Random News: $50 for Serve Direct Deposit, Load Serve at Family Dollar, Targeted Citi AA Admirals Club Passes Spending Bonus, Targeted US Bank Club Carlson Spending Bonus, Club Carlson Business Credit Card Rejection, and Chase Southwest Airlines Credit Card Referrals

World’s longest blog post title. Check.

Greetings from California, I am back from my trip but still feeling the jet-lag. I’ve been up since 3:30am PST this morning. Let me get this post out before I fall asleep…

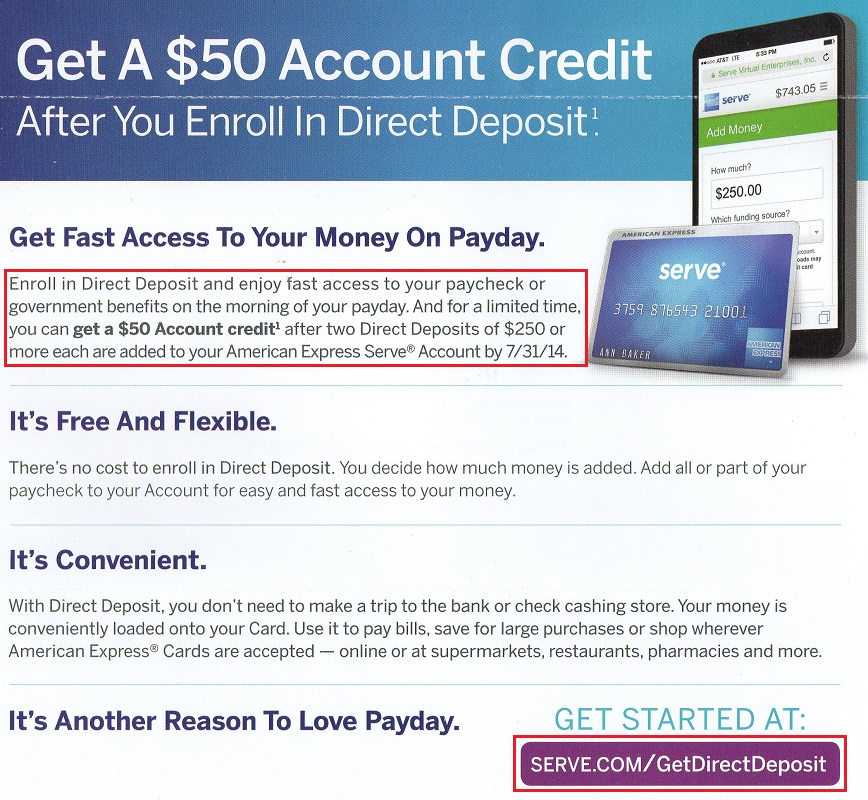

After returning home, I received a few targeted credit card offers worth mentioning. The first doesn’t seem to be targeted as there is no sign up link, but if you have an AMEX Serve Card, you can get a $50 statement credit after having 2 direct deposits of $250 or more post to your AMEX Serve account by July 31.

Just follow the link and set up direct deposit. If you have a PayPal account, you can use the Serve direct deposit information as a bank account and add it to your PayPal account. After you verify that account with PayPal, you can withdraw $250 from PayPal to your Serve “bank account.” That *might* count as a direct deposit, but that’s not a guarantee.

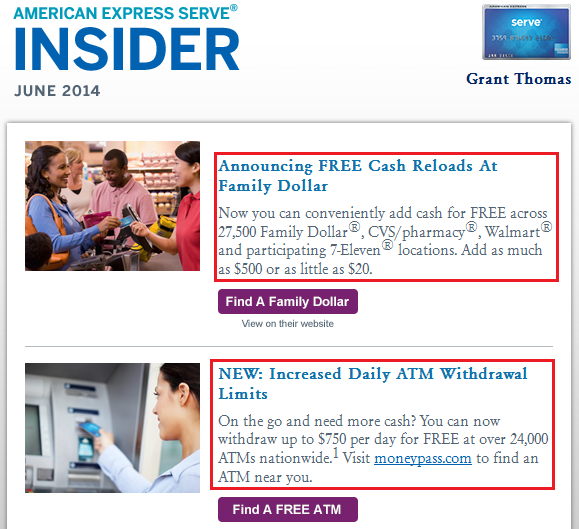

I received an email from Serve that said you can now load “cash” to your Serve Card at Family Dollar stores. There are no Family Dollar stores near me, can anyone test this out for me and report back on the findings. Also, you can now withdraw up to $750 per day from ATMs with your AMEX Serve Card.

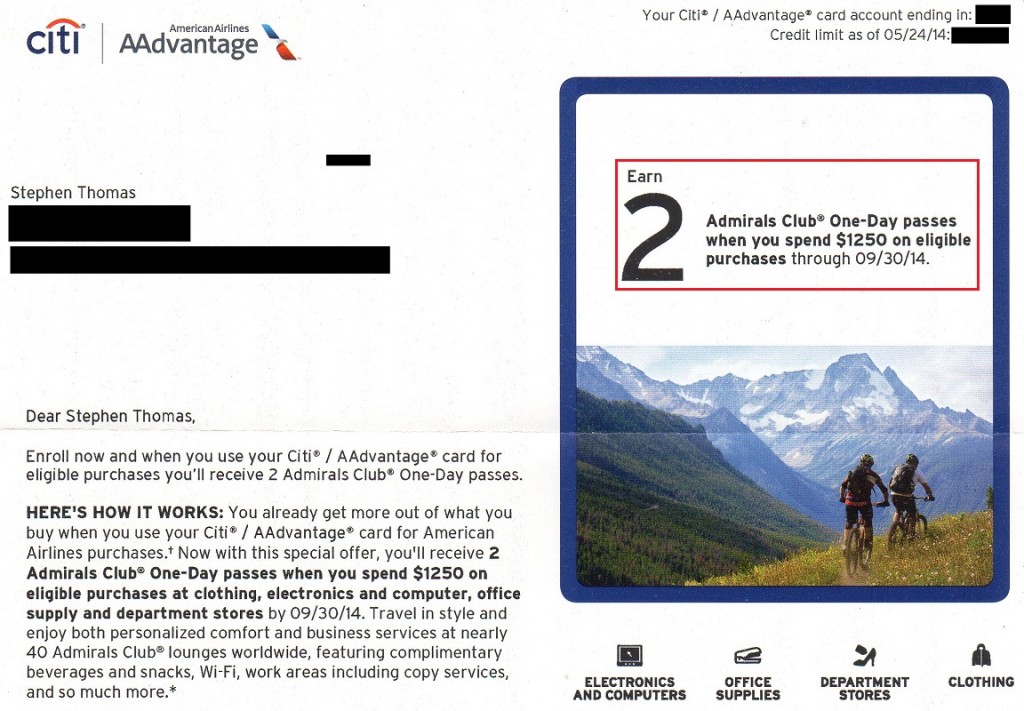

My dad received an interesting targeted offer for his old Citi AA credit card. If he spends $1,250 or more at select merchants (electronics and computer stores, office supply stores, department stores, and clothing stores), he will receive 2 Admirals Club Lounges. I recently sold 2 lounge passes on eBay for $97, so this could be a great promo.

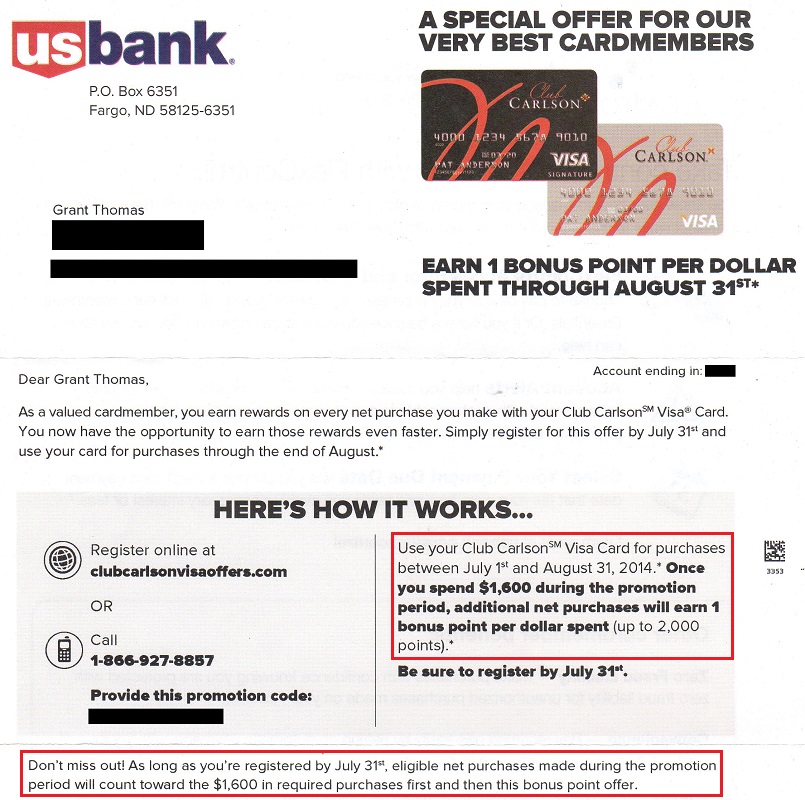

I received the following targeted offer from US Bank regarding my Club Carlson credit card. After I spend $1,600, I will earn 1 bonus point per dollar (maximum of 2,000 bonus points). Since this card already pays 5x on all purchases, I will earn 6x on all purchases made from $1,600-$2,600. I have many credit cards that I need to focus on reaching minimum spending levels, so I am not sure if I will get to this promo in time.

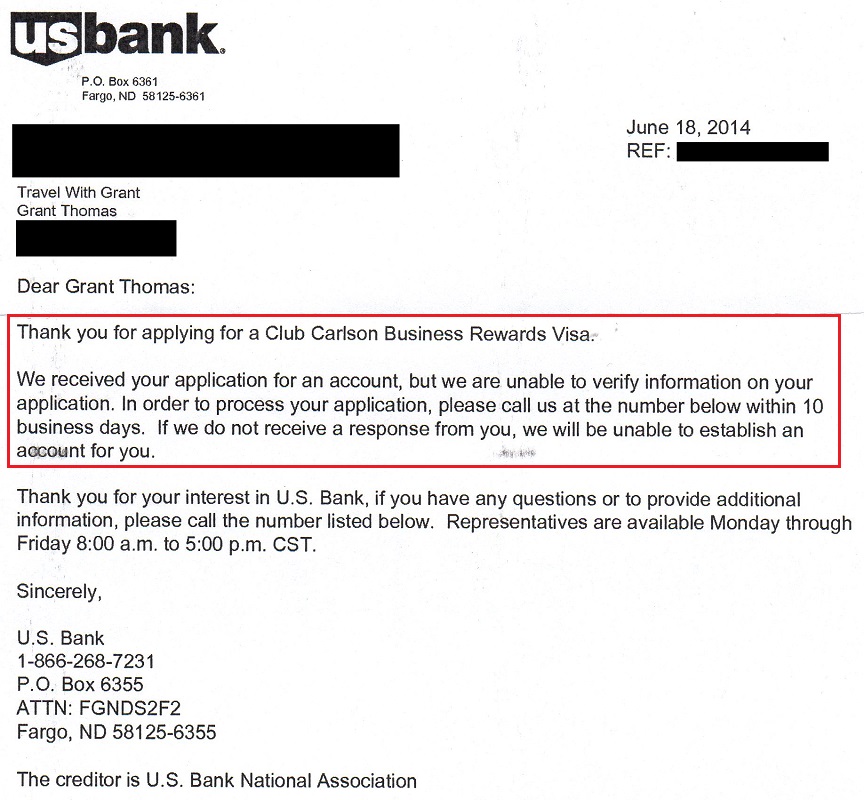

I received the following letter from US Bank regarding my application for a US Bank Club Carlson Business Credit Card. I was instantly approved for the personal version back in November (after freezing my ARS and IDA credit reports) so I was hoping for another instant approval. Unfortunately, that didn’t happen. After calling the number on the letter and speaking with a credit analyst, I was told that I needed to send in documents pertaining to my business license, business lease, and last 3 months of income/expenses. I told him I had a small online business (this blog), but I was told my business was too new and didn’t have the necessary documents. That is a bummer since I have no problem getting business cards with Chase, Bank of America, and American Express. If you had better luck than me, please let me know.

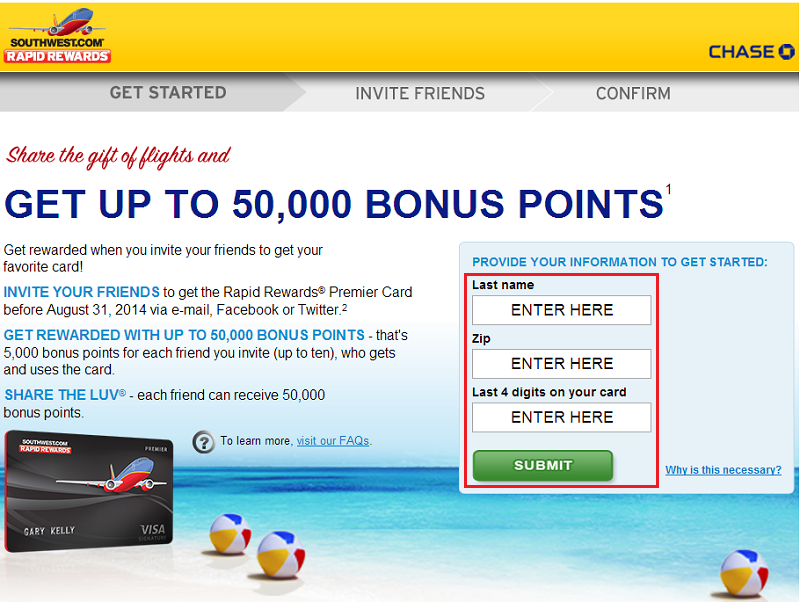

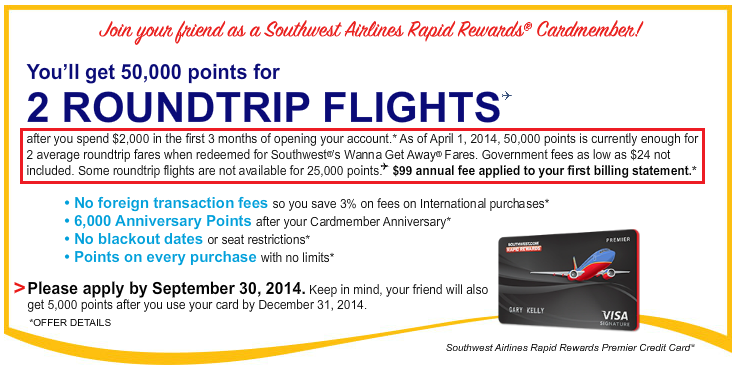

Chase has introduced another refer-a-friend portal for their Chase Southwest Airlines Premier Credit Card. If you have this card, you can refer friends and family members and earn 5,000 Southwest Airlines Rapid Reward Points for each approval. All you need to do is go to this link and fill in your card info.

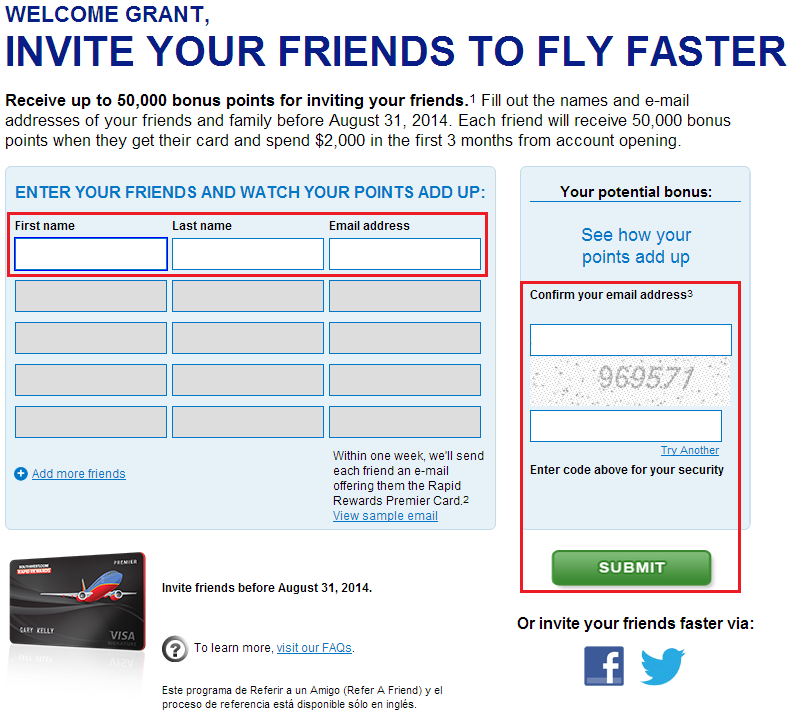

Then enter your friend’s or family member’s name and email address, confirm your email address, type the CAPTCHA code, and click submit.

The offer is the same as the currently available public offer (50,000 Southwest Airlines Rapid Reward Points after spending $2,000 in 3 months, $99 annual fee not waived). I have this card and can send you a referral if you are interested.

If you have any questions, please leave a comment below.

Grant, you should go to your local US Bank branch. They can grab the application and review with a local underwriter. They did this for me for the CC Biz card and did not ask for any document and approved me. Good luck.

That’s an idea, I’ll see if I can do that over the weekend. Thank you.

My “business” is that I have one rental property that brings in $1400/month. I was honest about my “real estate business” having a revenue of $1400/month, and was approved instantly. I got this card (club carlson business) the same day as the club carlson personal card, both were instantly approved. Maybe I’m just lucky.

I think your rental income is a bit more than my blog income, which might have helped you get instantly approved.

Interesting. My Club Carlson offer is similar, but starts the bonus points after only $450 in spend.

Nice, is there a 2,000 point bonus cap on your offer?

Hi Grant,

My wife got the invitation for 2 bonus points with Club Carlson credit card.

Nice, does it have the same spending threshold as mine? Two bonus points after spending $1,600?

Hi Grant,

I am not sure since my wife may throw away and I did not register it for her yet. I still did not get companion pass yet and now I am on the phone waiting for customer service, I earn 112K points since 6/22.

Let me know what customer service says. You should have received the SWA companion pass already.

Hi Grant,

No luck. The first one is terrible she did not know what she talk about and kept saying I do not earn enough points this year then she gave me the phone number 214-932-0333. I called twice and got busy signal. I call back again and they offered the call back and they did but she said nothing she can do let the system takes care since today is the 1st day of the month and wait for few more days!!!

Send a secure message to Chase and see if they can look into the issue.

But the SW companion pass is SW program nothing to do with Chase. By the way I just applied Carlson Biz and no decision yet.

I think Southwest sends out an email when you achieve Companion Pass status in their system, so maybe their system is a bit behind.

Wow, I must be very lucky. Applied for the CC Biz card and the Barclay Arrival at the same time using the 2 browser trick. Did not freeze any credit bureau and was put on pending by both. Thought I was gone for. 3 days later Barclay sent me an email approved for $10k limit. Kept calling US Bank number with pending still the automated answer for 10 business days. Asked for a rep who said they could do nothing until the process was completed. Next day got my email approval and a $15k limit on the Biz card. Was neither asked for or provided no business information or details.

What business did you put on your Club Carlson Biz application? How much in monthly revenue?

Grant, I did not enter a tax ID and checked Sole Proprietorship. It only gives 2 choices for revenue, I selected under 1 million. Like I said no follow up questions but 2 weeks before approval.

Thanks Patrick, I wish my blog was in the over 1 million dollar range. Maybe someday…

Pingback: 50000 Points Southwest Cards still available online and via referral

Pingback: Random News: PayPal to Serve Direct Deposit, Global Entry is Awesome, $25 Costco AMEX Offer, Barclays Arrival Plus 0% APR, and San Diego FlyerTalk Meet Up | Travel with Grant

Hey Grant, would you mind sending me the referral for the Southwest card if it’s still available?

Sure thing Fabiola, check your email soon for a link from Chase. Good luck on your application.

Pingback: Chime Card Prepaid Reloadable Debit Card – Instant Cash Back Card | Travel with Grant

Pingback: Success: US Bank Club Carlson Business Credit Card Reconsideration Bank Visit | Travel with Grant