Updated 12:00pm PT on 7/27/23: The travel credit posted about a week after purchasing 2 flights from the Capital One Travel portal. Scroll down to see the update.

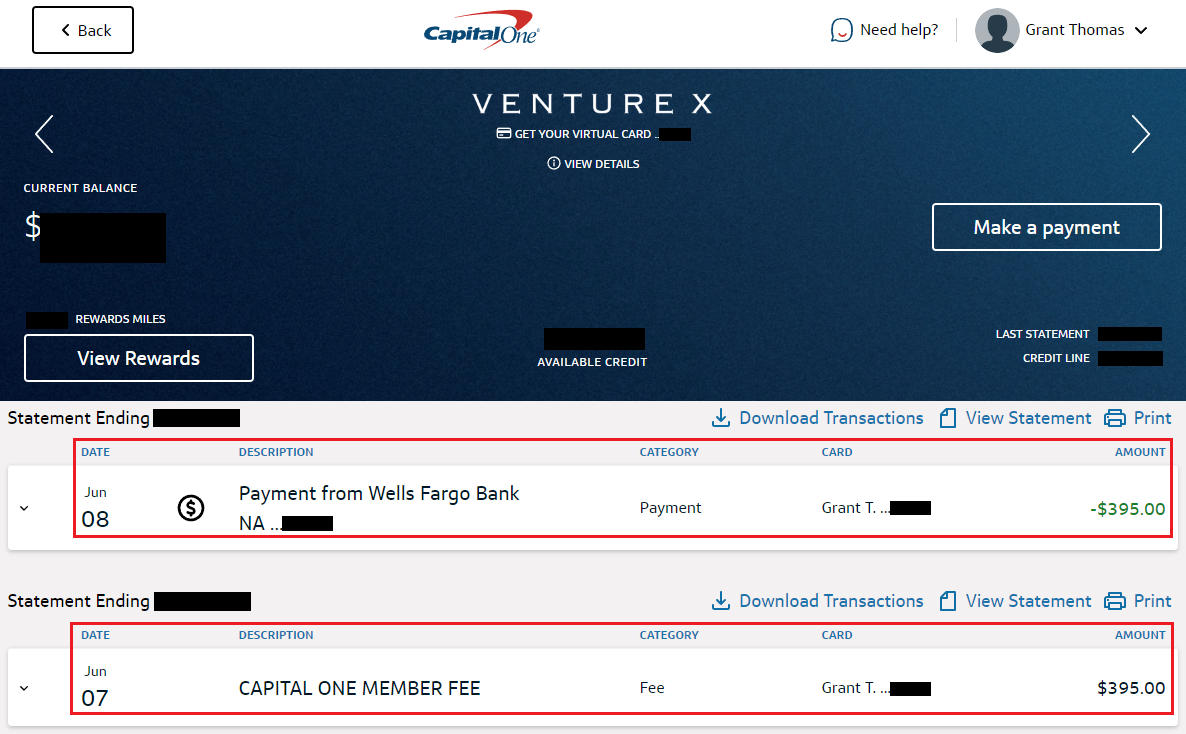

Good afternoon everyone, I hope your week is going well. I just paid the $395 annual fee on my Capital One Venture X Credit Card and wanted to share how quickly the 10,000 anniversary points posted to my account and when the $300 travel credit resets. The $395 annual fee posted to my account on June 7 and I called Capital One to see if they had any retention offers available. Unfortunately, they did not have any offers for me, so I paid the $395 annual fee on June 8.

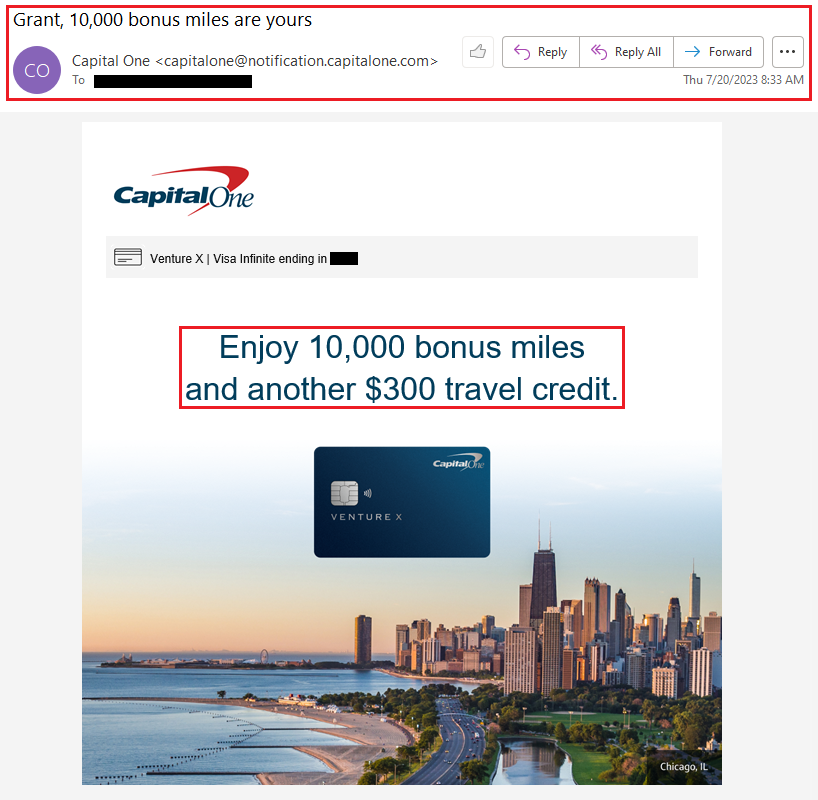

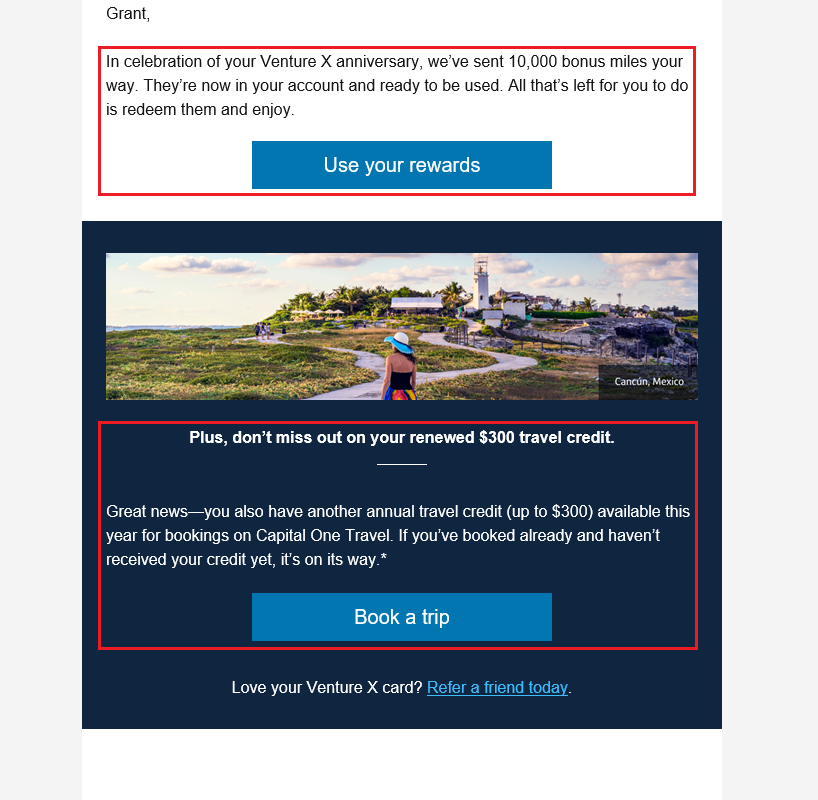

On July 20, I received this email from Capital One that said my 10,000 anniversary points were sent to my account and my $300 travel credit was “renewed” and ready to use. From June 7 to July 20, that is just over 6 weeks from when the annual fee posted and when I paid the annual fee.

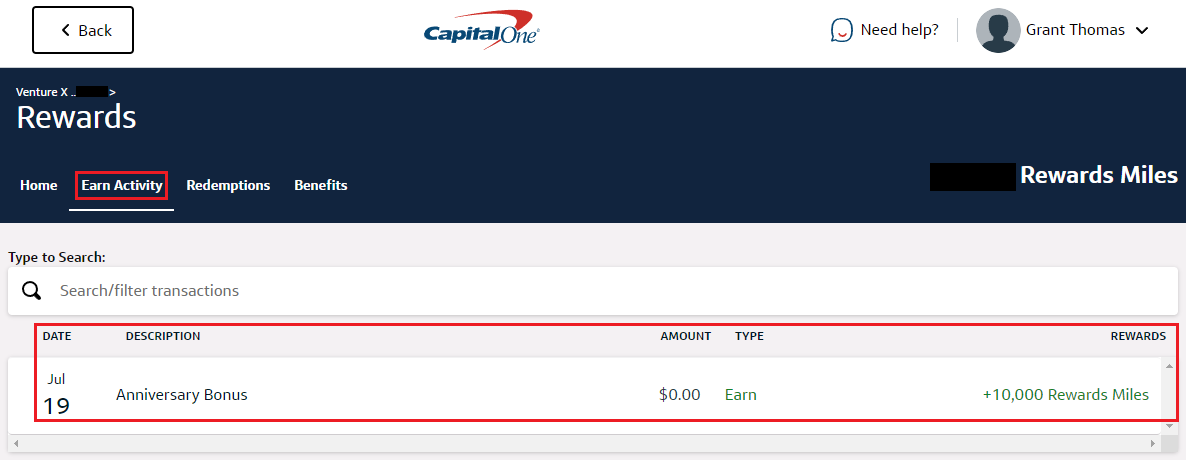

When I signed into my Capital One account, I went to the Earn Activity page and saw that 10,000 anniversary points posted on July 19 (1 day before receiving the above email).

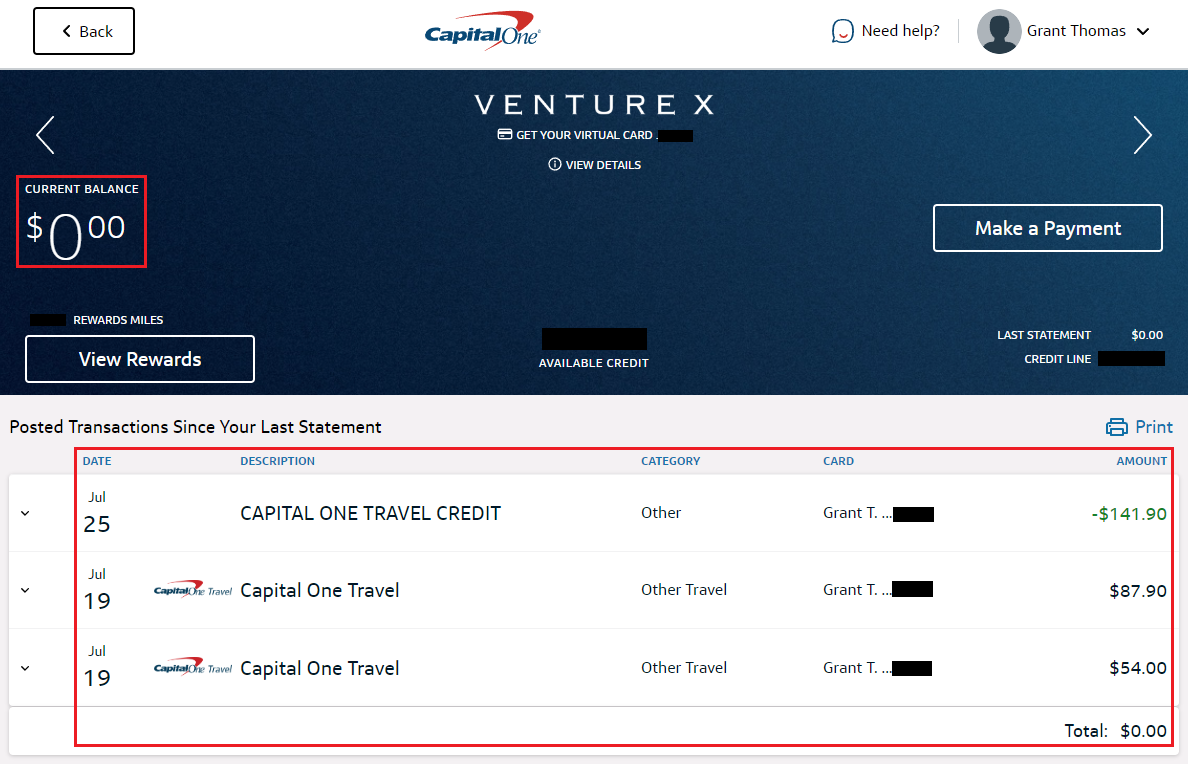

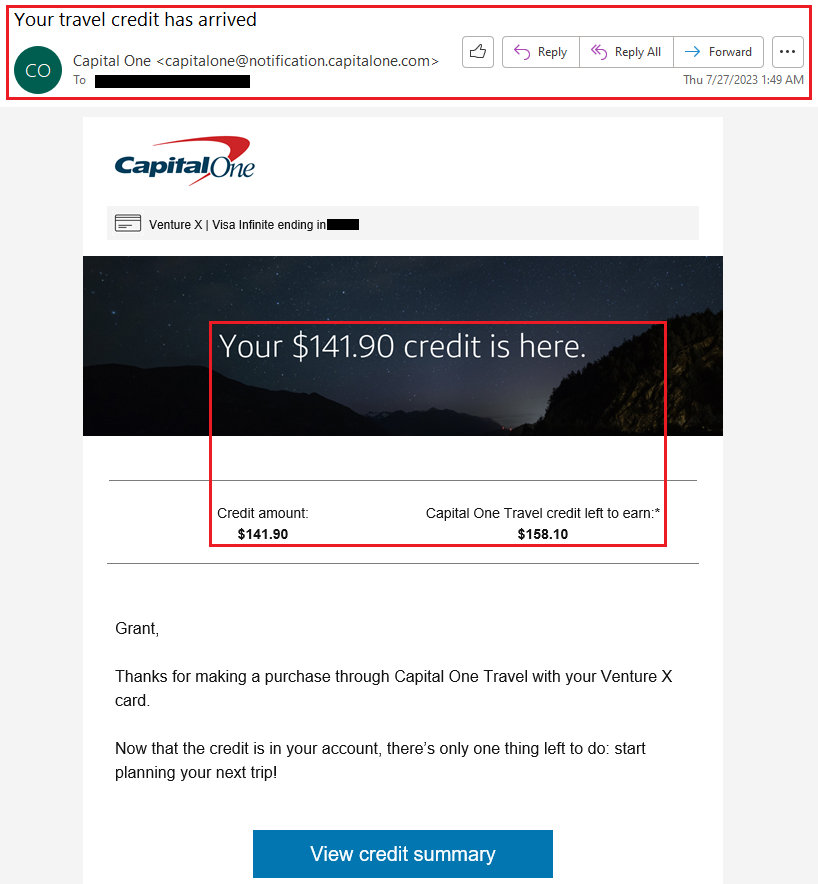

I made 2 Capital One Travel flight purchases on July 19 and the travel credit posted on July 25.

I also received an email about the travel credit being applied on July 27.

Long story short, you should receive your 10,000 anniversary points and the $300 travel credit roughly 6 weeks after the annual fee posts to your account. If you have any questions about the anniversary points or the $300 travel credit, please leave a comment below. Have a great day everyone!

Interestingly, I spent my travel credit this year about 6 weeks before this email showed up. It seemed to be renewed right on the anniversary date.

Hi Peter, that is good to know. You might be able to spend it sooner than when the email arrives. How many days between when the annual fee posted and you redeemed your $300 travel credit?

Pingback: PSA: Check for Targeted Capital One Travel Discounts (Ex: $75 Off Flights to Montana & $30 Off Flights to New Mexico)

Here’s a tip: Once you have the travel credit available, simply make a reservation for $300+ through the portal, wait for the credit to post, and then cancel your reservation. You’ll receive a refund for the travel expense and they won’t claw back the credit. It remains. My wife and I stumbled into this by making two individual hotel reservations back in January, thinking we’d use them. Had a change of plans 2 months later after the credits posted. The refund of the travel expense was nearly immediate as expected, but the two $300 credits remained, as they do 5 months later. I called customer service to inquire and the guy I spoke with told me that they do not claw back credits. Both as a policy and as a function of how their IT system works. For me, I’d rather just be done with receiving the credit value and turn it into usable cash right away, rather than having to plot a Capital One travel portal trip for more than $300. I do have to admit that their portal is pretty good and you do get 10X points I believe. I also have to admit that I have left more than a sane person’s share of annual certs and credits on the table due to forgetting I had them. So converting them immediately makes sense for me.

Hi Mike, I really only hold onto the Capital One Venture X for the $300 travel credit, 10k points, and Capital One Lounges, so I don’t really spend any money on this credit card. I would rather redeem the $300 credit for a $300 flight and not deal with asking for a refund on the balance. But I appreciate the tip, thanks for sharing :)

So that raises an important question for me…..I use my no annual fee Business Plus Amex for all spend unrelated to getting specialty points or for hitting a bonus. 2X automatically of MR’s is fantastic as I value them at 4X. But Amex isn’t taken by all institutions. So for everyday spend on Visa or MC, which card do people use? I used to use my US Bank Altitude Reserve for the 3X online payment points, and mainly at Costco. But since the Venture X gives 2X points on all purchases, and I value their points at slightly more than the 3X on the Altitude, I’ve been putting my everyday spend Visa spend on Venture X. More valuable now that Virgin (a transfer partner) are offering 1 week European cruises for 80K/points each.

Thoughts on your everyday spend approach?

Hi Mike, that is a good question. Since Discover It is 5x at ApplePay this quarter (and I have 2 of these), this is my go to card for everything ApplePay. If Discover doesn’t work, then I would use my US Bank Altitude Reserve for 3x (worth 4.5% cash back with real time rewards). Then my option is Citi Double Cash 2x, since I have less than 100K ThankYou Points. My balance is lower with Capital One and I did redeem 5k Capital One points for baseball tickets early in the season, but the other games I plan to attend are sold out of the 5k tickets. Capital One does have the occasional transfer bonus (like the 20% bonus to KLM that I used yesterday), but they don’t have any unique partners that I can’t find on other transferable points.

But I do have my eye on 1 week European cruises for 80K/points each, that seems like an awesome deal!

A popular travel web guy has talked about it and even taken one of the Virgin cruises. Amazing value. Of course, Virgin has transfer partners other than Capital.

https://awardwallet.com/blog/virgin-red-cruise-virgin-points/

Thanks for the link, I will check it out. I’ve seen some short YouTube videos about Virgin Voyages and I am sold!