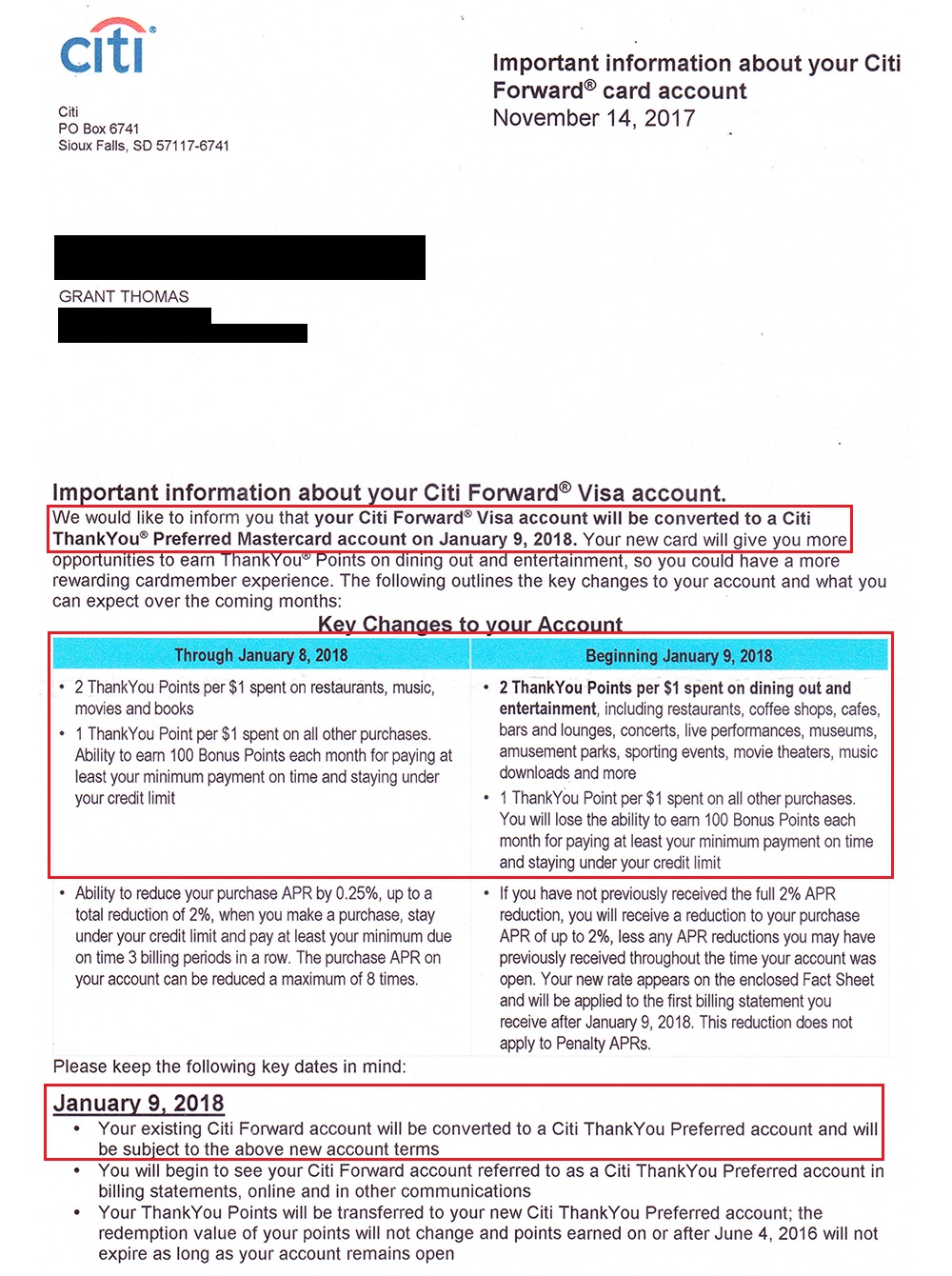

Good morning everyone, happy Black Friday. I hope you all had a great Thanksgiving with your friends and family members. This post isn’t about Black Friday, but if you have a Citi Forward Credit Card, you might want to read this post. Citi is sending out letters informing Citi Forward Credit Card holders that their credit card is going to be converted to a Citi Thank Your Preferred Credit Card on January 9, 2018. Most people do not have Citi Forward Credit Cards (Citi has not allowed applications for several years), but it used to be an awesome credit card… 5x Citi Thank You Points (TYPs) for Amazon, entertainment and restaurant purchases, but back in June 2016, Citi changed the 5x TYP categories to 2x TYP categories and the credit card became worth much less than before. The best feature of the current version of the Citi Forward Credit Card is that you get 100 TYPs when you pay your credit card bill. That bonus is ending, but the 2x TYP categories are staying about the same.

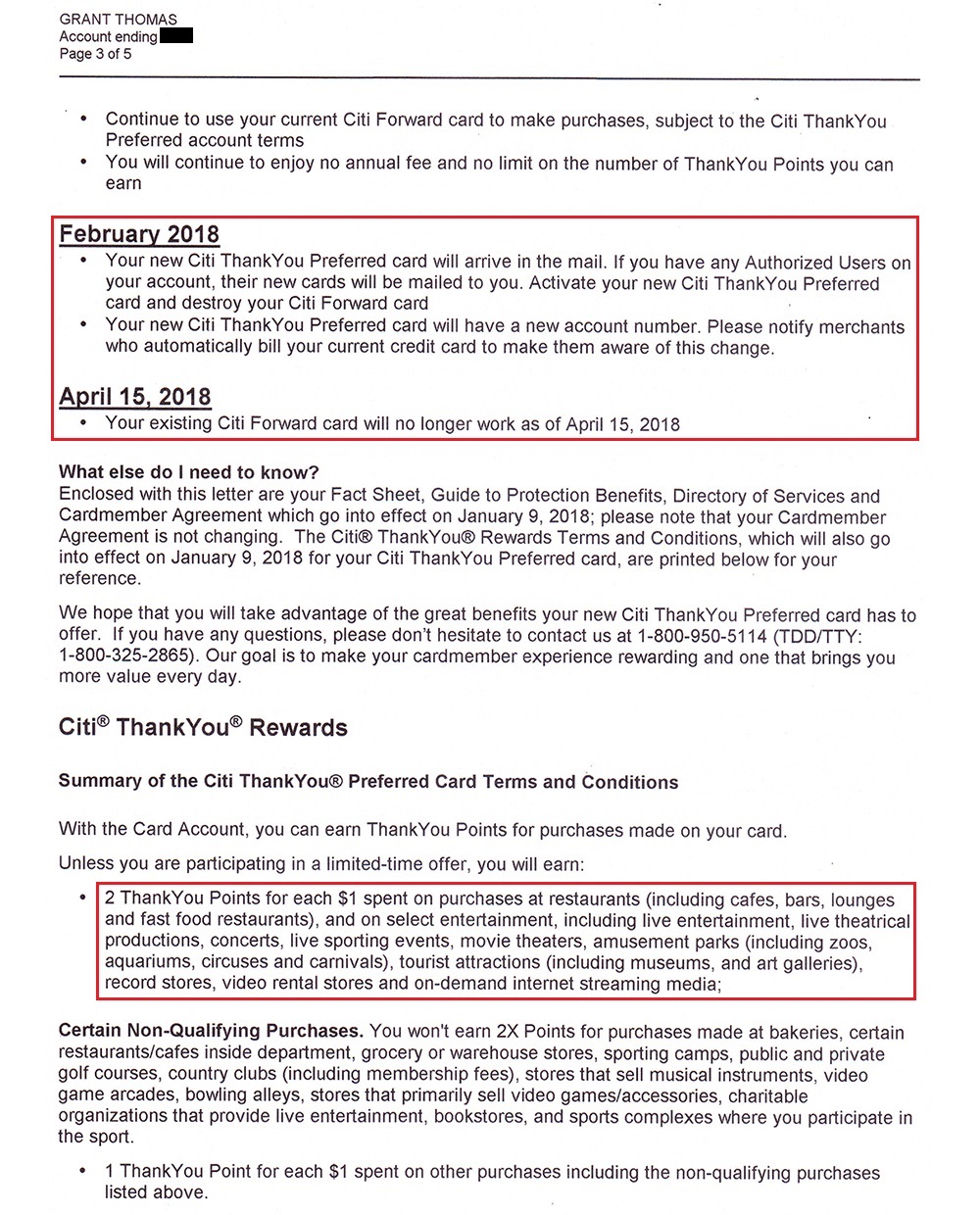

Sometime in February 2018, you will receive your new Citi Thank You Preferred Credit Card and your Citi Forward Credit Card will no longer work after April 15, 2018 (Tax Day). The 2x TYP categories are pretty broad. I currently have a Citi Thank You Premier Credit Card that I no longer use, since I switched all my travel and restaurant purchases over to my new Chase Sapphire Reserve Credit Card. My Citi Forward Credit Card is/was my oldest credit card with Citi, so I will keep the Citi Thank You Preferred Credit Card open and continue to put my automated $5 Amazon gift card balance reload on the credit card to keep the credit card alive.

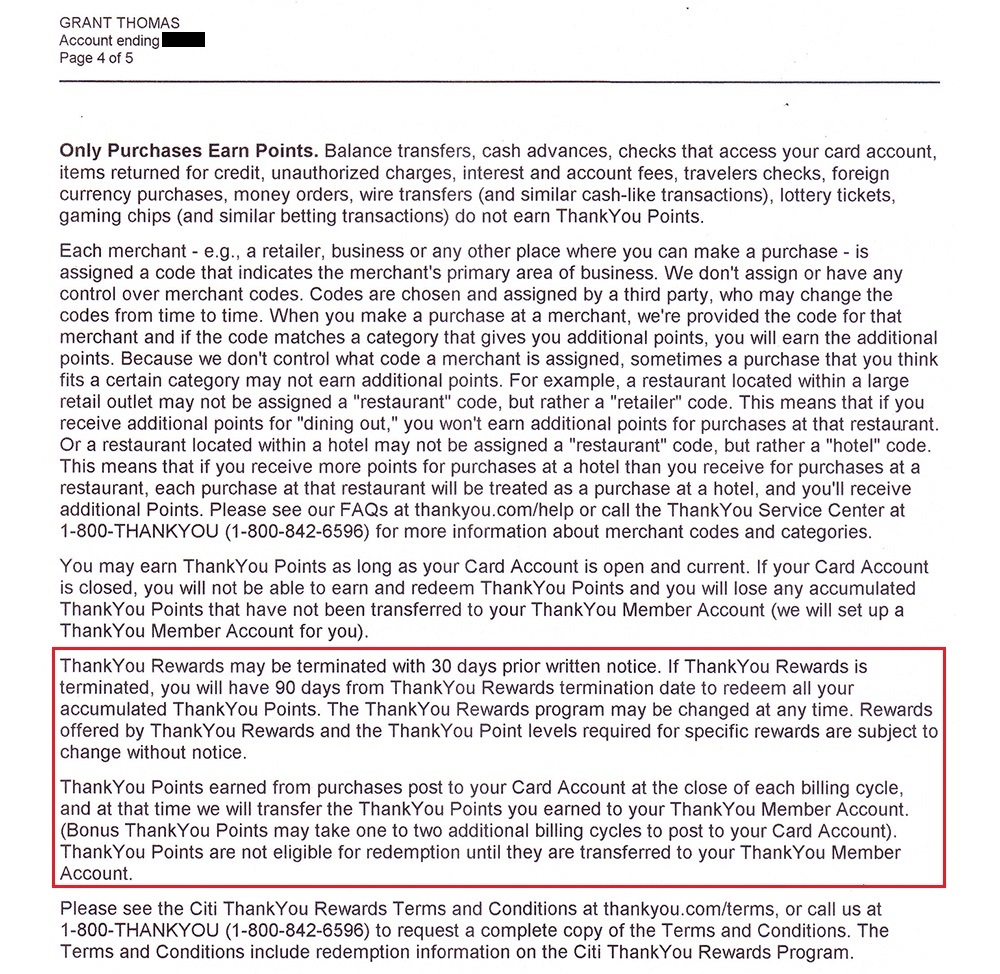

If you do close your Citi Forward Credit Card or Citi Thank You Preferred Credit Card or convert either of those credit cards to a non-TYP earning Citi credit card, please pay attention to this section. You have 60 days to redeem your TYPs that you earned from your Citi Forward Credit Card or Citi Thank You Preferred Credit Card or the TYPs will be lost.

If you have any questions about the Citi Forward Credit Card conversion letter, please leave a comment below. Have a great day everyone!

I was a told by a not too knowledgeable sounding CSR that no conversions to any other products are possible until January 9

What card would you product change to?

AT&T More

Nice idea. I already have a Citi AT&T Access More CC, but maybe I should get another.

In California, it’s probably not necessary to put a monthly $5 charge on a no-fee card to keep it alive. In CA they can normally only close an account without notice if the card hasn’t been used in 18 months if they don’t have any information to indicate you’re not creditworthy.

http://codes.findlaw.com/ca/civil-code/civ-sect-1747-85.html

Personally, I try to use a card at least once a year.

Good to know. I have a bunch of CCs that I put $5 Amazon GC balance reload charges on. Nice to keep generating CC statements and keep the CC alive. Not sure if it helps/hurts with regard to retention/spending offers.

End of an era. 5x on manufactured spend at Barnes & Noble campus bookstores is tough to beat.

Yes indeed, it was great while it lasted.

The Forward is also one of my oldest accounts, so I think I’ll let it automatically convert as well.

Do you plan on converting it again? Maybe if the 2018 dividend categories are good, I would convert the CC to Citi Dividend.