Update: 7AM PST – Chase Sapphire Preferred and Chase Freedom reloads are showing up as cash advances online.

*Some* Chase Credit Cards Charging Cash Advance Fees for Online Serve Reloads

There have been reports on FlyerTalk (link) and some Tweets that Serve is now charging cash advance fees for *some* online Serve reloads. Most of the cash advance reports state that Chase is charging cash advance fees for online reloads.

RRGG on the FlyerTalk thread (link) has some good info:

It seems like you should include a little more information if you’re going to start a new thread. You didn’t mention the type of card for example. NOT EVERYONE is getting a cash advance from Chase, as mentioned in the Serve thread.

There are reports of no cash advance today on:

UA Explorer Visa

UA Explorer MC

Sapphire Preferred

Southwest Visa

Also Barclay, Citi cards (Prestige), Fidelity AMEX

There are reports of a cash advance today on:

UA Club

UA Explorer

Ink Bold Visa

Sapphire Preferred

Also a Capital One card

As you can see it’s not even consistent.

Finally, in the past sometimes Chase has posted these as cash advance at first. After a few days they get changed to a regular charge. If anyone actually got a cash advance fee, you might want to share that.

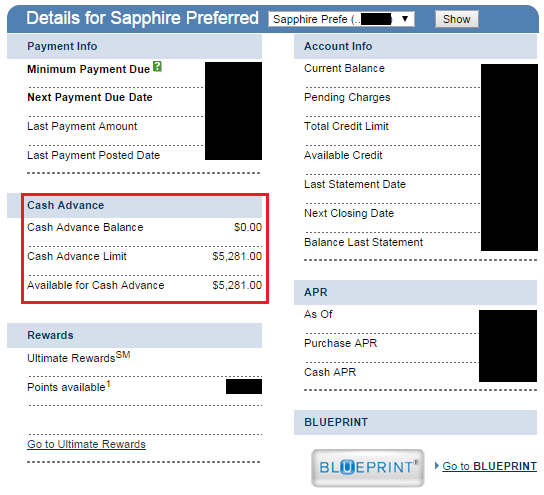

I wanted to test my Chase Sapphire Preferred to see if a cash advance fee would show up when I did an online Serve reload. Here is the beginning cash advance limit:

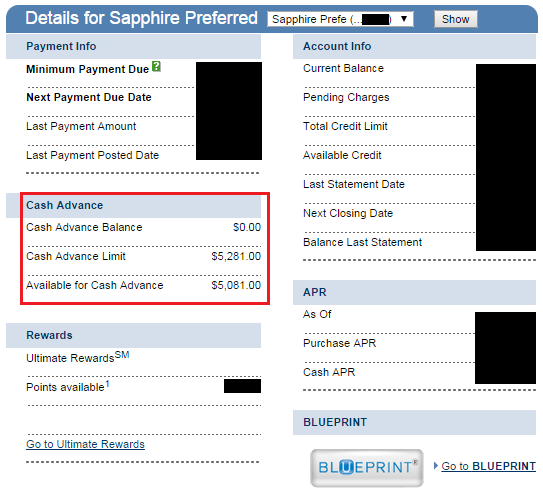

A few hours after the online Serve reload, the cash advance fee has dropped by $200:

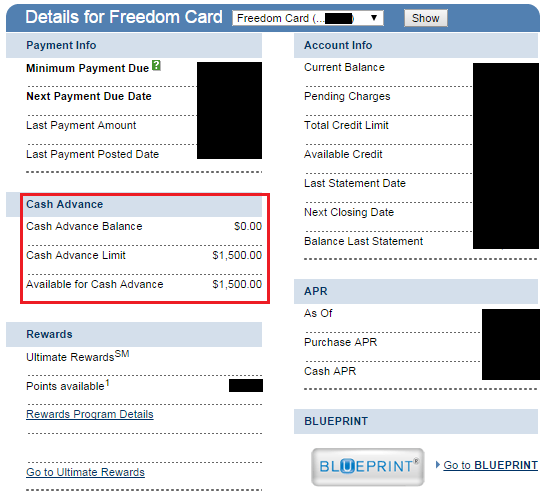

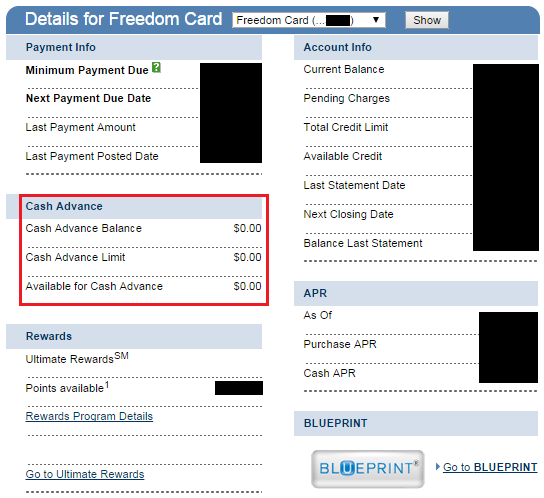

I wanted to test my Chase Freedom to see if a cash advance fee would show up when I did an online Serve reload. Here is the beginning cash advance limit:

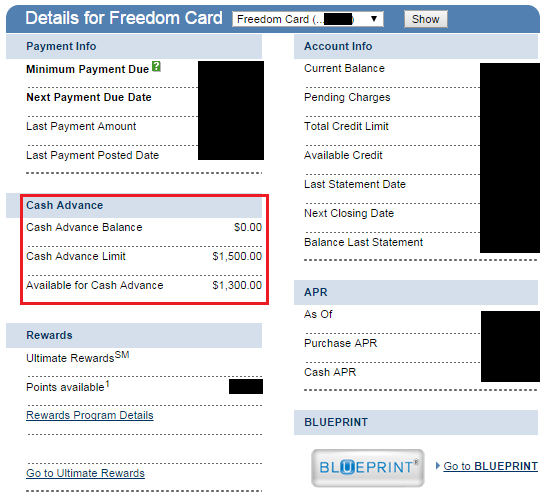

A few hours after the online Serve reload, the cash advance fee has dropped by $200:

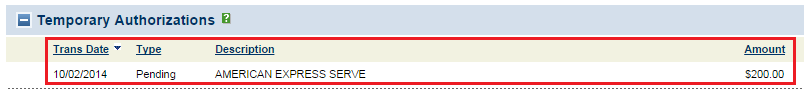

Both online Serve reloads were approved by Serve and Chase. When I log into my Chase account, I see the following pending charge.

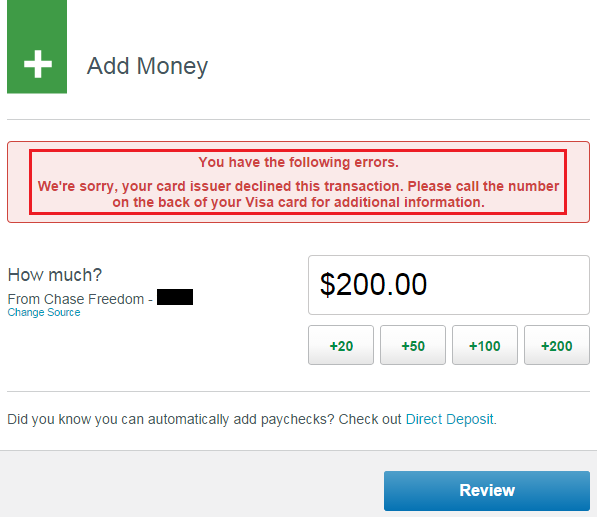

Lastly, I wanted to test a Chase Freedom card that has a $0 cash advance limit:

During the online Serve reload, the transaction was denied (I assume Serve was trying to access the cash advance limit and there are no funds in there, so the transaction was denied).

If you are worried about cash advance fees on your Chase credit cards or any credit cards, call the number on the back of your credit card and ask them to lower the cash advance limit to $0. Most banks will be able to do that, but I think Citi or US Bank can only lower the cash advance limit to 10% of your credit limit.

Updated 7:45PM PST on Friday

Credit cards with no cash advance fees for online Serve reloads:

- American Express –

- Bank of America –

- Barclays –

- Capital One – Venture, Quicksilver

- Chase –

Freedom, Sapphire Preferred, Ink Bold MC, Marriott Biz (?) - Citi – American Airlines MC, Forward

- Discover –

- US Bank – FlexPerks, Club Carlson

- Others? – USAA AMEX/MC, Fidelity AMEX

Credit cards that charge cash advance fees for online Serve reloads:

- American Express –

- Bank of America –

- Barclays –

- Capital One – Venture

- Chase – United MileagePlus Explorer Visa (2x Confirmed), British Airways, Hyatt, Freedom, Sapphire Preferred, Ink Bold Visa

- Citi –

- Discover – It

- US Bank –

- Others? –

Please share your data points here and I will do my best to add your input to the above list. If you have data points that contradict previous data points, please share that as well. Thank you everyone for your help!

Hey Grant, for loading your parent’s serve card, are you using their credit card to load it or are you using your own credit card account with them as an authorize user? I am trying to load my parents serve also but not sure if I can use my credit card with them as an authorized using to do it.

Good evening Phil, see my email response to you.

Hi Grant – I have the same question as above. Any guidance would be great.

I recommend using a primary credit card that matches the name on the Serve/Bluebird account. I have heard mixed reports of authorized user cards working/not working. If you have access to the other person’s point balance, then it doesn’t really matter.

Please e-mail me the same thing! :)

So far my USAA Amex & MC did not charge any fee. Used the MC today! My PayPal Business Debit MC also has not had any issues! Hopefully this continues !

Thank you Trevor!

Trevor, Are you saying you used your PayPal MC for credit card loading? (Or do you mean for debit card loading?) Thanks.

oh freak, getting charged as cash advance

I used Chase United Explorer.

now what, call Chase and revert cash advance fee? :(

Call Chase and tell them to lower your cash advance limit to $0 on all your credit cards. Thanks for the data point Jason.

Does lowering the limit to zero prevent you from doing online serve reloads at all, or is it a work around?

Lowering it to $0 will prevent any cash advance fees from going through, which will result in unsuccessful reloads for some credit cards.

Hello Grant,

Don’t they charge $35 or something for cash advance?

or am I cleared with any fee as long as I pay in time?

That sounds like a debit card overdraft fee or a credit card late payment fee. Most cash advance fees are 5% to 10% with a $10 minimum amount (or something like that).

Looks like the Serve load with my Chase British Airways card is being coded as a cash advance…

Thank you Jenny, I’m sorry to hear about that with your British Airways Card :(

Great site Grant. I have a Capital One Venture and it loaded as a purchase today.

Thank you Steven!

Loaded $200 to Serve with Chase United Explorer today 10/2. Showing as pending sale. Yesterday’s load showing as processed sale.

Never mind posting as cash advance as cash advance limit decreased

Thank you for the update, I’m sorry to heard that the United card is showing up as a cash advance :(

It ended up posting as sale in spite of reduction in CA limit while pending!

Agreed, time to create a new post with updated info!

It’s been a few days, but no problems with Fidelity Amex.

Thank you Jeremy!

Citi aa MasterCard no cash advance fee today or yesterday’s

Thank you Fred!

subscribe

Chase Hyatt fine yesterday, today pending and deducting from CA line. We’ll see tomorrrow

That’s no good, please let me know what happens. Thank you Jordan!

United Explorer (10/2), currently pending as CA. Spoke with CSR at Chase, they said CA fee + APR for cash advance. But APR is calculated daily up until statement close date. For example, if transaction posts tomorrow as CA, I will collect interest up until statement close date on (10/15), even if I pay off total balance tomorrow. Have you had experience with CA fees? Does this sound correct?

I believe if you pay off the full balance (credit card purchases and cash advance fees), then the cash advance fee stops accruing interest. I would make a payment tonight/tomorrow morning and hope that works.

Used Sapphire this evening…my CA limit went down by $200 initially, then two hours later went back up by $200 to regular limit. Preauth is showing as a purchase.

My transaction was the opposite. The credit line did not decrease until several hours after the online Serve reload. Nothing has officially posted as a cash advance, so I must wait and see what happens.

Pingback: Serve cash advance? Don’t panic, and don’t call. - The Frequent Miler - The Frequent Miler

Grant,

I figure the cards you tried were all Visa. Is that correct?

Although I’ve seen reports of Ink Bold Visa failing, I saw one today about Ink Bold MC going through OK. Since Citi MC all seem to be in the clear so far, I was wondering if all MC still work.

(I know this is not strictly a Visa issue though, since someone reported a change in the cash advance limit on Discover IT.)

All my cards that I tried are Visa. I’m still waiting to see what happens, but to be safe, I sent a partial payment.

US Bank tried FlexPerks and Club Carlson…..both are coded as purchase….had to call up and get it verified….the rep didn’t know of a way to set cash advance limit to 0….Have any one did it with their US Bank cards

Good to know about US Bank credit cards working. I will update the chart soon.

Anyone tried with Discover IT card? I guess I will bid goodbye to freedom card..

I’m not sure, call Discover to lower your cash advance limit to $0 and then give it a try on Serve.

Capital One Quicksilver posts as a transaction (Discount Stores) and has from the beginning. This is on an authorized user (not primary).

Thank you Jesse, I will update the chart shortly.

Pingback: MIleage-earning Opportunity Begins to Slam Shut, Plus Crabs on a Plane and Donating to US Customs - View from the Wing - View from the Wing

Yes. Someone on FT reported seeing the available cash advance amount change after loading with Discover IT.

P.S. My Ink Bold MC is still working.

Thank you for the update RRGG. I have FT reading to do tonight.

Great post Grant! I had lowered my cash advance limit to $0 and was denied today and stumbled upon this post in a google search. I’m glad I lowered that limit! At least I cashed in on a free $1000 of manufactured spend last month before this kicked in. What a shame!

Welcome to TWG, Anthony. As of this minute, there are no confirmed cash advance fees posting to anyone’s Chase credit cards. It is entirely possible that the Serve reload amount is being held as a cash advance for some reason before the reload amount is posted as a purchase. If that turns out to be the case, then you and I may have to raise our cash advance limit to $200 to allow the “purchase” to go through. I will keep you updated if I find out any new info.

Capital one Venture transaction from 10/02 decreased my CA. Never has before today.

Thank you for the data point Ashjam. I will update the chart shortly.

I did a Serve load on Oct 1, and another on Oct 2, using a Chase Marriott Business card. My Cash Advance availability has not changed, though neither load has yet to show up in a way that clarifies whether they’re classed as Purchases or CA’s.

Thank you RR, please let me know what happens with your 2 Serve reloads.

Still no verified report of anyone being charged a cash advance fee. Many people calling Chase to call attention to it is not helping. My UA Explorer from 10/1 posted as a purchase. Reducing cash advance limit to $100 resulted in a decline, now I will raise it again and do a new test.

Thank you RTC, I agree that NO ONE SHOULD CALL CHASE unless you are calling to change your cash advance limit. We must wait and see what happens over the weekend to see if any cash advance fees do indeed post to our Chase cards.

I don’t think Serve reloads were affecting cash advance limits before. I have had my Chase Freedom set to $0 cash advance limit for several months and have not had any problems loading to Serve over the last several months until yesterday.

Lowered cash advance limit to $100 on citi forward. $200 load just went through.

Chase ink bold did not go through, because it attempted to process as cash advance.

Thank you Patrick, was your Chase Ink Bold a Visa or MasterCard?

I was just coming back to add this, after reading above. It’s the Visa.

Thank you Patrick, I thought it would be the Ink Bold Visa.

How did you end up with a limit of $26405 on your sapphire preferred? I have heard of some strange limits before but that is a new one. I’m assuming your card has been matched to Chase policy of having the cash advance limit at 20% of the total line.

I have no idea, that is just what is showing up.

As predicted, people on FT are now reporting that supposed pending cash advances finally posted and they are ordinary charges with no cash advance fee.

You can now stop panicking and go back to worrying about Ebola.

With a $20 CA limit on a Chase Sapphire, I successfully added $200 on 10/1, but was denied on 10/2. I would like to try again, but am wondering if declined CC charges will harm my credit score or have other negative effects. Thoughts?

Many reports and my own testing are showing the Serve reloads are counting as purchases, even though the cash advance balance may change.

Comments are closed now, please see the updated post with good news.

Pingback: False Alarm! Online Serve Reloads are Posting as Purchases (Not Cash Advances) | Travel with Grant

Pingback: Requesting an Increased Cash Advance Limit from Chase for Online Serve Reloads | Travel with Grant

Pingback: PSA: Set Your Cash Advance Limit To $0 To Reduce Your Risk & Always Have A Float » Doctor Of Credit