Good afternoon everyone! It’s been a while since I’ve posted here but I think I’ve stumbled across some juicy information that warrants coming out of hiding. Lately, there’s been a lot of blog coverage regarding the change to the Marriott/SPG loyalty program. However, American Express also announced a change to the earning categories of their personal and business SPG credit cards. Both credit cards will continue to have the same annual fee, however 1 will earn TWICE as much as the other in certain popular categories.

I currently hold both the personal and business SPG credit cards and I have decided that I need to cancel one credit card because the annual fees just posted on both credit cards. My SPG business credit card has a lower APR (although you shouldn’t be carrying a balance and paying interest if you’re travel hacking) but my personal SPG credit card has been open for a longer period of time. There are no downgrade options so closing one of them and hopefully transferring the credit limit of that credit card to another credit card might be the best way to go. I initiated a chat with American Express to discuss my options. I asked the agent if there were any benefits that one credit card had over the other. (I know this info is available on the web but I’m at work and didn’t have the time to do a search and compare.) What I found out was exactly what I needed to decide which credit card to close and which credit card to keep open.

American Express actually sent out emails yesterday, 1 for each credit card but I didn’t think to compare 1 to the other. Luckily, the agent I was chatting with spelled it out clearly for me. These changes all go into affect on August.

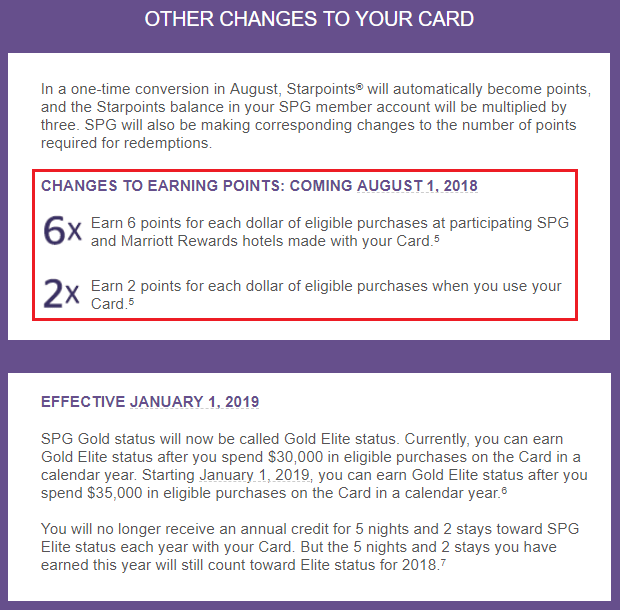

- American Expess SPG Personal Credit Card Earning Rates on 8-1-2018

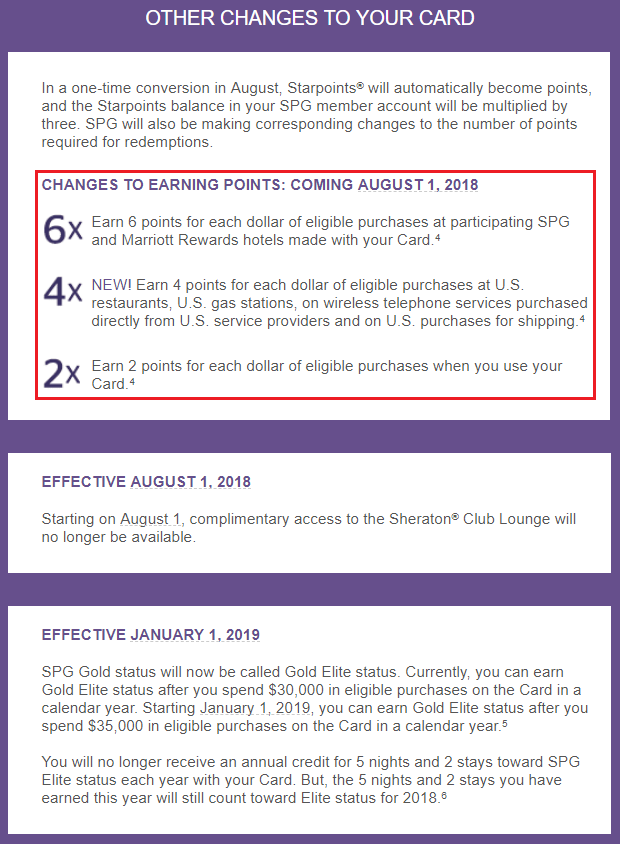

- American Expess SPG Business Credit Card Earning Rates on 8-1-2018

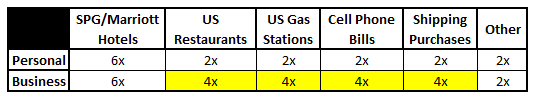

I’ve summarized it in a table below. Note the 4x Marriott Rewards categories on the SPG business credit card that were not present in the email regarding the SPG personal credit card.

So if you are like me and having to decide whether to keep the SPG personal or the SPG business credit card, considering they will continue to have the same annual fee, hopefully the fact that the SPG business credit card earns twice as much as the SPG personal credit card at restaurants and gas stations makes your decision an easy one.

Let me know in the comments below what your plans are as far as keeping and/or closing your SPG personal and business credit card and how you came to that decision.

Between my immediate CC friends, I think we feel that Personal would be the better long-term (with Sheraton Lounges going away), but the value in the Biz version is AU. So, whichever one. I’m having a hard time, but I might in the end switch out Biz version for another Biz card like BBP.

I am in this same situation, holding both cards. I will miss the lounge access on the business version. Curious as to how you came to the conclusion that the Personal cared is a better long-term call. Do you mind sharing your calculation?

I don’t have a calculation, but I’m not sure whether Amex will let me hold another Biz card as readily as personal. We’ll see, if it’s possible.. then I’m axing my personal.

The opportunity cost is no longer valuable to hold both, that’s for sure.

Shirley thanks for reading! Would you mind explaining why you believe personal is better long-term despite the Business card earning twice as many points at restaurants and gas stations? And what value in AU cards does the business card offer that the personal doesn’t? Also what is the BBP?

Keeping both as both pay themselves out by giving one free annual night (capped at 35k)

very good point Leo! personally I prefer staying at Hyatt & IHG (and have annual free nights with both) so I mostly use my SPG points to transfer to AA but I will definitely make use of the free night that comes with the card that I do keep. Just don’t want to pay a second $95 for another one. Thanks for the insight :)

Very helpful article. Thanks so much Whitney.

My pleasure thanks so much for reading :)

Thanks for the great post. I have the same situation. I think I would just cancel Biz card due to lounge going away. Even though Biz card has the better earning ration, other Amex or Chase cards can be more competitive.

Ozzi, I guess it all depends on which program you’re trying to ramp up points in. Personally I’m trying to ramp up my AA miles and I’m doing so via SPG due to the 5k bonus mile when transferring 20k points. Thanks for reading!

I already cancelled my personal. Unless everyday spending becomes more rewarding, the business card goes from top general use to the sock drawer.

Whitney,

Do you realize that either card will only get you .67 miles per dollar?

4X at restaurants? That equals 1.33 miles per dollar. The Chase Sapphire gives you 2 mIles per dollar, so as long as you have a premium Chase card.

Jason, not following your math, would you mind explaining please? Regardless, for me personally, I mainly use UR points to transfer to Hyatt as I find the award availability on AA through UR worthless as it’s mostly basic economy. (I find the Citi ThankYou program MUCH better for redemption on AA). Right now I have plenty of both Hyatt points and UR points but what I need to ramp up on right now are AA miles and I the Amex agent confirmed that the 5k bonus for transferring 20k points to airline miles would continue. Thanks for your insight!

@Whitney

I think you need to research the changes to Aug 1 again. Your article is very misleading and, quite frankly, you should have done a better job in your write-up. The SPG cards’ everyday spend at 2X is not really 2X because Marriott/SPG is devaluing the points value by 33%. If the new point structure would have been 3X, then that would have been okay. But that’s not the case. How do you not know this?

Honestly, what you wrote is nonsense.

Jason I never made any claim of how much each point would be worth. I was simply pointing out to people that in certain categories the business card word earn twice as much as the personal.

You are implying that these cards are worth keeping, when in fact they are not. This is something that I poignantly pointed out, which is something you should have done.

You basically said to keep the business card because it earns 1.33 miles per dollar as opposed to 0.67 miles. Who in their right mind would want to pay $95/year for a card that only earns 1.33 miles per dollar for restaurants when the Chase Sapphire Preferred earns 2 miles?

I can’t believe Grant allowed this horribly researched posting. I think it’s time for me to move on to other blogs.

not implying that at all. that is an individualized choice. for me personally, if I was not in an American Airlines hub I probably would not keep them because SPG / Marriott is not my top hotel chain or even my second choice. The purpose of the post was not to point out whether they are worth keeping or not. as I previously said, I made no mention of the value of the points so no, I did not “basically say that”. and as I’ve also already said, some people might not value the CSP as much as you do. for instance I do not value it at all. I have the freedom and an ink card, I already have way more ultimate rewards then I know what to do with, and i have premium travel & purchase protection with my Citi Prestige. apologies for not tailoring this blog post to your specific situation Jason, lol. keep in mind, i don’t post nearly as much as Grant or Shelli does so it would be silly to move on just because you disagree with one post written by someone who doesn’t even come close to being a majority contributor. it seems you had quite an awful day. i hope tomorrow is better for you :)

The simple answer is very simple – NEITHER card is worth holding for any reason other than possibly the free night. I find it funny that you think you found something “juicy” with one card earning “twice” as many points at restuarants. Yet you still fail to say that there are other cards that earn more than double that of your “juicy” find. If you have to make a decision within a few hours while still at work whether or not to keep a card, then maybe you really shouldn’t be posting and giving others advice on credit cards.

And for those thinking I’m too harsh and asking themselves why I am reading the post to begin with, I do it for entertainment and hoping that I could possibly find something I haven’t seen one of the other bloggers cover. But since the bloggers are paid by the CC companies, they will continue polishing the turd until you find it shiny enough to believe what they tell you.

Matt, it all depends on which program you’re trying to ramp up points in. For me personally I’m trying to ramp up American Airlines miles at the moment as I have plenty of Hyatt & ultimate rewards. I do so via the SPG program because of the 5K bonus when transferring 20K points to airline miles. I never said I had to make the decision within a few hours while at work. I just didn’t have time to do the compare while chatting with the agent as I was multitasking with work and the chat at the same time. I actually have a few weeks to decide but I found the difference in earning between the cards a valuable piece of information. Not giving anyone advice here. Deciding which card to keep or cancelling both is entirely dependent upon each individual’s personal goals when it comes to credit profiles and points/miles. If my goal of this post was to “polish the Amex SPG turd” I would’ve included my own personal referral link. Believe me that would pay much more than what I make from the blog itself. I don’t do this for the money as my full time job pays very well. I do it for the love of travel hacking. I hope you have a wonderful day Matt and thanks for the entertainment, lol. :)

@Matt

Your are correct. Whitney and Travel with Grant has failed to realize that 2X is not really 2X. I don’t understand why they don’t get it.

2x = 2 points per $1 spent. it does NOT mean that each point is worth $0.02 or that each $1

spent yields $0.02 in value. it is up to the individual to determine how they value each point or mile. i love your comments :). keep em’ coming!

Who is talking about cents?

My goodness; you really need a tutorial on reading comprehension.

and you need manners

I don’t believe you can transfer credit lines from a business card to a personal card, and vice versa.

Also, closing the business card won’t have any appreciable effect on your personal credit profile, where closing the personal card can affect average age of accounts, utilization, etc. depending on how old the card is.

when I close my personal card I will transfer the credit line to another personal card. My apologies I should’ve made that more clear. Definitely something to think about with regard to how closing each one will impact your credit profile though! Thanks so much for the valuable addition of information :)

“it seems you had quite an awful day. i hope tomorrow is better for you.” -Whitney

Actually, my day was fine. But, thanks for your condescending comment. I’m sure the many readers, including myself, appreciate it. /s

Try and do better next time.

you have things so backwards. it’s sad that you can’t even see how ugly you were with your comments. you’re interpreting my reply as condescending. try having a more positive view towards things and you may become a happier person.