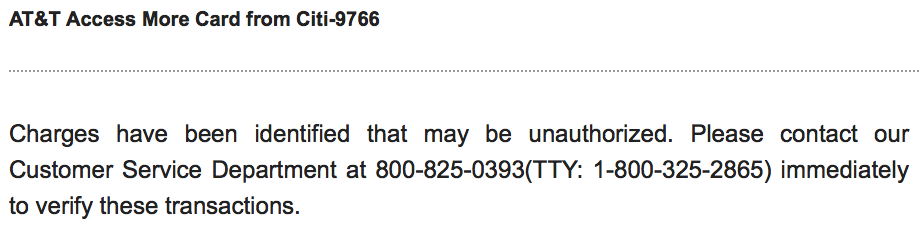

Buenos dias everyone. I got a voicemail last Sunday afternoon from a Citi fraud prevention representative in Jacksonville, Florida asking me to call in to verify some recent charges. In retrospect, the fact that they were calling on Easter Sunday might have been a red flag, but at the time I didn’t think anything of it, and actually forgot about the call until I tried to place an order with PayPal Digital Gifts using my Citi AT&T Access More Credit Card and got an error message. When I logged into my Citi account, I got a popup message informing me that my charging ability may be limited, and found the following message attached to my Citi AT&T Access More Credit Card:

The popup did strike me as a bit unusual, and I wanted to finish my purchase, so I went ahead and called the number. After verifying my information, the representative asked me if I called from a Tennessee phone number (she gave me the last four digits) on March 21.

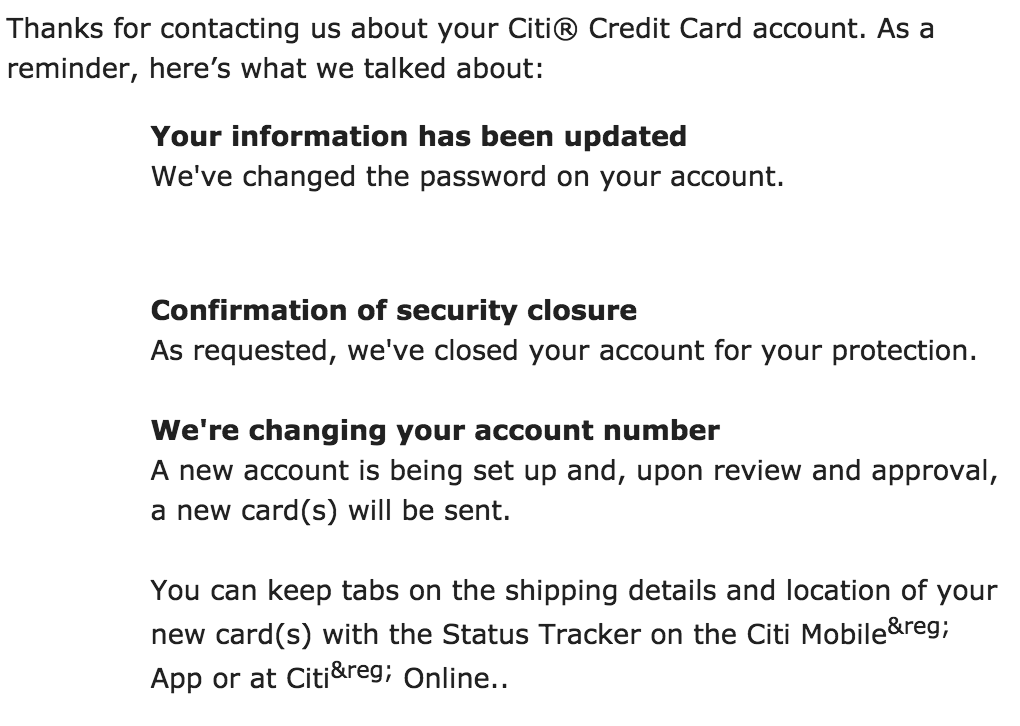

When I told her no, she informed me that someone had my card number and had tried to use it to access my account. She said they hadn’t gotten any information, but since my card number is compromised they will need to cancel the card and issue a new one with a different account number. After confirming recent charges and making sure I was aware that my card was linked to Apple Pay and Samsung Pay, she let me know that they will be overnighting the new card via FedEx Next Day Air. Finally, she asked me if I wanted to change my security word and I did so.

I’m not sure how this person with a Tennessee phone number got my card number, or what they were trying to accomplish – if they had been able to get through, they might have changed the contact information and billing address to get a physical copy of my card, or even leveraged their way into accessing my other Citi credit card accounts. I’m glad that Citi was watching out for me, even if it took them a month to inform me of the credit card hack attempt.

Have you ever experienced something like this? Let me know in the comments.

Citibank is not looking out for you. You are not responsible for unauthorized charges – Citibank is responsible. Consequently, Citibank is unble to keep your infromation under control which is an inconvenience to you. Citibank is looking out for Citibank.

Fair enough. Though it sounds like in this case they were able to keep my information under control (I have no reason to believe they were the reason my account number was compromised, and they stopped whoever obtained it from gaining other information from them)

For whatever reason, stuff like this tends to happen to me with my IHG card. Twice so far.

Have you used it at IHG hotels? http://pointshogger.boardingarea.com/credit-card-data-stolen-1000-ihg-hotels/

Regions bank does that, but they just send a new card. Their security department will decline charges if they see something unusual. If they know your spending habits, they usually prevent fraud from happening.