Transfer Chase Ultimate Reward Points to Another Chase Ultimate Rewards Account

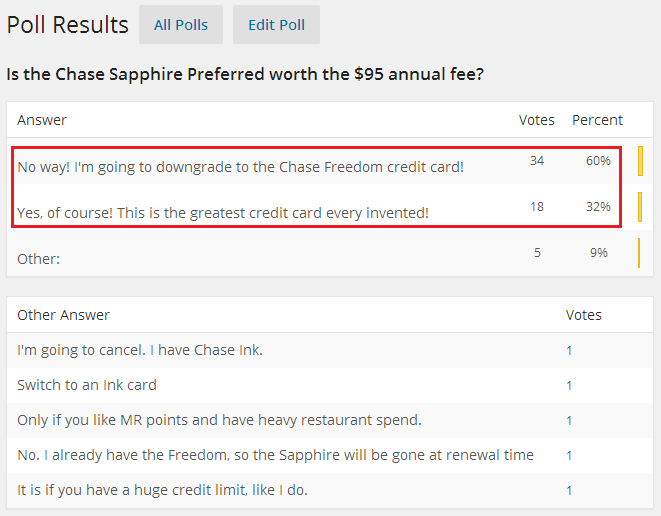

In light of recent changes to the Chase Sapphire Preferred and its 7% Annual Dividend (link and link), you might be more inclined on closing your Chase Sapphire Preferred Credit Card or downgrading to a Chase Sapphire Credit Card or Chase Freedom Credit Card.

But before you do anything drastic, think about your Chase Ultimate Rewards Points.

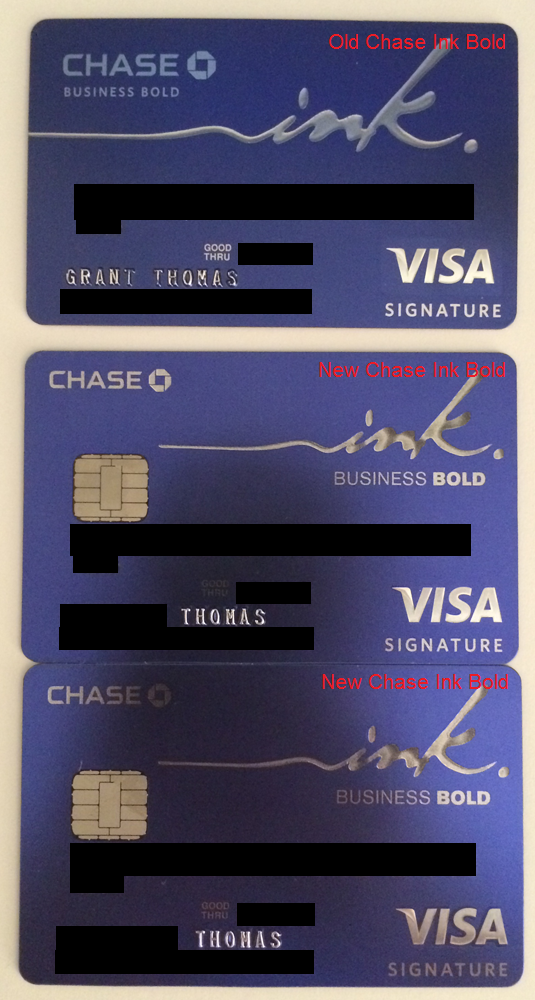

I’ve argued in the past that the more Chase credit cards you have, the less value you get from the Chase Sapphire Preferred. For example, you can earn way more points with a Chase Ink Bold/Plus than a Chase Sapphire Preferred. Several other Chase credit cards earn 2x on dining and travel, such as the Chase Hyatt Credit Card which earns 2x on restaurants, airfare, and rental cars. Just ask yourself, what are you paying $95 each year for?

If you do decide to close or downgrade your Chase Sapphire Preferred, you may want to transfer the Chase Ultimate Rewards Points out to a transfer partner (link) or to a different Chase Ultimate Rewards account.

According to the Chase Ultimate Rewards Terms and Conditions (link), you can combine points from different Chase Ultimate Rewards accounts:

Can I combine the points I earn from other Chase Ultimate Rewards cards?

Yes. You can combine points or rebates from any eligible credit or debit card with Ultimate Rewards.

Note: Once points are transferred, they cannot be credited back. Transfers may only be used to combine points belonging to the same individual or business in the program; or for the purpose of enabling spouses or domestic partners to combine points. Chase will not make the transfer if the credit card account(s) or checking account(s), as applicable, are in default at the time of the transfer.

To read the entire post, please click here.