Good afternoon from rainy San Francisco. Yesterday, I received the following email from Wells Fargo. My natural instinct is to delete this email and never give it a second thought, but I decided to click on the Summary of Changes link and see what Wells Fargo is up to. Long story short, here are the main changes: fraudulently induced electronic fund transfers are not considered unauthorized; Wells Fargo may decline, delay, or reject transfers that appear irregular or suspicious; customers must activate their Paze wallet before use; and the Personalized Insights and Cash Flow Manager services have been discontinued.

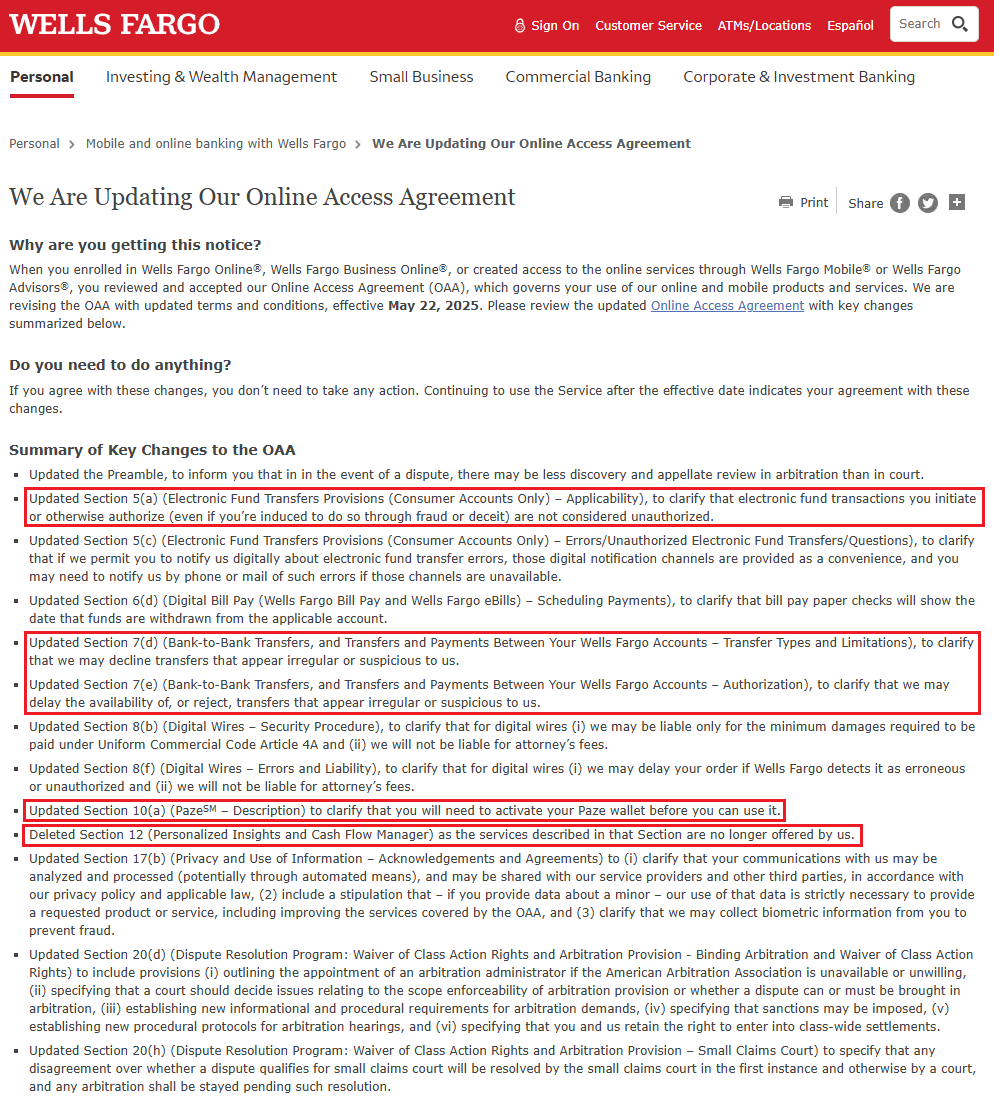

Here the Summary of Key Changes to the Online Access Agreement. I focuses on the changes that were most relevant to me as a Wells Fargo checking account customer.

I then asked my friend, ChatGPT, to summary those 5 sections in the full Online Access Agreement and explain the changes:

- Section 5(a) – Electronic Fund Transfers Provisions (Consumer Accounts Only) – Applicability

- Fraudulently induced electronic fund transfers are not considered unauthorized.

- Customers remain responsible for transfers they initiate, even if deceived.

- Section 7(d) – Bank-to-Bank Transfers, and Transfers and Payments Between Your Wells Fargo Accounts – Transfer Types and Limitations

- Wells Fargo may decline transfers that appear irregular or suspicious.

- This applies to both internal and external transfers.

- Section 7(e) – Bank-to-Bank Transfers, and Transfers and Payments Between Your Wells Fargo Accounts – Authorization

- Wells Fargo may delay or reject transfers flagged as suspicious.

- Transfer availability can be postponed for security reasons.

- Section 10(a) – PazeSM – Description

- Customers must activate their Paze wallet before using it.

- Paze is a digital payment service requiring setup before transactions.

- Section 12 – Personalized Insights and Cash Flow Manager

- This section has been deleted as the services are no longer offered.

- Personalized Insights and Cash Flow Manager features have been discontinued.

I think section 5(a) is the most important because it says that even if you were scammed, tricked, or deceived into transferring funds to someone, you are responsible. Wells Fargo will not reimburse you for the lost funds. I like sections 7(d) and 7(e) since they may decline, delay or reject bank transfers or wires if they seem suspicious by Wells Fargo. For section 10(a), I have not used Paze yet, since I prefer to pay with credit cards directly or through ApplePay to earn rewards. Lastly, I am not sad to see Personalized Insights and Cash Flow Manager disappear since I did not use those services. It’s possible that those services will be incorporated into new services that help members manage their finances.

If you have any questions about any of these changes, please leave a comment below. Have a great day everyone!