Chase Ritz-Carlton Credit Card, Gold Elite Status, Upgrades, Lounge Club, and Travel Reimbursement Updates

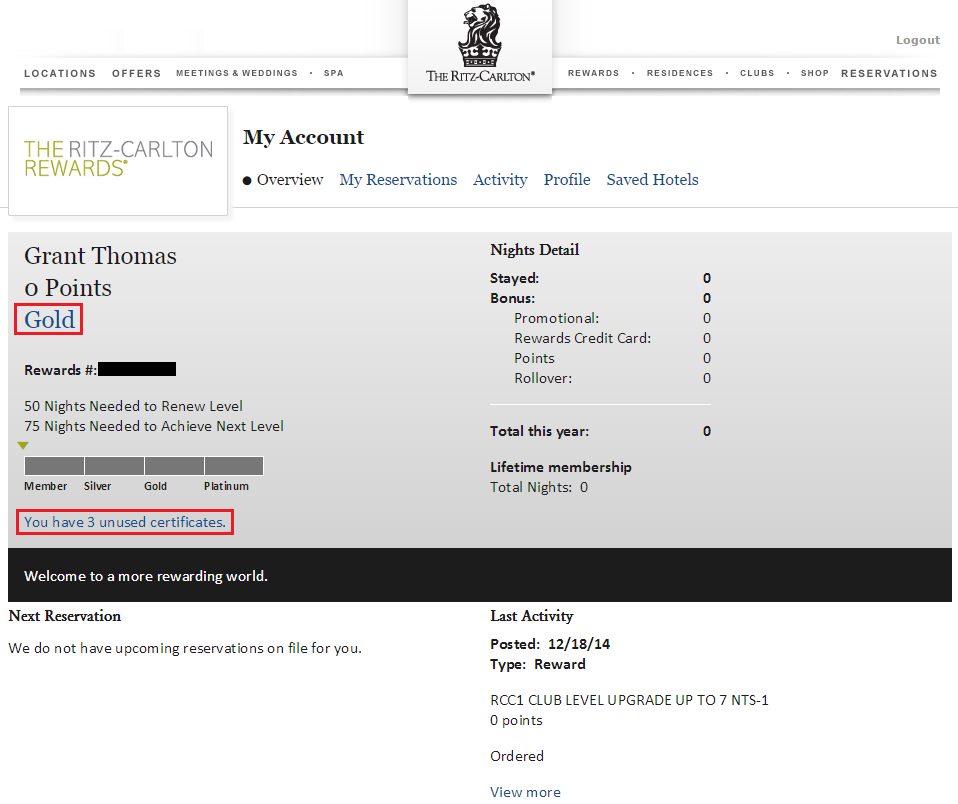

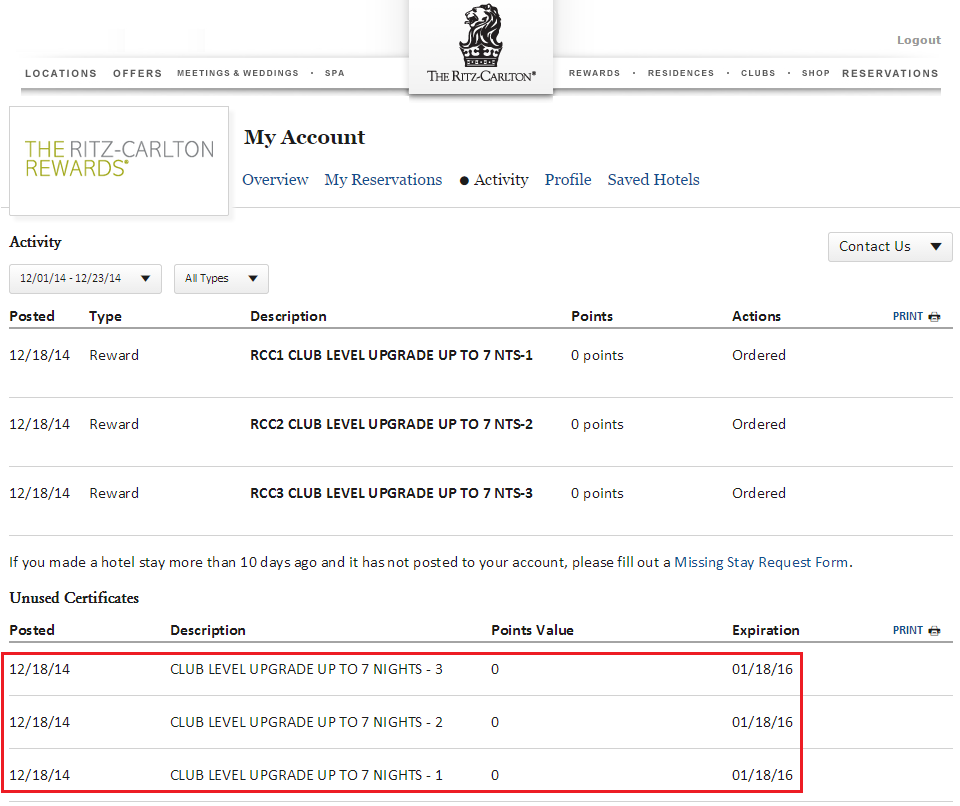

Good morning everyone, sorry for being MIA (missing in action, not Miami) the last few weeks. I have been busy at work and haven’t had much time to work on any posts. This post has a bunch of random information about the Chase Ritz-Carlton Credit Card. Since I forgot to enter my Marriott account number when I applied for this credit card, I now have a Ritz-Carlton account with Ritz-Carlton Gold Elite Status (learn more below). I also received 3 upgrade certificates in my account.

The upgrade certificates seem to be valid for 13 months from the date you were approved for the credit card. I haven’t looked into these certificates yet, so I am not sure if they can be gifted to others or can only be used in your account.

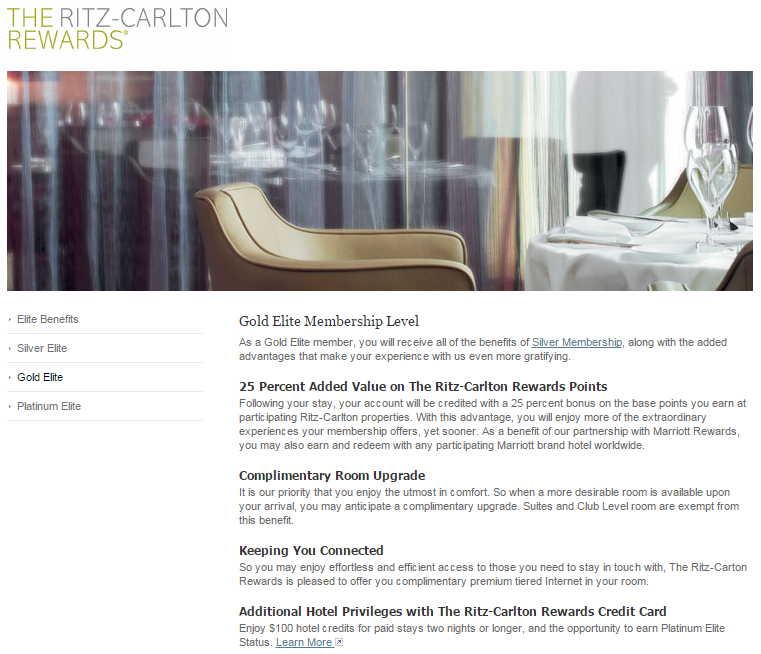

Here are the perks of Ritz-Carlton Gold Elite Status (included with the first year of card membership). To keep Ritz-Carlton Gold Elite Status for each additional year, you must spend at least $10,000 on this card (cumulatively across all purchases).

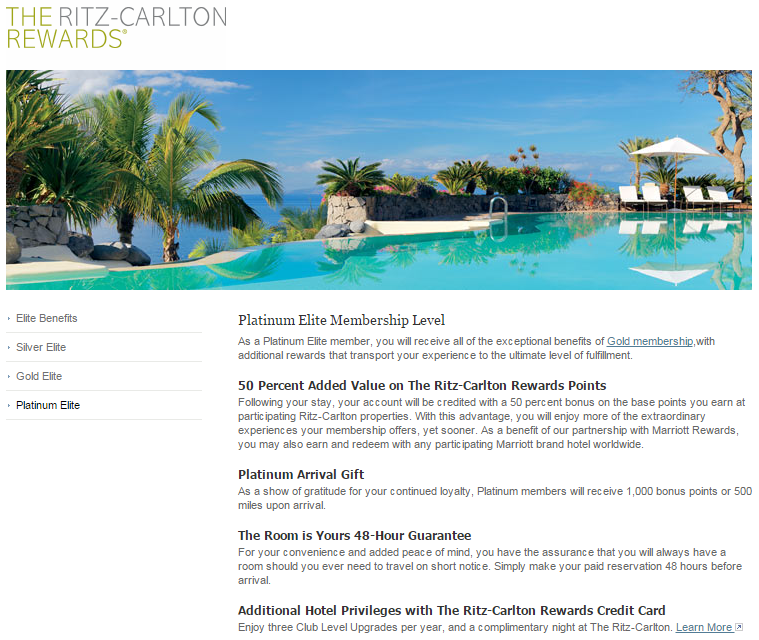

Here is Ritz-Carlton Platinum Elite Status, which can be earned after spending $75,000 on this card (cumulatively across all purchases).

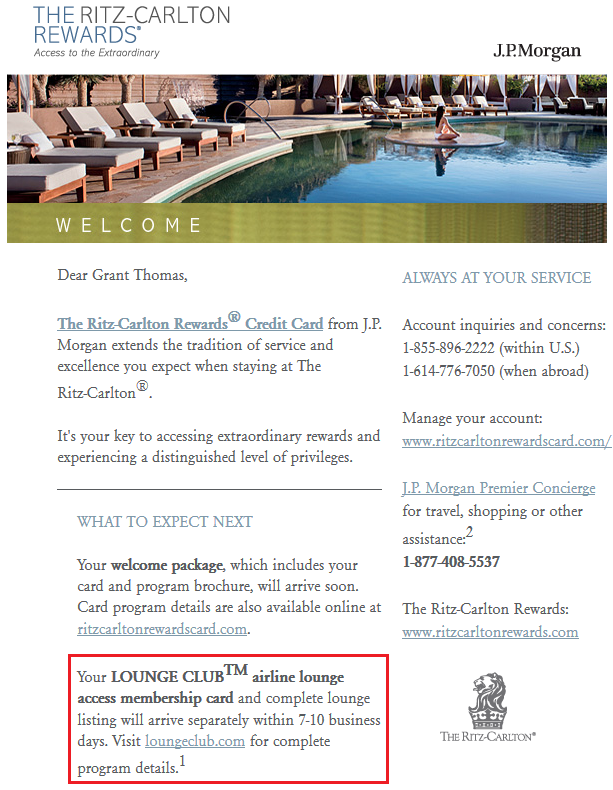

I also received an email a few days ago regarding my Lounge Club membership card. I was under the impression that the card was going to be a Priority Pass card, but maybe my memory is wrong. I know Chase Ink Bold/Plus card holders get 2 free visits to Lounge Club, so maybe there is a relationship between Chase and Lounge Club. I will let you know what the Lounge Club card provides in terms of benefits, after I receive the card.

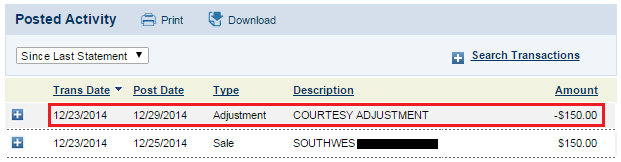

Last but not least, here is a screenshot of my first travel reimbursement. I’m not sure why it says courtesy adjustment, instead of a reimbursement.

Here is the first response I received from Chase:

Dear Grant Thomas,

Thank you for contacting J.P. Morgan about the travel credit benefit offered on The Ritz-Carlton Rewards® credit card ending in ####. We have issued a $150 statement credit to your account as requested.

Here’s what will happen next:

You will see the $150 statement credit posted on your January 4, 2015 billing statement. You have $150 of $300 remaining for the Airline Incidentals credit benefit for the 2014 calendar year.

Thank you again for choosing The Ritz-Carlton Rewards credit card from J.P. Morgan. If you have any further questions, please reply using the Secure Message Center.

Thank you,

[Name]

Customer Service Specialist

1-855-896-2222

This is the second response I received (asking for second travel reimbursement):

Dear Grant Thomas,

Thank you for taking the time to contact J.P. Morgan again in regards to the travel credit benefit offered on The Ritz-Carlton® Rewards credit card ending in ####.

Because the transaction is only in the authorization stages, we are unable to issue a credit for the transaction. To request a statement credit. Here’s what you need to do next:

Call J.P. Morgan Priority Services at the number on the back of your Ritz-Carlton Rewards Credit Card, or;

Send us a message through the Secure Message Center

Provide us with the name of the merchant, dollar amount of the charge and posting date for review.

Once we receive and review the information requested we will issue credit in accordance with the terms of the Travel Incidental Credit benefit.

Thank you again for choosing The Ritz-Carlton Rewards credit card from J.P. Morgan. If you have any further questions, please reply using the Secure Message Center.

Thank you,

[Name]

Customer Service Specialist

1-855-896-2222

For more information, please check out this FlyerTalk thread. If you have any questions, please leave a comment below. Have a great New Years everyone!

Hi Grant, My $150 charges with Southwest just posted yesterday and I sent a secure message to Chase yesterday for reimbursement, but haven’t get any response yet until today.

There are also other 2 transactions of $50 made on 12/29 still pending on my Ritz account and haven’t posted yet but I also sent a secure message too today since I am worried….today is the end of 2014 so I hope it get credited for 2014 travel credit, not 2015.

Do you think I should call the number on the back of my Ritz card to ask for reimbursement or just wait?

After buying 2 gift cards (AA for 200 and SW for 100), I sent a message through secure message center. They had no idea what I was talking about. I called the 800 # on the card, took 3 minutes, and about 3 days later I received the credit.

Thanks for the data point Harold. Glad calling did the trick. Have a great New Years!

I think you will be fine. I’m in the same boat as you. I’m confident that Chase will issue the statement credit. Chase might backdate the statement credit, that is my thought.

Grant, so I haven’t get any reply back since I sent them a secure message for reimbursement of my $150 travel credit, so I called the 800 number on the back of my Ritz card and spoke with the agent and asked for the reimbursement, she said that she can see the $150 from Southwest listed as gift certificate on their end so they won’t be able to reimburse the charge…..I am so shocked and sad now….I told her it was for 2 overweight suitcases but she still insist that it listed as gift certificate……how did you get around this and how Chase didn’t see your $150 SW e-gc listed as gift certificate?

I have heard some mixed reports of success with the SWA eGCs. I am still waiting to hear back regarding my second $150 SWA eGC. Fingers crossed!

It’s lounge club. Have had this card for last 8 months. It also allows unlimited guest visits. The lounges I have personally visited were in SJC which is my home airport and Atlanta. Both were nice and with excellent staff and a good selection of free alcoholic beverages. Personally I’m afraid all the over pumping of this card on blogs (no offense I am fan of your work) and gift card travel redemptions per calendar year is going to be it’s demise in the near future.

Random question for you, as a person that lives in an area with many chase branches as a good amount of your readers probably do. Why is there so much fear (might not be the exact right term) of either going into a Chase or calling the phone numbers to get things done? It’s always all about the secure message center. Is this just personal preference or do you have personal experiences that have led you to find this to be the most effective method of resolution?

Happy new year!

Good evening, I’m not sure about the over pumping, it seems like every month there is one credit card that gets a lot of publicity. Not sure this card has an affiliate link, that’s when you see the over pumping.

As for the secure message question, I think it has to do with people not wanting to wait and speak with a representative over the phone. It also is easy if you manage other people’s Chase credit cards, then secure messages would be easier too.

Personally, I like talking to Chase representatives, they are always very friendly and willing to help. 95% of the time this is true.

Definitely tried to call them instead of SM if you would like a quicker response! They may ask what the charge was for. There’s also debate on whether transaction date vs posting date counted towards this year’s travel credit. Be sure to ask them about it too.

There’s a talk that Southwest gift cards may no longer work: http://www.flyertalk.com/forum/chase-ultimate-rewards/1356263-70k-fee-waived-140k-395-fee-ck-wiki-new-info-ritz-carlton-rewards-card-82.html. post 1230.

Lucky for me, I fly on many different airlines, so I will probably have to purchase other airline gift cards moving forward. Happy New Year!

Grant, did you receive your second Southwest credit? Based on the previous comment, I wondered how that went.

I’m still waiting for Chase to respond. I sent them a follow up SM this morning.

Grant,

Sad news …..

I just received a reply through SM from Chase rep regarding my $150 SW e-gc reimbursement:

“Thank you for contacting J.P. Morgan about the travel

credit benefit offered on your Ritz-Carlton® Rewards

credit card ending in XXX

Only the following types of non-ticket purchases qualify

to receive credit for the Airline Incidental Credit

benefit offered on this card:

? Airline lounge day pass, or towards a yearly lounge

membership of your choice

? Airline seat upgrades

? Airline baggage fees

? In-flight internet/entertainment

? In-flight meals

? Global Entry fees

The credit cannot be applied to:

? Taxis/subway/car rental/airport parking

? Airline gift card purchase

? Airline ticket purchase

? Duty free shops

The Southwest Airline charge for $150 posted on 12/29/2014

appears to be an airline gift card purchase and does not

qualify for credit under this benefit.

As requested on 01/01/2015, please provide us with

documentation to show that the charge is for qualified

airline incidental charge as listed above. Once we review

the information requested we will issue credit in

accordance with the terms of the benefit.

Please accept our sincere apology for any inconvenience

this may have caused. If you have any further questions,

please reply using the Secure Message Center”

I am very upset now. I already met the minimum spend on this Ritz card and waiting for the 140k bonus to post on my Marriott account. Once it posted, I plan to cancel this card before the annual fee hits. They cannot claw back the 140k since it was posted on different account right? (Marriott account, not UR rewards or anything). What do you think of this strategy? since I already lost $150 and cannot maximize the card benefits for e-gc.

I’m sorry your $150 SWA eGC purchase was not reimbursable. Since it is now 2015, you have another $300 of airline reimbursable expenses. You can still take advantage of those expenses. I wouldn’t recommend canceling your credit card after receiving the sign up bonus. Chase will not like that and may blacklist you from receiving future Chase credit cards or sign up bonuses.

You may have luck calling Chase and seeing if the rep will give you a courtesy credit. Just explain how you were under the impression that airline GCs would be reimbursable. Good luck!

David, I just received the following response from Chase:

I’m not sure why I received a different answer than you did. This makes no sense.

Grant, Where did you purchase your southwest GC that the statement did not reflect that and you had success with the credit?

I purchased the SWA eGC on SWA’s website. Chase will no longer reimburse SWA eGCs though.

Hello grant, my SWA reimbursement went through as yours. But it looks like things are changing. I do have a question. I used my Marriott account for the card and my spouse used the Ritz account and when we both get the points, how to combine and redeem for the Hotel + Air package? Does the Ritz account has to be converted to Marriott first? Thanks.

When you have enough points in both of your accounts, I believe you can call Marriott and tell them you want to book and Hotel and Air travel package. You can tell them you want to use points from your Marriott account and your spouse’s Ritz-Carlton account. They should be able to pull points from both accounts to pay for your Hotel and Air travel package. That is what I believe happens, but I have never tried this myself.

Pingback: Reminder: Max out your $300 Travel Reimbursement Credit on JPMorgan Chase Ritz Carlton Credit Card | Travel with Grant