UPDATED 6/17 @ 8 AM: Updated the chart below with current offers and newly announced categories.

Chase Freedom vs. Discover It vs. Citi Dividend 5% Cash Back Credit Card Comparison

All of the credit cards below have no annual fee and offer a base rate of 1% cash back on all purchases. Every quarter of the year (January – March / April – June / July – September / October – December), the credit cards below offer 5% cash back on rotating categories, instead of only 1% cash back. This post is designed to compare each of the rotating cash back credit cards.

I will update this post whenever new cash back quarters begin or when new quarterly categories are announced. Make sure you register your credit card with the 5% cash back categories before the quarters begin.

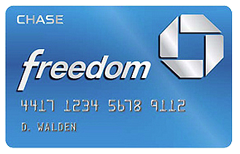

Chase Freedom Credit Card

Current Sign Up Bonus

- 20,000 Chase Ultimate Reward Points after spending $500 in 3 months (can be transfer to Chase Sapphire Preferred or Chase Ink Bold/Plus credit cards)

- 20,000 Chase Ultimate Reward Points = $200 cash back

Annual Cap on 5% Cash Back

- $300 annual cap ($75 per quarter)

Payout Increments

- 100 Chase Ultimate Reward Points = $1 statement credit

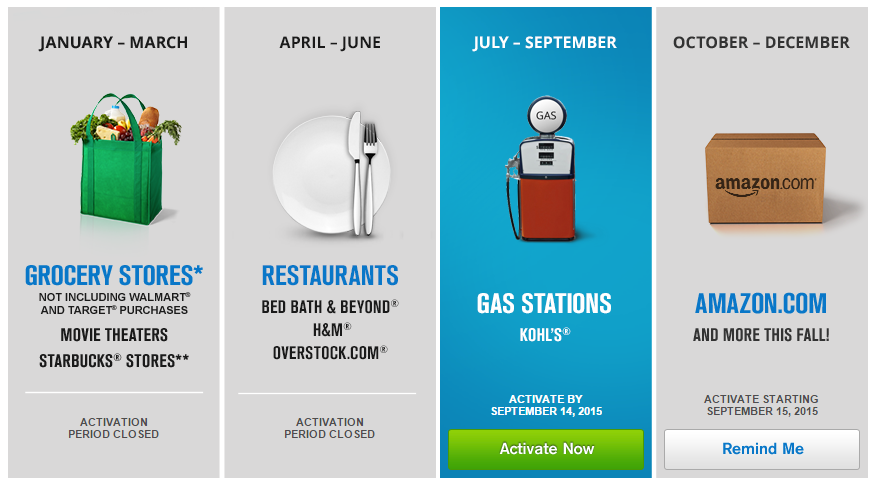

Current 5% Categories (July – September 2015) – activation link

Discover It Credit Card

Current Sign Up Bonus

Annual Cap on 5% Cash Back

- $300 annual cap ($75 per quarter)

Payout Increments

- $1 cash back = $1 statement credit or bank deposit

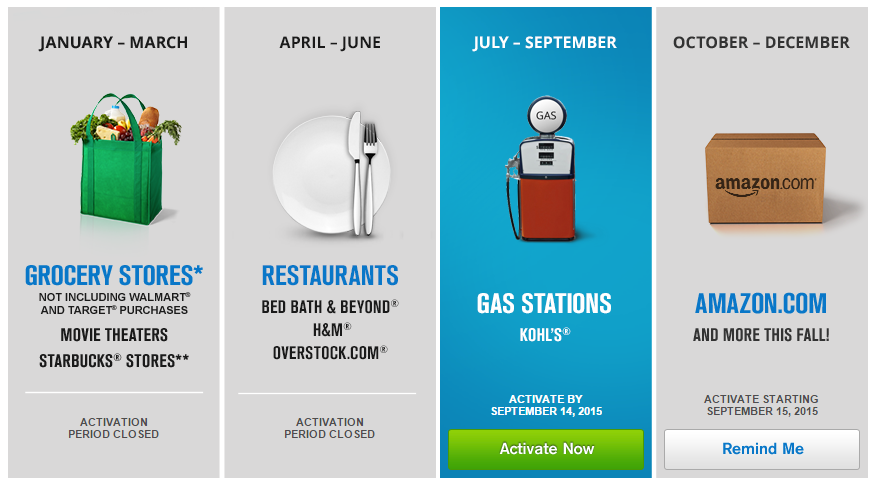

Current 5% Categories (July – September 2015) – activation link

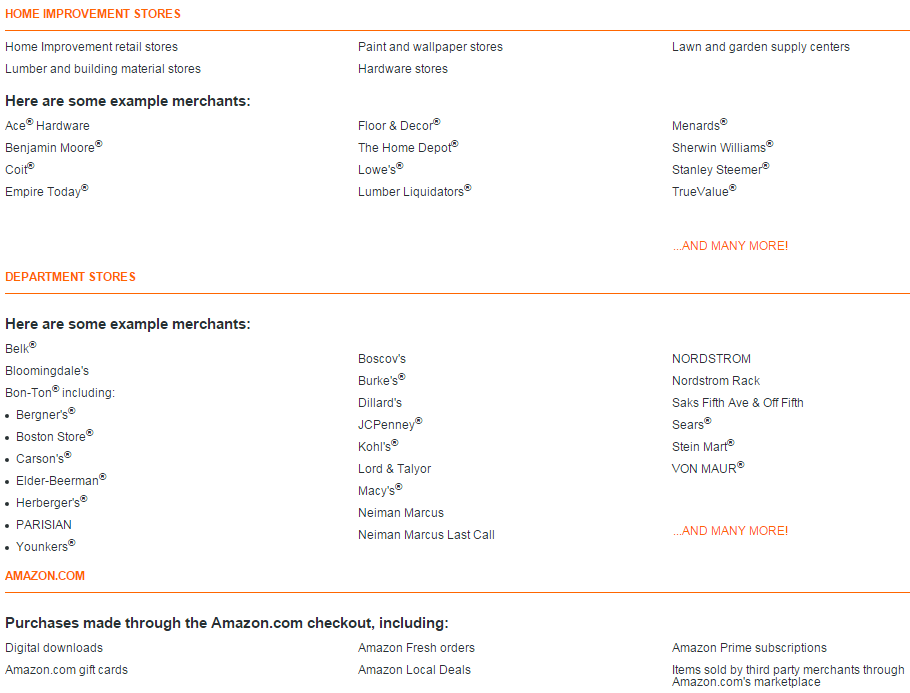

- Home Improvement Stores

- Department Stores

- Amazon.com

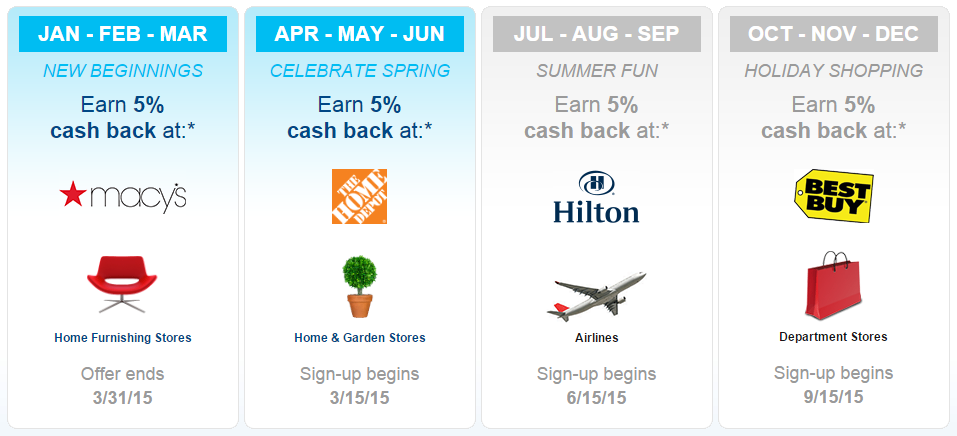

Citi Dividend Platinum Select Credit Card

Current Sign Up Bonus

- $100 cash back after spending $500 in 3 months

Annual Cap on 5% Cash Back

- $300 annual cap (no quarterly cap)

Payout Increments

- $50 checks (available only upon request)

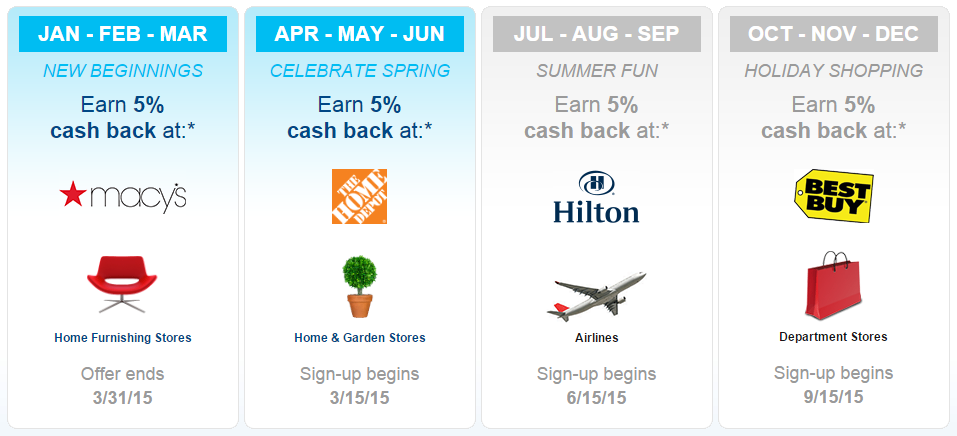

Upcoming 5% Categories (July – September 2015) – activation link

If you have any questions, please leave a comment below.

Check Out These Related Posts:

What exactly does Discover mean by “online shopping”? Does that mean anything online, including Gift Card Mall, Giftcards.com, and purchases of Visa gift cards on Walmart.com?

I don’t have a Discover It card nor have I read on Discover’s site what qualifies as an online purchase. The possibilities are endless.

Amazon payments triggered it last year, so that’ll be the easiest way to meet that requirement.

Got an It card recently and the list of online shopping vendors is literally endless. A big one that’s included: Amazon.com!

Thanks for the confirmation. That should be easy to maximize the cash back for this quarter.

Citi Dividend Q1 2014–Macy’s, Drug Stores, Fitness Clubs

Thanks Jim, I will update the post in the morning. Happy holidays!

Chase FREEDOM. Yes, how to get $200 actual cash after min spend without involving transfers to other cards? Details, please.

All you have to do is spend $500 in the first 3 months to get the 20,000 Chase Ultimate Reward Points, worth $200. Just ask for a statement credit from inside your Chase account.

Correct me if I’m wrong, but I don’t think the citi is capped at 1500 a quarter. It’s just 300 a year

That’s what I’ve heard from a few other people, I will have to double check online and update this post. Thanks for sharing Chuk.

Grant, any ideas on how to spend gas station categories to meet reward maximums? Do you know gas stations that sell visa gift cards?

I think very few gas stations still sell VGCs and allow payment by a CC. You have to test out your local gas stations. Good luck!