Full Disclosure: I don’t recommend taking out an installment loan unless you understand the costs and how the process works. I did my best to explain the process, but I apologize if it is still confusing.

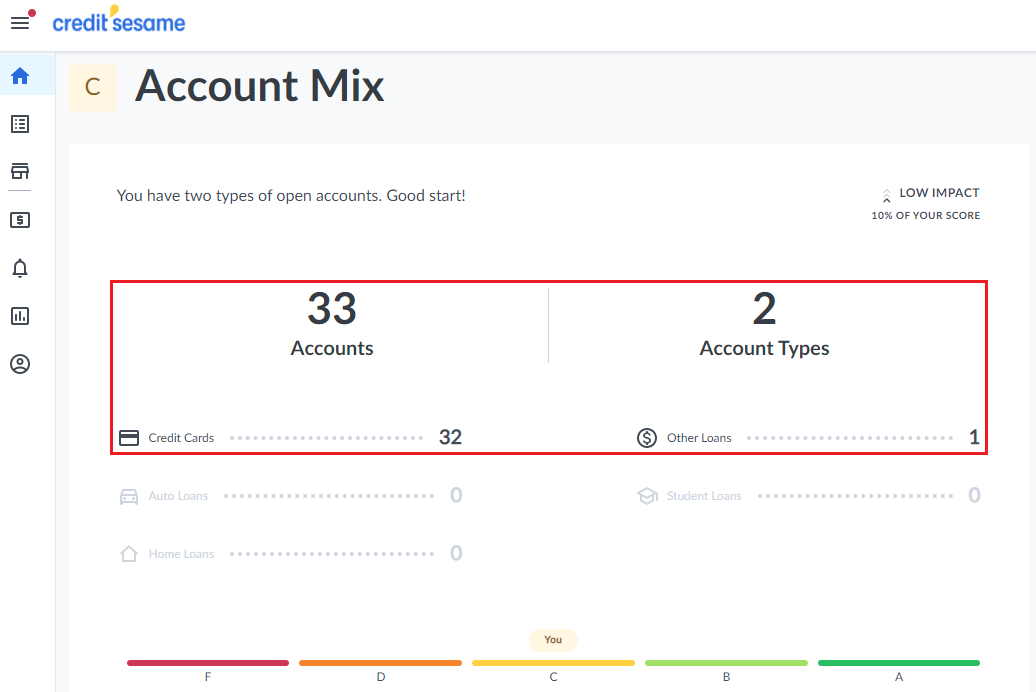

Good afternoon everyone, I hope your week is going well. 12 months ago, I started a journey to increase my credit score by opening an installment loan called a Credit Builder Account with Self (Self was previously named Self Lender). Before I started this experiment, the Account Mix portion of my credit score was very 1 sided. I had 30+ credit cards, but no auto loans, home loans, student loans, or installment loans. As of September 2020, my Credit Sesame account shows that I now have 2 types of accounts (30+ credit cards and 1 installment loan). This information can be found at the 3 credit bureaus and on Credit Karma, but the screen on Credit Sesame was the prettiest and easy to understand.

As a reminder, the Account Mix portion of your credit score only makes up 10% of your overall credit score, so it is not as important as your Payment History (35%) and your Credit Usage (30%). In this post, I will show you how the Credit Builder Account works and how much it costs to take out the installment loan.

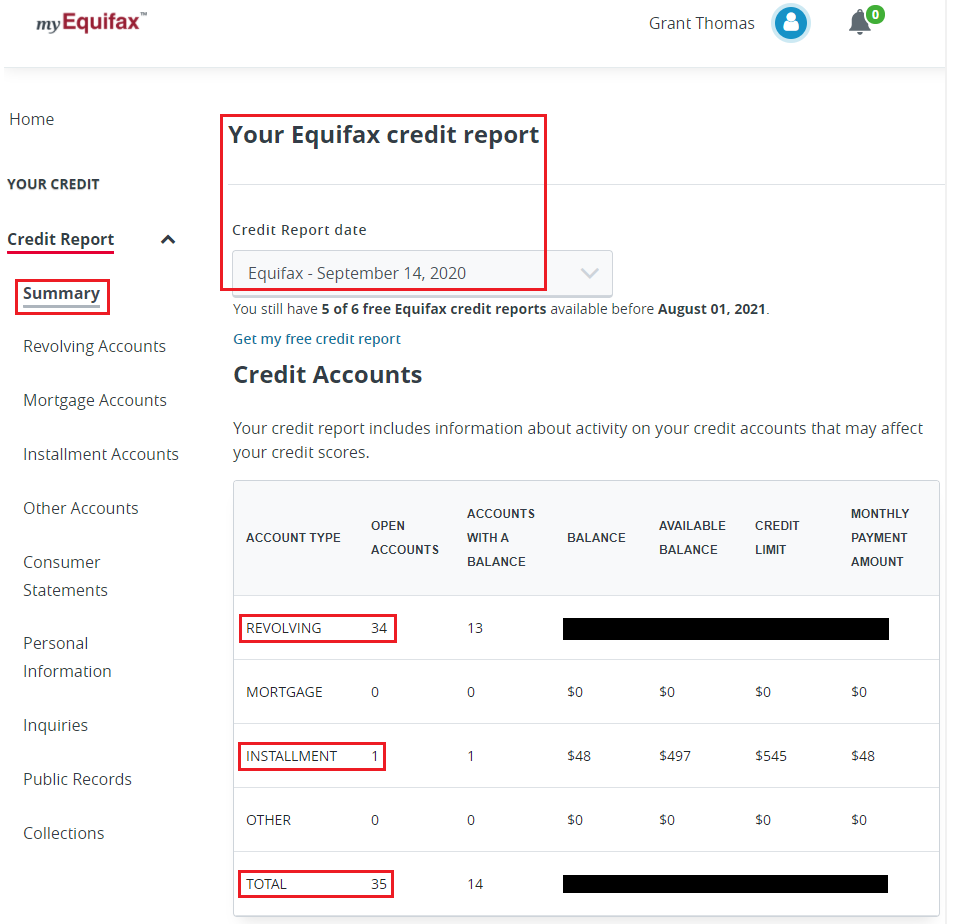

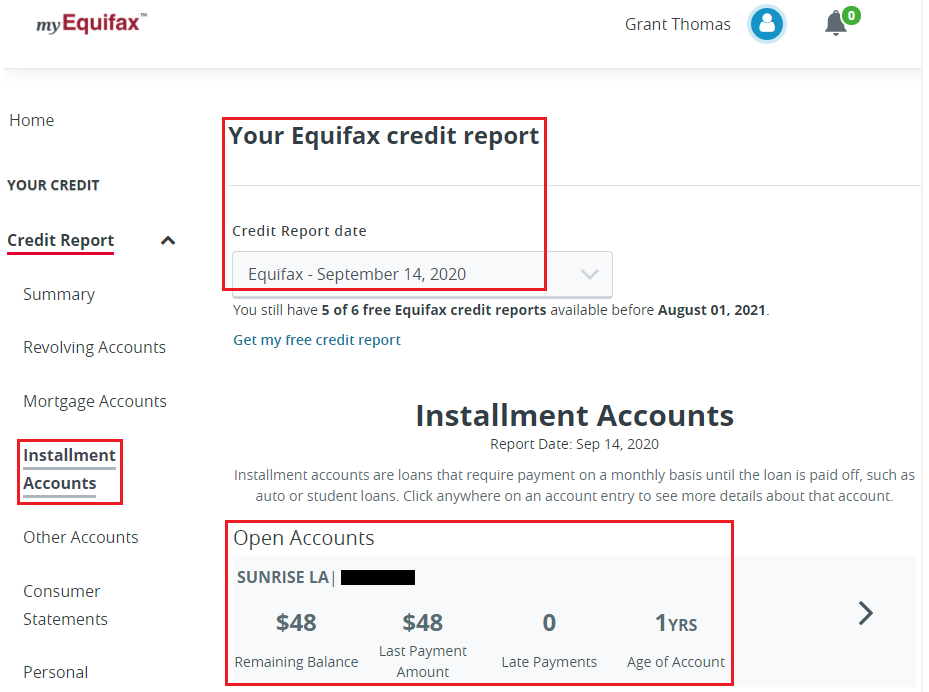

One of the great features of the Credit Builder Account is that is reports your installment loan to all 3 credit bureaus. Here is the summary page of my recent Equifax credit report. My Equifax credit report shows that I have 34 revolving (aka credit card) accounts and 1 installment loan (the Credit Builder Account). I finished paying back the loan a week ago, so my credit report won’t show that the loan is completely paid off until early next month when the loan payment is reported to all 3 credit bureaus.

Here are some more details on the Credit Builder Account. The loan was administered / created by Self but held at Sunrise Bank.

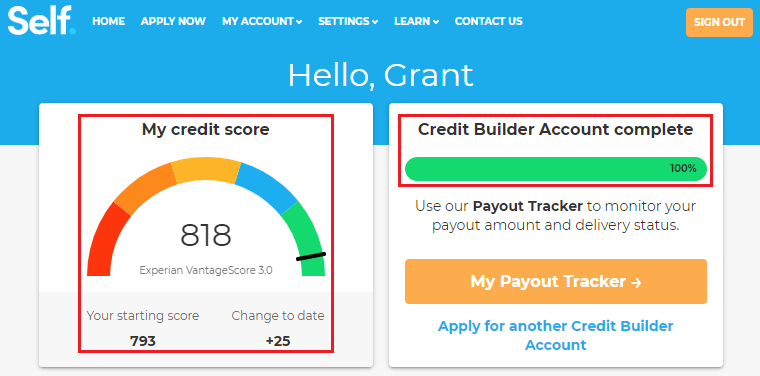

When I sign into my Credit Builder Account, the home screen shows that my credit score went up 25 points, based on my Experian VantageScore 3.0 score. I don’t want to give all the credit to the Credit Builder Account for the score increase. Some of the score increase was due to not applying for any new credit cards in the last 12+ months and keeping my credit card balances low (thanks to spending more time at home during the Coronavirus Pandemic).

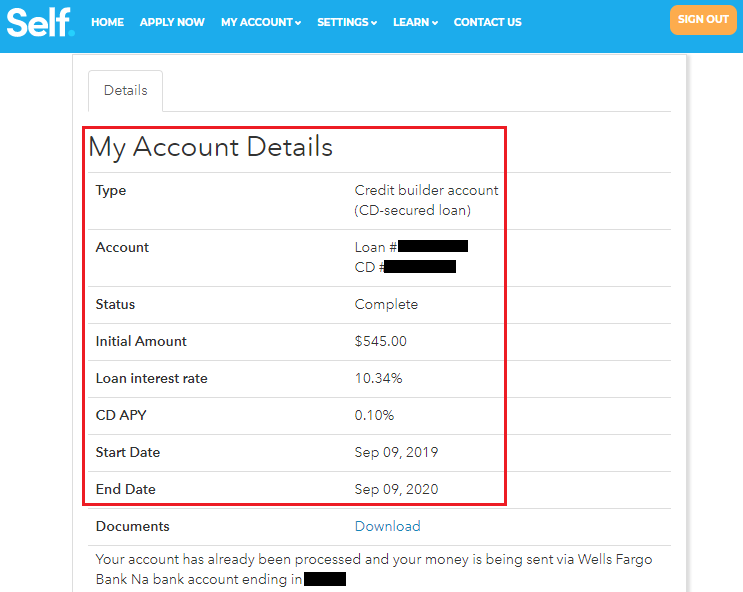

Here are more details about the Credit Builder Account. I opened the installment loan on September 9, 2019, and finished paying it off on September 9, 2020. This next part is kind of tricky to explain, but instead of taking a traditional lump sum loan up front and then paying it back over time, the opposite happened. You pay the loan back and the funds go into a CD (certificate of deposit) that earned 0.10% interest. After you pay back the entire loan, the CD is unlocked and directly deposited back into your checking / savings account.

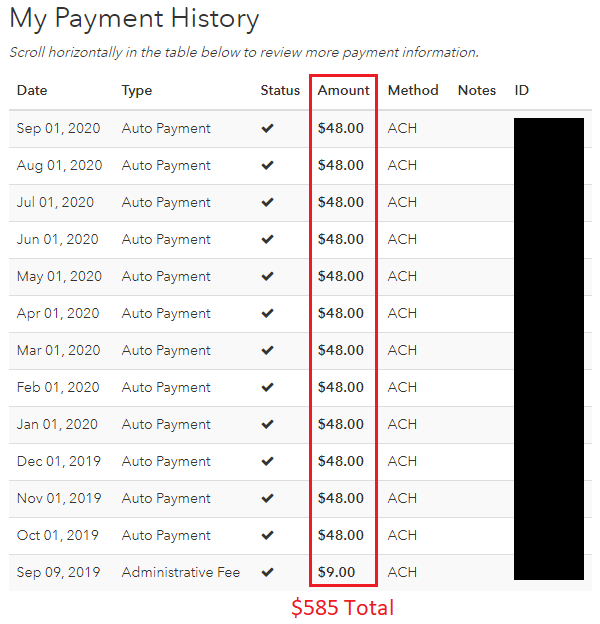

Here is the complete payment history of the installment loan / CD funding. I paid a $9 administrative fee for Self to set up my loan / CD and then I paid $48 each month for the next 12 months. After 12 months, I paid a total of $585 to Self. When the installment loan / CD funding was completed, I received $545 back. I “lost” $40 in cash plus whatever interest I could have earned if I put the money in a traditional savings account, but that is where the 10.34% loan interest rate comes in.

Long story short, I paid $585 over the course of 12 months in order to get a $545 payment and an installment loan added to my credit report.

If you already have credit cards, a home mortgage, a car loan, and a student loan, the Credit Mix portion of your credit report is probably as good as it’s going to get. However, if you only have credit card accounts and no other type of accounts, you might consider following in my footsteps with this Credit Builder Account. To get started, click here to create a Self account (this is my referral link and I will receive $10 after you create a Self account and make your first loan payment).

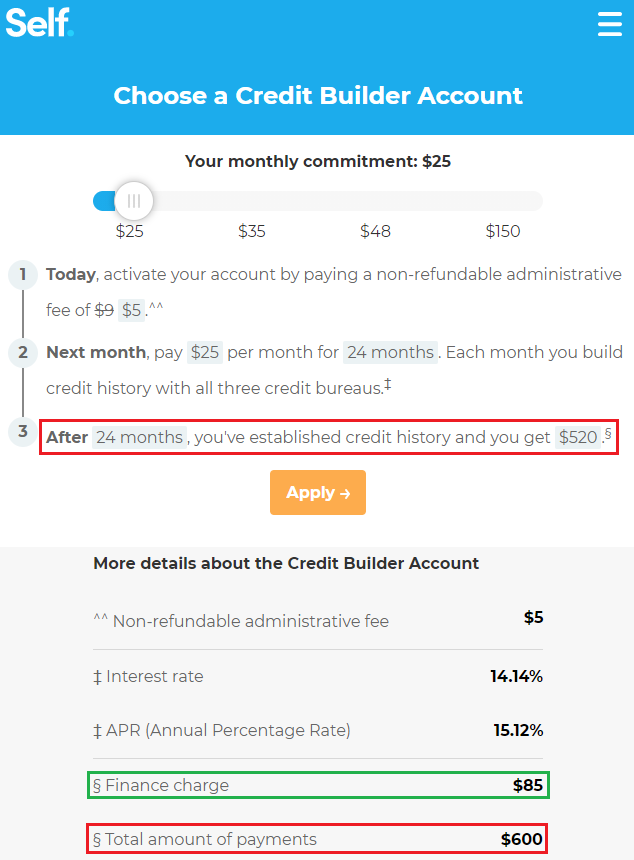

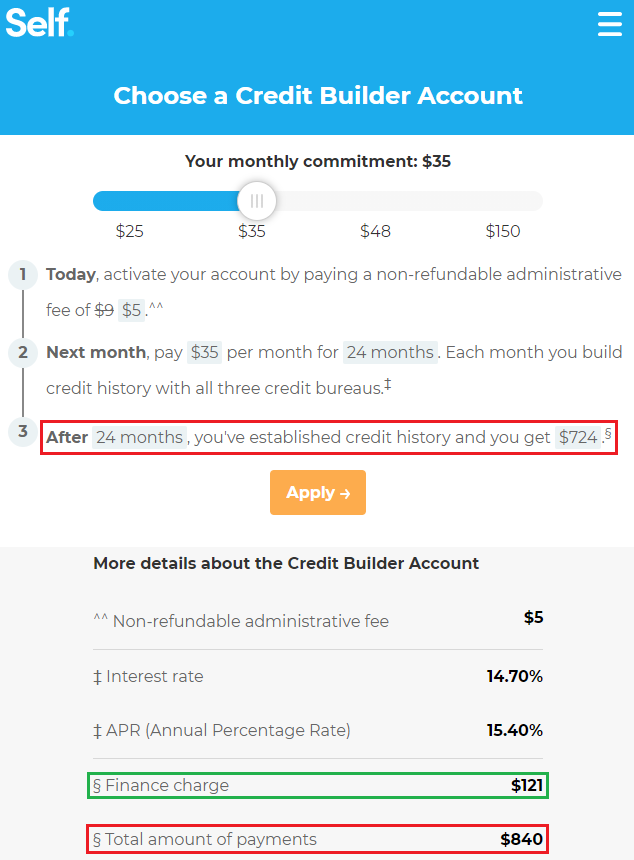

Self offers 4 different “monthly commitment” dollar amounts ranging from $25-$150. As long as the installment loan is successfully completed and paid off in full, I don’t think it matters what the monthly payment amount is or the duration of the loan. With that in mind, I decided to pick the “cheapest” loan, based on the total dollar amount I would lose at the end of the loan. Due to changing interest rates, the loans listed below have slightly different numbers than the Credit Builder Account I opened in 2019. All the loans have a $5 administrative fee, so I am not including that in the numbers below. Here is a breakdown of the first 2 loans with the lower monthly commitment amounts:

- With the $25 monthly commitment, you pay $25 for 24 months and receive a $520 payment 2 years later. $25 x 24 months = $600 total paid – $520 payment = $80 cost of the loan

- With the $35 monthly commitment, you pay $35 for 24 months and receive a $724 payment 2 years later. $35 x 24 months = $840 total paid – $724 payment = $116 cost of the loan

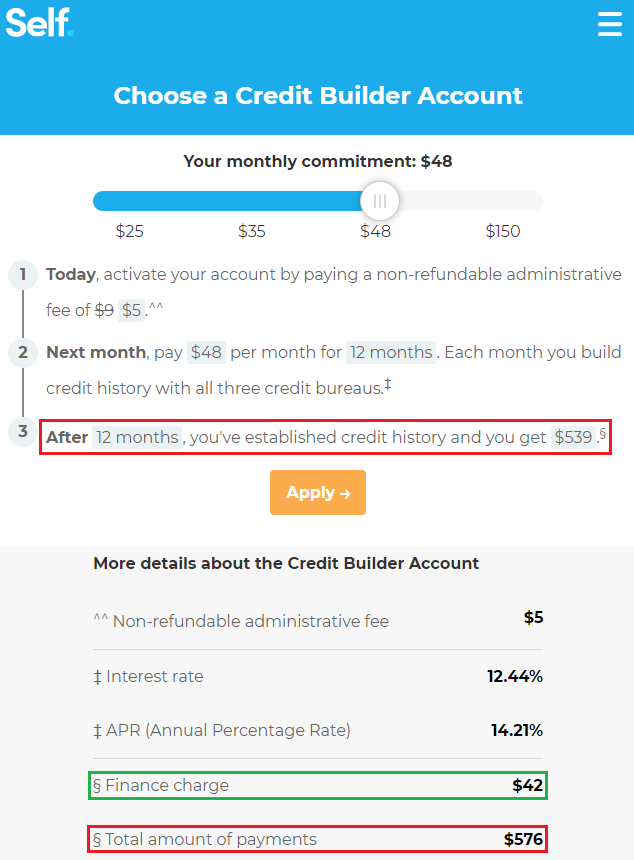

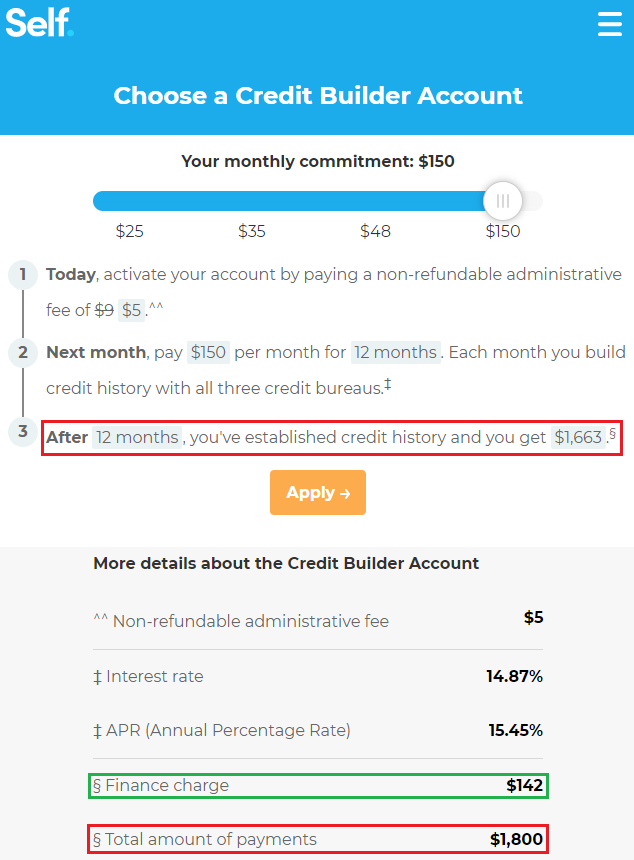

Here is a breakdown of the last 2 loans with the higher monthly commitment amounts:

- With the $48 monthly commitment, you pay $48 for 12 months and receive a $539 payment 1 year later. $48 x 12 months = $576 total paid – $539 payment = $37 cost of the loan

- With the $150 monthly commitment, you pay $150 for 12 months and receive a $1,663 payment 1 year later. $150 x 12 months = $1,800 total paid – $1,663 payment = $137 cost of the loan

As you can see, the $48 monthly commitment loan is still the cheapest option since you will only lose $37 after making all the monthly payments and receiving the payment back at the end of 12 months. As I mentioned at the beginning of the post, I don’t recommend taking out an installment loan unless you understand how the loan works and what the cost will be. If you have any questions about the process, please leave a comment below. Have a great day everyone!

It’s sad how the US credit scoring system works. If you don’t have debt (home, auto, student, personal), you’re less credit worthy despite having 30+ credit cards with less than 1% utilization and excellent payment history.

We paid off our homes years ago; we own our cars fully; we don’t have student debt or any other debt, yet the credit agencies want to see more diverse kind of debt.

Yes, it is a real catch 22 situation, but thankfully the Account Mix only makes up 10% of the total credit score. I’ve heard some people stretch out their home mortgage by an extra few years, even though their monthly payments are under $5.

Great to see you back. Is there a minimum credit requirement? I have a niece who badly damaged her credit and something like this could help.

I don’t think there is a minimum credit score requirement, since it is a secured type loan (you don’t receive the CD payment until all loan payments are made). You could also consider adding your niece (or her parents could) as an authorized user to some of your credit cards (just keep the CC in your drawer).

Hey Grant! I’m in a similar situation, so this is excellent information! They can hardy call this a loan though, but it has the same affect. A cheap way to juice up your credit score for a couple of years now s nice.

Hi Brant, yes, the “loan” name is not quite right, but if your end goal is helping your Account Mix on your credit score, it gets the job done. I hope the setup process goes smoothly for you.

Excuse me but what’s the point? 793 to 812? You aren’t going to get a better loan rate or anything else if you have an 812 vs.a 793. So you paid $40 for a credit boost that really doesn’t do anything? Or was it just an experiment?

Hi Patrick, you are right, it doesn’t make much sense in my case to pay $40 to go from 793 to 812, but it could make sense for someone else in a different situation with a lower credit score.

Even if it were an experiment, it was an exercise in vanity. The higher score is of no appreciable value.

Does this give just a temporary boost? I had read of cases where the score takes a hit when the installment loan is paid off.

Hi Carl, that is a great question. I believe the paid off loan will stay on my credit report for 7-10 years, and then drop off. I’ll report back in 1-2 months if I see my score drop, but I doubt that will happen.

Sounds good. I saw this on bankrate.com. “This category of your credit score is called your credit mix. Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan, you might actually see your credit score drop because you now have only revolving debt.”.

Like you said – we’ll see,

I did some more digging and found this Experian article (https://www.experian.com/blogs/ask-experian/why-did-my-credit-score-drop-when-I-paid-off-a-loan/). The article doesn’t provide a straightforward answer, saying that a paid off loan might cause a credit score to drop a few points if that was your only installment loan, while also saying that paid off loans will stay on your credit reports for up to 10 years. Either way, it sounds like my score will stay the same or drop by a few points over the next few months. I will check back in a few months and see if I can tell one way or the other.

Hey Grant

You should see a moderate drop (12-27pts) when the Installment Account is closed. It’s definitely weird logic, but most credit algo’s want to see both Revolving and Installment Accounts, otherwise the Account Mix factor of a credit score takes a moderate hit.

The drop in score wont be an issue for you I’m sure, given your extensive credit history which I assume has no Missed Payments. Long term, those 12 timely payments will continue to show in your credit history for up to 10 years (7 yrs for Derogatory Marks).

This is helpful for Consumers on the brink of credit bracket levels. If a Borrow is at 759 and the Lender requires 760 for the best terms for mortgage, then the Borrower doesnt qualify for best terms. Though, many would argue scores dont matter now in 2020 given the severe tightening in lending requirements Lenders have imposed with interest rates at record lows.

The moderate boost in score that most Borrowers receive when near the end of their term with SELF (Self Lender) may be needed to ensure they meet the Lender’s score requirements. Same could apply for Lenders’ other credit products like cards, auto loans, HELOC, etc.

Good read, I’ll be doing an experiment myself on buying precious metals with the Lenders’ money (on credit) later this year. The goal is to see how long I can go without paying for the metals by opening cards and shifting the balance via Bal Txfrs. Then tracking my credit score along the way to see if the impacts come as expected. Ideally, the value of the metals should go up as we make our way out of the recession, which many analysts expect long term.

Thanks for making posts like these Grant. Your marriage is a testament to how far you’re willing to take these experiments, and it’s much appreciated.

Hi Cap, thank you for the detailed analysis and insight into how the credit report and credit score will change in the near term. Your experiment sounds very interesting and I wish you good luck. I’m glad you enjoyed reading the post and thank you for the marriage compliment :)

Pingback: Disney's Aulani Resort Reopening, Get Loan to Increase Credit Score, SkyMiles Will Not Be Devalued, Jailed for a Review, and Marriott Losing Hotels - Danny the Deal Guru

Just dropped in to offer some data points. While I agree with some responders that there isn’t a need to do this with good scores, it may very well help someone with poor scores.

I have a mortgage that was paid off 8 years ago that is still showing on 2 credit reports but not on the 3rd. My FICO8 scores are as follows: EQ- 822, TU- 826, and EX- 792. While my scores are fine, Experian is NOT showing the mortgage which has caused the 30+ point drop. The loss of points is due to the following 3 factors: no credit mix showing at EX, the age of my oldest account dropped by 7+ years and the average age of accounts dropped by over 3 years.

There is no need for me to pursue an additional installment account to elevate my scores but I should see my Equifax and TransUnion scores drop around 30 points in the next couple of years once the mortgage drops from those reports. If somebody doesn’t have a credit mix and has low scores, the installment account recommendation could be very helpful.

Hi CD, thank you for sharing your credit score numbers and your experience with how you saw your credit scores change over the years.