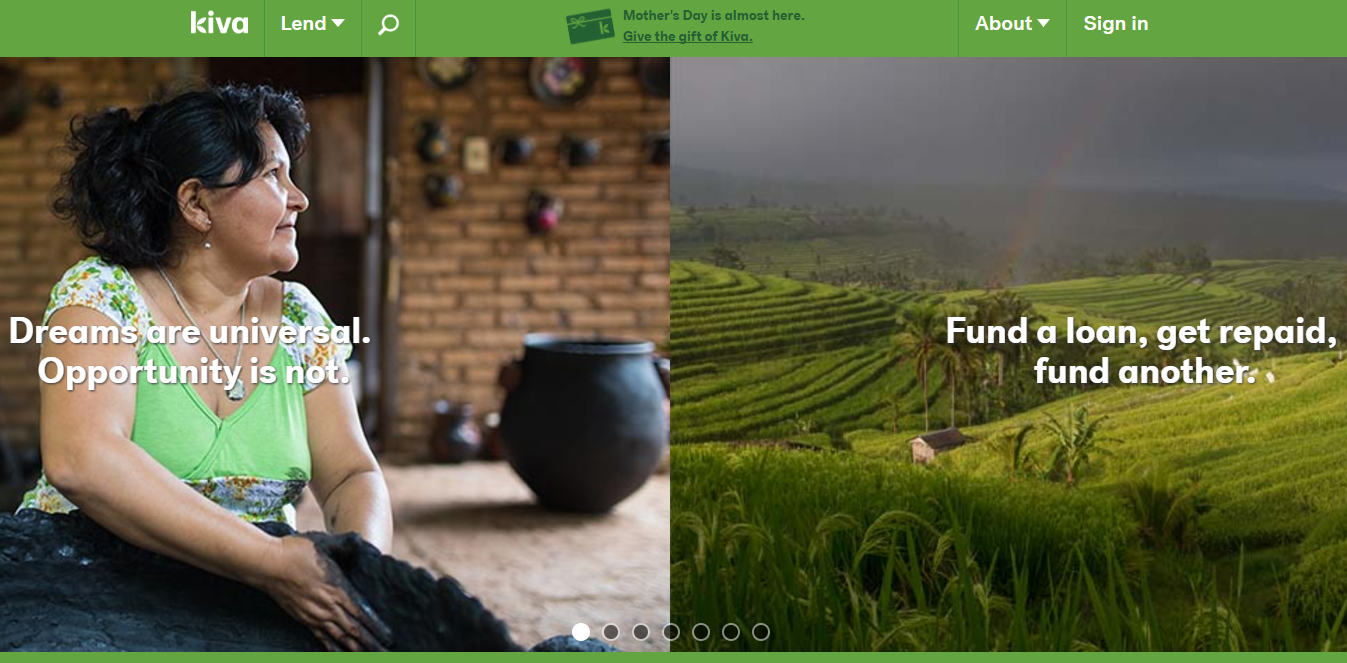

Are you a supporter of Kiva loans? Many in the points and miles world are. Kiva, a micro loaning business, allows you to make loans, for as little as $25, to low-income entrepreneurs and students in over 80 countries. By using a credit card and Paypal, you load money to your Kiva account and then make loans. When the loans are paid back, you can always withdraw the funds or make new loans. In making these loans, miles and points are generated either by completing the minimum spend on a new credit card or by using credit cards you want to accrue miles/points on. Of course, your first priority should be your willingness to fund these loans. I find most miles/points folks do fund Kiva loans because they believe in Kiva and the concept of micro loans.

Using caution, doing your own research, and knowing that there is no guarantee of payback are three important factors. And make sure you can pay off your credit card when it comes due because you’ll most likely get your money back over the course of a few months, not right away. This is for people who have spare cash that can be put to use and tied up over time.

I like to look at the use of the loan. What purpose is being fulfilled? Being a small businesswoman myself, I like loans that are for either starting or maintaining a business; loans that will benefit society and also the loan recipient. I’ve been making Kiva loans for many years and recently this article came across my radar and I wanted to share it with you. It’s not my usual coffee DRINKING blog piece, but it does present an aspect of the coffee world worth knowing about. Take a look at this… One woman brewing change in Africa, and beyond.

I realize that this blog post doesn’t include anything about a local coffee shop I encountered on my travels, or the taste of a coffee I’ve tested, but I thought my coffee drinkin’ readers might be interested, and maybe Kiva loan providers would too. I’m not sure if I’ll make this loan or not, but wanted to give an example of what a typical Kiva loan might look like.

I like Kiva because it combines doing good with earning miles and points along the way. And like many Kiva enthusiasts, I knew about Kiva before I knew about miles and points, so it was a natural fit. Here are two blog posts, one over at Frequent Miler and one over at Rene’s site, that will help you even more should you decide to fund some Kiva loans yourself.

How about you? Do you use Kiva? Had a good experience with them? Let me know!

I have a hard time justifying the idea of micro-loans and Kiva specifically, when I dig a little and uncover a whole lot of problems. All the success stories seem to be cherry picked, and there seems to be more economic devastation created by everyone else who make unsustainable sacrifices to repay their loans. If and only when I’m proven wrong can I conscientiously put a little bit of my money with Kiva. It makes me feel like I’m a global part of the 1% that’s profiting by economically ravaging all others.

Hi LHP. It’s good that you’ve done your own research and decided Kiva isn’t for you. Thanks for your comment, as differing lens are always welcome at TWG.

Shame on you!

KIVA is a total scam. Borrowers pay usurious rates of 40-60% interest. If you really are interested in helping without ripping off the poorest of the poor, then use Zidisha or others that cut out the middle man and lend directly at a fraction of the interest rates charged by KIVA affiliates. Zidisha borrowers pay about 10% all-in (and some even less).

Only the willfully ignorant “lend” to Kiva.