Random News: Ebay and PayPal Split, Hilton Free Night Certificate, RebAgents, Emirates Miles, $160 AirTran Credit, and Nickelodeon AMEX Offer

Before I dive into the random news, today is the last day of September. Make sure you max out your Amazon Payments, Bluebird reloads, Server Reloads, etc. before the limits reset tonight at midnight. With that said, here are some random news topics…

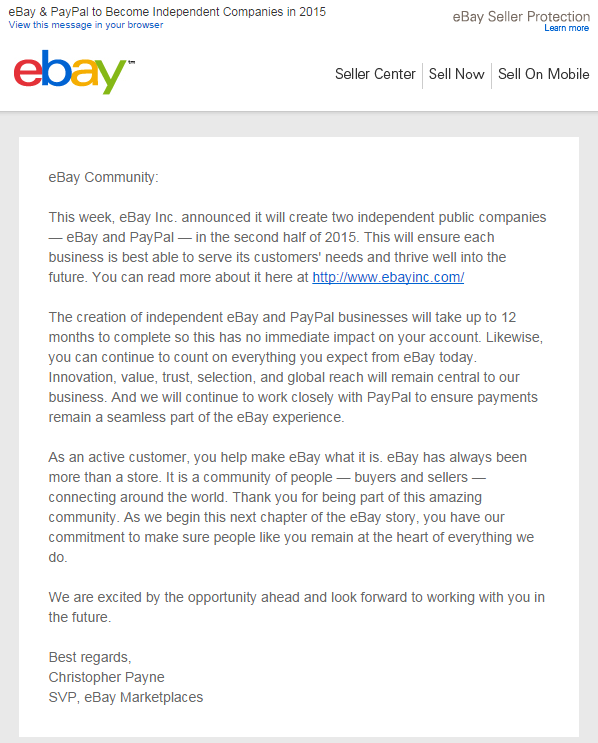

I just received the following email from Ebay. Sometime in 2015, PayPal will become a separate company (probably going IPO as well). I’m not sure how this will affect anything, but I think it is worth sharing.

A few weeks ago, I wrote about the Citi Hilton HHonors Free Night Certificates (link) and received a helpful email response regarding how Citi calculates your $10,000 annual spend to qualify for the free night certificate:

The screenshot you posted says you only get credit for charges after your annual fee date. I assumed that was the day I activated the card so I spent $10,750 on the card in my first year with some cushion to be safe. I never received the annual certificate and when I asked, Citi said I only spent $9,800. I checked my statements and that number excluded the $950 I spent in the few days between when I activated the card (around 7/25) and the date the first annual fee was charged (8/2). Citi is investigating for me and it seems like this is a technicality that will ultimately be resolved in my favor, however, if I had known I either would have not spent anything until I saw the annual fee hit or would have spent the extra $200 to hit the bonus before moving on to a different card.

Hopefully this warning can help avoid potential time spent on the phone with Citi for you and others that may be cutting it tight on the $10K spend.

A friend of mine writes for the blog RebAgents (rebate + agents) and sent me the following link: Why finding a Real Estate Agent or Realtor should be the last step in your home search checklist (link). If you are in the market for buying or selling your house, check out the link to learn more about how to reduce your real estate agent’s commission and buy/sell your house faster.

A reader of mine has Emirates miles and wants to know what to do with them. Any advice?

I have like 14500 skywards emirates miles what will be best way to redeem it ?? I tried to do some research on it , I cannot find anything.

Also I have 5 different accounts with emirates ( my relatives ) all has 8k miles

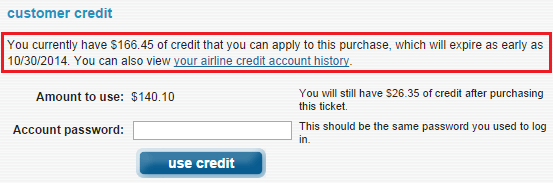

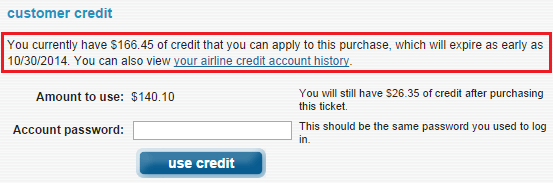

I have $166.45 in AirTran credit that will expire on October 30, does anyone have any experience converting this credit to Southwest Airlines credit? Any way to extend the expiration date?

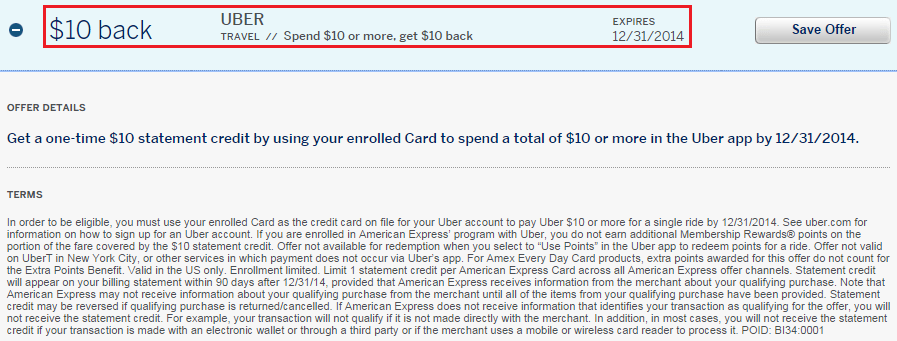

Last but not least, I checked my AMEX accounts and this AMEX Offer caught my attention. If you have kids (or are a kid yourself), you probably watched Nickelodeon at one point. I spent a large chunk of my childhood watching these shows and it would have been awesome to go check out Nickelodeon Suites Resorts when I was younger. I am too old now, but maybe you can take your kids and give them the best vacation ever!

If you have any questions, please leave a comment below. Have a great day everyone!