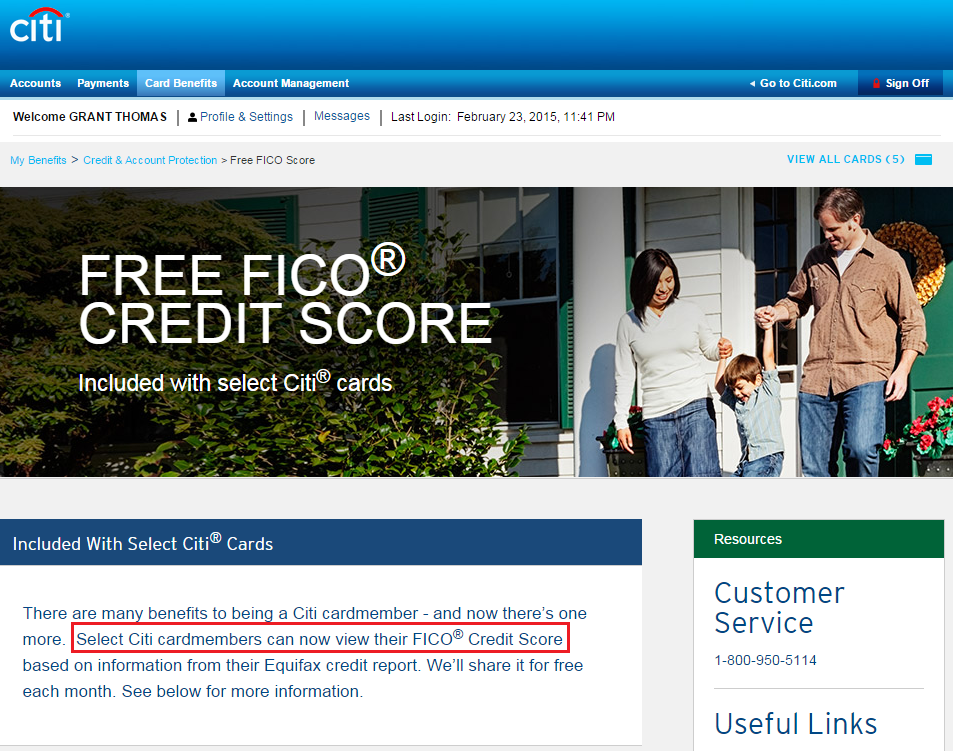

Good evening everyone, I just received an email from Citi regarding a new feature for Citi cardmembers: view your FICO Score online for free (only available to select Citi credit card holders). To see if you are eligible, please click here and sign into your Citi Benefit Builder page.

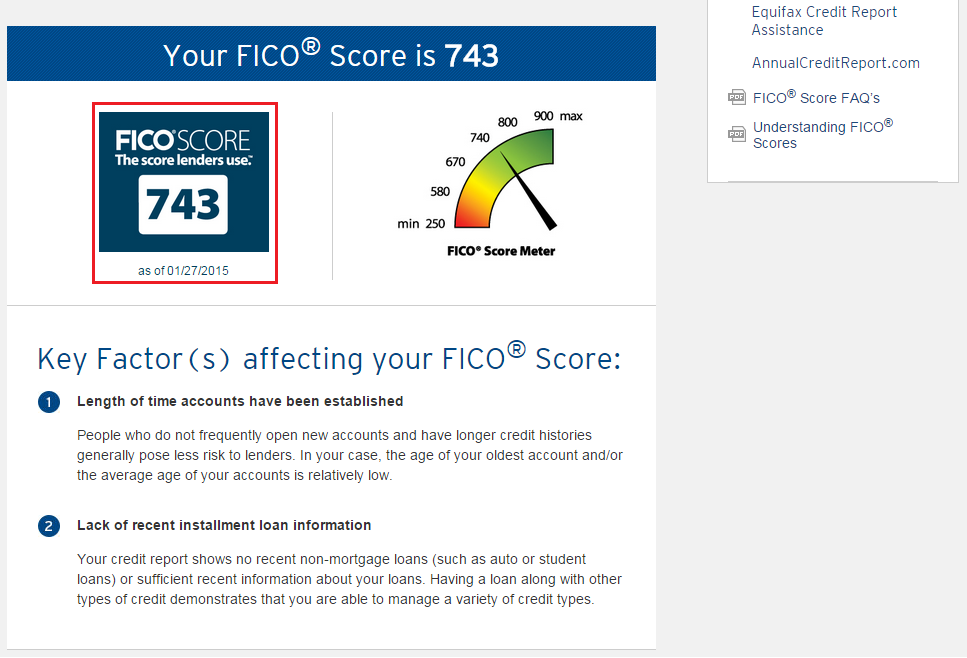

After logging into my Citi credit card account, I was able to see my FICO Score is 743 (as of January 27, 2015).

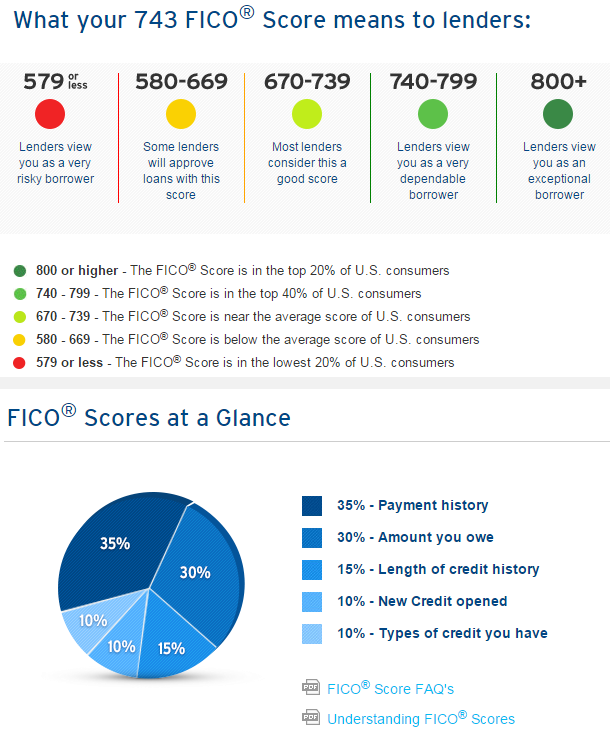

Citi also provides additional information regarding credit scores, what factors affect your score, and characteristics of each credit score band.

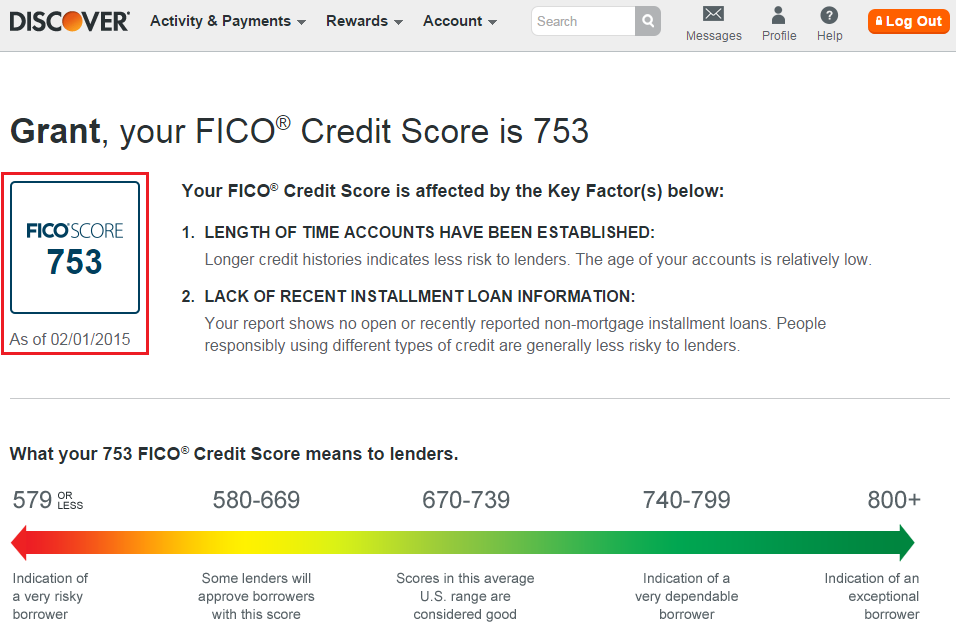

To compare Citi’s FICO Score, I checked out my Discover FICO Score. According to Discover, my FICO Score is 753 (as of February 1, 2015).

Why the difference in scores? After doing some digging, I was able to find some information as to why the scores differ:

- Citi FICO Score: “Your FICO® Score is calculated based on data from Equifax using the FICO® Bankcard Score 8 model. This model has a FICO® Score range from 250 through 900 (link).”

- Discover FICO Score: “The FICO® Credit Score we provide is the FICO® Score 8, based on information on your TransUnion credit report, and has a score range of 300-850 (link).”

- In this case, it is like comparing

Equifax to TransUnionapples to oranges, making it difficult to compare the various scores from various credit bureaus.

What does it all mean? Not much, but it is always good to see your credit score rise from month to month. If you apply for new credit cards or close existing credit cards, your credit score will go down. But if you continue to pay on time and keep your credit utilization ratio below 30% (ideally 10%), your credit score should continue to rise. As for my credit scores, I have 20+ credit cards, so my scores must be good enough for the credit card companies.

If you have any questions, please leave a comment below. Have a great evening everyone!

OK, Citi is Equifax, Discover is TU. What card(s) provide Experian?

FNBO.

First National Bank of Omaha?

I’m not sure. What credit bureau does Barclays use?

TU as well

Gotcha, thanks Will. Anyone use Experian FICO?

At least with USAirways, Barclay updates a TU score every 10 weeks.

That is good, I like updated FICO credit scores.

American Express’ pilot program is using Experian. FNBO provides an Experian bankcard enhanced score like R. pointed out. PSECU also provides an Experian score.

Pretty confident American Express will roll out the program to all cardholders soon.

Excellent, that is great to hear. Looking forward to the Experian FICO score from AMEX :)

Grant, this is useful information for your readers, but this was publicized in several travel blogs not too long ago. I remember reading about this in a post by William Charles.

I’m not surprised to hear Doctor of Credit beat me to the news. I must have missed that post from the last few days.