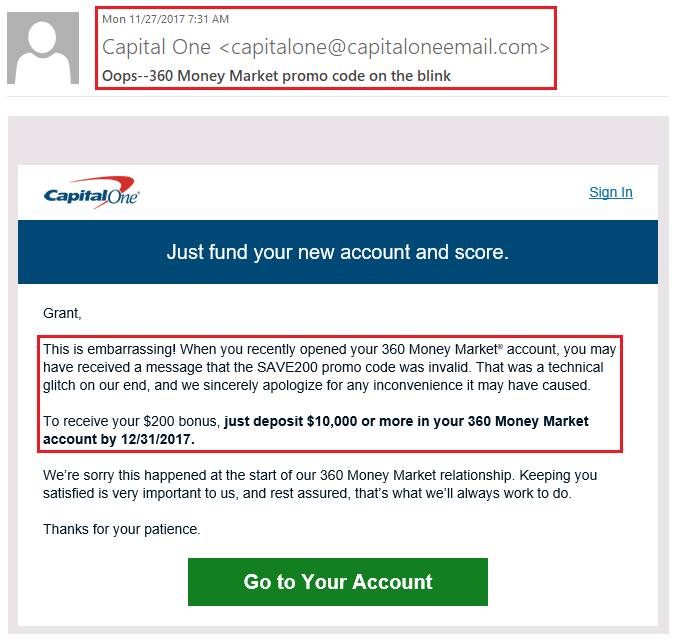

Good afternoon everyone. A few months ago, I signed up for a Capital One 360 Money Market account with a $200 sign up bonus (thanks Doctor of Credit). The promo seemed simple enough, sign up for a money market account, using promo code SAVE200, and then deposit $10,000 before December 31, 2017. I even received the following email on November 27 confirming the details from DOC. I thought it was going to be smooth sailing, but after waiting 2+ months since the December 31, 2017 deadline, I got antsy and went in search of my $200 bonus…

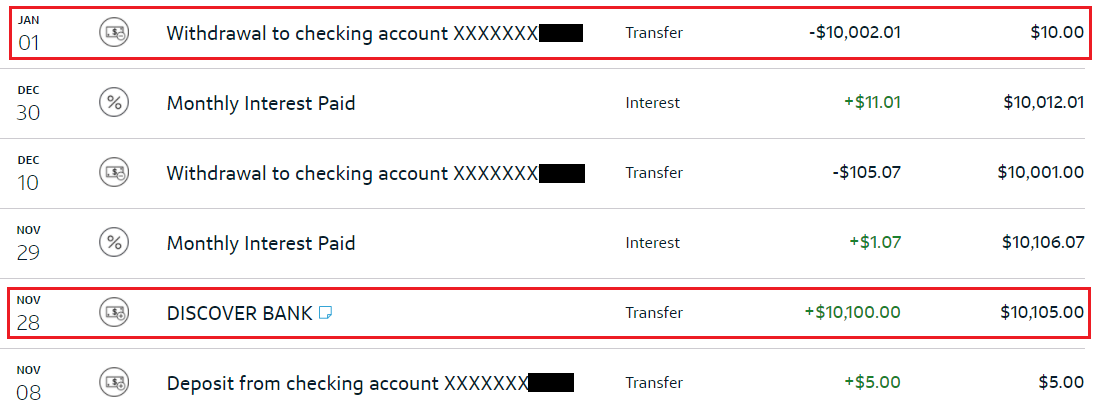

As you can see, I moved $10,000 from my Discover Savings accounts (thanks Doctor of Credit for another $150 sign up bonus) into this Capital One Money Market account. Since I assumed I had completed the requirements, I transferred out a majority of the funds on January 1. I assumed that by moving funds out on January 1, I was on some kind of Capital One blacklist.

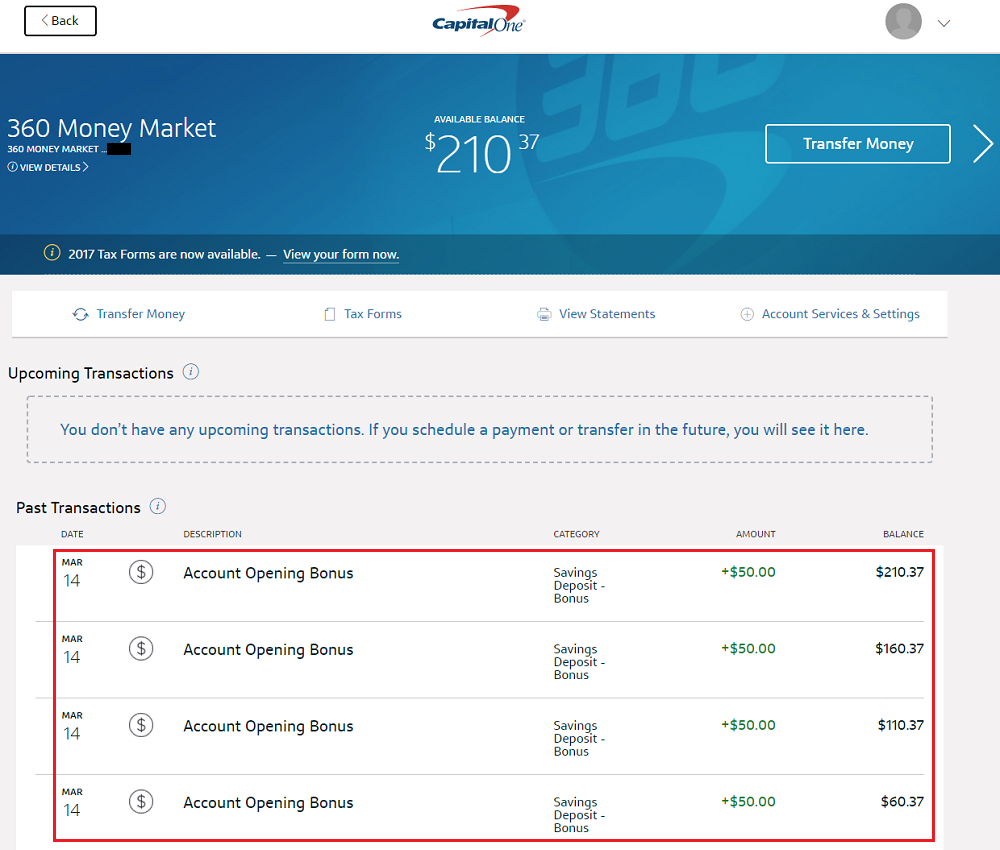

Luckily, when I called Capital One this afternoon, the agent said there was an extra character in the promo code field (SAVE200z) instead of the correct promo code (SAVE200). She said that I met all the requirements, so she manually added $200 to my account. Score!

I’ve never had a checking / savings / money market account instantly credit the bonus to my account while I was on the phone and I have plenty of experience with bank account bonuses (see How Much Money Did I Make from Bank Account Bonuses in 2017?). I am much more used to the “we requested your bonus to post, please check back in 3-4 weeks”, and then following up a few more times before the bonus actually posts to my account. This was a very pleasant interaction with Capital One. The rep was very friendly on the phone, I just wish the interest rate on this money market account (0.85% APY) was more competitive to my other high interest savings accounts (1.50% APY).

If you have any questions about bank account bonuses, please leave a comment below. If you want to know the best current bank account bonuses, check out Doctor of Credit’s post. Thanks for reading and have a great day everyone!

P.S. I am not on the Doctor of Credit payroll or anything, that site is the best resource for all things related to bank account bonuses :)

Just don’t die while you have an account there, as they do not allow beneficiaries. I am currently having to pay an atty $2500 to get my mom’s account transferred thru probate, and that was the only thing that I had a problem with, Schwab was no problem or BOA, so beware!

Good call, I’m sorry you are having a difficult time getting the money from Capital One. Hopefully everything gets resolved soon for you.

Do they allow POD (payable on death)?

I have no idea, I’m sorry. Call Capital One to find out.