Good afternoon everyone, I hope your week is going well. Yesterday, I wrote about My Las Vegas Casino Status Matches: Caesars Diamond > Wynn Platinum > Fontainebleau Gold > MGM Gold > Unity by Hard Rock Icon. In today’s post, I will cover riding the Las Vegas Monorail, getting 20% off Cirque du Soleil tickets, using InKind and Resy credits for the same restaurant, and redeeming 60,000 Caesars Rewards Points toward my paid hotel stay at the Paris Las Vegas.

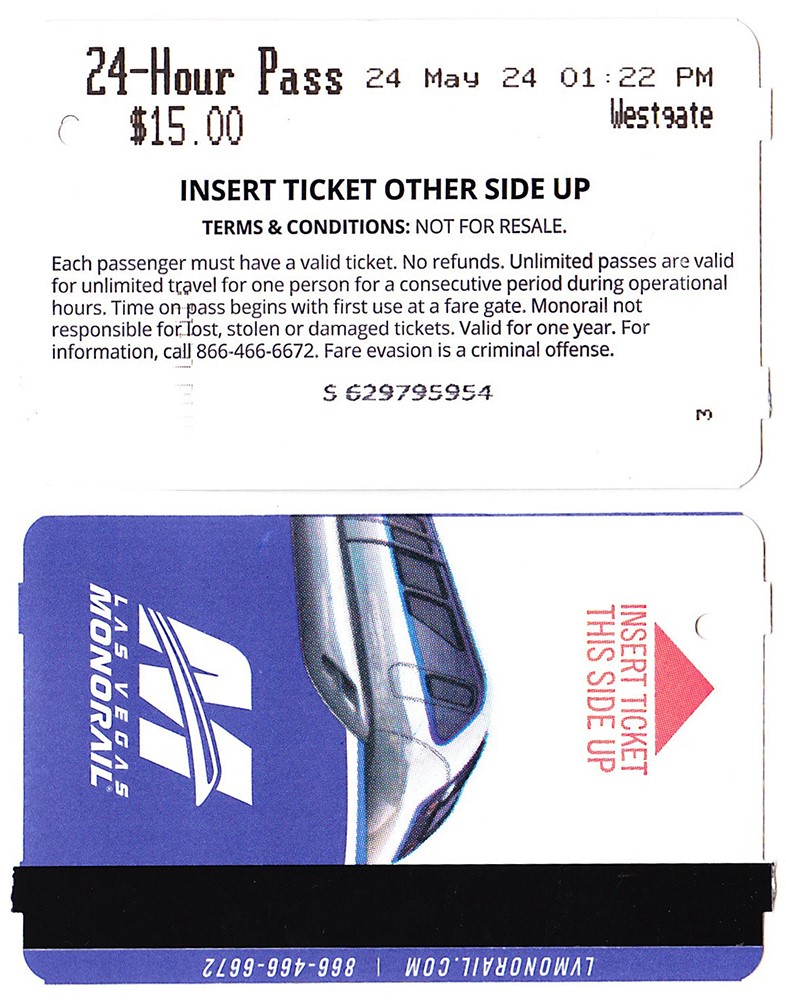

Las Vegas Monorail (save more with multi trip passes)

After walking from the Paris Las Vegas up to the Fontainebleau, we didn’t want to walk all the way back, so we decided to take the Las Vegas Monorail back to our hotel. Since we had dinner reservations back at Don’s Prime (inside the Fontainebleau) in a few hours, we decided to get a 1 Day Pass (unlimited rides within 24 hours) for $15 / ticket. It was about a 13-15 minute walk from the Fontainebleau to the Westgate Monorail Station, then only a 10-12 minute ride back to the Paris Las Vegas. If you have a prepaid commuter debit card, you can use it on the Las Vegas Monorail.