Almost every week, someone who knows I’m a miles and points girl, and savvy about credit cards, asks me this question: “If I want to get a cash back credit card, which one do you suggest?” There’s never a one-size-fits-all answer! There’s a lot to consider. For instance, it’s smart to consider how much cash you get back, how much you spend and in what categories, and what the fees and rebate rules are. And there are tons of card choices out there.

Recently, I came upon a great tool that helps navigate these cash back card choices, and I wanted to make sure you knew about it. It helps by calculating the costs and benefits of the major cash back cards based on buying patterns. It’s called the Credit Card Advisor Comparison Tool and it was created by Consumer Reports.

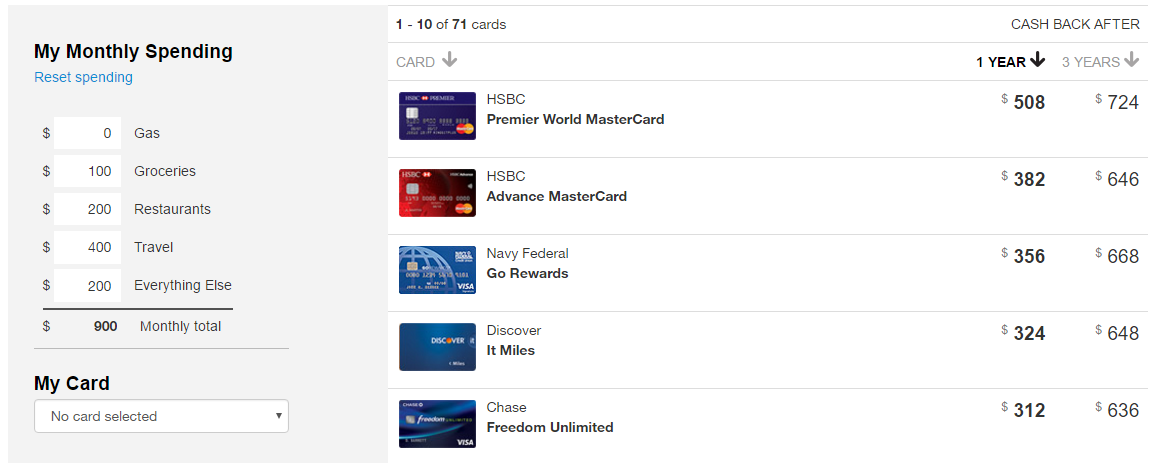

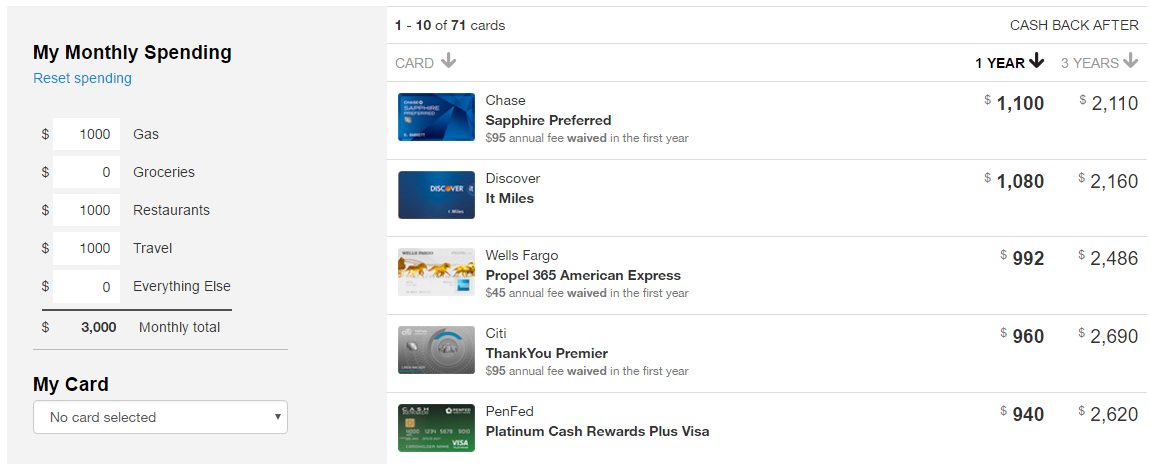

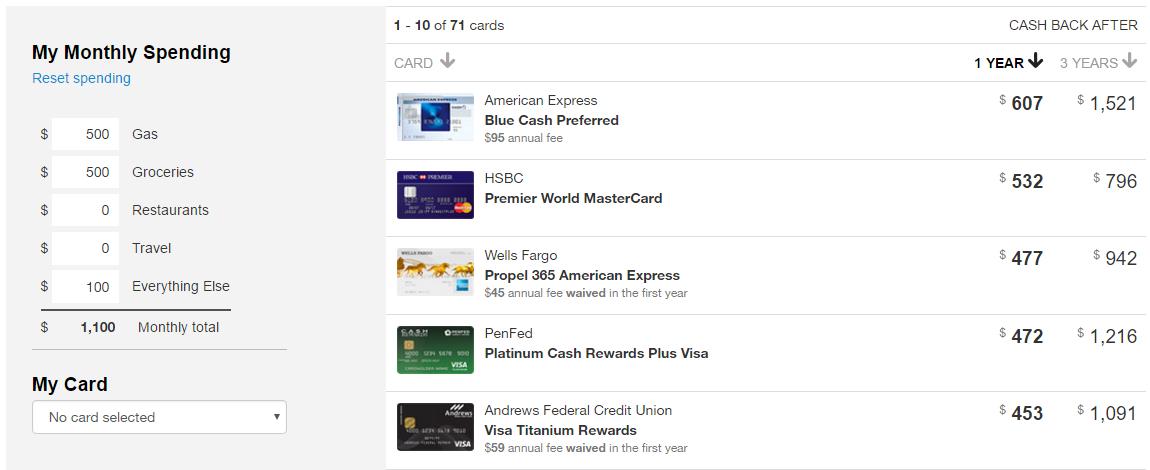

Here are 3 different scenarios (showing various spending amounts in a few categories) and the credit cards the tool recommends. It also incorporates any sign up bonuses and shows that in the 1 year total.

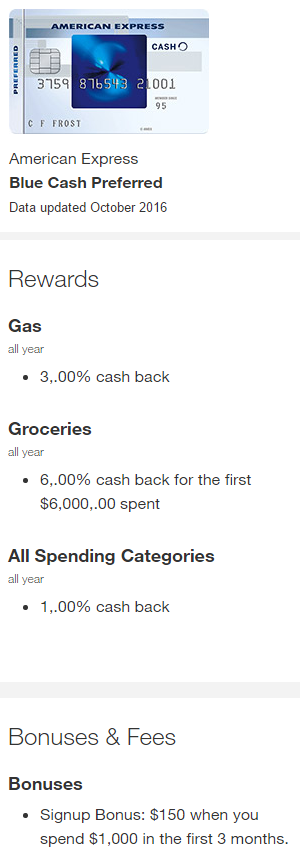

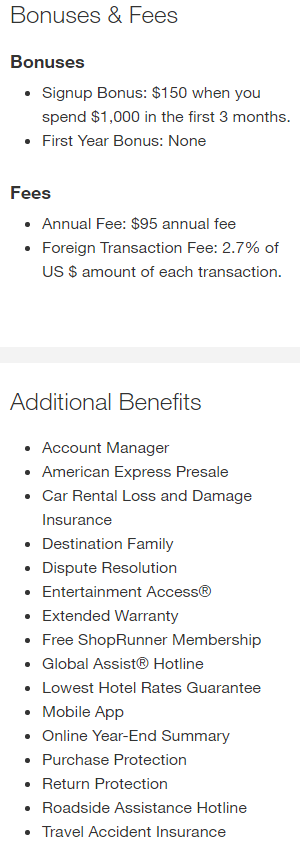

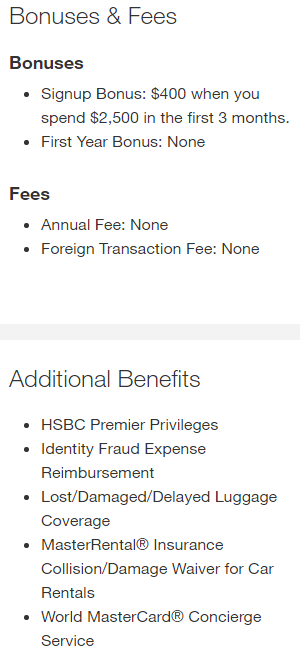

If you click on a credit card, it shows you more details, such as the credit card rewards, any bonuses, and any additional benefits.

Try out the tool and let me know if you agree or disagree with the suggestions. Do you use a cash back card? If so, how did you decide which one was right for you?

It doesn’t include the USAA Limitless Cashback Rewards Visa, which is definitely my card of choice for purchases without a category bonus.

What are the perks of the USAA Limitless Cash Back Rewards Credit Card?

2.5% cashback on everything