When you travel a lot, like most of us do, you may have a hard time keeping track of all your different account balances, payments received and checks posting etc. Combine that with multiple accounts, each bank has a different app with unique passwords, you’re outside of the USA so some don’t work without VPN and the tasks can be time consuming and frustrating. I use a service that helps track all your financial accounts and presents them to you in one convenient dashboard. Once set up, the service updates your checking, savings, credit card, investment, retirement, and HSA accounts periodically so the totals and transactions are all displayed when you login to their app or website.

Personal Capital

I have used Personal Capital for years and think you may enjoy it as well. You can sign up for free, and there is no ongoing subscription costs to use the service. Of course, they also sell financial planning services and would like to talk to you about their products, but no purchase is necessary. Personal Capital has all the security features you would expect like second factor authentication by text, email, etc and they also identify login by browser so you can see which browsers have logged on and delete those you don’t want to allow access anymore. If you sign up using my link, we will both get $20 from Personal Capital.

Betterment

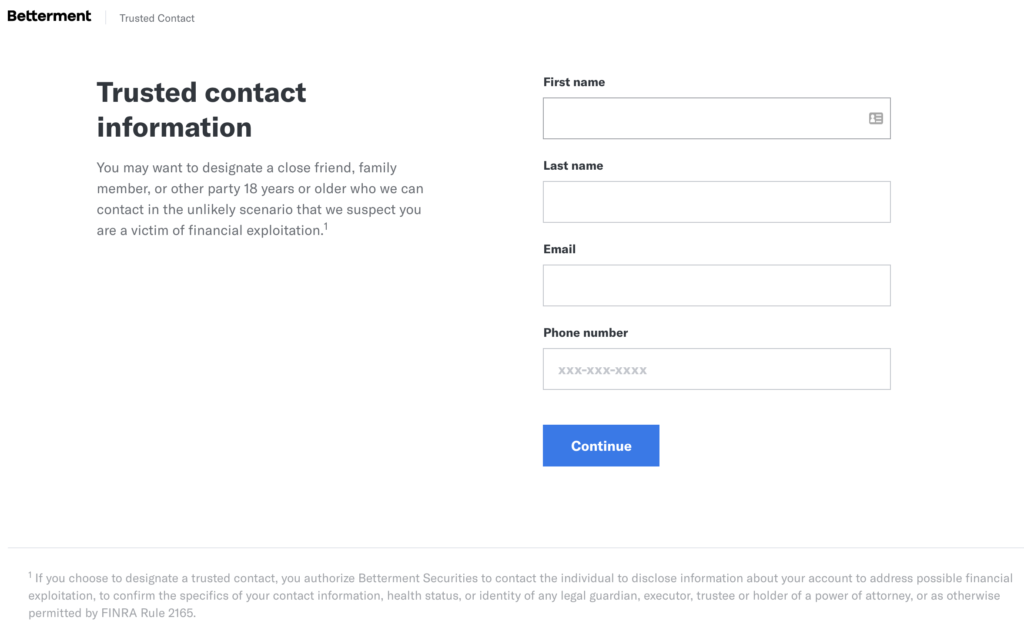

There is also a second service that I use that can also track external accounts similar to Personal Capital but requires you use their service, Betterment. You are probably already familiar with their automated investment offerings; one area I recently noticed in my Betterment screen was an option to list a “trusted contact” that Betterment can contact if they suspect you are under duress and are being forced to remove / transfer money.

I have not seen this with other financial services, but the idea is great for travelers who may potentially be kidnapped or otherwise scammed out of their cash and assets. As I mentioned before, Betterment will allow you to link your external accounts so you can see your entire net worth but you do have to be a subscriber to their service. If you sign up using my link, I may get free account credits with Betterment.

Other Uses for Personal Capital and Betterment

We’ve all heard the horror stories of the elderly being victims of scams from lottery “winnings” to paying IRS debts with gift cards, or just being abused by someone who is supposed to care for them, but because they may have power of attorney, they deplete their life savings and investment accounts. If you have parents, grandparents, or someone else you care about and are authorized to look after them setting up an account with one of these services and linking their accounts may help you get a picture of their income and expenses. If something out of the ordinary happens, you will be able to potentially intervene much quicker than finding out when the cash is long gone.

If you have any questions about Personal Capital or Betterment, please leave a comment below.