an AA Exec card open. I was actually tempted to ask that he transfer part of that credit line to my new AA Exec card, but decided against it. Congrats on your App-O-Rama, I hope you get approved for the Club Carlson card.

I know you ve been salivating for the Barclays Arrival for a long time as most bloggers touts its points value but you shouldnt fall into that trap.I think each individual needs and strategies to apply are different but I think you know that since you are a blogger yourself. my CC kryptanite is the US Bank Club Carlson, just impossible to get. you should wait for the set amount of time( one year) before applying for Barclays instead of trying and trying to get denied each and every time which doesnt look good on your record

It’s strange that I have pretty good luck with Club Carlson (you froze your ARS and IDA credit reports, right?) but no luck with Barclays. Some people are the complete opposite. I think they key is to get your foot in the door aka getting 1 card from each bank, that way you have some leverage with the bank. I’ll put off Barclays until the end of this year or early next year. Oh well :(

Establishing relationships with these bank is key long-term. Plan strategically, as your relationship will span decades. For example, Chase gives me substantial credit lines (way more than I would use), but I had two previous mortgages with them, and also a checking and money market account. Even tho these closed (divorce), they are on my credit record an in their records also.

I got my foot in the door with Barclays by applying for purchase credit with Apple, to get a laptop after returning to college. 0% APR for 24 months that purchase was all I received, but I paid it off on time. It now sits in my desk drawer. I just received the US Airways MC in my first AOR of 3 cards. I called them 2 weeks prior and asked about the benefits of the existing account (there are none), and informed them that I appreciated their willingness to extend me credit, and that I was looking to apply for another card with their bank. I don’t know whether or not this helped, but I figured it couldn’t hurt!

Yes, I agree. The long term relationship is key. You never want to get blacklisted by a credit card company for perk abuse. Being a good, long-term customer is always a good idea. Chase is my favorite bank to work with. Even though I’ve never had any other accounts with them besides credit card accounts.

How many Chase cards do you have? I am at 4 right now (Hyatt, Marriott, IHG and Sapphire) I’ve heard that they frown on any more than that…I would drop the Marriott one, been thinking about the United and or Southwest card…

I have 2 Ink Bolds, Freedom, Marriott, Hyatt, IHG, SWA Premier, and now SWA Plus. I like holding onto the hotel cards for a long time since the free night certificates (on the 3 Chase hotel credit cards I have) are worth more than the annual fee. It is hard to justify the annual fees for airline credit cards unless you check bags frequently. SWA cards provide 6,000 and 3,000 SWA RR points each year you pay the annual fee, that partially offsets the annual fee, but I will do retention calls on those when the time is right.

I’ve been wondering for a while how many Chase cards you can have; I currently have: Ink Bold, Ink Classic, Sapphire Preferred, BA, Freedom, and United Explorer. Was looking at applying for the Sapphire card. My credit limits are decent too.

Oh I forgot about BA…crap, and Freedom which I got denied for (no clue why) awhile back. I need to figure out how to get the BA, SW, UE and Freedom….this is gonna be tough lol

All good cards. You might be able to downgrade an existing card to a freedom card, but then you bypass the sign up bonus, but you also save the credit inquiry and possible rejection.

Why not apply for a hotel credit card instead of a Sapphire credit card? I used to have CSP, CS, BA, and UA credit cards.

I have Citi Hilton and AMEX Hilton and am thinking about Hilton Reserve for Gold status. We travel mainly to Europe and usually rent apartments and only use hotels in airline connection cities. Really no need for one at present, but Hilton is usually close to where we are.

Hilton points are easy to get and Gold Status is excellent. Enjoy those upgraded rooms, free breakfast, free wifi, free lounge access, and early checkin/late checkout.

Just had an app-o-rama this week. I applied for the Club Carlson Visa, SPG, and Arrival Plus on Tuesday, and just applied for my second Citi AA Exec this morning (opened first one a few months ago). I was instantly approved for SPG and they next day air shipped the card, which was nice. I got a decision pending for Club Carlson Premier and Arrival Plus. I checked the statuses of both today and they’re still being processed. I didn’t freeze my ARS or IDA credit reports (wish I had known beforehand) so I’m bracing myself for denial of the Club Carlson.

Within 2 of submitting the application for the Citi card, a rep called me telling me I need to send in verification of my address so that the application can continue to be processed, which is somewhat weird since I wasn’t asked this when I applied to the first card and my address hasn’t changed. Hope this turns out okay..

I always make a recon call if I’m not instantly approved. Have you called Barclays? I hope you get the Club Carlson credit card *fingers crossed*

Thanks, Grant! I was thinking about calling them before but decided to see what happens. When I don’t get instant approval, my first assumption is that I got declined. But I actually got an email just now from Barclay saying I was approved! Crossing my fingers too with the Club Carlson and Citi AA Exec.

Congrats on the Barclays approval, good luck with CC and AA Exec cards!

I just got an email from Club Carlson.. Approved!

Nice work! I hope I get that email too!

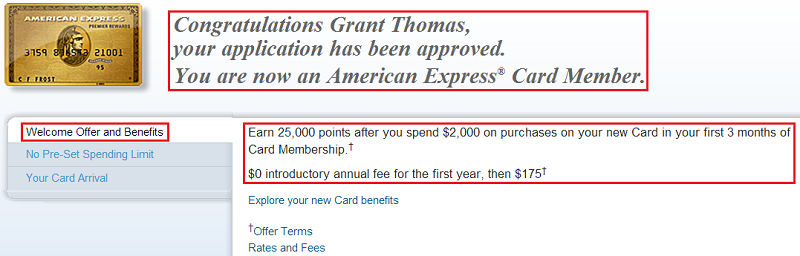

Nice App-O-Rama! What was your thought process with the Amex gold of only 25K and not waiting for the 50K?

Idk I needed some MR points and that seemed like the best offer that wasn’t another Platinum Card. I didn’t want to wait any longer.

That banks don’t see same day inquiries is a myth, at least at this point. If you pull your own credit during an App-o-rama you can see that for yourself, the lag time is at *most* minutes. (So maybe, potentially if you do two browsers and submit at the same time it may help). There is still an advantage because they don’t see *new accounts*.

As far as Barclays, after a bunch of apps between me & my wife, I’m convinced the key to instant approval is 3 things: 1) At least 6 months since last Barclay’s approval 2) Few/no inquires 3) Manually reduce credit limit on existing barclays cards to well below what they are willing to grant you.

#2) Sounds like something you can’t change, but Barclays only pulls Transunion, and you can Bump all your TU inquiries off by the time of your next app-o-rama in 90 days.

Ya I agree with your list. #2 sounds like the nail in the coffin for me. I’ve heard about bumping credit inquiries by doing many soft pulls, but I haven’t attempt it myself.

I recently applied for citi exec and got a pull from both transunion and experian. Have you checked your pulls yet?

I know I got a pull from Experian, but I am not sure about TU. I checked my Credit Karma which uses TU, but I don’t see any credit inquiry from Citi.

I also got a pull from experian but not TU when I applied for a citi exec.

Yes, we are both in SoCal, so maybe it is a CA thing. What state are you in Mark?

I ended up applying for a few cards including ink, freedom, amex cash preferred, discover it, and Barclays recently. Did it over span of 3 wks though …. Fortunately I Got approved for all.. Surprisingly good credit limits too. Not really quite on board yet with the miles thing though … Decided to still maximize pure percentage regardless if it’s cash or miles…have the cards I think I want now… unsure if I will keep this up come next year when it’s time to decide if to keep annual fee cards etc. At the least it’s fun!! I love reading your site….

Congrats on getting approved for all those credit cards. Cash back is great, but miles/points are even better, if you know how to maximize your value. For example, the AA Exec card offers 100,000 AA miles, which I value at 1.5 cents each, equal to $1,500. There are no cash back cards with that high of a sign up bonus.

Pingback: Crazy Weekend: UCLA Graduation, San Diego Wedding, LAX Flight, and My Credit Card App-O-Rama Updates | Travel with Grant

Grant have you thought about going for a no annual fee card at Barclay’s for possibly a foot in the door with an easier approval?

I haven’t tried that approach, but I will give it a go next time.

“They do not like to see many credit inquiries on your credit report, which is why they continually deny me.”

I’m also in the market for this card. Do you mind sharing how many TU inquiries you have on your report, and how recent?

I don’t have direct access to my TU credit report, but Credit Karma pulls from TU. All my credit inquiries would be from this Wednesday or from March 15.

So why do you think they are denying you for inquiry reason? Do they dis-like even a single inquiry?

I have 2 TU inquiries, one from a month ago and one from 4 months ago. Was thinking of trying in a couple months, and hoping that 2 inquiries isn’t that much. What do you think?

You should be good to go. I have around 10 credit inquiries since March 15 :P

Grant, as Amex SPG has both personal and business type, can I apply for both of them on same day and get approved for both, if so, which one should I apply first, business or personal?

Yes, you can get approved for both a personal and a business credit card on the same day. I would do personal first and hope you get an instant approval. If you do business afterwards, you might have to make a recon call, explaining your business. AMEX wants to make sure you didn’t apply for another card by mistake. If you are interested, I can send you an SPG referral email. Good luck!

In March I was able to get BoA to transfer some credit from one Alaska Airlines card to a new one I was applying for in order to break the $5,000 threshold necessary for the Visa Signature card – I found their CSRs on the phone really open to trying to do whatever was necessary to make it work (I actually had applied for a Virgin Atlantic card at the same time and the same rep did whatever he could to get both of them approved). Can’t hurt to try…

That’s a good idea. I think the idea of moving credit from one personal card to another personal card is a bit if a long shot, especially since I already have an Alaska Airlines business card. I’m traveling around Spain right now but I will call Bank of America when I get back home.

All I can say is that my wife and I were both able to – I don’t have any business cards with BoA but a few personal, and they were very open to moving the credit lines around. Hope it helps!

Thanks Elliot, I’ll definitely give it a try. Have a great day!

Just a note. I got a Citi AA Exec card ~2 months ago and when I asked for expedited deliver before a trip was told that all Exec cards were automatically expedited. Came in a fancy black box… I forget how long it took exactly, but under 5 days from approval (and I’m in Hawaii).

I was told that they were no longer expediting card shipments but I received the credit card a few days later in the nice black packaging as well.

Data points to help. I got the Barclaycard US Airways with 7 inquiries in the past 6-12 months, not counting the other cards I applied for simultaneously in 3 separate browsers. In addition, I had the Arrival World. I also have put a decent amount of spend on the Arrival above the minimum spend of 1K when I was approved for it (about 8-9k). Between that and a few other factors of my situation, and what I have gleaned from blogs and FT, below are my principles for Barclay:

1. Avoid double digit inquires in past 12.

2. If you already have a Barclaycard, spend well above the minimum spend so you have proven your profitability.

3. Apply simultaneously or first in an AOR.

4. Do not MS on Barclays

5. Have a relatively high income and credit score.

6. Pray.

Thanks for sharing your tips. Maybe I am not praying hard enough or maybe it is several other reasons, but I might stop applying for Barclays Cards until 2015.

Pingback: Random News: How to Connect to Free Boingo Wireless Hotspots, Alaska Airlines Platinum Plus Credit Card Update, and Changing Credit Lines on Chase Credit Cards (Online) | Travel with Grant

Pingback: More Info Regarding Chime Card Loads After October 8 and my App-O-Rama Planning | Travel with Grant