Good morning everyone, I hope you all had a great weekend. A few days ago, I noticed that US Bank began offering free credit scores online. Before I review the credit score feature, I wanted to get a few credit card and credit score annoyances off my chest.

[rant on]

Whenever I talk to people about credit cards, I eventually reveal that I have 30+ credit cards. Since most people think having 2-3 credit cards is a lot, they automatically assume I have thousands of dollars in credit card debt. It is annoying that people assume you have a shopping addiction and have no financial responsibility – that couldn’t be further from the truth.

People also ask about my credit score, since they assume it is 1 static number (like your age or height) – that couldn’t be further from the truth either (below, I compared my credit score from 5 different services). There is actually no single credit score since each credit bureau (Experian, Equifax, and TransUnion) each have their own scoring models and reports, which subsequently produce different credit scores. When people ask me what my credit score is, I don’t tell them a number, but I do say, “I have a great credit score, good enough to be approved for 30+ credit scores.” Here are 2 other annoying misconceptions that I want to put to rest about having 30+ credit cards:

- I do not carry all 30+ credit cards with me at all times – I only carry my Citi Forward and AMEX Old Blue Cash on a daily basis

- I do not use all 30+ credit cards every month – aside from meeting minimum spends on new credit cards, I only use 4-6 credit cards in any given month

[rant off]

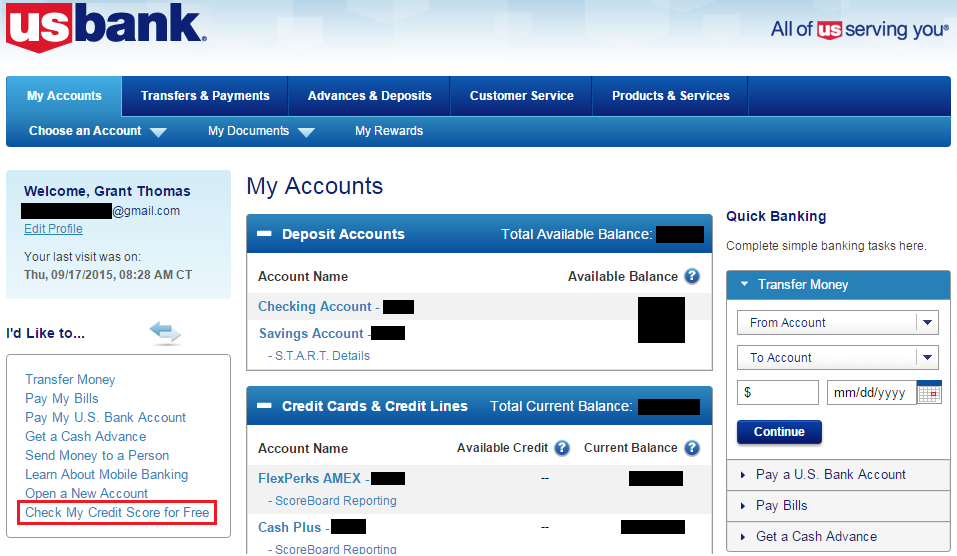

Now with that off my chest, let me show you the new US Bank credit score feature. After you log into your US Bank online account, click Check My Credit Score for Free on the left hand side.

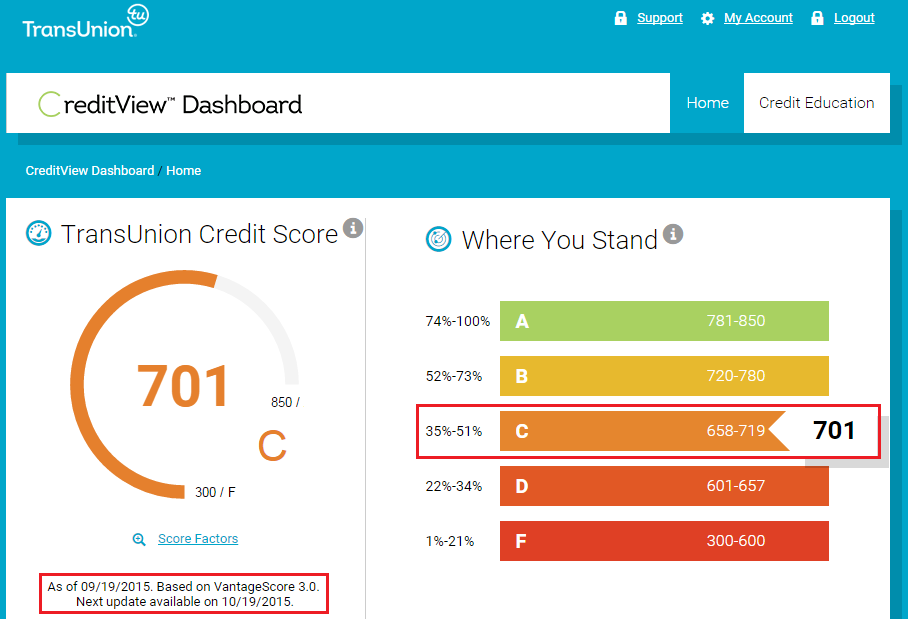

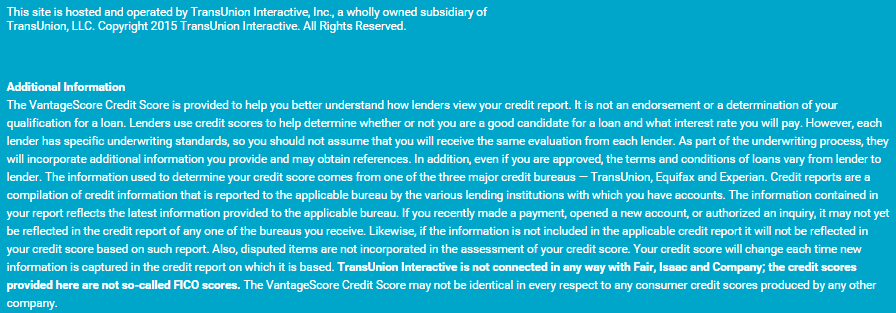

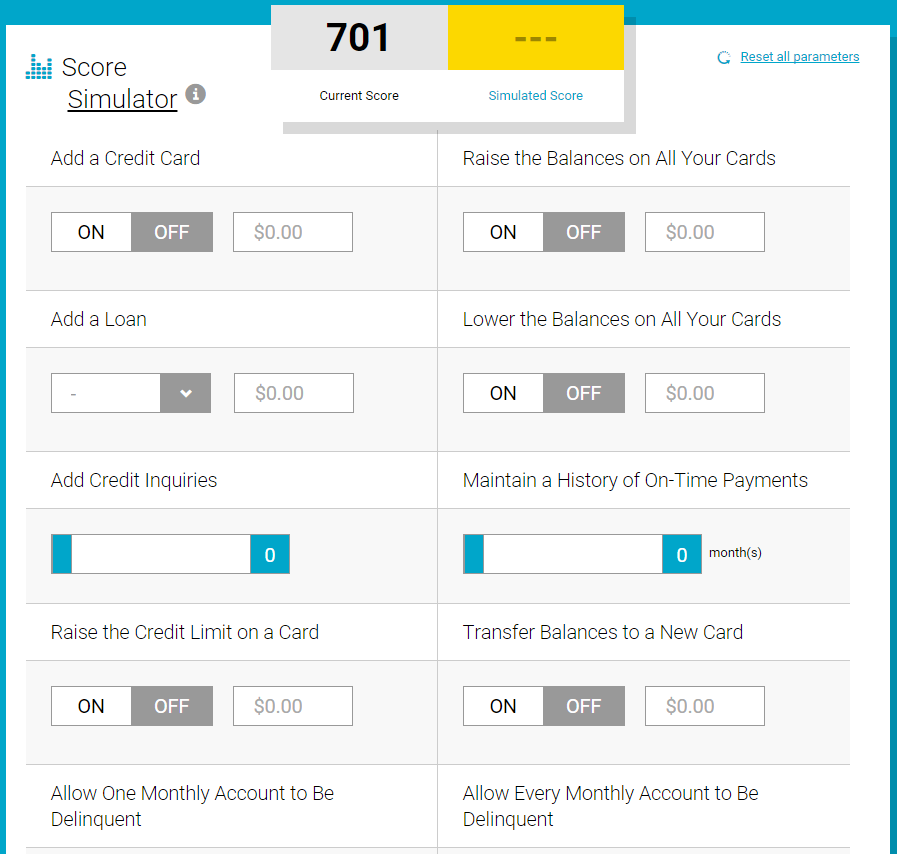

You will be redirected to a page showing your TransUnion VantageScore 3.0 credit score. The interface is pretty, but there are no unique features that you cannot find from any of the other free credit score services.

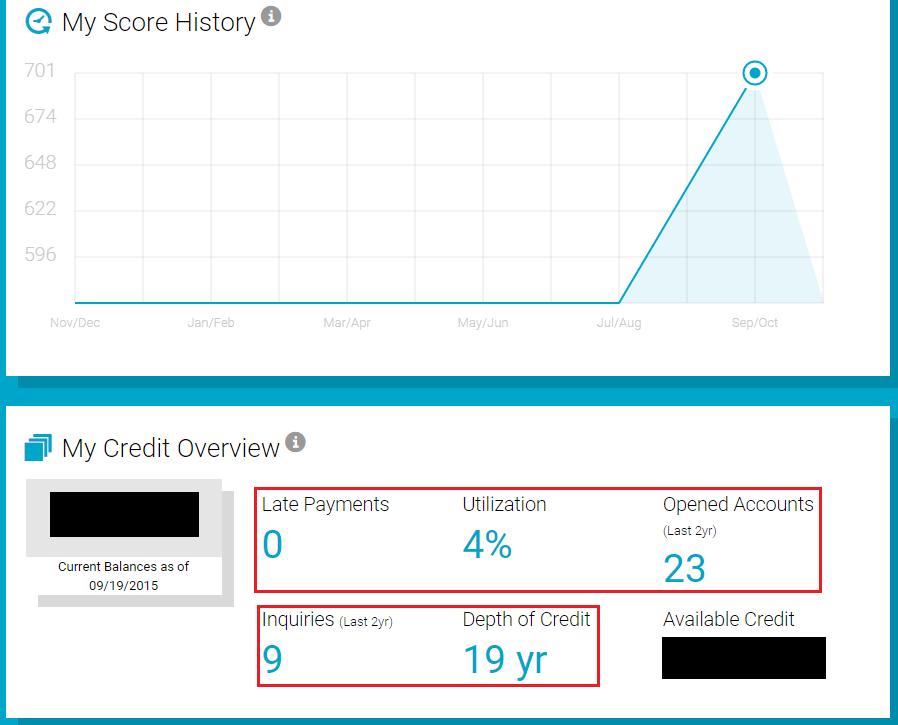

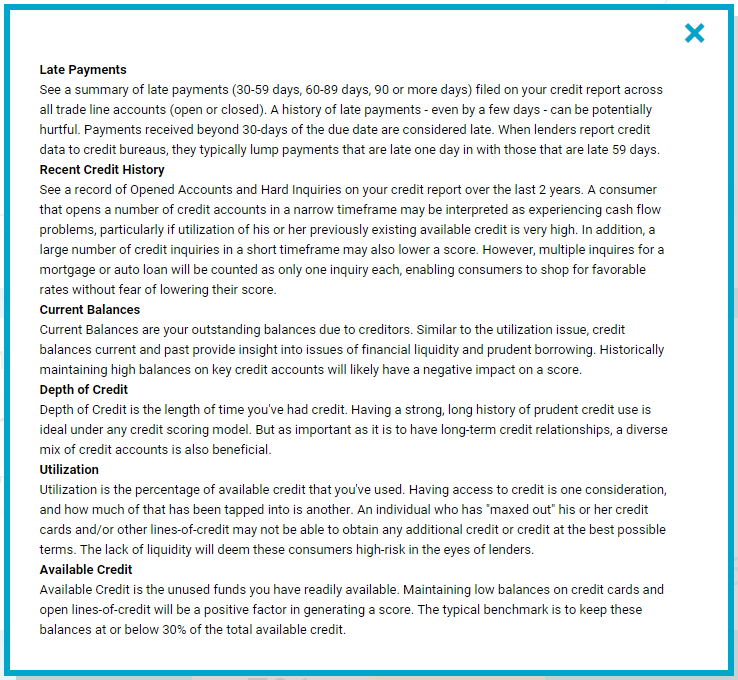

I like the My Credit Overview section since it shows your total available credit, credit utilization ratio, and credit inquiries, but there are some confusing numbers here. Does Opened Accounts mean credit card accounts that were opened in the last 2 years or does it mean the total number of credit card accounts that I have open during the last 2 years? Are the 9 credit inquiries over the last 2 years counting only TransUnion inquiries (most likely), or credit inquiries from all the credit bureaus? Maybe the information icon will answer my questions…

…Nope. It doesn’t mention anything about opened accounts or credit inquires. Apparently I am the only one who is confused about those values.

I haven’t tried the Score Simulator, but you can play with the numbers and see how much you can increase/decrease your credit score by playing with the buttons and dollar amounts.

Below the Score Simulator, you can read about the factors that impact your credit score and credit report (all pretty standard information).

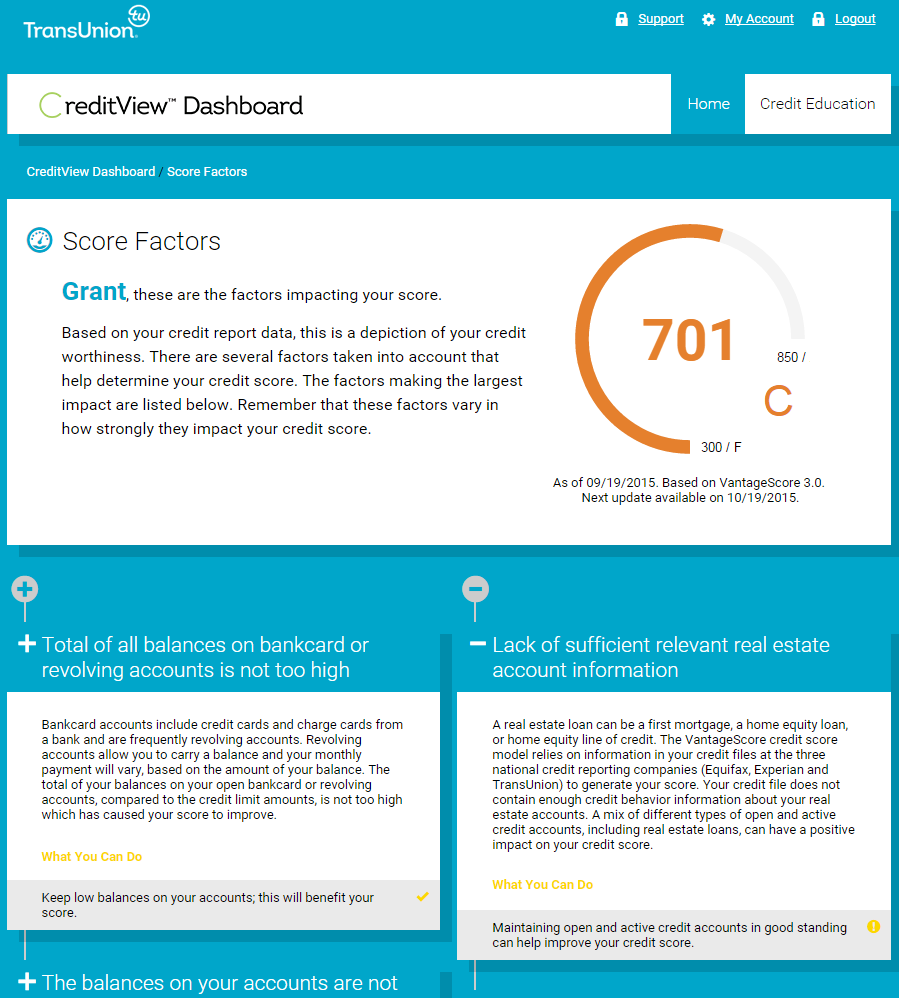

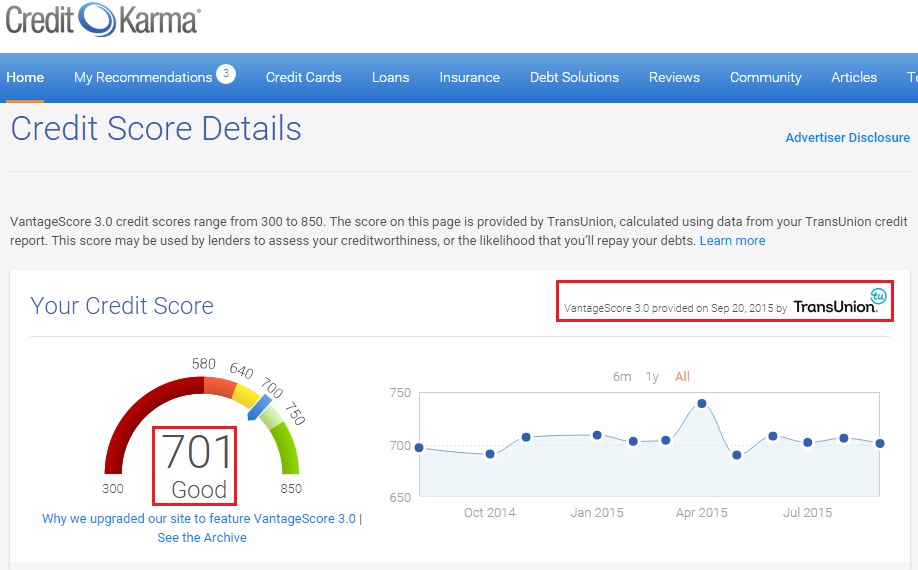

As I promised earlier, I will show you how much variety and variation there are in credit scores. I pulled/viewed my credit score from Credit Karma, Credit Sesame, Discover, Citi, and American Express on 9/20/2015.

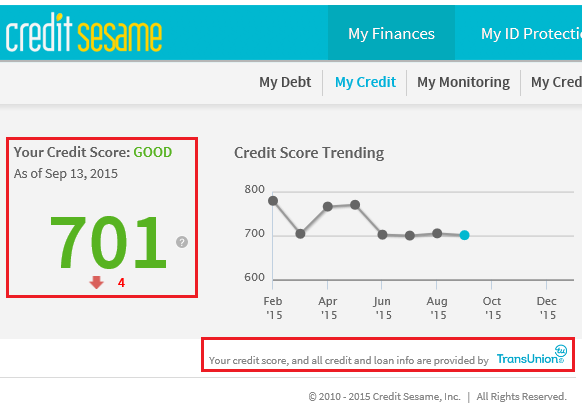

Before I go into my credit scores, I recommend that you read about Credit Karma & Credit Sesame. Credit Karma uses TransUnion VantageScore 3.0 and reports that my credit score is 701 (the same service US Bank uses above).

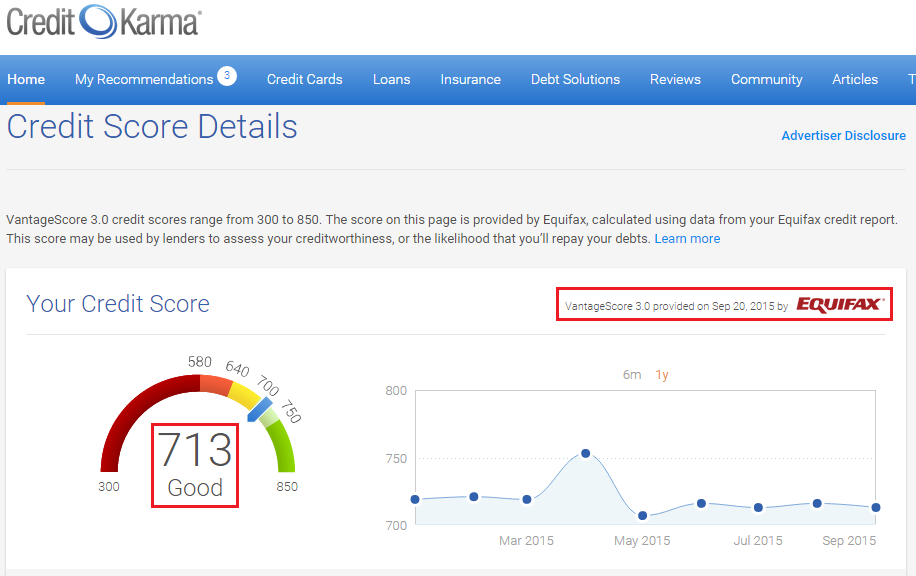

Credit Karma also uses Equifax VantageScore 3.0 and reports that my credit score is 713.

Credit Sesame uses TransUnion and reports that my credit score is 701. Since Credit Sesame and Credit Karma have the same score and use the same credit bureau, I will assume that Credit Sesame uses TransUnion VantageScore 3.0 as well. The TransUnion VantageScore 3.0 seems like a very popular score – it is probably the cheapest credit score option available.

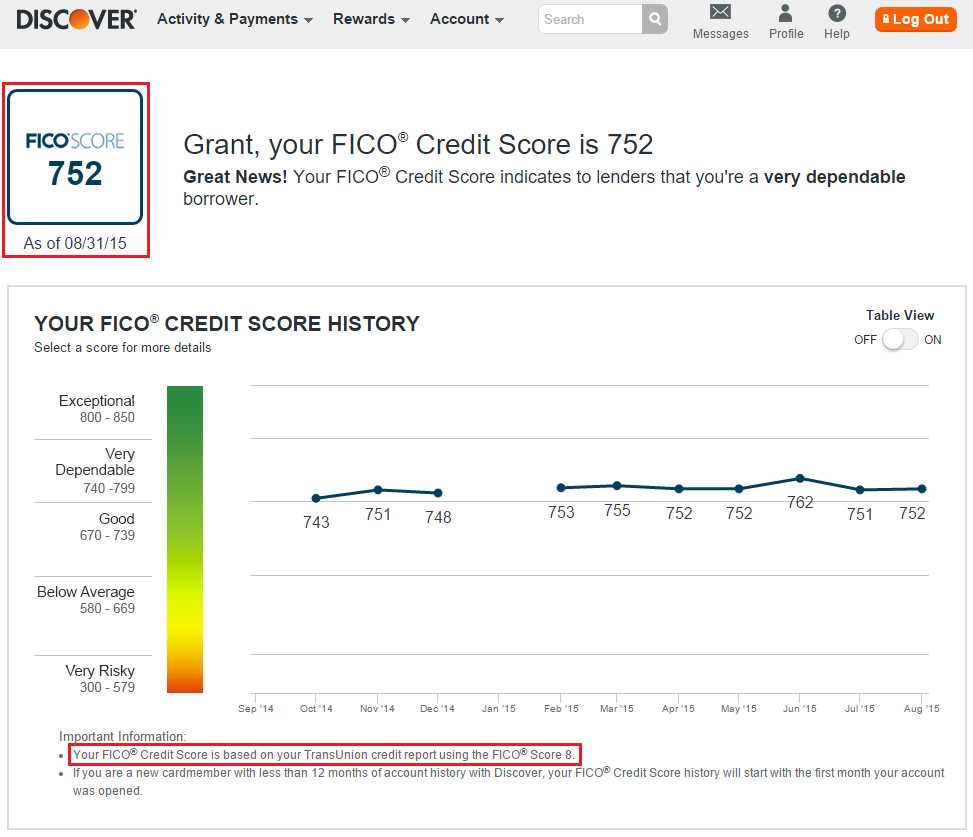

Discover uses TransUnion FICO Score 8 and reports that my credit score is 752. It seems strange that 2 credit scores from TransUnion can be 51 points apart…

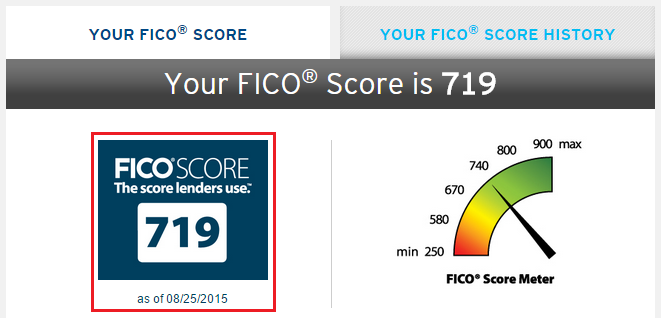

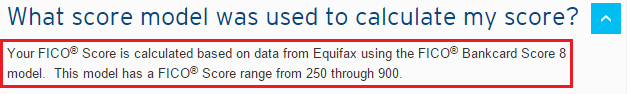

Citi uses Equifax FICO Score 8 and reports that my credit score is 719.

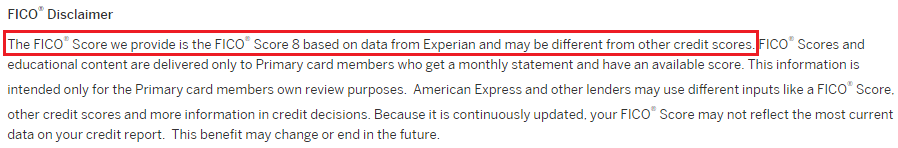

American Express uses Experian FICO Score 8 and reports that my credit score is 732.

As you can tell from the above screenshots, there is no single credit score. In fact, there is not even a single score from each credit bureau. If you add in the fact that your credit report is constantly changing (new credit card data is reported on a monthly basis) and the credit scoring algorithms are always in flux, you come to the realization that you will never know exactly what your credit score is. How wonderful…

If anyone every asks what your credit score is, please have them read this article. If you have any questions, please leave a comment below. Have a great day everyone!

Great post. It really shows that Vantage scoring model is irrelevant. My scores are at least 50 points lower with Vantage than FICO (similar to yours). For example, my USAA free score shows a 710 Vantage score, but I recently applied for a loan with USAA and they pulled a FICO of 770, that is a huge difference.

Yes, that is a huge difference. I think I read about how VantageScoring was supposed to a more accurate score than the “outdated” FICO score, but I still prefer the higher scores – it makes me feel better.

Good article Grant. I have 31 cards with 30 separate cards for spouse, Only difference is I try to add at least one small charge($1-$10) every calendar month to all cards to make credit lenders happy.

I’ve tried that in the past but I’m not sure if it’s necessary. I might do that every few months but not every month. That is too confusing for me. Do you ever get low balance adjustments/credits?

you are right. Not necessary to charge every month. But then i find it more difficult to keep track otherwise. Also i pay in full couple of days after purchases posts. So never tried low balance adjustments/credits again because of tracking difficulties.

Gotcha, thanks for sharing. What do you charge to your cards? Small purchase in person or an online purchase?

around 90% in store small grocery purchases at retail stores, and 10% online. mostly use self checkout and scans 5 items with 5 cards for example, obviously when customer lines are less.

Gotcha, that’s what I would do too

This is a really great article. One of those that people will find as a resource for a long time. Let’s keep it rolling by tracking down the truth about how the Discover promo is going to shake out. Good luck!

I’m sure we will get to the bottom of the Discover ApplePay promo soon enough. Stay tuned.

What a mess to say the least! Thank goodness Congress fixed all this for us!

What exactly did Congress do?

Keep in mind that each lender (creditor) could post information to the bureaus on whatever day they wish, and may not report to all three bureaus.

My understanding about VantageScore was that it was geared towards approval of new accounts. Lenders can use any model they wish, and may be customized for home, auto, or other purposes.

Thanks Bill, I believe you are right about when creditors/banks report credit info to the bureaus.