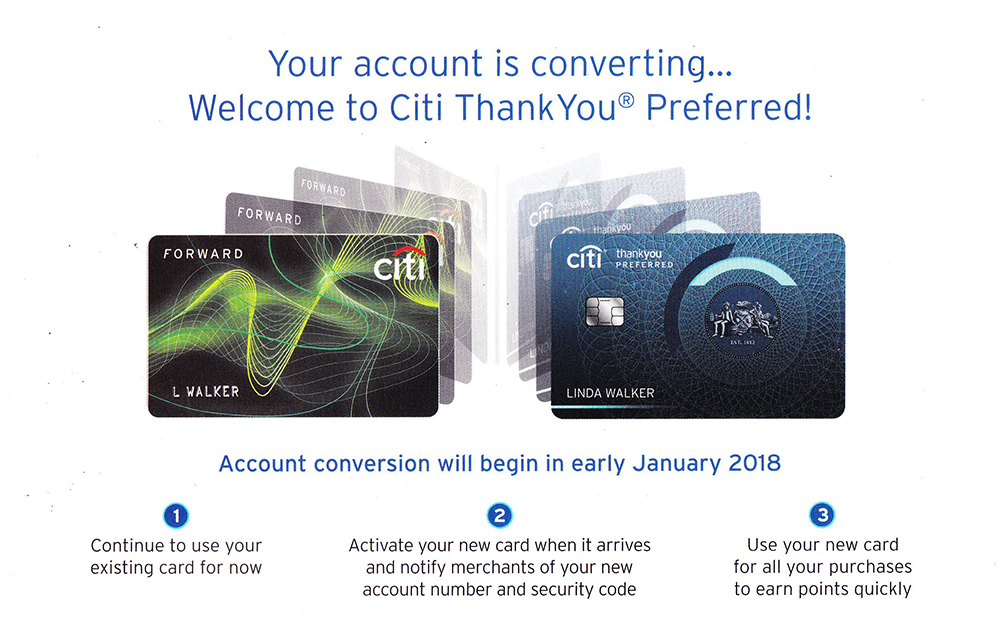

Good morning everyone. A few days ago, I received the following letter from Citi regarding my Citi Forward Credit Card. The letter was similar to the letter posted on Doctor of Credit, but mine did not include a targeted spending offer. I reached out to Citi on Twitter and asked if they could match me to the targeted offer. Long story short, I spoke to a member of the Citi social media team and we went through a few options. I will share what my long term plan is regarding the Citi Forward Credit Card conversion into the Citi Thank You Preferred Credit Card and share my plans for some of my other Citi credit cards. Here is what the letter from Citi looked like:

Here are the inside flaps of the letter. In the Doctor of Credit post, the reader saw a targeted offer: spend $500 and earn a $50 bonus. Unfortunately, I did not receive that offer :(

During my call with a member of the Citi social media team, I asked if I could get matched to that offer. She looked over my account and said there were no offers available and they could not match me to that offer. I explained that my Citi Forward Credit Card was my oldest Citi credit card (opened in 2012) and it used to be my primary credit card back when the Citi Forward Credit Card offered 5x at restaurants, entertainment, and bookstores (aka Amazon). After the devaluation in June 2016, I did not put much spend on the credit card. This could explain why I did not receive a targeted spending offer. I told her that I currently have a Citi Thank You Premier Credit Card and that the Citi Thank You Preferred Credit Card had no value to me. She said I could not do anything to stop the conversion or change which credit card it would be converted to.

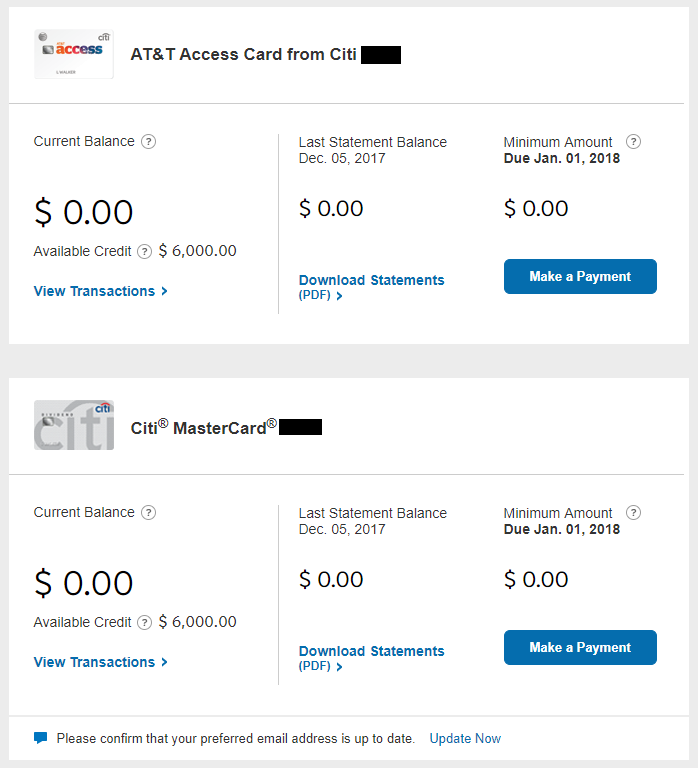

I then asked her if I could product change my Citi Dividend Credit Card to a Citi AT&T Access More Credit Card. I wanted to get the 10,000 bonus Thank You Points after spending $10,000 on the credit card. She said the Citi AT&T Access More Credit Card was not an option to convert to, so I asked if I could convert to the no annual fee Citi AT&T Access Credit Card. She said yes. I then asked that when I got the Citi AT&T Access Credit Card, could I upgrade to the Citi AT&T Access More Credit Card? She did not know, but I will try it out and report back if that is possible.

If that upgrade process is successful, I will try to convert my Citi Thank You Preferred Credit Card to another Citi AT&T Access Credit Card and then upgrade that to another Citi AT&T Access More Credit Card. If everything works out the way I hope, I will end up with 2 new Citi AT&T Access More Credit Cards to go with the Citi AT&T Access More Credit Card that I have had for the last 2 years.

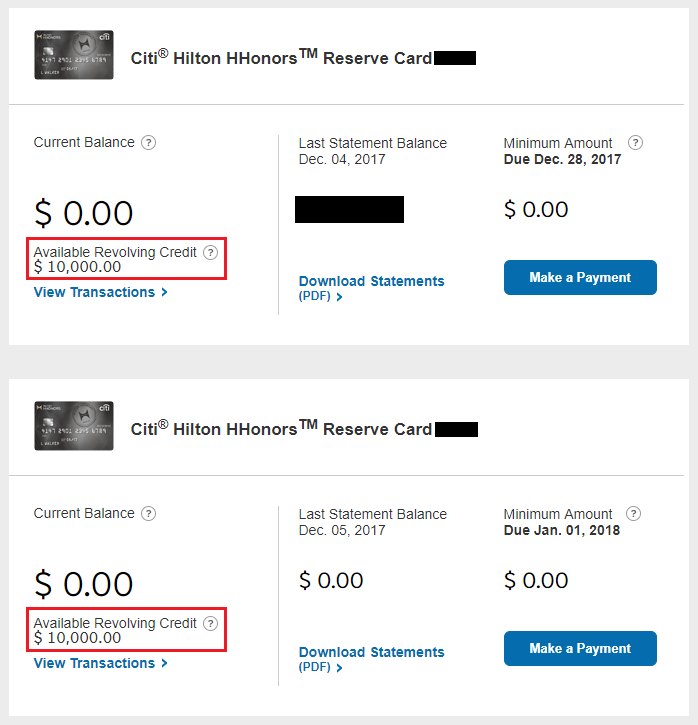

I then asked if it would be possible to move some of the credit limit on my 2 Citi Hilton Honors Reserve Credit Cards (both with $10,000 credit limits and my 2 highest Citi credit limits) to another Citi credit card before the conversion to American Express Hilton Ascend Credit Cards. She said I could not touch those credit cards during the conversion process. Bummer.

I didn’t ask her directly, but I bet that Citi has a few exciting credit card announcements early in 2018 to make up for the loss of Hilton. At least I hope so, since I don’t use Citi credit cards much any more. Citi used to get so much of my credit card love, but I have switched the majority of my spending to Chase (Chase Sapphire Reserve and Chase Ink Plus).

So that is my long term plan for my Citi Forward Credit Card and some of my other Citi credit cards. What are your long term plans with your Citi credit cards? If you have any questions, please leave a comment below. Happy holidays and travel safe everyone!

Why 2x ATTAM cards instead of moving all credit to one and closing? You get the yearly 10k on 10k spend but does it offset the AF?

I could do that, but I want to get the 10,000 bonus Thank You Points on multiple credit cards. It should offset the $95 annual fee.

What’s the benefit of having 3?

If I spend $10,000 on each credit card, I will get 10,000 bonus TYPs. So the more CCs, the more bonus TYPs.

Citi will rarely move credit lines without a hard pull anymore.

That is true, but sometimes you can get lucky :)

Greetings from the East Bay. Nice work. I too am curious to see what Citi has in store for 2018. My 18 wish list is filling up fast and there is only so many HP’s to go around. Right now I’m hoping to add the Hyatt, WF World Propel, US Bank Altitude, Stash 50k, Hilton Amex, and whatever Chase and Amex due with Starwood/Marriott.

Those are a lot of good cards. It will be tricky to plan your applications. Wait and see if any credit cards get increased sign up bonuses and then apply for those credit cards.

I am 99% sure I received the same letter as you (with no targeted spending offer), but unfortunately I threw it away (keeping the other letter with detailed info about the conversion process) so I can’t be 100% sure. After seeing the Doctor of Credit post I called Citi customer service, and after a little bit of talk regarding the conversion to TY Preferred, they WERE able to match me with the 50/500 offer. They said I have 3 months after activating the new card to get the bonus. Worth the phone call for sure.

My plan is to call and ask for a PC to the Double Cash card after getting that targeted spending offer, which will be a lot more useful to me than the TY preferred. Actually, I’ve (unsuccessfully) tried a couple of times since the Forward devaluation to PC to the DC so hopefully they’ll be willing to do it from the TY Pref.

You should be able to product change the Citi Thank You Preferred to a Citi Double Cash after you get the new credit card.