Guest Post: 5 Card App-O-Rama (Diners Club, Club Carlson, US Airways, Southwest Airlines Plus, and Citizens Bank)

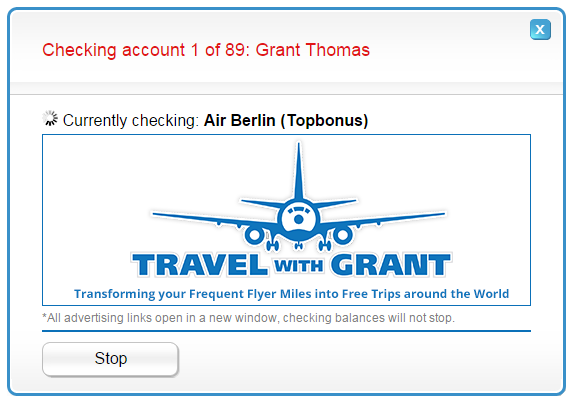

Good morning everyone, I hope you are having a great holiday season with your friends and family members. Today, I have a guest post from my friend Nigel, where he is sharing his experience with his recent App-O-Rama. Take it away Nigel…

In brief, an App-O-Rama (AOR) is a strategy in the miles/points community where an individual applies for multiple credit cards within a short period of time to maximize their odds of getting approved for multiple credit cards. For me, this typically involves submitting four or more applications within seconds of each other in the hope that the banks don’t denied me for “too many inquires.”

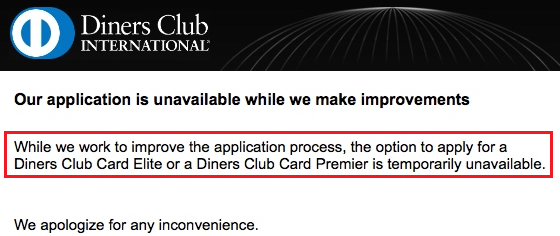

With my Experian inquires starting to pile up from prior AORs, I wanted to limit this AOR to two Experian hits. After doing some research on the Credit Boards credit pull database (link), I discovered that applications for the Diners Club Elite Credit Card have reliably resulted in a Transunion inquiry. I was quite excited at the news, except there was one problem…