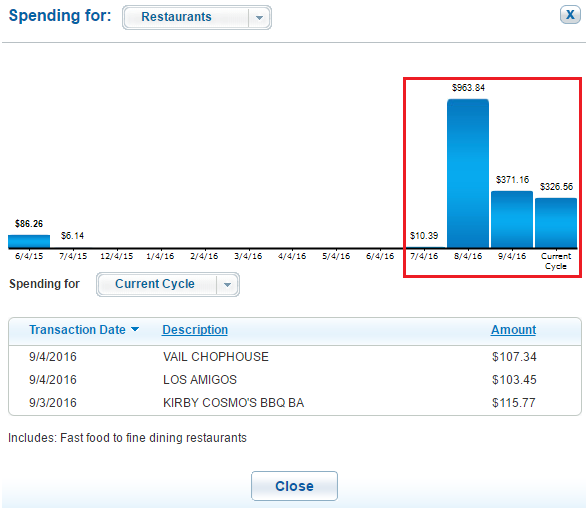

Good morning everyone, I hope your weekend is off to a great start. Last month, I wrote 3 Ways to Calculate Progress Toward Chase Freedom Q3 Restaurant Spend. In that post, I showed how to calculate restaurant spend on your Chase Freedom Credit Card to see where you stand regarding the $1,500 Q3 bonus spend limit. Over the last few weeks, I made a few large restaurant purchases, so I wanted to make sure I wasn’t going to far above the $1,500 bonus spend limit (all restaurant spend after $1,500 only earns 1% cash back or 1 Chase Ultimate Reward Point per dollar).

I logged into my Chase online account, went to my Chase Freedom Credit Card, clicked on Blueprint and looked at all my restaurant purchases over the last few months. If you are unfamiliar with Chase Blueprint, click the link above to see step by step instructions. I added up all the monthly totals for restaurants and I am currently at $1,671.95. Depending on your statement due date, you may want to adjust your July restaurant total if you made restaurant purchases in June (I only made restaurant purchases after July 1 on my Chase Freedom Credit Card).

So now that I maxed out my Q3 restaurant spend, which credit card should I use for the remainder of Q3 and all of Q4? Before June 4, my go to credit card was the Citi Forward Credit Card, which offered 5x Citi Thank You Points at restaurants. That credit card has since been devalued to only 2x at restaurants, matching several other credit cards, including the Chase Sapphire Preferred and Citi Premier. I listed a few other restaurant credit cards here: Which Credit Cards will Replace my Citi Forward Credit Card after June 4? In that post, I made the case that the US Bank Cash Plus Credit Card was a good option, earning 2% cash back at restaurants and 5% cash back at fast food restaurants. I pointed out some inconsistencies in regards to which places posted as restaurants versus fast food restaurants.

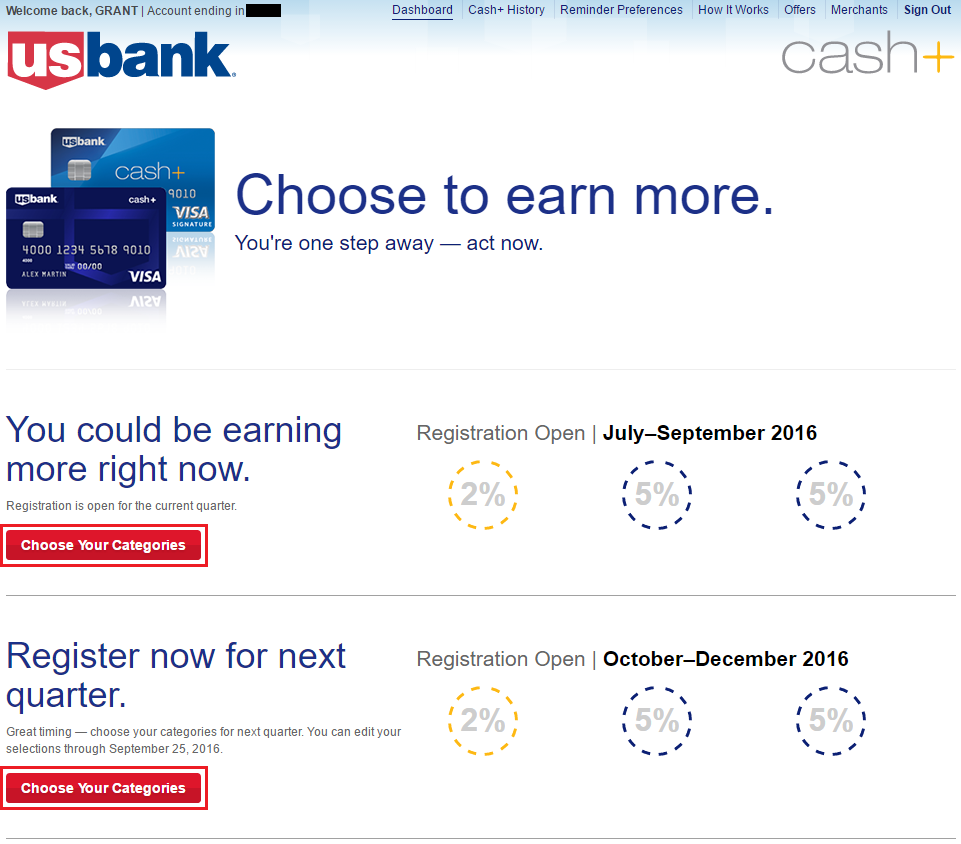

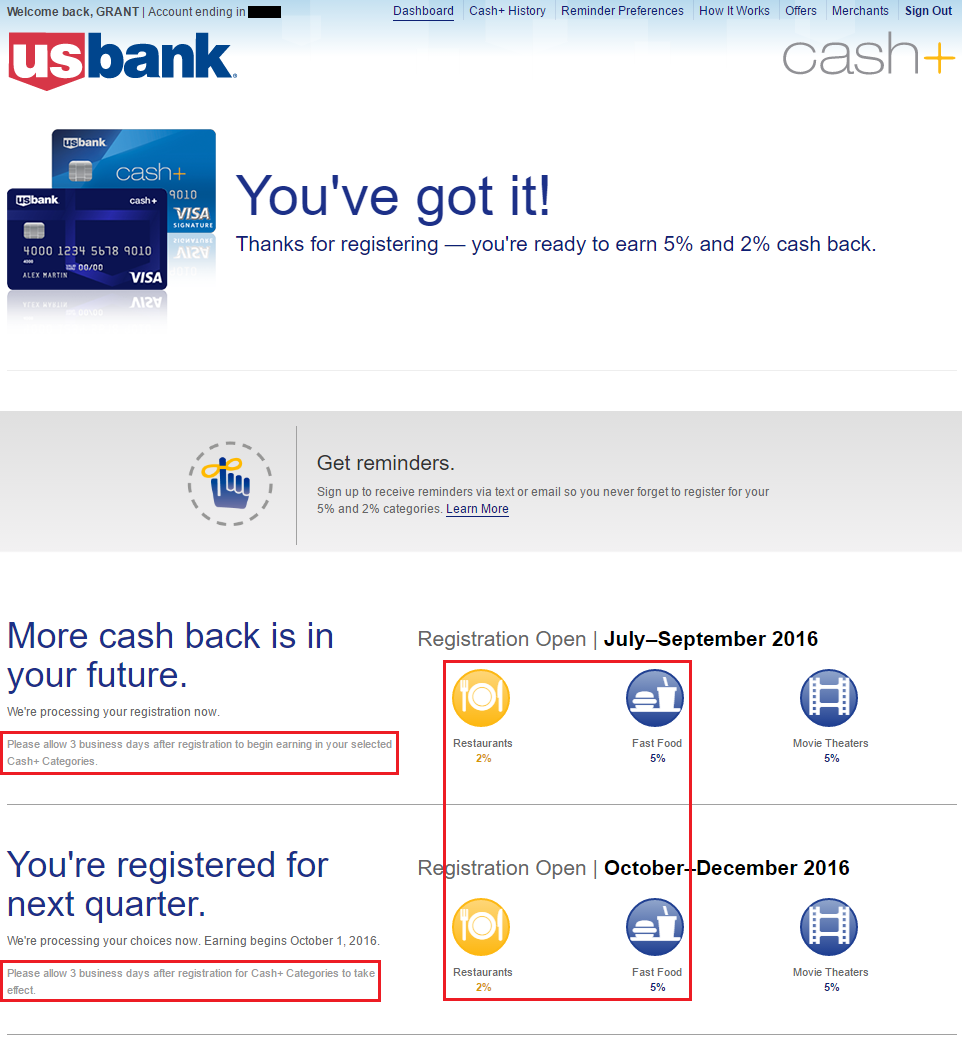

I decided to bite the bullet, dust off my US Bank Cash Plus Credit Card, and select my Q3 and Q4 bonus categories. To get started, go to the US Bank Cash Plus site and sign in. Click the Choose Your Categories buttons for Q3 and Q4.

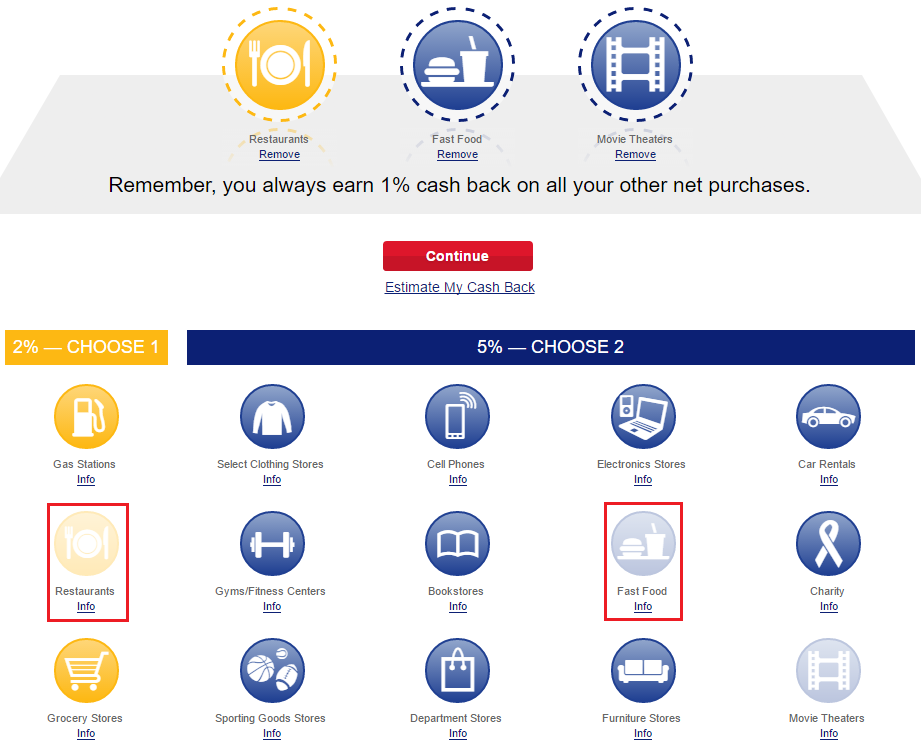

Apparently, the bonus categories are exactly the same for Q3 and Q4. I picked Restaurants in the 2% cash back category. Why not gas stations and grocery stores? I use my AMEX Old Blue Cash that earns 5% cash back at those categories. I picked Fast Food and Movie Theaters in the 5% cash back category.

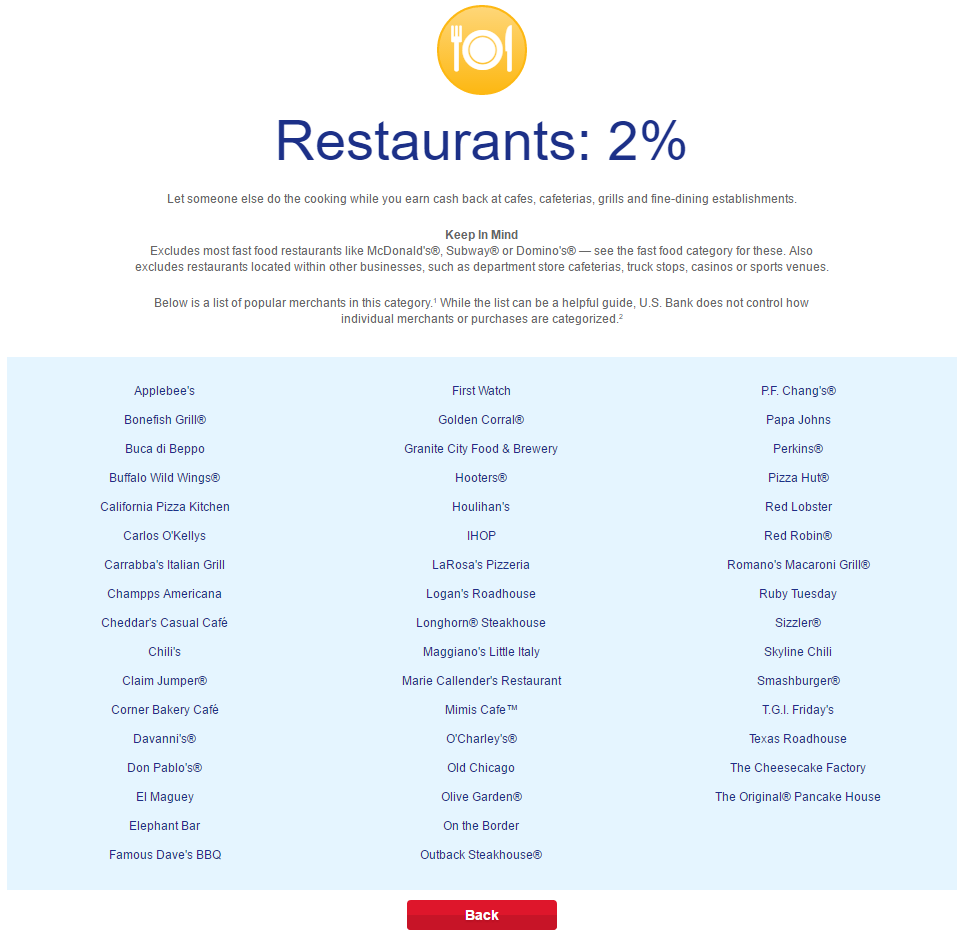

Here is a sample of 2% cash back restaurants:

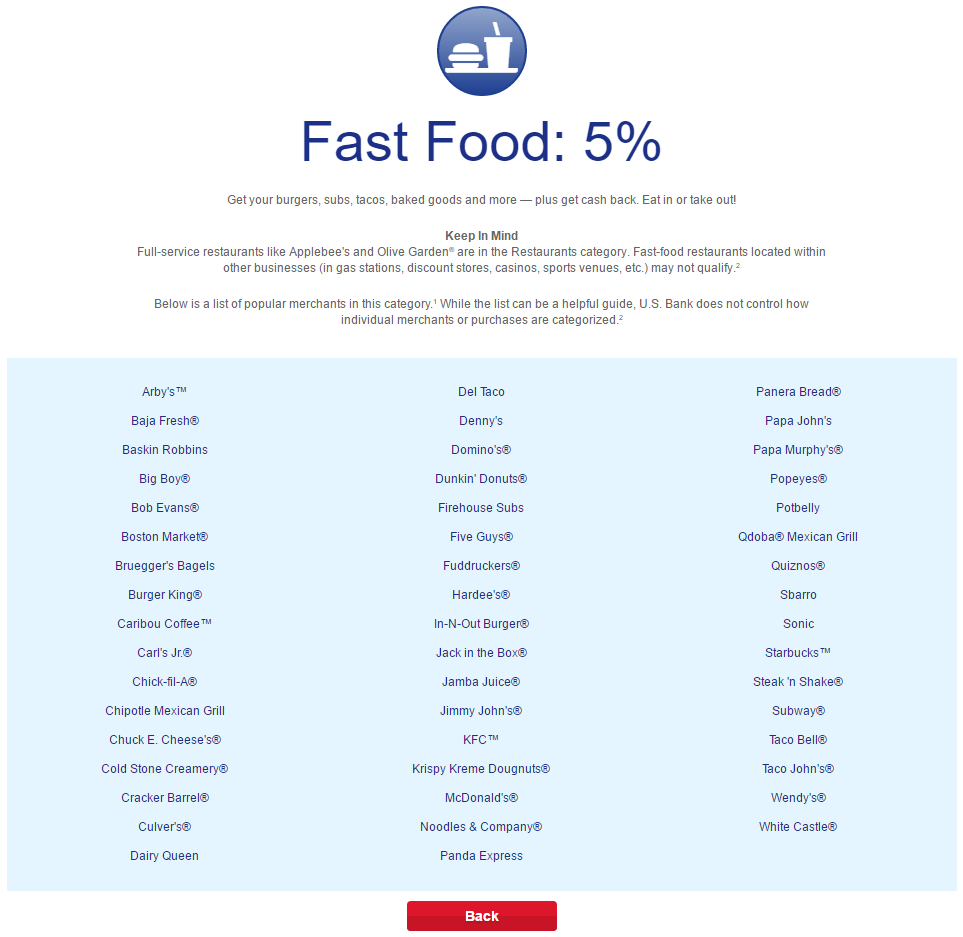

Here is a sample of 5% cash back fast food restaurants. Fun fact: Papa John’s still appear on both lists – silly US Bank!

After picking the categories, US Bank *recommends* that I wait 3 business days before making a purchase at my selected bonus categories. That seems strange to me. I hope US Bank upgrades their technology so that purchase count right away.

If you have any questions about calculating your Chase Freedom restaurant spend or picking your US Bank Cash Plus bonus categories, please leave a comment below. Have a great weekend everyone!

Yo Grant…are there caps on the earning for the US bank card?

I think it’s $2,000 per quarter for the 5% categories, I don’t think there is a cap for the 2% and 1% categories.

Not maxed my restaurant bonus but I believe Costco also codes as 5X during Q3.

If you don’t have Costco membership can you buy Costco GC and in the future shop at Coscto without a membership and just with Coscto GC?

I believe you can buy stuff on Costco.com without having a Costco membership.

Pingback: Calculate Discover It & Chase Freedom Q4 5% Cash Back Category Spending