Good afternoon from the beautiful Hyatt Regency Mission Bay in San Diego, home of the Frequent Traveler University (FTU) event. I walked around and took a few pics of the property (see the best pics at the end of this post). Before I get my swimsuit on and checkout the pools and water slides, I have a quick deal to share.

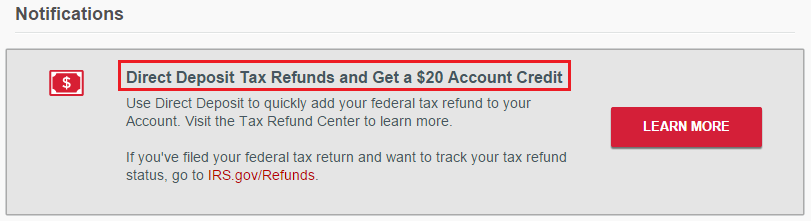

If you have a Redbird Card (or a Serve Card), you should be able to get a $20 statement credit if you have a portion of your federal tax refund deposited to your Redbird Card. Just log onto your Redbird account and click the Learn More button to get started.

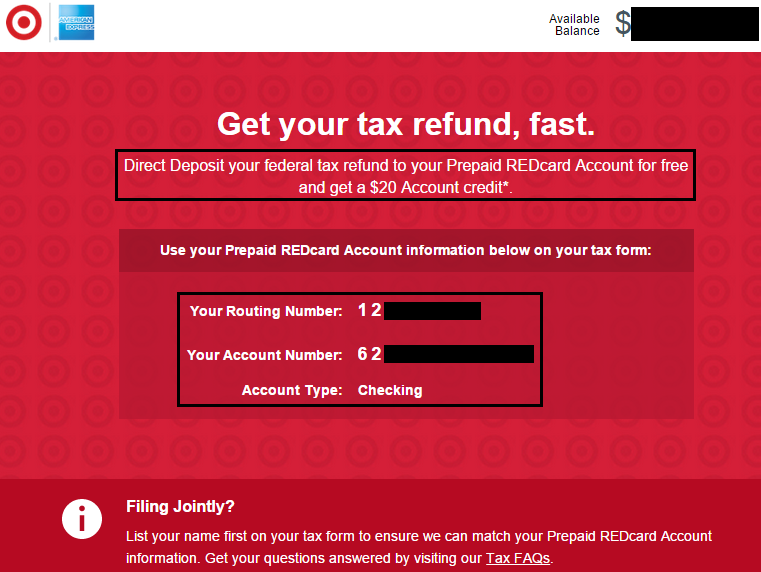

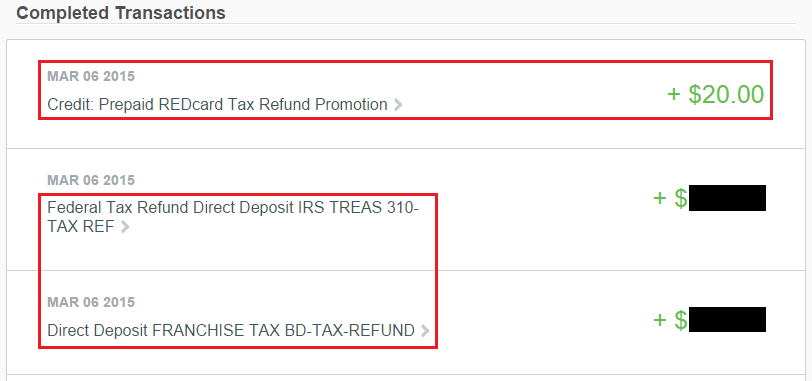

When you file your taxes, you can request to have your federal tax refund be deposited to your Redbird Card by enter the following routing and account number from your Redbird account. I received a few hundred dollars back from my federal tax refund and received the $20 statement credit. A friend of mine only had a $6 federal tax refund post to his Redbird Card and he received the $20 statement credit as well.

I believe only federal tax refunds qualify, not state tax refunds. I had both credit to my Redbird Card. The statement credit shows up as soon as the federal tax refund deposit is received.

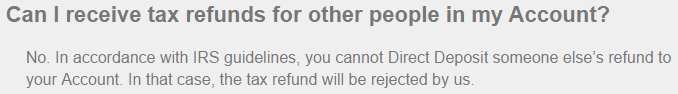

In case you were wondering, you *cannot* have funds from your federal tax refund split into multiple Redbird accounts that you manage. If the name on the refund doesn’t match the name on the Redbird Card, the transaction will be rejected.

Here are the pretty pictures of the Hyatt Regency Mission Bay from the harbor, of the swimming pool and water slides, and my balcony view overlooking the harbor. Not bad for a Hyatt Platinum member :)

If you have any questions, please leave a comment below. Have a great weekend everyone!

Grant, is this targeted and one has to receive an email for this promo? and also only Redbird with your name qualified, right? I manage Redbird of other family member so maybe not qualified?

I don’t think it is targeted. All three Redbirds I manage had the offer. You won’t be able to deposit your federal tax refund on any other Redbirds than the one that is in your name.

Thanks. There is no minimum amount requirement for tax return deposit to RB/BB/Serve, right? If we deposit $1, it will still trigger the refund?

I don’t think there is a minimum amount, so technically a $1 deposit should count.

Thanks Grant!

I filing my tax jointly (wife). red card is under wife name, I can use her card to get my tax refund? Would the refund be rejected by target?

If you file your taxes jointly, I believe as long as one of the names matches the name on the Redbird Card you will be fine.

Keep in mind you can split your federal refund into multiple accounts (up to 3) by filing form 8888. Details in below link

http://www.irs.gov/Individuals/Frequently-Asked-Questions-about-Splitting-Federal-Income-Tax-Refunds

Yes, that is true, just make sure all the accounts are in your name otherwise the deposits will get rejected.

I did not have the $20 option on any of my serve cards. Is this only for Redbirds?

It might be just for Redbird. if you want, you can send a small portion to your Serve Card and see if you get any bonus. No harm in trying.

I disagree that you cannot get the bonus for splitting the refund into multiple accounts, despite what the terms say. My wife and I filed jointly, and I split our refund between our accounts. Both of us instantly received the $20 bonus.

If you file jointly, as long as one of the names on the federal tax refunds matches the name on your Redbird Card, you will be fine.