Good afternoon everyone, I have another guest post from my buddy Nigel. You might remember him from such great blog posts as Guest Post: 5 Card App-O-Rama (Diners Club, Club Carlson, US Airways, Southwest Airlines Plus, and Citizens Bank). Without further ado, take it away Nigel!

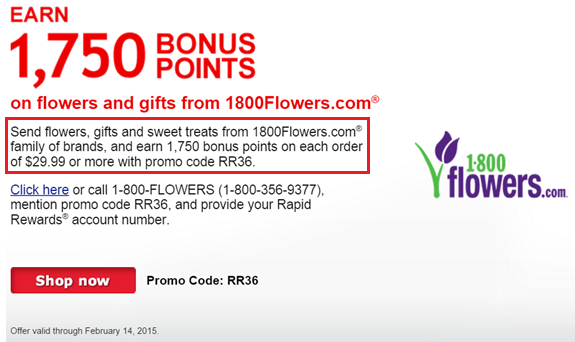

Hello TWG readers, I wanted to share my experience with the recent 1-800-Flowers promotion to help qualify for the Southwest Airlines Companion Pass. The inspiration and instructions for this endeavor came from Frequent Miler’s post: How to Feed the Hungry and Fly for Free.

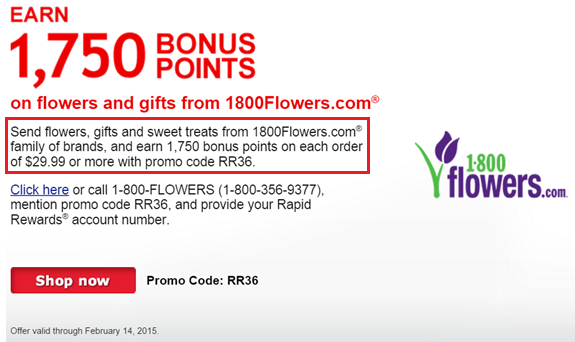

In brief, through February 14th, 1-800-Flowers was running a promotion where every qualifying order of at least $29.99 with promo code RR36 or RR43 would earn 1,750 Southwest Airlines Rapid Reward Points. In November, there was a similar promotion and many people reported that the points posted as Companion Pass qualifying points. Rather than further depleting my Chase Ultimate Rewards Points or Hyatt Gold Passport account balances, I decided to go for it.

Continue reading →