Random News: 3 Retention Calls, 2,931 Southwest Airlines Miles, and 50% Companion Tickets on Hawaiian Airlines to Beijing

Good evening everyone, here are some random news stories from today. This morning, I helped my parents with their retention calls. The only call worth listening to is the first one since my dad was able to get a $95 statement credit and a spending challenge on his Citi American Airlines Platinum MasterCard. My dad used this card a fair amount during the last 12 months so I wasn’t that surprised with the generous retention offer. Download Link

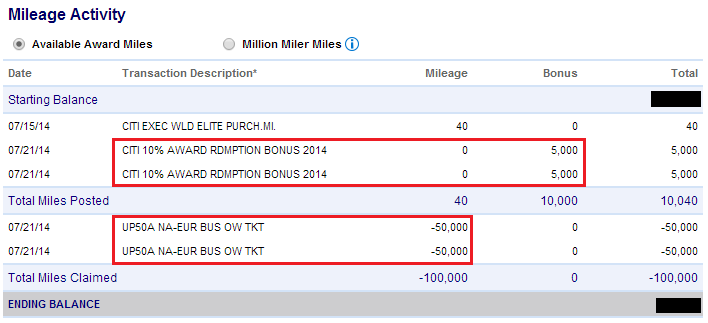

The only reason I told him to keep the credit card open is the 10% rebate on the redeemed miles. For example, 2 one way business class flights to Europe cost 100,000 AA miles, shortly after booking the award flight, 10,000 AA miles are rebated and credit back to his AA account. In essence, you are paying $95 for 10,000 AA miles each year if you max out this credit card benefit.

Up next is my mom’s American Express Delta Gold SkyMiles Credit Card. Since she got this 11-12 months ago, she has not used it since. I told her to not bother asking for a retention bonus and just to transfer the credit line over to her American Express Costco Cash credit card. The credit line process was quick and easy and then her Delta credit card was closed. She still have several months to use the Delta SkyMiles before they expire. Download Link

The last retention call this morning was for my mom’s Bank of American Alaska Airlines Visa Signature credit card. She hasn’t used this card much this year either. She signed up for the credit card to get the 30,000 Alaska Airlines miles and received the $99* companion pass. We are using that pass for Labor Day weekend to fly to Portland. Since you can get the Alaska Airlines credit cards multiple times (and multiple sign up bonuses), I told her just to close the card and reapply for a new one in a few months. Download Link

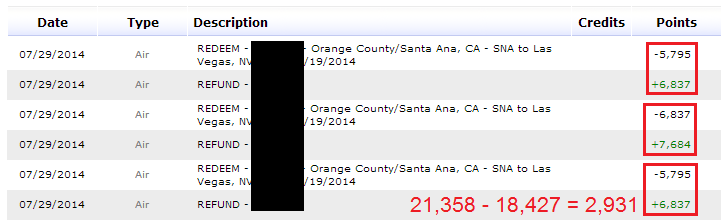

In other news, I decided to check on some of my Southwest Airlines flights and see if the price in SWA RR points/miles decreased. To my surprise, 3 of them did decrease in points. I was able to re-book the flights at the lower “price” point and saved 2,931. I was also able to re-book some paid Southwest Airlines flights and saved almost $50. Green numbers represent miles credited to my account, black numbers represent miles deducted from my account. I love Southwest Airlines!

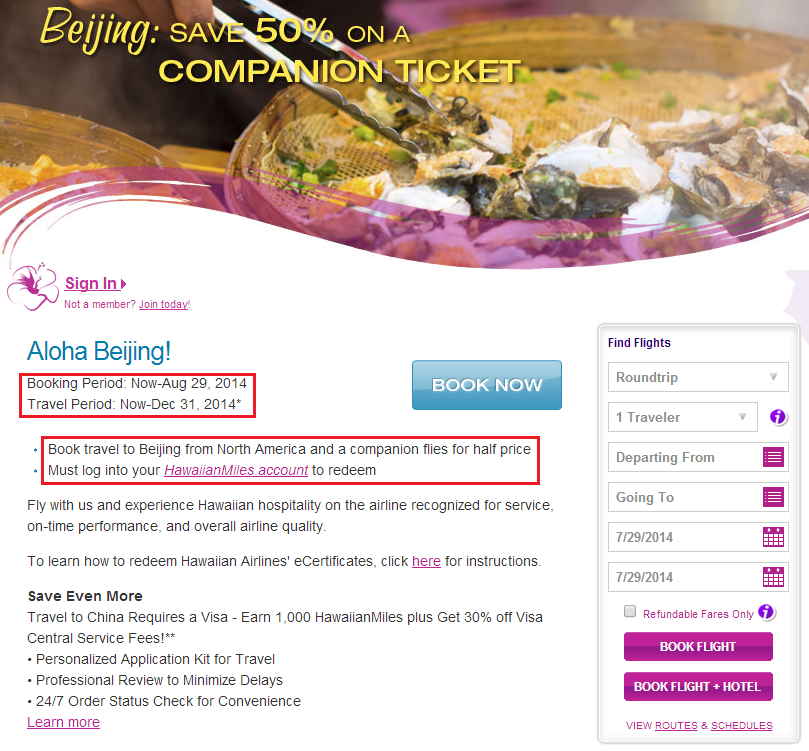

Last but not least, Hawaiian Airlines has a sale to Beijing. You can save 50% on a companion ticket. To learn more, please click here.

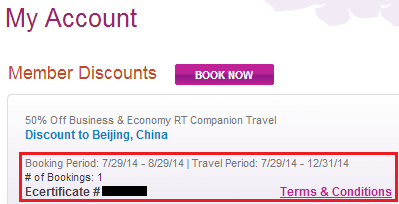

I believe the offer is targeted since I had a special Hawaiian Airlines Ecertificate code in my Hawaiian Airlines account. I no longer have any Hawaiian Airlines miles or credit card, so I am not sure why I was targeted.

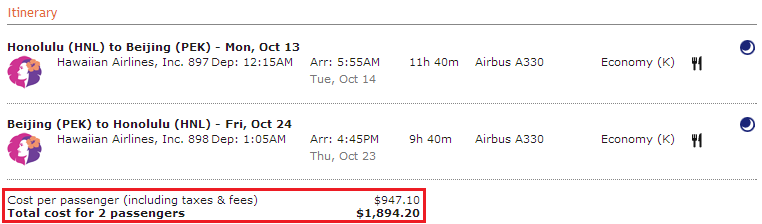

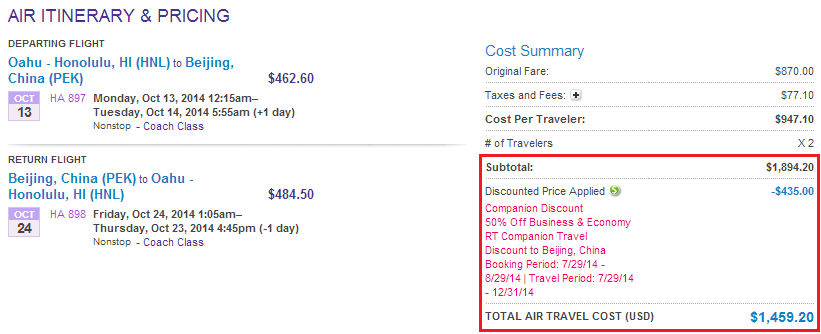

Here is a sample itinerary from HNL to PEK for 2 passengers. Total price is $1,894.20.

In comparison, with the Hawaiian Airlines Ecertificate code, the total price for 2 passengers was only $1,459.20, a savings of $435. Not bad!

If you have any questions, please leave a comment below. Have a great night everyone!

“She still have several months to use the Delta SkyMiles before they expire”

Under the SkyMiles Mileage Expiration policy, miles do not expire.

http://www.delta.com/content/www/en_US/skymiles/about-skymiles/program-rules-conditions.html

Very good to know, this is Delta’s policy on miles:

Account Deletion & Mileage Expiration

Under the SkyMiles Mileage Expiration policy, miles do not expire. Delta reserves the right to de-activate or close an account under the following circumstances:

– Fraudulent activity occurs

– A member requests an account closure

– A member is deceased

– A member does not respond to repeated communication attempts regarding the status of his/her account

On the SWA point differences, when you say rebook, are you simply booking again and canceling the other or calling them and getting a credit back at the new rate? Thanks.

Actually neither. There is a link on the right hand side of the SWA page that says Change Flight. Enter your existing reservation number and you can choose a new flight or the same price at a lower price. It is very cool.

Grant,

So the main benefit of keeping a card for 11-12 months is mainly so the CC company doesn’t see you cancel it too soon after opening right? Cuz otherwise if there was no intent in keeping the card / trying for a retention bonus, then wouldn’t we’d all be canceling them soon after the signup bonus?

I have an Amex platinum I opened about a month ago (fully intending to close at some point, after I receive my 100K MR points and sign up my whole family for global entry, priority pass, etc.) … debating whether to close it sooner (and get more of the $450 + $175 additional cardmembers AF refunded) vs. later (only benefit in waiting would be for the additional $200 SW GC credit after Jan 1…..) Not sure what to do!

My main goal when closing credit cards is not to leave a bad impression with the credit card company. If you close cards too soon, that might negatively impact your chance at being approved for future cards. Usually if you put descend spend on a credit card, even if it is only MS, the retention bonus should be good. If not, HUCA.

Best practice is to convert the Alaska card to a Better Balance card which will award $100 a year for minimal spending. I have 6 of them. :)

Good idea Steven. I might do that for my 3 Alaska Airlines credit cards. How much spending do you do per card per year?

I only have one Better Balance Card, so I have some work to do to catch up to Steven! I purchase an Amazon eGC for $0.50 each month, so I spend $6 per year to get $100. Actually for me it’s $120 because you get a $5 bonus per quarter if you have a BofA checking account as well.

Dang, that’s a nice payoff. This card is definitely on my list now.

I have 1, I converted my oldest credit card, which only paid 1% back on purchases, and now I put my monthly Spotify subscription on there. The $30 bonus every quarter pays exactly for the subscription.

I have another old BoA card that I think I will convert into the Better Balance card, too. Gotta love free money.

Do you think I should do a blog post about downgrading/converting to that card? I have a feeling most people are totally unaware of the awesomeness.

I think a blog post about all the “good downgrading cards” would be great. Include the BoA Better Balance Rewards and the Citizens Bank Green$ense (pays you $0.25 per transaction, up to $20 per month; great for purchases under $5) in addition to other cards. Although other than those two I haven’t found any really useful, zero annual fee cards.

That would be a great post, but could take a lot of time to research. Many of the good no annual fee cards are not listed online, you can only get them by downgrading/converting from an annual fee card. I could cover my favorite no annual fee cards, but I don’t think there would be any new info. (Chase Freedom, Citi Dividend, Discover It, AMEX EveryDay, Barclays Arrival, etc.)

Maybe write a post about the BoA Better Balance Rewards card and then ask people to post similar cards in the comments?

That could work. Make it a group effort and then summarize the findings later on. I’ll get that post up tonight I hope.

Are you allowed to use miles for the Hawaiian airline deal?

I’m not sure, but that would be a pretty sweet deal. I’ll check that out in the morning.

Thank you! I look forward to learning about it. :)

I just tried to book it with HA miles and it didn’t work. They still wanted 80,000 HA miles round trip per person for HNL to PEK in economy.

Did you let the rep on the phone know that you were recording the calls? In California you have to let them know if you are recording the call.

I was not aware of that rule. Do other states have a similar rule?

Edit: According to http://en.m.wikipedia.org/wiki/Telephone_recording_laws, CA is an all party state. Every time I call the credit card companies, they tell me that this call may be recorded for training purposes or similar reasons. If they are recording me, I should be able to record them. I will ask in future recordings for their permission. Thank you for bringing this to my attention. The last thing I want to do is get in trouble with my BFFs the credit card companies.

Oh my god! I love China, especially Beijing. I went to Beijing with my family last year, and it was great. The people there were friendly, and the food was so delicious. Chinese culture is amazing. Wish I have anther chance to go there again (to visit other cities, such as Shanghai, Hongkong, and Taiwan.) this year or next year.

Just go! You only live once…

LOL

Hope you weren’t referring to Hong Kong and Taiwan as cities in China. You might not have been but just wanted to point that out just in case ;)

I believe Hong kong is part of China, google it yourself :)

Taiwan I’m not sure though. Some of my friends from Taiwan told me it is one country, but a special administrative region.

What Citi AA card that gives you 10% back in redemption?

The Citi AA Platinum Select has this feature. I think most Citi AA cards have this feature, with the notable exception of the Citi AA Exec card.

Not sure if I have already made a mistake!

I have both Citi platinum and Citi Executive mastercards. I redeemed 135k AA miles and used the Executive card to pay the taxes. Will I get 10% rebate or did I miss it! That’s shame if I missed 13.5k miles!

The limit on rebated miles each cardmember year is 10,000 AA miles. Log into your AA account and see if you received any rebated miles into your account.

Thanks!

I redeemed only 2 days ago, so points haven’t posted as yet. My concern was, should I be using Citi Platinum select card for award travel purchase to get the 10k rebate. I gather that it doesn’t have to be as long as you have platinum card in good standing. Did I get this right?

Yes, just having the card is enough to get the rebated miles.

Pingback: Weekend TWG Homework Assignment: What are the Best Credit Cards for Downgrades or Conversions? | Travel with Grant