Chime in the New Year Targeted Offers and $8 Million in Funding

Good evening, Chime is ringing in the new year with a new promo called Chime in the New Year. I received an email this afternoon and there are some good offers. I will show you how the promo works. If you are new to Chime, please read this post.

After you log into your Chime account, there is a new tab in the upper right corner called Resolutions (link).

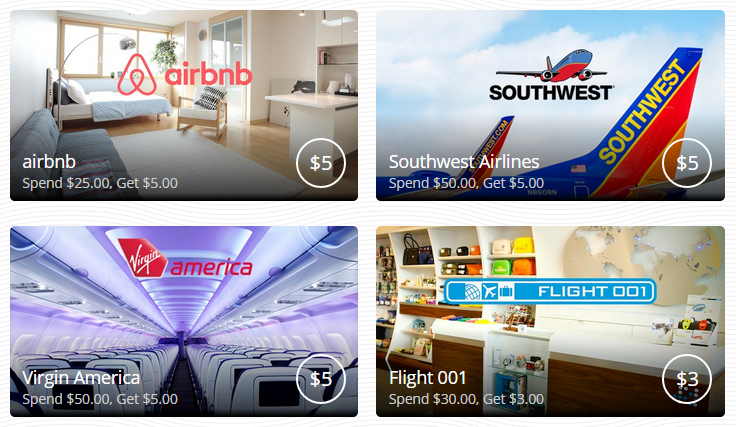

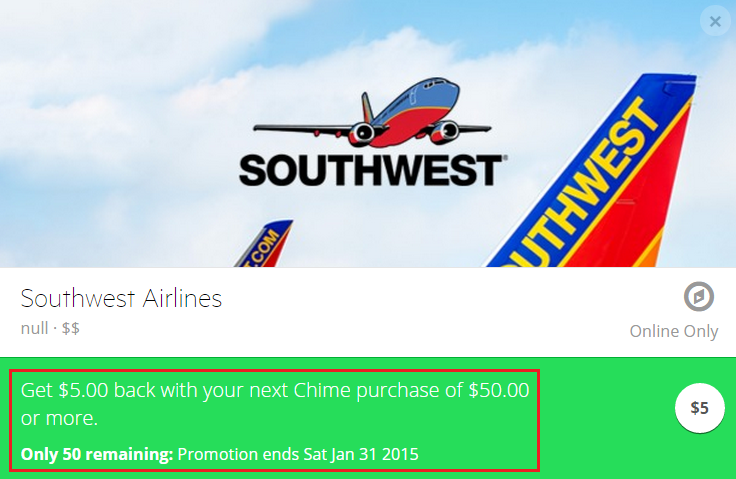

This next part is very important. The option you click will be permanent and you will only see offers from that category. You cannot change your mind later on. I selected Travel More and here are the 4 travel related offers available.

It appears that the offers are pretty limited, so I would recommend participating in each offer you are interested in pretty soon. I plan on buying a $50 Southwest Airlines eGift Card to trigger the 10% cash back offer.

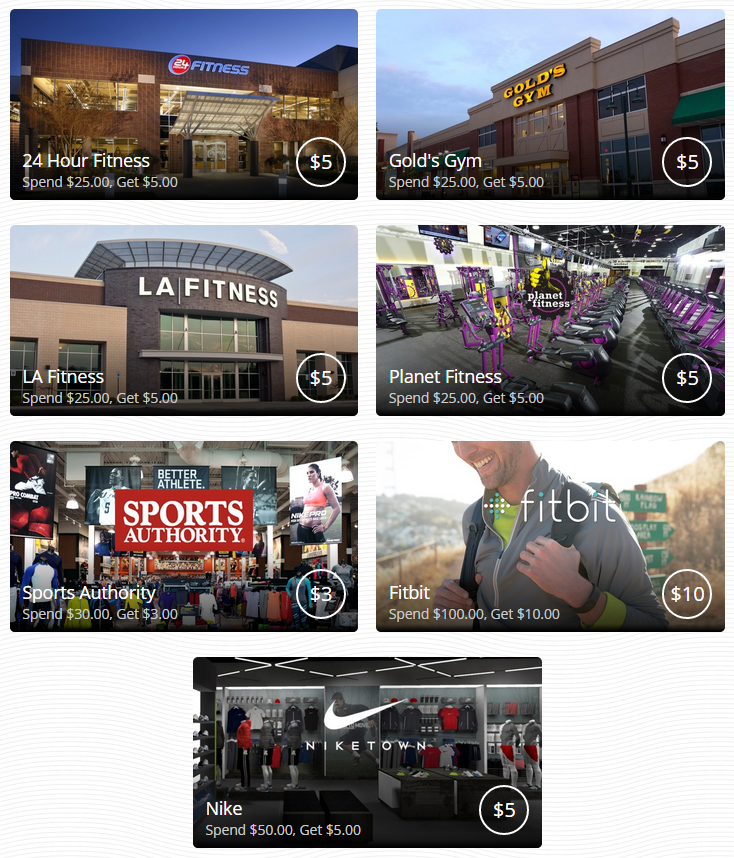

From my dad’s account, I clicked on Be Active and here are the gym-related offers available. If someone chooses Learn Something, please take a screenshot and email it to me so I can include it in this post. Thank you.

I was skeptical of Chime’s long term success (they lose money on every cash back offer), but I was happy to see that they received some additional funding. Here is a press release from November 5, 2014 about the Chime’s $8 million funding:

Chime has secured $8 million in funding in a round led by Crosslink Capital. The other investors were Homebrew, Forerunner Ventures and PivotNorth Capital. Based in San Francisco, Chime is a bank account and rewards app for millennials.

PRESS RELEASE

SAN FRANCISCO, Nov. 4, 2014 (GLOBE NEWSWIRE) — Chime (www.chimecard.com), the bank account and rewards app for mobile millennials, has received $8 million in funding led by Crosslink Capital along with seed investors Homebrew, Forerunner Ventures and PivotNorth Capital.

Chime delivers a mobile banking alternative for the smart-phone generation that rewards consumers with more spending power and control.

The company has introduced a mobile-first debit card and location-based rewards app. A Chime account offers ubiquitous acceptance, personalized rewards and instant cash back with no overdraft or monthly fees.

“Millennials are seeking alternatives to traditional banks. They’re avoiding credit and want services that put the mobile experience first,” said Chime CEO Chris Britt. “Chime is reimagining banking and payments with a fresh approach designed to give consumers the control of a debit account with instant rewards when they pay.”

Chime’s management team includes CEO Chris Britt, formerly a senior executive at Green Dot & Visa and Ryan King, former VP engineering at social networking pioneer Plaxo (sold to Comcast Interactive Media).

“We believe Chime has the opportunity be a leader in payments and a trusted financial services brand for both young adults and the broader population,” said Jim Feuille, General Partner at Crosslink Capital.

Mr. Britt is speaking at the Money 2020 conference today during the Launchpad 360 program.

About Chime:

Based in San Francisco, Chime partners with FDIC-insured banks to design and deliver innovative financial services products for a mobile generation.

If you have any questions, please leave a comment below. Have a great weekend everyone!

P.S. If you haven’t already voted for the Travel Summary Awards, please do so. These are the unofficial miles/points blogger awards. I am in the same category as Frequent Miler and Big Habitat for best MS blog, so every vote counts. Thank you for your help and may the best blogger win!

For Learn Something option: $5 off $30 Barnes & Noble, $3 off $30 Groupon, $10 off $100 Rosetta Stone, $5 Free Credit New York Times

Thank you. Would you be able to send me a screenshot of the offers? Thank you RV3.

“I was skeptical of Chime’s long term success (they lose money on every cash back offer)”

Are you sure of this? AmEx doesn’t lose money on their offerings which are similar. The 8 million round was awhile back. Chime’s team is pretty good, one of them was apart of Plaxo which had a 150 million exit to Comcast and the other was the CPO of GreenDot.

It’ll be interesting to see how much of the un/underbanked market they can capture.

I have no info to claim that Chime is losing money, it just seems hard to imagine they make enough money on each offer to offset the instant cash back. Do you have any intel on Chime? I’ll check out your recent Chime blog post.

Nah, I don’t know much about the company to be honest. But they are basically just giving an instant rebate, which is similar to what those companies are offering via other channels so I imagine that Chime is actually getting paid for some of the offers.

Obviously some offers (e.g free Amazon credit) they are probably footing the bill, I like the business model though they get to double dip. $8 million is a pretty big first round, although it was four VC firms so I wonder how much equity they had to give up.

Hope you’re enjoying San Fran!

Thanks Will. I believe Chime Card has their HQ in San Francisco, so maybe I will run into the guys one of these days. I’m actually in OC this weekend hanging out at home. Have a great weekend.

Pingback: Chime In The New Year Offers - Doctor Of Credit

Pleased to get my vote in for support. I appreciate all the great info.

Thank you Judy, have a great weekend!

Pingback: AMEX Offers: Staples $25 Statement Credit Update and 4 New Offers | Travel with Grant