Good morning everyone, I hope your weekend is off to a great start. A few days ago, I wrote My 8 Credit Card App-O-Rama Results (Mostly Bad News). In that post, I shared the details (and denials) for most of the credit cards below. At the end of that post, I said I would share my experience applying for the Barclays Wyndham Rewards Credit Card.

- Bank of America Alaska Airlines Visa Signature Credit Card: 30,000 AS Miles + $100 statement credit after spending $1,000 in 3 months ($75 annual fee)

- Bank of America Virgin Atlantic Credit Card: 75,000 VA Miles after spending $12,000 in 6 months ($90 annual fee)

- Bank of America Amtrak Rewards Credit Card: 30,000 Amtrak Points after spending $1,000 in 3 months ($79 annual fee)

- US Bank Altitude Reserve Credit Card: 50,000 FlexPoints ($750 in travel credit) after spending $4,500 in 3 months ($400 annual fee)

- Wells Fargo Visa Signature Credit Card: 20,000 Go Far Reward Points after spending $1,000 in 3 months ($0 annual fee)

- First Bankcard Best Western Credit Card: 50,000 Points after spending $1,000 in 3 months ($59 annual fee, first year waived)

- Synchrony Bank Cathay Pacific Credit Card: 50,000 CX Miles after spending $2,500 in 3 months ($95 annual fee)

- Barclays Wyndham Rewards Credit Card: 45,000 Wyndham Points (3 free nights) after spending $2,000 in 3 months ($75 annual fee)

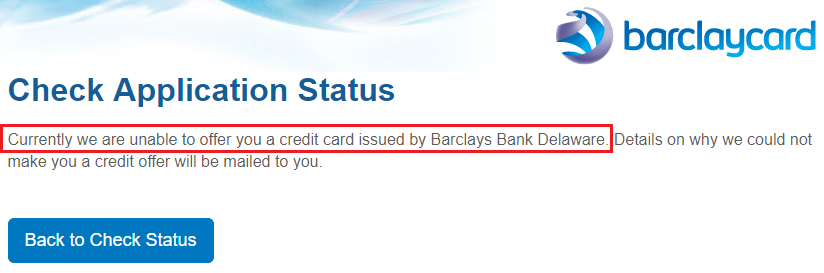

Even though this credit card was listed at the end of my App-O-Rama post, it was actually the first credit card I applied for during this App-O-Rama. Unfortunately, my application went to pending and then to denied a few days later. This credit card was going to be harder to get than I thought. I decided to wait for the denial letter and put my reconsideration skills to the test.

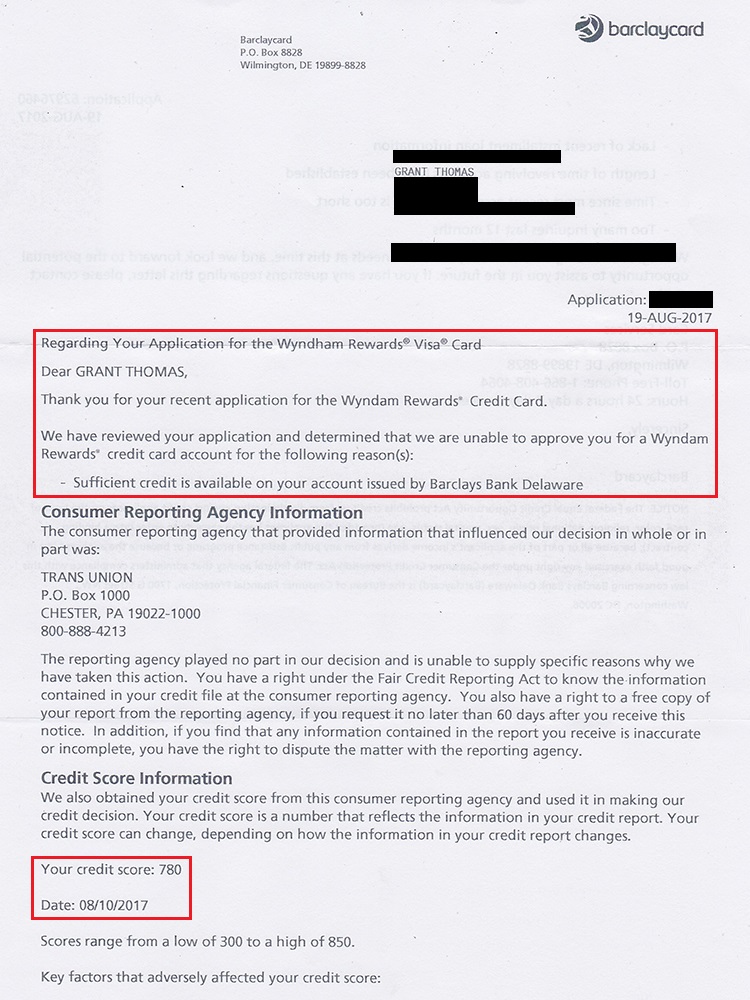

A few days later, I received the denial letter from Barclays. In the letter, Barclays stated that I had sufficient credit already available with Barclays. At the time, I had a Barclays Lufthansa Credit Card, Barclays JetBlue Credit Card, and Barclays Arrival+ Credit Card – all with credit limits of $5,000 to $10,000. Overturning that denial reason would not be too difficult, since there are a few other denial reasons that are harder to overturn, such as too many recent credit card inquiries on your credit report. That denial reason would be much harder to explain. I then looked up the Barclays credit card reconsideration phone number on Doctor of Credit’s website.

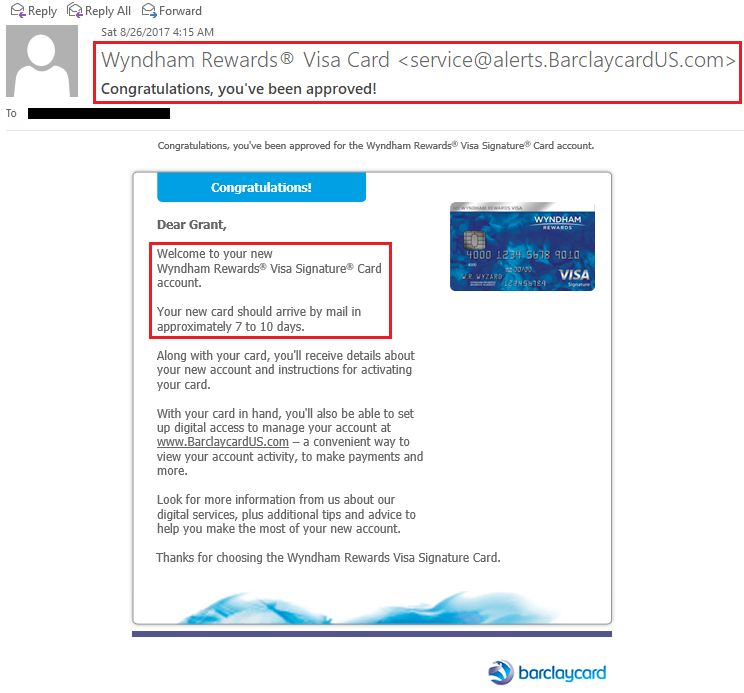

When I spoke to the Barclays reconsideration rep, I explained that I did not want any more credit with Barclays, I just wanted to move credit from one of my existing Barclays credit cards to open the Barclays Wyndham Rewards Credit Card. She took a look at my Barclays credit card history and then asked me to explain some of the recent credit card inquiries on my credit report. I explained that I recently applied for a gas credit card and a grocery store credit card to earn bonus rewards in those categories. She put me on hold for a minute and came back with good news. She would approve my Barclays Wyndham Rewards Credit Card application if I moved $5,000 from one of my other Barclays credit cards. Perfect, I said, let’s move credit from my Barclays Lufthansa Credit Card. A minute later, I was approved for the credit card and I received the congratulations email from Barclays.

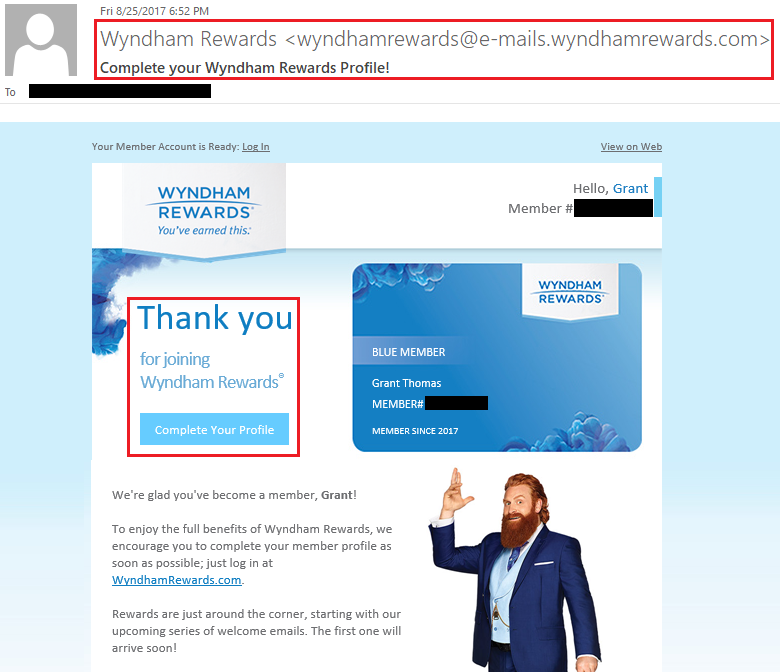

I also received an email from Wyndham Rewards about my new Wyndham Rewards account.

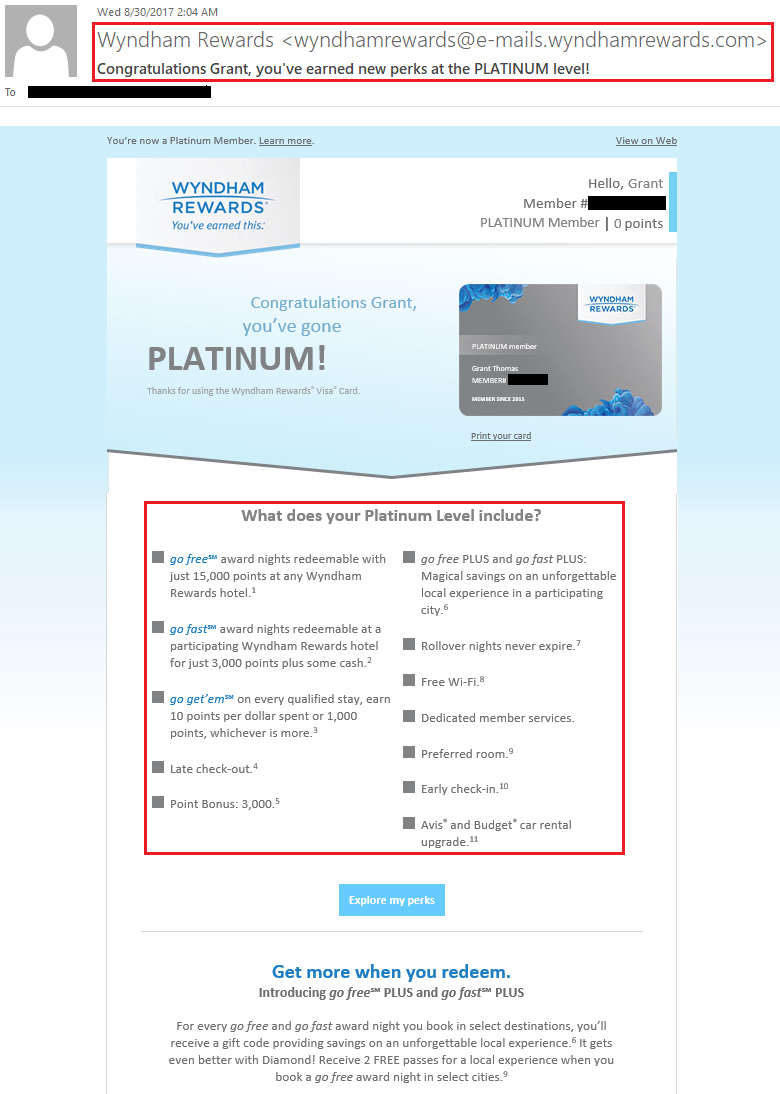

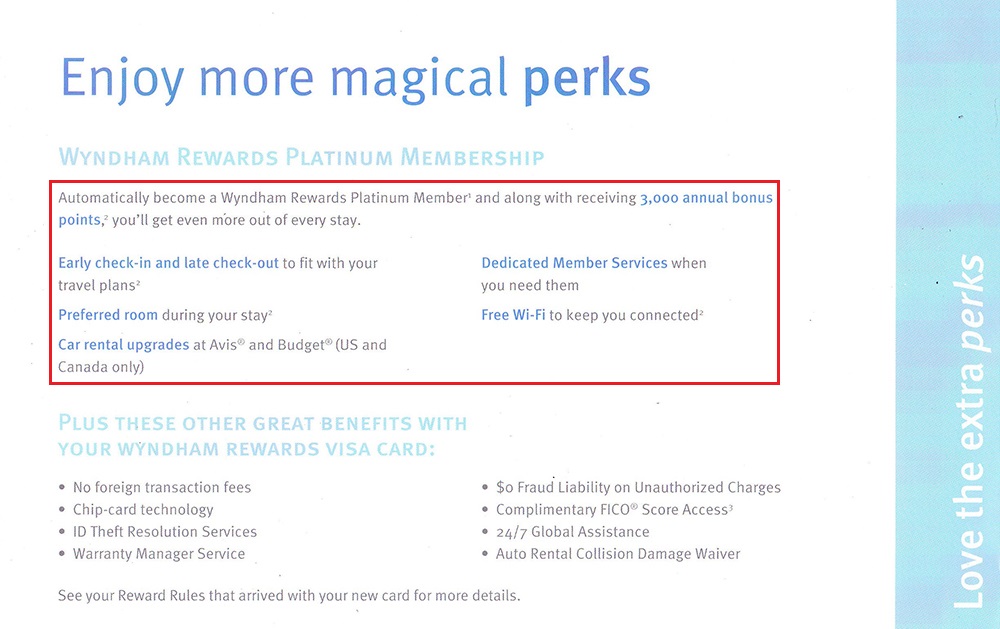

A few days later, I received another email from Wyndham Rewards that I was now a Platinum Elite Member, thanks to the Barclays Wyndham Rewards Credit Card. I have no experience with Wyndham Rewards or their Platinum Elite Status, but I’m sure I will get more familiar soon.

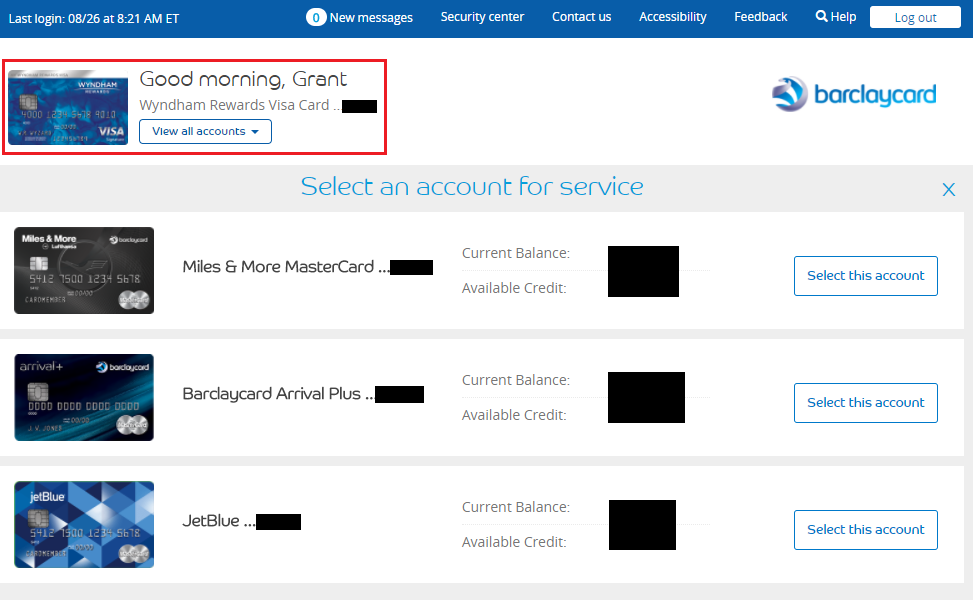

A few days later, I received the Barclays Wyndham Rewards Credit Card and activated the credit card online. The credit card automatically showed up in my Barclays online account.

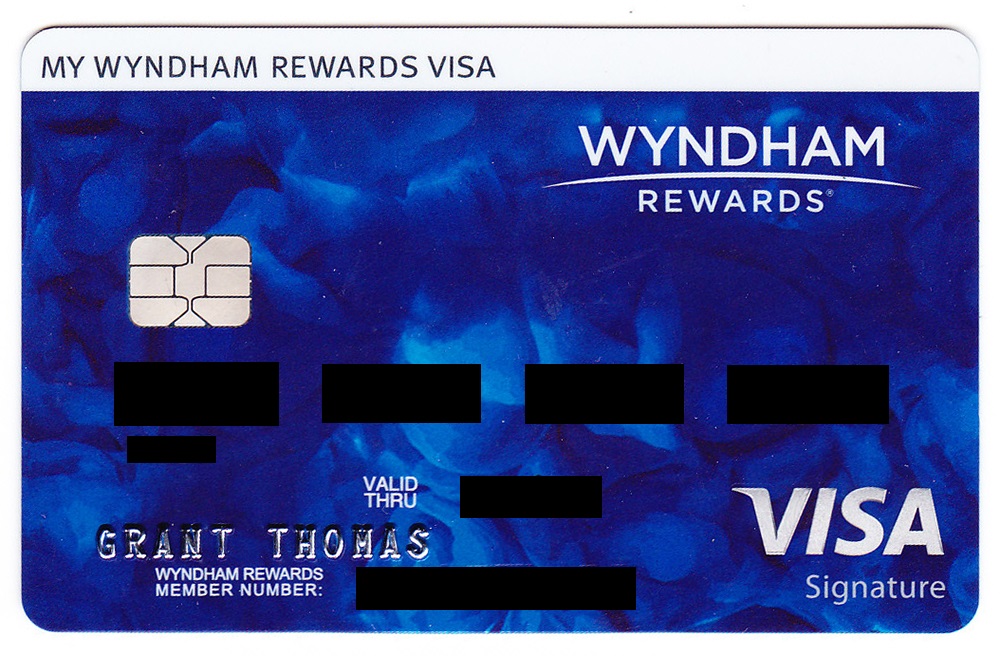

Here is the front and back of the Barclays Wyndham Rewards Credit Card. I like the cool blue colors on the front of the credit card. It also has my Wyndham Rewards account number. I then finished setting up my Wyndham Rewards account online and then I added the account to my Award Wallet account.

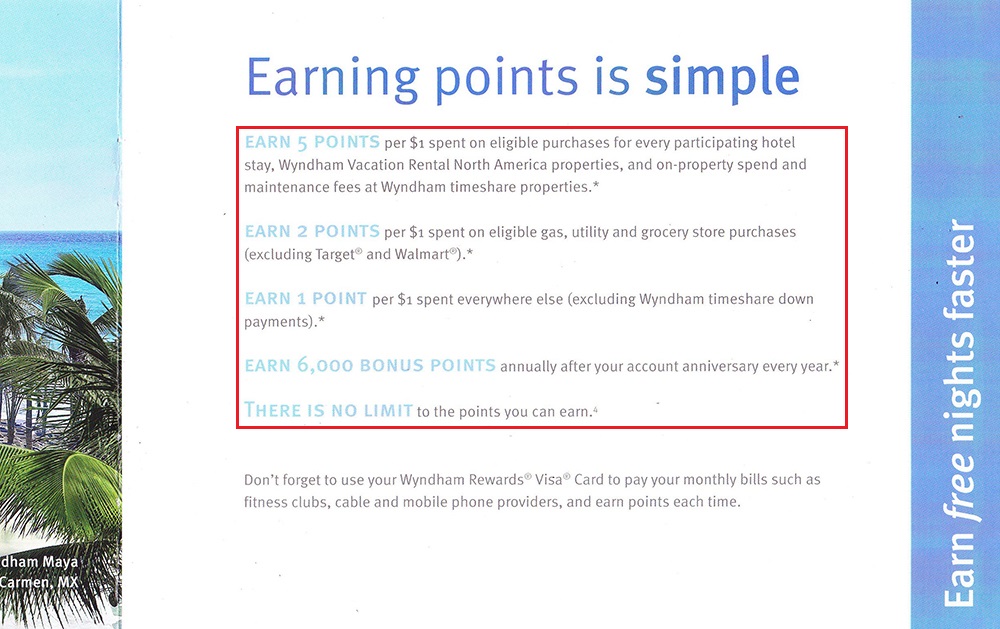

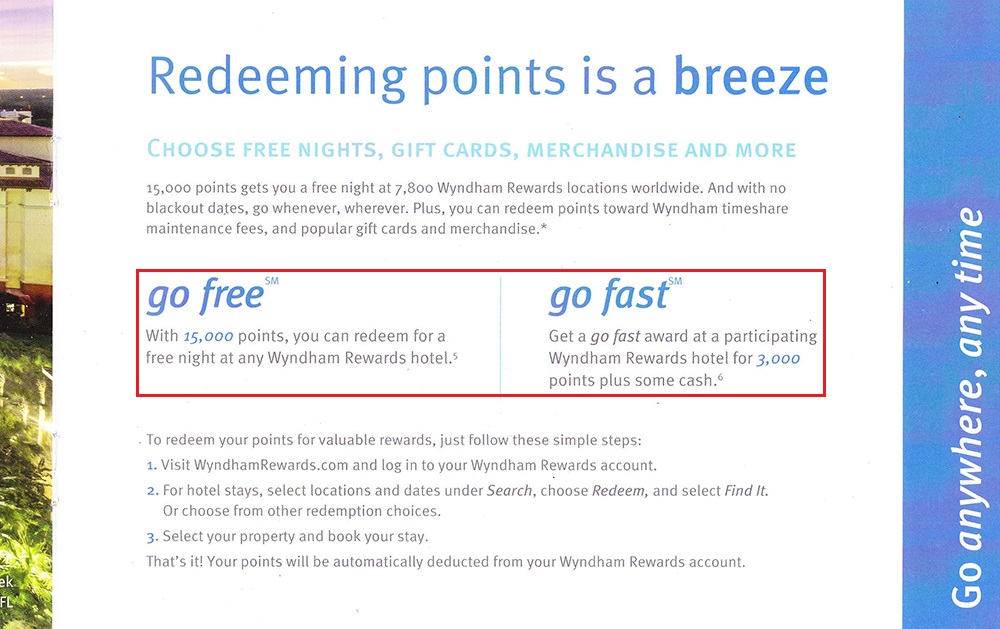

Lastly, I also received a Barclays Wyndham Rewards Credit Card program guide. Every year you pay the annual fee, you get 6,000 bonus Wyndham Rewards points. As a Platinum Elite Member, I also get 3,000 bonus Wyndham Rewards points. Free nights start at 15,000 Wyndham Rewards points and you can do points and cash with as little as 3,000 Wyndham Rewards points. After I meet the $2,000 minimum spend requirement, I will receive 45,000 bonus Wyndham Rewards points, which is enough for 3 free nights at any Wyndham hotel.

If you have any questions about the Barclays Wyndham Rewards Credit Card, please leave a comment below. Have a great weekend everyone!

I find the BofA hard to apply for. I’m told they could only approve me for $2500 CL and that doesn’t qualify me for the visa signature card. I’ve $13000 CL on existing BofA accounts, none of which I can comfortably close. Any strategies?

You can proactively reduce your credit lines on your existing Bank of America credit cards. If you don’t use the credit cards much, you can lower the credit limit to $1,000. That should improve your chance of getting larger credit limits on your next Bank of America credit card application.

My experience as been that Barclays approves one CC application after 6 months lapse since the last application

I think I’ve gotten almost 3 Barclays credit cards in the last 8-9 months.

Can you share the link to the 45k bonus? I can only find the standard 30k, or did you receive a targeted offer? Thanks.

The 45,000 point sign up bonus offer ended, standard offer is only 30,000 points now.

“I explained that I recently applied for a gas credit card and a grocery store credit card to earn bonus rewards in those categories”

You got me to grin. I will have to use that one myself…and probably real soon!

Haha, that did the trick :)

Congrats! Where do plan on redeeming your Wyndham points at? Some places allow you to book suites and upgraded rooms for the standard 15k.

I honestly have no idea, but I’m sure I could find some nice Wyndham hotels to stay at. Do you have any recommendations?

Some of the Dolce properties are nice. You have the all inclusives too. The Go Fast nights can be helpful if you need a quick stop hotel. I redeemed some at the Silverado Resort and Spa in Napa.

All inclusive hotels sounds good to me. When I get the sign up bonus, I will do more research on the all inclusive hotels.

Pingback: My Barclays Credit Card Retention / Targeted Spending Offers for September 2018

Pingback: My Barclays Credit Card Retention / Targeted Spending Offers for September 2018 [Letters Added]