Good afternoon everyone, I hope your week is going well. My friend just forwarded me an email from US Bank along with some screenshots of the survey. My friend has a US Bank Altitude Reserve Credit Card (USB AR) which is no longer available for new applicants. Some of the questions hint at a relaunch of the USB AR credit card or a brand new credit card entirely. I highlighted the questions, but you may need to read between the lines to infer what US Bank is considering.

In a perfect world, it would be awesome to turn some credit card benefits off, and other benefits on, so that your annual fee only covers the benefits that you use or care about. In reality, this sounds like either an increased annual fee from the current $375 annual fee or a new more premium credit card with a even high annual fee.

This was my favorite question. I don’t know about you, but I would love to have the ability to transfer points from my US Bank Altitude Go or US Bank Smartly credit cards to the USB AR. And if they added the ability to transfer points to airlines or hotels, that could be a game changer (depending on which programs they add). As of today, the only airline credit card US Bank offers is with Korean Air, so that might be one of the programs they start with. I would be curious to see which other airline or hotel partners they can add.

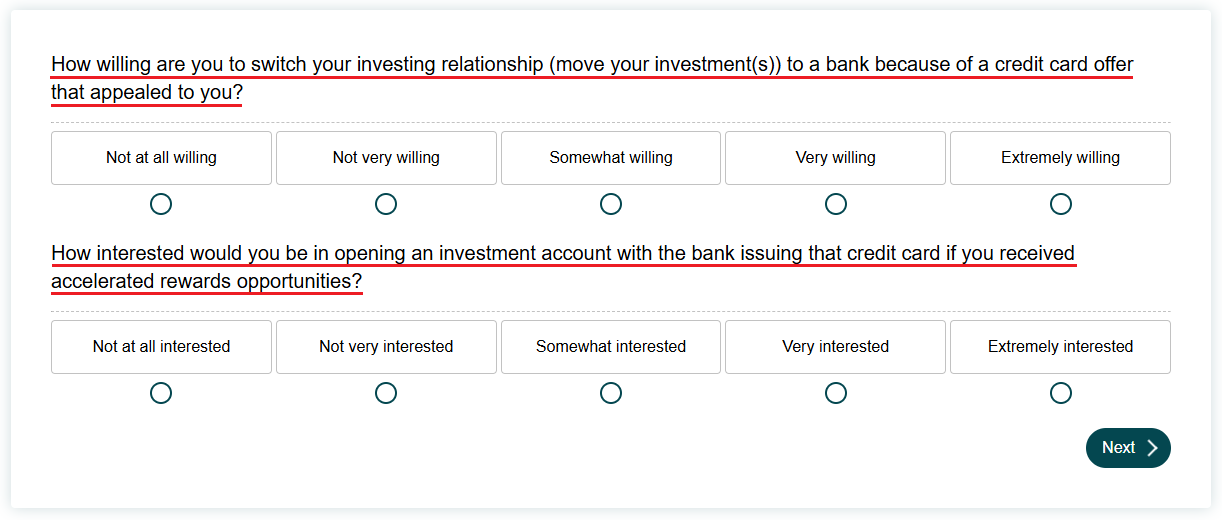

This question sounds like the premise for the US Bank Smartly credit card that needed $100K in assets to get the top 4% cash back rate. Maybe you will need to have substantial assets with US Bank in order to get the relaunched USB AR or another premium credit card.

This also sounds similar to the US Bank Smartly initial launch. I’m curious how the accelerated rewards would work. If you had $50K with US Bank, maybe you could get 3x transferrable points. With $100K with US Bank, maybe you could get 4x transferable points.

That is all the info I have available about the survey. I would love for the USB AR to add the ability to transfer points between different credit cards and for the ability to transfer points to airlines and hotels. Only time will tell if any announcements come from US Bank in the coming months. What are your thoughts on the survey questions? Please share them in the comments section below. Have a great day everyone!

All the other banks already offer transferrable points. What’s great about the USBAR is that it covers all other travel expenses that are not available with airline points. Way more valuable to have this. Also I easily use all my AR points every year whereas I have hundreds of thousands of transferable points that collect dust.

Hi Jeff, I’m on the same team as you. I earn the points quickly and use them as soon as an eligible travel purchase comes in as a real time rewards text message. This is my go to card for traveling around Europe since ApplePay works almost everywhere.

No survey for me, perhaps because I only have Cash + and Smartly?

I have those 2 USB credit cards too, but didn’t get this survey.