Buenos dias everyone. I was looking at my Membership Rewards account recently and noticed that although I have used Uber many times in Mexico City over the past couple of months, I only had a couple of credits for bonus Membership rewards points. After some further digging, I realized that I was actually missing a lot of the Membership Rewards points I expected: over the past year or so, I’ve put $869 in Uber charges on my Membership Rewards-earning cards (American Express Business Platinum and my American Express Everyday), but only received 346 bonus points over that time period.

I had an idea of why these were missing, but I reached out to American Express via web chat anyway. The agent said they would file a ticket for me and someone from the Membership Rewards department would call me in a few days. In the meantime, I decided to do some research.

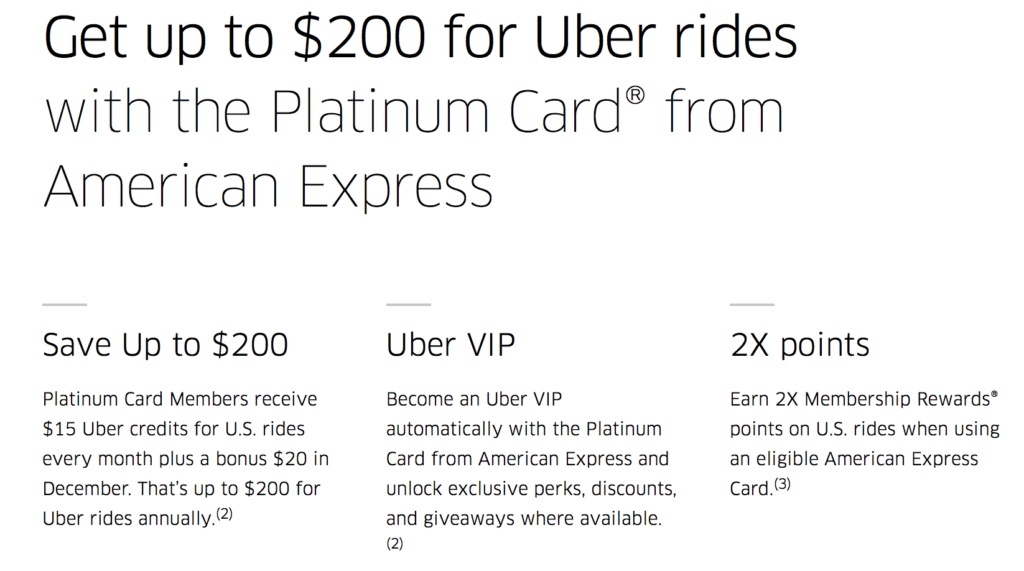

Here’s what Uber’s American Express promotion site looks like today:

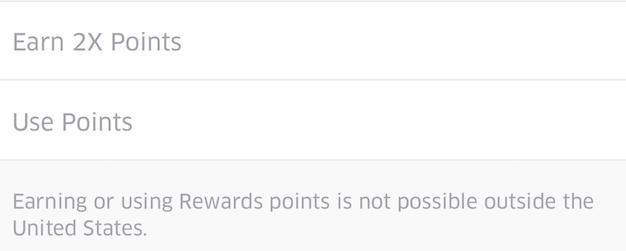

The Membership Rewards site is similarly clear on the subject:

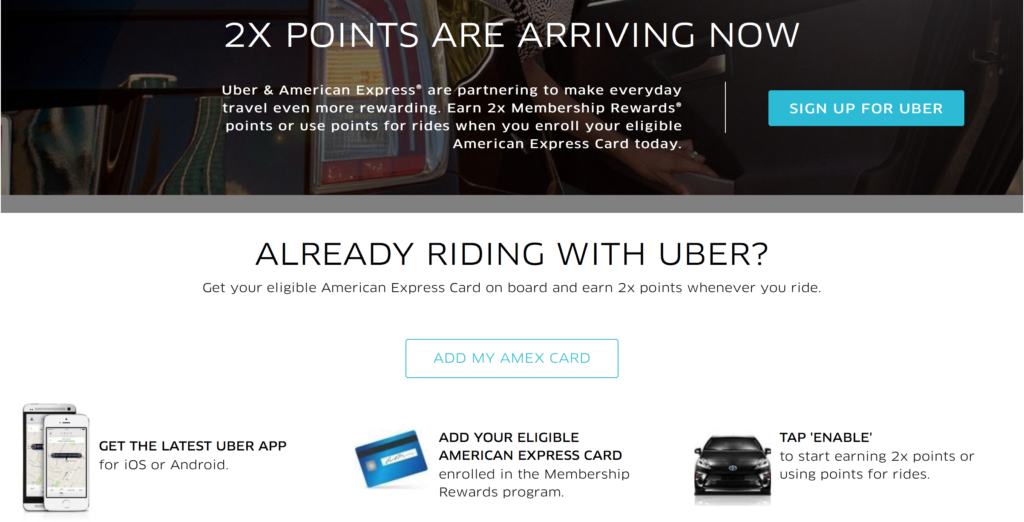

But this wasn’t always the case. When Uber launched their American Express promotion in June 2014, Uber’s press release didn’t mention this detail, nor did Amex’s press release – and a quick trip in the Internet Archive’s Wayback Machine shows that as recently as January it wasn’t disclosed on Uber’s website either:

From what I can tell, when Uber and Amex revamped their messaging for the launch of additional Uber benefits for Platinum cardmembers, they also increased the prominence of the restriction to rides within the United States. It’s also clearly displayed in the app if you dive into the details on your enrolled American Express card:

Doesn’t get much clearer than this. I’m not sure when this was added to the app – I’m certain it wasn’t there when I added my Platinum card.

When a representative from Membership Rewards called me back, she confirmed that the reason I did not have all of the points I expected was because they only award bonus points on rides in the United States. Although I was disappointed to discover these missing points, it’s not really that many – and I’m glad that they now make this much clearer. (I have no doubt that they still want people to make their American Express card the default card on their Uber account and forget to change it when they’re abroad – but at least the terms are transparent now.) Fortunately, other Uber promotions like their Starwood partnership and ShopYourWay Rewards don’t face this restriction.

I’m now using my Chase Sapphire Reserve card for Uber rides – which I probably should have been doing ever since I got the card, since 3x Ultimate Rewards points are definitely worth more than 2x Membership Rewards.

What card do you use for Uber and Lyft rides? Let me know in the comments!

Grant says: I currently use my US Bank Cash Plus Credit Card for Uber and Lyft rides, thanks to the 5% cash back on Uber and Lyft this quarter. Alternatively, I have yet to try to Use Pre-Tax Commuter Benefit Debit Cards to Pay for Uber Pool & Lyft Line Rides to/from Work.

Pingback: PSA: Check your American Express OPEN Small Business Savings Preferences (5% Cash Back vs. 2 Membership Reward Points)

Pingback: AMEX Platinum Cardholders Will No Longer Earn 2x Membership Reward Points on Uber Rides (Effective February 1)