App-O-Rama Update: 4 Approvals, 2 Recon Calls, 1 Pending Application, and a Barclays Denial

Advice: you do not need to apply for 6 credit cards at one time. You should only attempt this if your credit score is high and you have the ability to Manufacture Spend $5,000-$10,000 per month. Please proceed at your own risk/skill level.

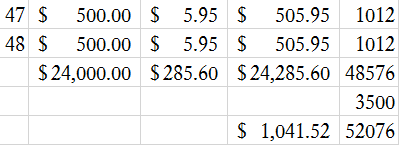

In a nutshell, this is what happened yesterday morning when I applied for 6 cards.

- Barclays Arrival Plus Credit Card – automatically denied :(

- Citi American Airlines Executive World MasterCard – recon call approved, $5,000 credit line + $4,500 moved from Citi Dividend Credit Card.

- AMEX Premier Rewards Gold Charge Card – automatically approved (charge card, no preset credit limit).

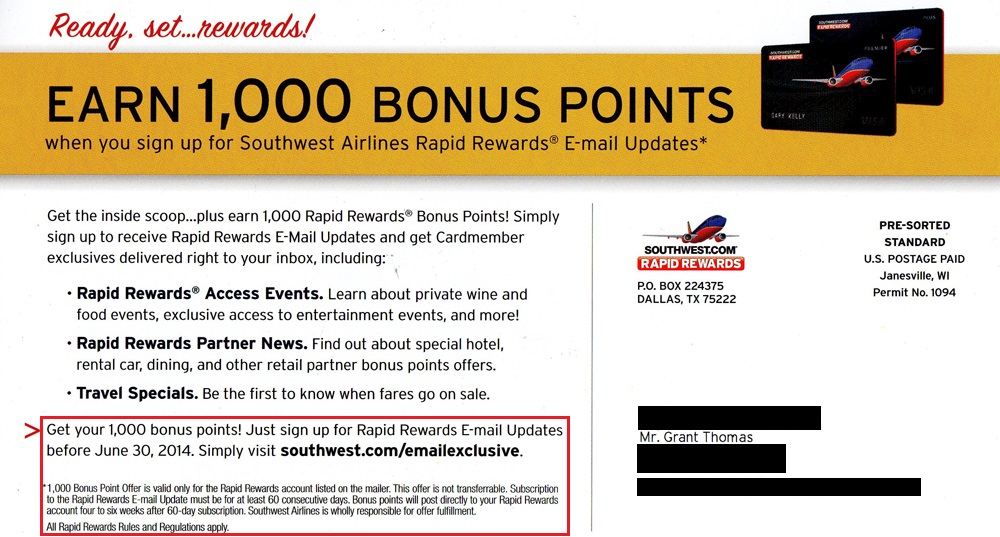

- Chase Southwest Airlines Rapid Rewards Plus Credit Card – recon call approved, $2,000 credit line.

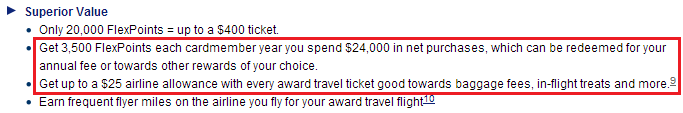

- US Bank Club Carlson Business Credit Card – pending, must wait 24-48 hours for results.

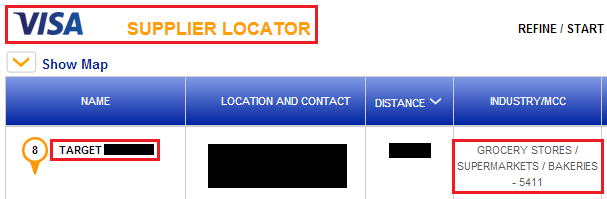

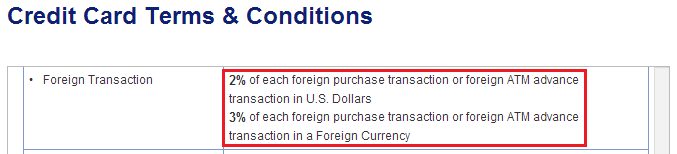

- Bank of America Alaska Airlines Visa Signature Credit Card – automatically approved, but for a Platinum Plus credit card with a $2,000 credit line.

Here are more details about each application and approval/denial process… Continue reading