Lesser Known Perks of the US Bank FlexPerks Travel Rewards Credit Card

(Hat Tip to the US Bank website – link)

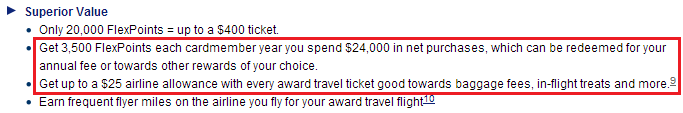

I really like my US Bank FlexPerks Credit Card (besides the fact that it has a Chip and Signature and charges FOREX fees – link), since it is a great way to manufacture spend you way to free travel (link). In this post, I want to highlight some of the lesser known perks of the US Bank FlexPerks Travel Rewards Credit Card, such as the 3,500 bonus FlexPerks you will receive after spending $24,000 in 12 months.

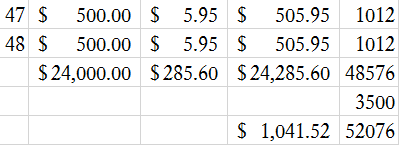

Since the card earns 2x points at grocery stores, I plan on using this card to buy $500 gift cards at my local grocery stores. Including the $5.95 gift card activation fee, my total will come out to $505.95, which will earn 1,012 FlexPerks Points. Assuming I bought 48 $500 gift cards over the next 12 months, that would put me across the $24,000 12 month limit. 48 gift cards would cost me $285.60 in activation fees, but would generate 48,576 FlexPerks Points (48 x 1,012). Adding in to the 3,500 bonus FlexPerks Points, your new total comes to 52,076 FlexPerks Points.

In essence, you are buying 52,076 FlexPerks Points (including the 3,500 point bonus) for $285.60 in gift card activation fees. Assuming you could redeem every single FlexPerks Point for travel, you would get exactly 2 cents per point. In our example, we are spending $285.60 to get $1,041.52 in travel, or a return of 3.65 cents per dollar. Remember, you also earn frequent flyer miles on the airline ticket.

The next lesser known perk is the $25 reimbursement you get for “airline expenses.” Here is how the $25 airline allowance works based on their terms and conditions (link):

9 FlexPerks Travel Rewards Visa Signature cardmembers may receive up to a $25 airline allowance with each redeemed airline award travel ticket. Cardmembers who redeem FlexPoints for award travel may be credited up to $25 on a future statement for qualified purchases made using their FlexPerks Travel Rewards Visa Signature card with the airline carrier providing award travel flight. “Qualified purchases” are any purchases made with your FlexPerks Travel Rewards Visa Signature card that post to your account under the airline carrier providing your award travel flight between the dates of your award travel flight. Cardmembers must call Cardmember Services at 877-978-7446 to request a statement credit within 90 days of a qualified purchase. Once the request is approved by Cardmember Services, the cardmember will receive a statement credit within 4 to 6 weeks for the amount of the qualified purchase, up to $25. U.S. Bank does not have the ability to control how a merchant chooses to classify their business and therefore reserves the right to determine which purchases qualify for allowance. You may redeem allowance for qualified purchases only if the outstanding balance of your account is below its revolve limit and if your account is open and in good standing under the terms of your cardmember agreement. Once you or we close your account for any reason, your allowance may be forfeited.

To me, it sounds like any charge processed by the airline during your outbound and inbound flight dates will count. That is just a guess, since I haven’t redeemed any FlexPerks Points yet. If you have, let me know how the reimbursement works. You also must call US Bank within 90 days of the charge posting to your account to receive the statement credit.

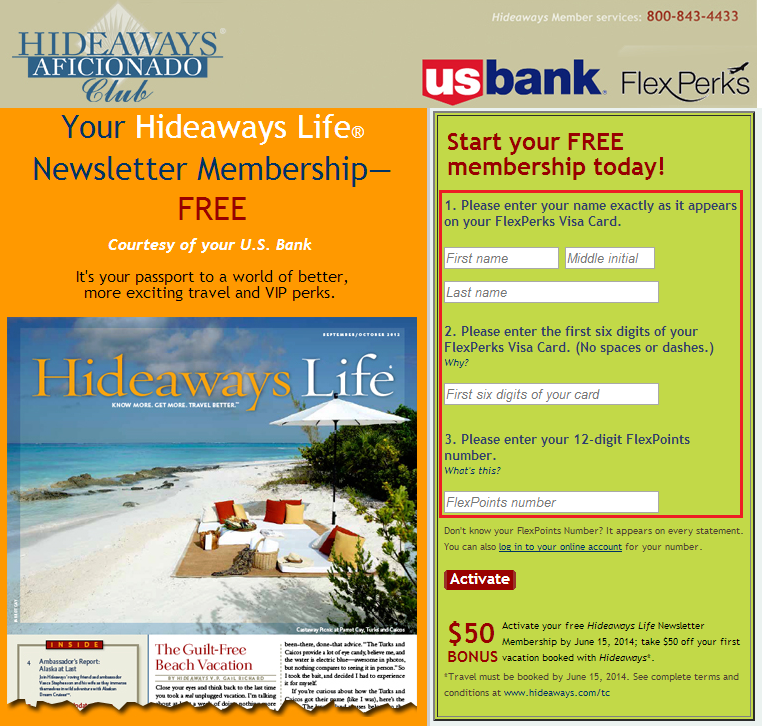

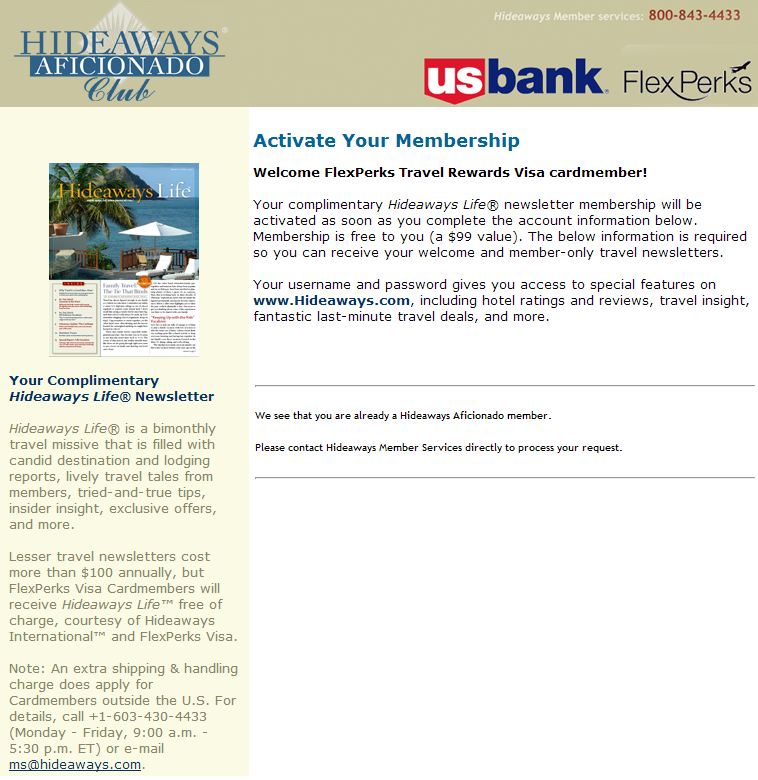

The next lesser known perk is not very cool, but might be beneficial to someone. By being a card member, you are entitled to a subscription of Hideaways Life, an online website/service that can plan and organize trips.

Here are the terms and conditions of the Hideaways Life Newsletter Membership:

12 A free Hideaways Life® newsletter membership (retail value $99/year) is available to FlexPerks Travel Rewards Visa Signature and FlexPerks Business Edge Travel Rewards cardmembers. Cardmembers receive a Hideaways members-only publication, Hideaways Life, at no cost to U.S. residents and for an $18.15 shipping fee to Canada. Cardmembers must provide their name, address, email address and FlexPoints number in order to activate their free membership. Verification of FlexPerks Travel Rewards Visa Signature or FlexPerks Business Edge Travel Rewards account status will be required for enrollment. To activate your free membership, sign up online at hideaways.com/fpv or call 800-843-4433. For assistance using your membership, please call Hideaways International at 800-843-4433. For questions regarding this benefit, please call the Cardmember Services number on the back of your card.

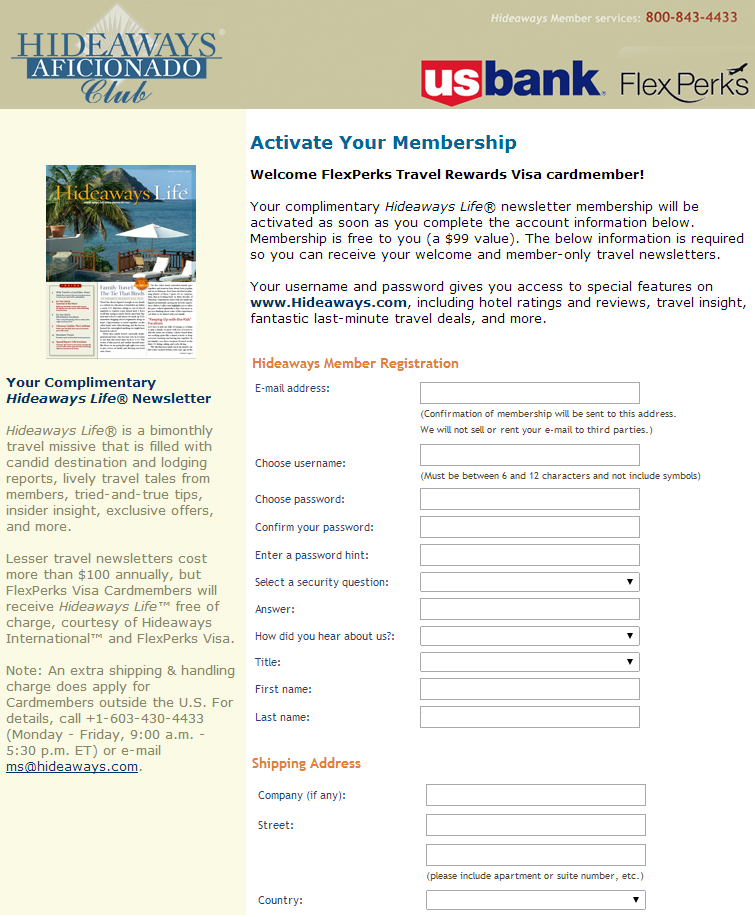

From the home page, enter your first name, last name, first 6 digits of the US Bank FlexPerks Travel Rewards Credit Card, and your FlexPerks account number (see below for instructions on how to find this number).

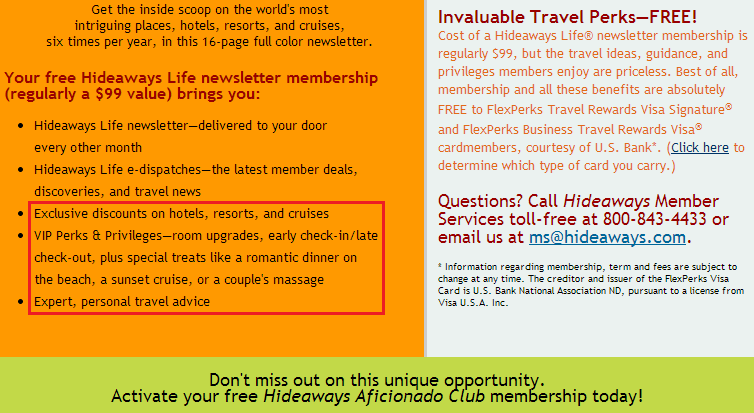

This is what your free membership offers:

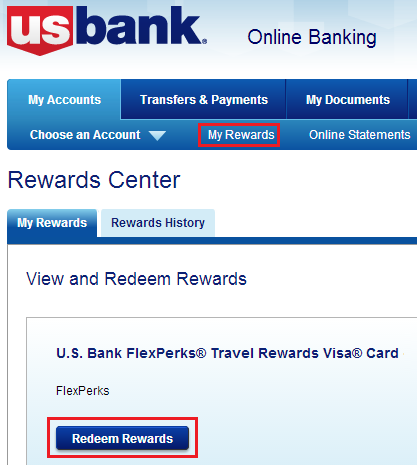

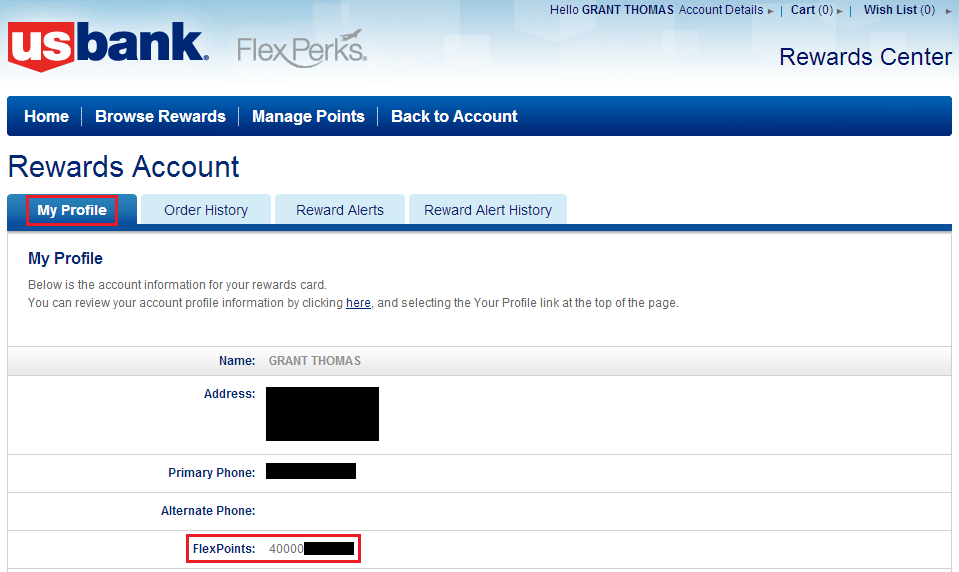

To view your FlexPerks account, log into your US Bank online account. Navigate to the My Rewards section and click the blue Redeem Rewards button.

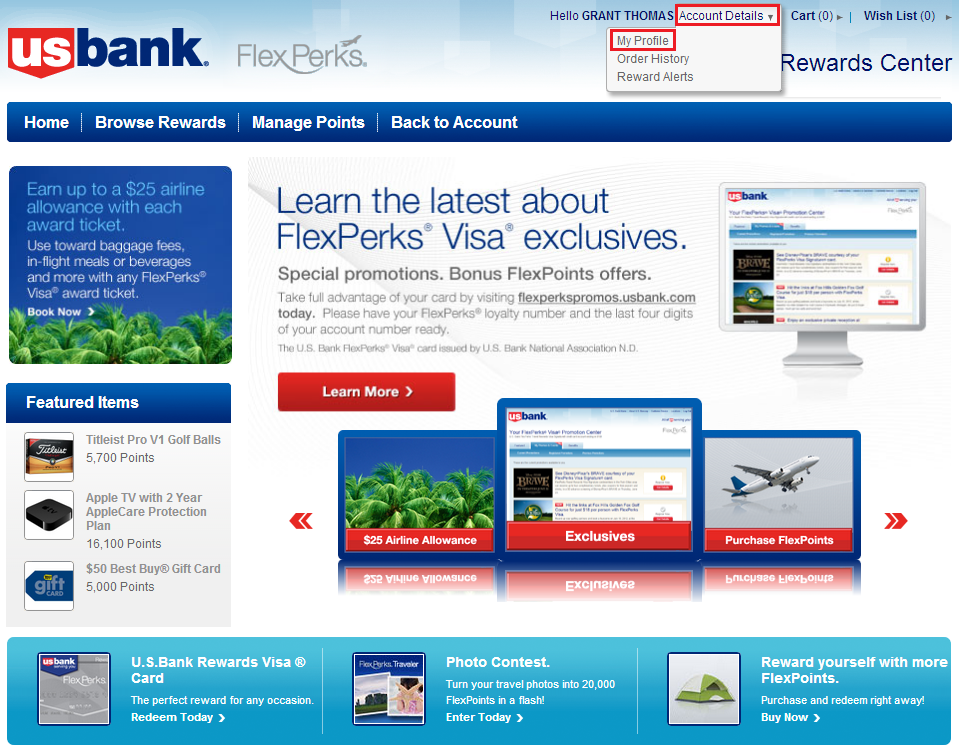

Click the Account Details link at the top of the page and then click the My Profile link.

Under the My profile tab, you should see your FlexPerks account number. Copy that number into the form above.

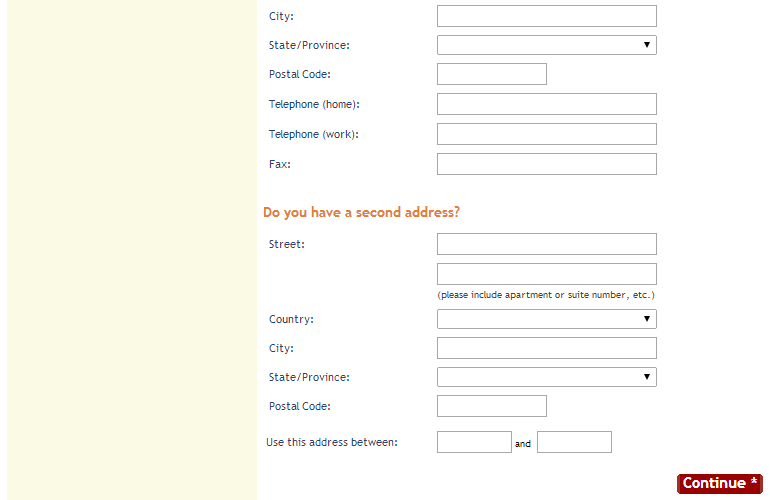

Once you have verified your US Bank FlexPerks Travel Rewards Credit Card, fill in your personal information to create a Hideaways account.

Your membership should be activated right away.

From the home page, you can view other interesting information.

If you have any questions, please leave a comment below.

Thx Grant for another cool article :)

This reminded me to ask: whenever I buy a GC at my local grocery store (500$ at a time never more than that) they always ask for my driving L. And enter my number into their system..

Should I be worried about that? I was used to have that done at CVS during the VR days when buying 1-2k at a time, but this is a first for me.. Usually if any store asks to see the DL is just to verify but not to enter numbers..

What’s ur thoughts?

My grocery store doesn’t do that. You aren’t doing anything illegal, so I wouldn’t be worried. It might just be store policy.

I use this card at Target to load the Amex/target reload. Target is consider a grocery store when using this card.

That’s great Jane, I did a test load of $1000 with my US Bank FlexPerks credit card to my Target AMEX and was waiting for my statement to close to see if it coded as a grocery store. Great minds think alike!

Wait… I didn’t realize the you received 2 cents per point to use toward travel on this card. So if I’m understanding this correctly, that could mean 4% towards travel based on grocery purchases?!?!

I was strongly considering MSing the Barclay card, but now having second thoughts. Yeah, foreign transaction fees, but I don’t travel out of the country often.

Do you have to book through the US Bank portal? I prefer booking direct, but still. This is interesting.

Yes, this card has the potential to earn 4% cash back on groceries if you redeem only for travel at 2 CPP.

I haven’t redeemed any FlexPerks Points yet, but I have played around a bit on the FlexPerks website. You have to book it through the FlexPerks portal, just like if you were booking through Expedia or Travelocity. Just enter your frequent flyer numbers and you will earn the appropriate miles.

Interesting on the 4% remark. I was considering using the Barclay Arrival+ in addition to my old Blue Cash. Currently using my Southwest card so I can get Companion Pass. Great info.

It’s only 4% if you redeem for airfare right at the $400 mark, anything less will equal a lower cash back rate.

Pingback: Random News: US Bank FlexPerks Visa Signature vs. American Express vs. Business Cards and 4 New AMEX Offers | Travel with Grant