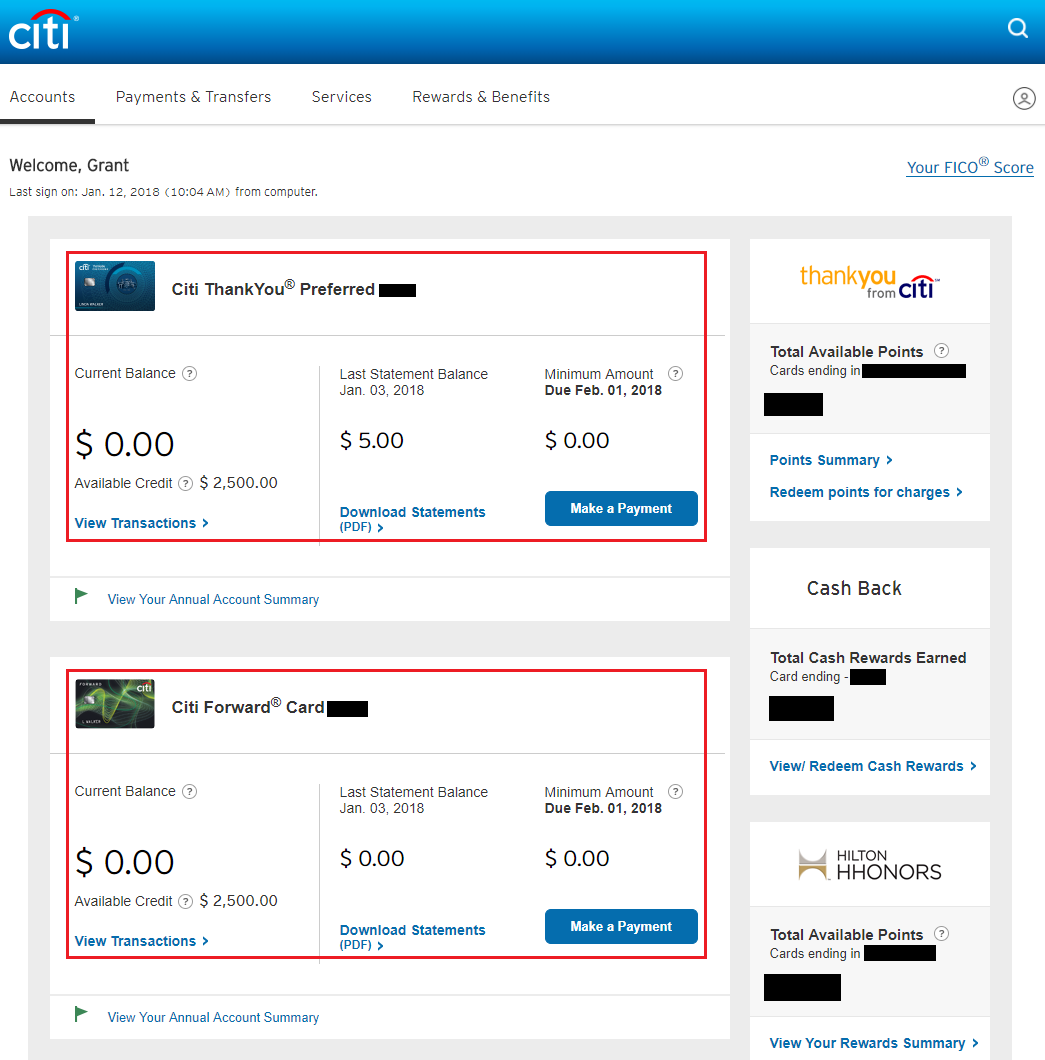

Hi everyone, this is my last post of the day. I have spent the last few hours lounging around at a Priority Pass lounge in San Salvador, El Salvador (SAL) and I need to get on a plane to Lima, Peru (LIM) and then to La Paz, Bolivia (LPB). I’m not sure if this is interesting to anyone else (maybe just Will at Doctor of Credit), but when I logged into my Citi online account, I spotted my new Citi Thank You Preferred Credit Card above my Citi Forward Credit Card.

Citi is currently in the process of converting all Citi Forward Credit Cards into Citi Thank You Preferred Credit Cards (who knows why). I have not received the physical credit card in the mail, but I thought I would call Citi and see if I could product change the new Citi Thank You Preferred Credit Card into another Citi credit card. The Citi rep I spoke with was not very knowledgeable, so I hung up. I will wait to get the Citi Thank You Preferred Credit Card in the mail and see if I can product change that credit card into another Citi AT&T Access More Credit Card (I currently have 2 of those).

If you currently have a Citi Forward Credit Card, are you going to keep your Citi Thank You Preferred Credit Card or try to convert it into another Citi credit card? Let me know in the comments. Have a great weekend everyone!

Hope you’re not a smoker. In-transit flyers who wanted a smoke last time I passed through SAL had to pay $10 for a visa to leave the premises.

Haha, nope. Never smoked a day in my life. Not starting on this trip either!

Why more than one att access and more? There is no limit to the points you can obtain, there is no longer a sign up bonus of $650 off a phone available, and you wouldn’t get that with a product conversion. The only thing I can think of us if you wanted another opprotunity to get 10,000 anniversary thank you points after $10,000 spending at paying two $95 annual fees to get that privilege the first year (because you have to pay the annual fee on conversion and at anniversary and the points only post on anniversary). Am I missing another reason to convert? I ask bc i already have one att access and more and just got my old forward converted to a citi preferred like you, and I cannot come up with how more than one access and more card is beneficial.

You are exactly right. I’m only converting for the 10,000 anniversary miles after spending $10,000. I don’t think I need to pay 2 annual fees to get the anniversary bonus.

Why IS Citi pushing the Thankyou Card. I have another type of Citi card (not Forward), and they keeping sending me mail and email asking me to convert to Thankyou. I don’t want Thankyou points, it seems like there’s nothing you can do with them. Am I wrong about that?

Since Citi owns the product and the loyalty program, it is probably more profitable for them to have their customers use Citi Thank You credit cards.

Pingback: How to Remove / Unlink Citi Credit Card from Online Account