Good afternoon everyone, I hope you are having a great weekend. I am currently in Miami on my way back home to San Francisco after my week-long vacation to Saint Kitts and Nevis and my stay at the Marriott Saint Kitts Beach Club timeshare property (2 trip reports coming later this week, or next week, or never – let’s see if I can get these posted before I forget). Enough about me, let’s talk about credit card rewards.

A long time ago, my go to credit card for all restaurant purchases was my beloved Citi Forward Credit Card. I used to earn 5x Citi Thank You Points for all restaurant purchases, from fast food to fine dining. Unfortunately, Citi changed the card earnings on restaurant purchases from 5x to 2x, so I looked for a suitable replacement. The obvious choice was Chase Sapphire Preferred with 2x on restaurants, then along came the Chase Sapphire Reserve with 3x on restaurants. I tried to apply for the Chase Sapphire Reserve (twice!), and got declined (twice!) due to 5/24. I don’t have any other Chase credit cards that I want to convert / product change to a Chase Sapphire Preferred or Chase Sapphire Reserve either. With those sad facts, my search for a suitable restaurant credit card continued.

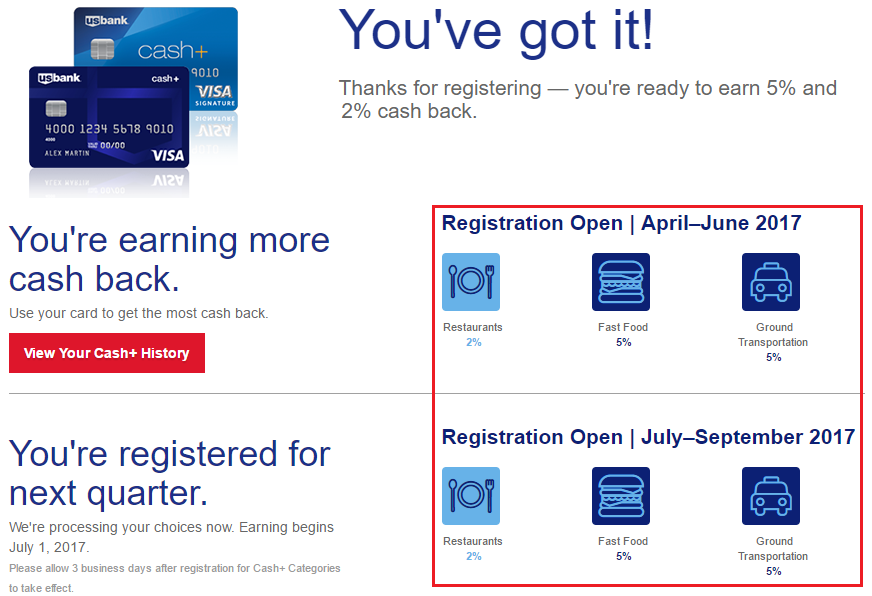

I was pretty happy using my US Bank Cash Plus Credit Card for restaurant purchases – earning 2% cash back at restaurants and 5% cash back at fast food restaurants. That was good enough for a few months until I got an email from US Bank that changed everything…

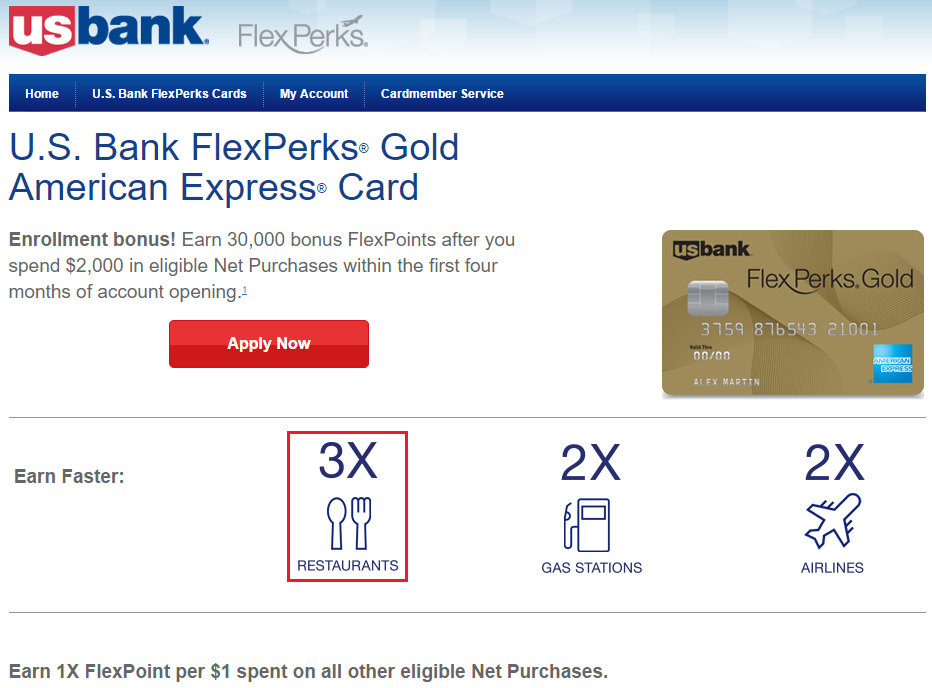

A few days ago, I received an email from US Bank regarding my US Bank FlexPerks Gold American Express Credit Card. I recently got that credit card as part of my March App-O-Rama and had already completed the minimum spending requirement and received my 30,000 FlexPoints. In the email from US Bank, they reminded me that the US Bank FlexPerks Gold American Express Credit Card earns 3x FlexPoints on restaurant purchases (all restaurants from fast food to fine dining), and each FlexPoint is worth ~2 cents if you redeem 20,000 FlexPoints for a ~$400 airline ticket. I am very good at finding flights that are $380-$400 each, plus the $25 airline credit you get when you redeem FlexPoints for airline tickets. Therefore, I will gladly take 3x FlexPoints with my US Bank FlexPerks Gold American Express Credit Card over earning 2-5% cash back with my US Bank Cash Plus Credit Card.

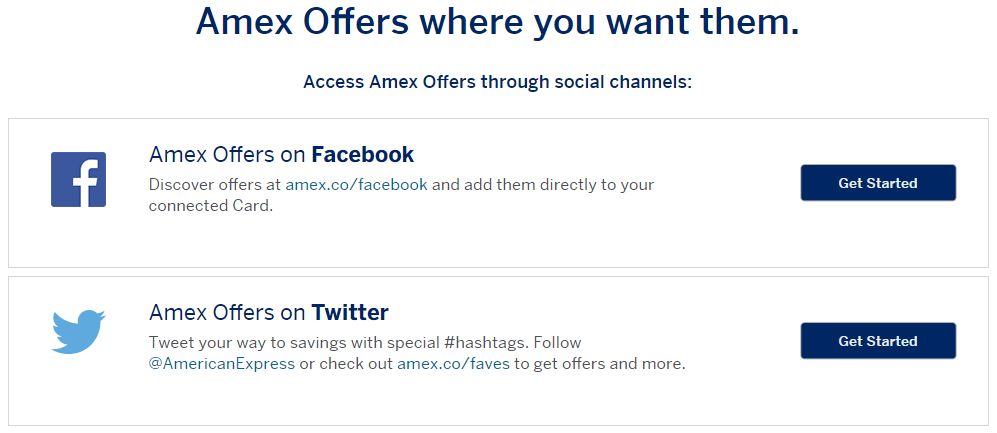

Since the US Bank FlexPerks Gold American Express Credit Card is a credit card that runs on the American Express payment network, you can enroll that credit card into AMEX Offers via Twitter and Facebook.

Just sign into your Facebook or Twitter account to start adding offers to your credit card.

The only drawback I can foresee by using my US Bank FlexPerks Gold American Express Credit Card is that not all restaurants accept American Express credit cards. This might happen on a few occasions, but I always carry my Citi Premier Credit Card with me, which is a MasterCard, and earns 2x Citi Thank You Points for restaurant purchases. Do you agree with my decision to use my US Bank FlexPerks Gold American Express Credit Card on all restaurant purchases for restaurants accept American Express credit cards? If not, which credit card do you use for your restaurant purchases? If you have any questions, please leave a comment below. Have a great day everyone!

I tried using this card when I first got it last year, but I sock-drawered it after realizing that a high percentage of my purchases weren’t coding as “restaurant.” Unlike other issuers, there’s no way to tell how or why something coded a certain way without calling. When I did that and went over a couple of statements, I learned that typically the only thing that counts is a traditional sit-down restaurant. These are places I (and apparently most Millennials) don’t frequent. QSRs, cafes, sandwich shops, food trucks, etc. don’t count. And seemingly any business that uses Square gets coded differently. USB is notoriously inflexible about offering credit in these situations, and this was no exception. I PCd CF to CSR, which I highly recommend for numerous reasons. Way better value for me, and it’s easy to see how things code immediately (plus Chase promptly credits if there’s a category issue).

All that said, I’m curious to hear your experience with the USB Gold Amex.

Thanks for the head up, Carl. I’ll see what my experience is with over the next month or so.

I have nearly all Gold Amex my restaurant purchase coded as a restaurant. Even those that are made using Square. The main. Exception is restaurant purchases in a hotel.

Thank you for the data points, Dave. That is good to hear :)

Do points apply to restaurants outside of the US? My amex PR does not

I believe some do but most international restaurants are not set up with the correct merchant categorization code (MCC) to tell the credit card that this business is a restaurant.

I received a pre-qual offer for this card recently that said in the fine print that the AF would be waived if you held another USB product (CC, mortgage, checking account, etc.). Is that new or has that been there a while?

I believe that is true. If you have a US Bank checking account and a US Bank credit card, you do not pay monthly fees on the checking account or annual fees on the credit card. I’m sure there are limitations on that too.

I have had this card for over a year. I dine out a lot, including significant business tabs. I love the 3x at restaurants, but I also found that some domestic restaurants do not code properly and MOST international do not. I have given up using this card outside the US, using my CSR instead.

I believe the fee is waived due to my other US Bank card.

THAnk you for the datapoints. I’m glad US restaurants track almost all the time and I’m not surprised by the low success rate for international restaurant purchases.