Good morning everyone, last Saturday, I went to my local Citibank Branch to apply in person for the Citi Prestige Credit Card. By applying in-branch, you receive a different (better?) version of the Citi Prestige with a larger sign up bonus and a lower annual fee. Read this post to learn more about the difference: Citi Prestige: 50,000 ThankYou Points Online or 60,000 TYP In-Branch Offer? Without further ado here is my experience…

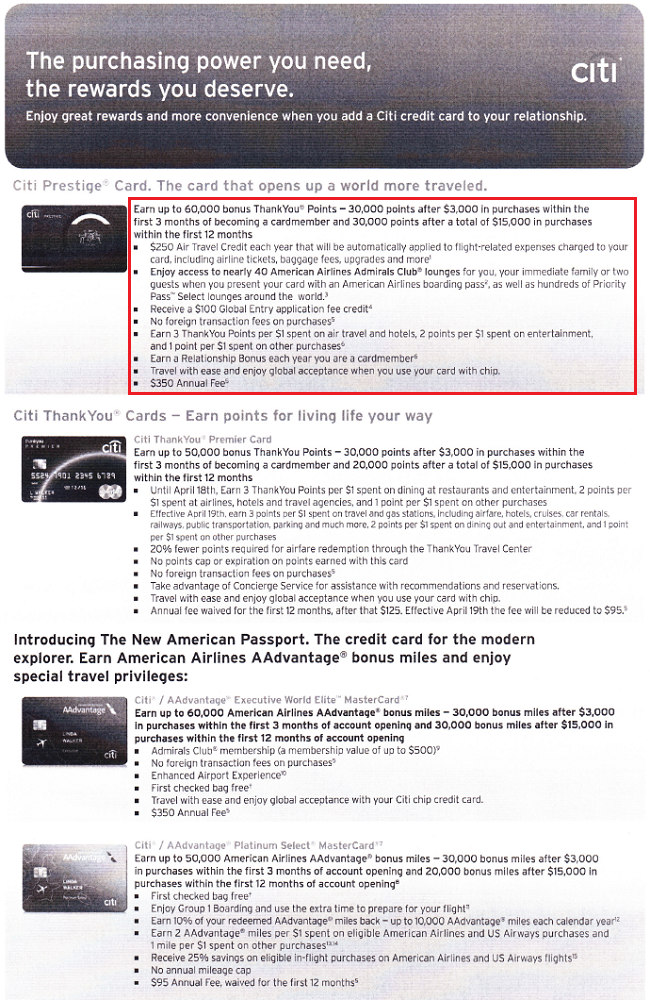

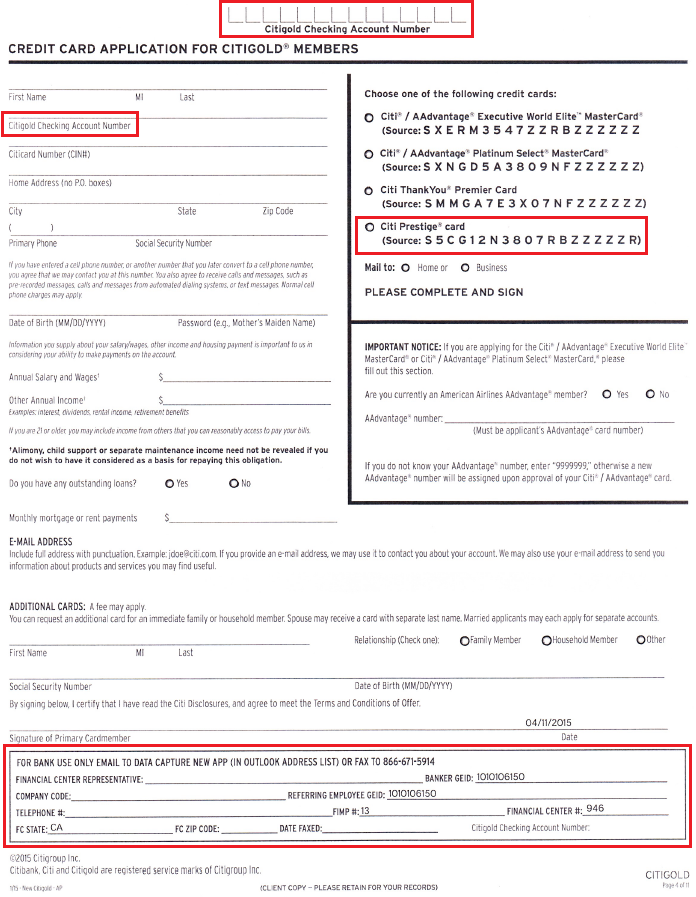

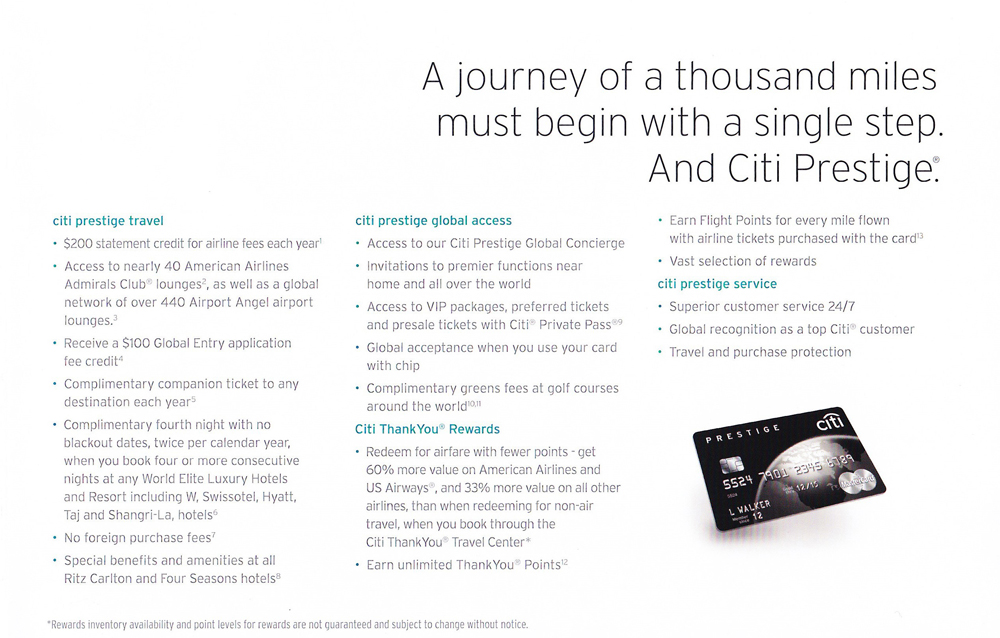

I went to my local Citibank Branch as soon as it opened so I would be able to get in, apply for the card, and get out as fast as possible. I also had a meetup in Sacramento later that day that I had to get to, so it was important to finish fast. I spoke with a personal banker who told me to speak with a credit analyst (title?). I told her I wanted to apply for the Citi Prestige Credit Card and she handed me a brochure and packet of information (see below). I asked her to print out an extra copy for my friend, which I scanned into PDF form here: Citibank In-Branch Offers 4-11-2015.pdf. This is the slightly modified sign up bonus details page. There are currently 4 in-branch credit card offers as of April 11, 2015. All of these offers are slightly different (better?) than their online counterpart.

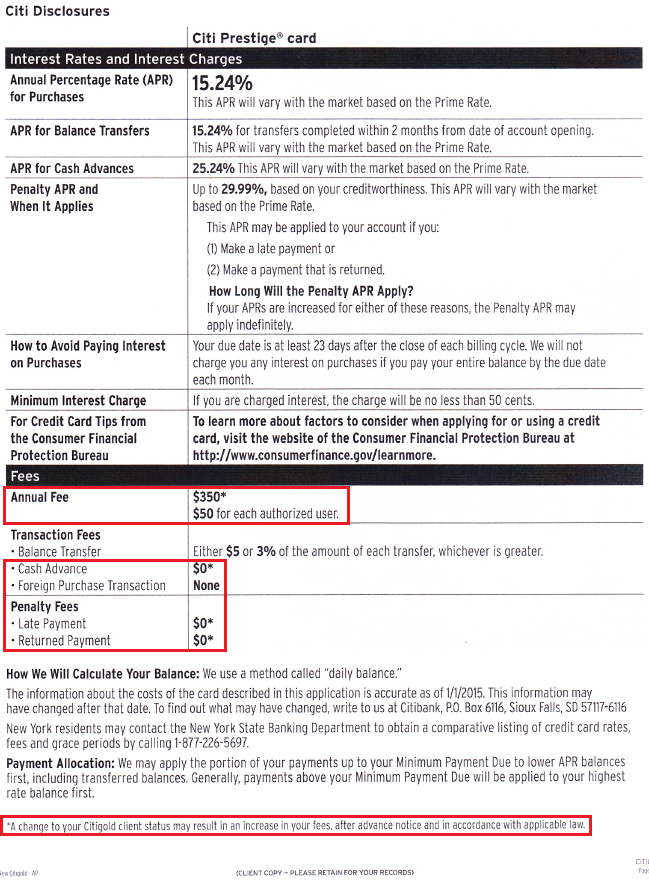

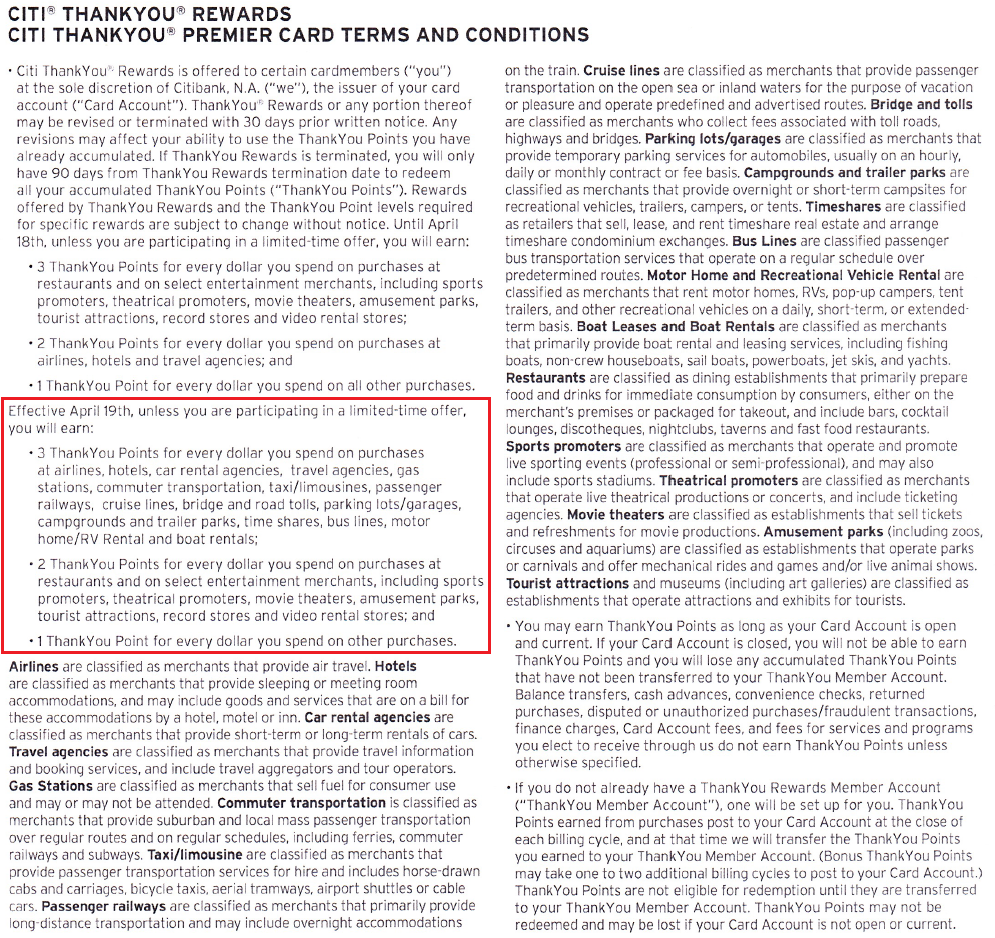

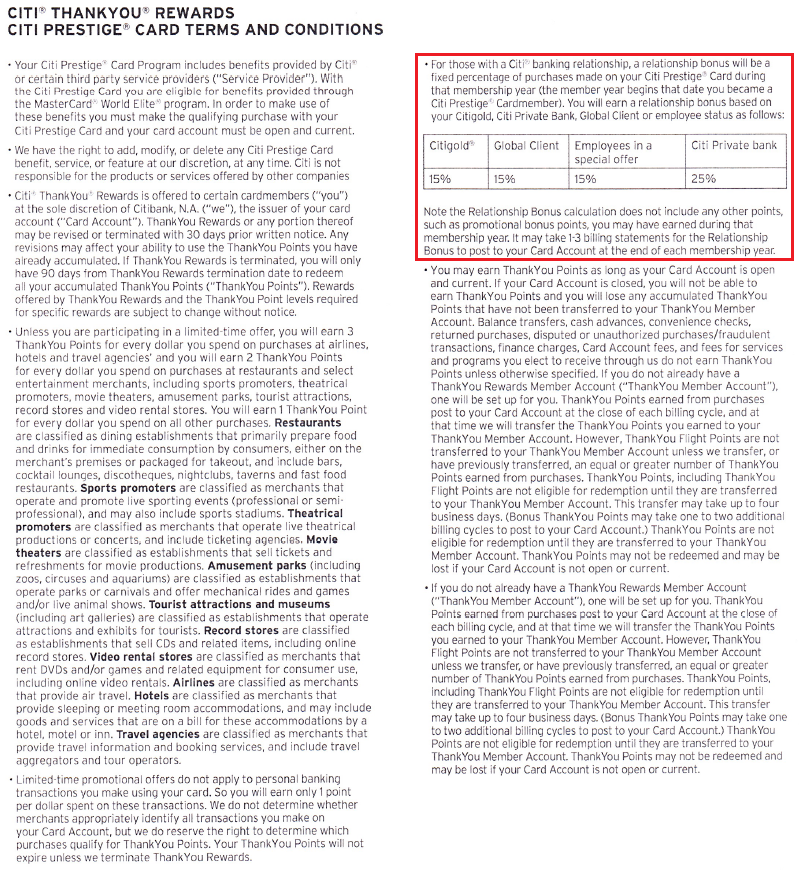

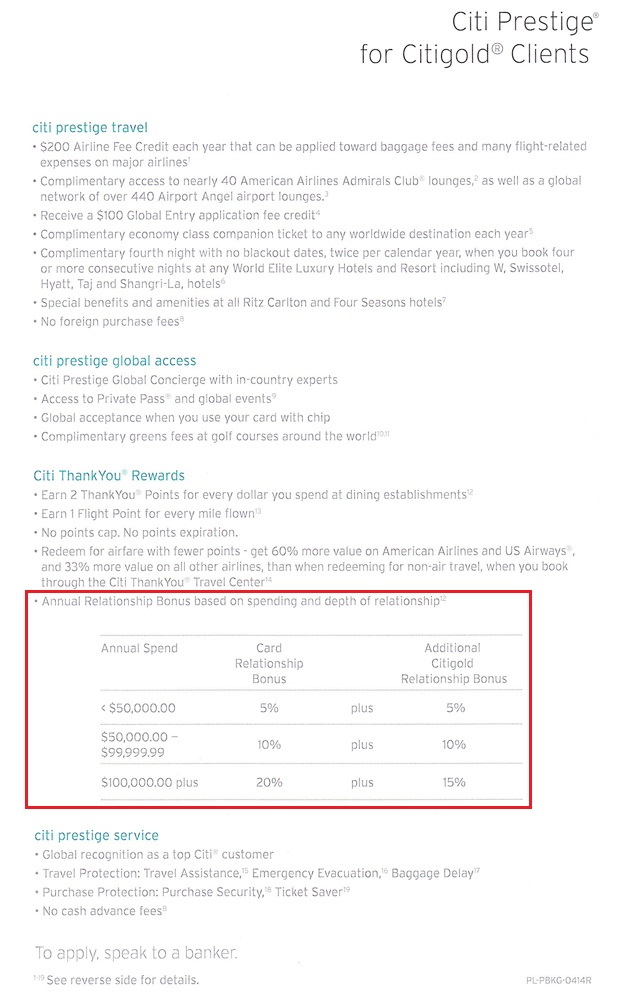

The first page is the actual form you fill out when you apply in branch. It looks like you *must* have a Citi Gold Checking Account. I believe the bottom portion of the form is specific to each branch, so take that into consideration. The second page shows the annual fees and interest fees. The annual fee is $100 cheaper for Citi Gold Checking Account customers and you can add an authorized user to the account for $50. The third page shows the changes to the credit card terms effective April 19, with new bonus categories announced. The last page has details on the “Annual Relationship Bonus” which is very interesting.

Here are more details on the Annual Relationship Bonus. After the first year of spending $50,000 or below, it looks like I will get a 10% bonus on the number of Citi Thank You Points (TYPs) I earned (probably minus the sign up bonus). If I spend more than $100,000 on the credit card, I would get a 35% bonus. Very interesting…

Here are the images of the Citi Prestige brochure:

Now back to the application process. Filling out the form took 5 minutes and you have to write in all your information. Presumably since you have a Citi Gold Checking Account, Citi has already done a background check and credit check on you, so there is not a lot of information that is needed on the application. After completing the form, I was told that they would fax the form into the credit department at Citi.

On Monday morning (and each subsequent morning after that), I called the Citi Personal Application Status and Reconsideration Line @ 1-800-695-5171 to check the status of my application. I learned that the fax arrived sometime on Tuesday evening, but had not been processed yet. I called again Thursday morning and the rep was able to pull up the application and approve me for a $5,000 credit line. No questions asked, I would have been “instantly” approved if I had waited 1-2 more days.

I asked to transfer the $5,000 credit line from my 1 year old Citi American Airlines Executive Credit Card but I wasn’t able to since I still had the $450 annual fee left to pay. I asked to transfer $5,000 from my Citi Double Cash Credit Card to raise the Citi Prestige credit limit up to $10,000. I asked about the sign up bonus and the rep confirmed the in-branch offer. I asked about expediting the credit card, but 2-3 business days was as fast as possible.

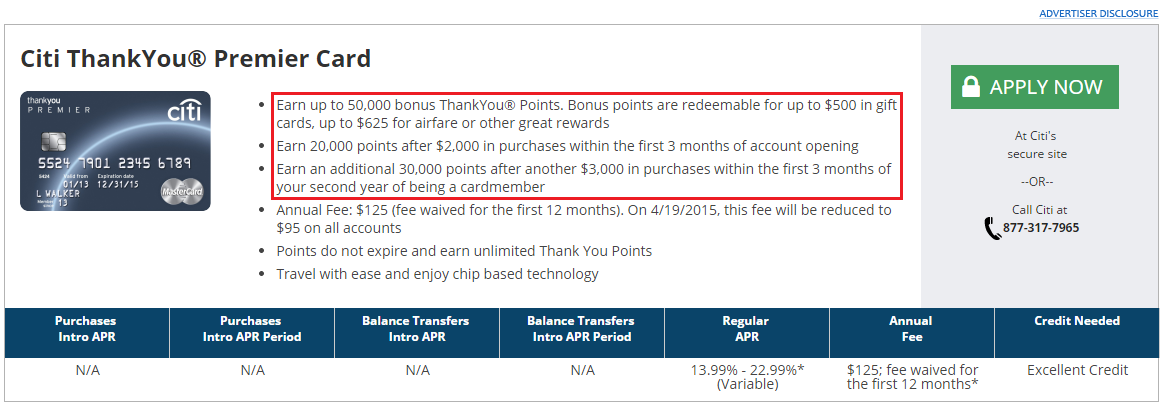

I will wait 8 days (from when?) to apply for the Citi ThankYou Premier Credit Card which has a 50,000 Citi TYPs sign up bonus after spending $5,000 in 3 months. Do I wait 8 days from my original in-branch application (Saturday, April 11) or should I wait 8 days from my approval date (Thursday, April 16)? I will probably play it safe and wait at least 8 days from now. I will then call the reconsideration department and move the $5,000 credit limit from the Citi American Airlines Executive Credit Card to the new Citi ThankYou Premier Credit Card.

If you have any questions, please leave a comment below. Have a great weekend everyone!

P.S. I will be at FTU Dallas this weekend, so I will probably not post anything over the weekend.

Thanks for the post Grant. I just opened a CitiGold account (30k AA bonus), and just opened a Premier CC (50k bonus) within the last month. I am going to wait a bit longer and do the in-branch 60k Prestige CC also. To me that’s a better deal. Amazing none of the bloggers, with few exceptions, even mention this. I think most of them are more interested in making money than helping people.

The commission for the Citi Prestige is very generous, which explains why you don’t see the in-branch offer mentioned much.

Frequent Miler blogged about it ages ago.

Yes, Greg has talked about the Citi Prestige Credit Card for several months.

FM blogged about it when it was a very lucrative deal – those that only blog about it after the affiliate links show up are blogs you want to avoid…and that’s a very long list…

The time to apply for the Prestige was last September, enough time to double dip on the airline bonus before the terms changed in October. So those who applied got a $200 credit per the old T&Cs, and then another $250 credit when the T&Cs changed, then another $250 credit this year. All for a $350 AF. Plus 60K TYP for $15K spend. Was the best deal going (other than the Exec with 100K offer)

I agree. I can’t go back in time, so now is the best time to apply. Just waiting for my annual fees to post on those cards.

Your documentation is very significantly out of date. Specifically, (1) the current in-branch offer is 50K points for $3K spending in three months, (2) the airfare credit is for anything at all from an airline and its $250 not $200, and (3) the relationship bonuses are, in fact, now just a dead flat 15% (Gold) or 25% (private bank) across the board on your spending.

I ought to know. I just did this and, besides, and unlike some folks, I’ve actually read the on-line T&Cs . . . ok, maybe ex “golf benefit,” which I don’t care about.

Anyway, you need to fix and/or update your post.

Oh boy. I went in last weekend and things have already changed since then? I’m sorry for the old news.

I did this yesterday. I got the 30+30k deal and 350 yearly rate

Nice, was your Citibank experience similar to mine?

?? When did you apply? I just applied on April 15 and they printed out the brochure and application straight from their intranet. My offer brochure looks like exactly like Grant’s first image, which says $250 air travel credit as well, not $200. I got a different application packet though, that didn’t say anything about Citigold so I can’t comment about the relationship bonus.

How’s your different in branch offers are there?! Your application process was so much harder than mine. It might be due to having a Citi Gold Checking Account. Who knows.

I don’t know why anyone would want the Executive card now (I’m about to cancel mine now that the annual fee is due) but the document they give you at the branch shows a $100 reduction in fee for that card too if you are Citigold. So if you are Citigold and want the card or plan on renewing heck it out.

Yes, I noticed that too. Still not worth it to me though.

Whoa. My experience was super different. When I went to Citi on Wednesday, the application packet they gave me looked different from yours. I get the same 60k bonus and the $350 AF, but no mention of requiring a Citigold account. They didn’t even ask. However, they did ask me to provide a copy of my driver’s license, my SSN card, 2 recent paystubs, and a printout of my bank statement showing that the opening date and an average daily balance of $2000 over the past 3 months. I didn’t have most of this so they let me take the application home to print out everything and bring it back the next day.

Hey Grant,

So, I don’t have a CITI bank branch anywhere in Texas, so I was hoping you might supply a phone number for the location you used. I’d like to call and apply over the phone.

Sure, here is the local Citi branch I went to: (925) 246-2978

10-5pm M-F and 10-2pm Sat PT