My recent opportunity in using secure messaging to request being matched to a better credit card offer turned out to be quite a learning experience. You see, I’d never used secure messaging before! I’m not sure how that’s even possible, even though it’s true, given that I’ve been a miles/points enthusiast for many years now. And it’s not because I’m anti-technology or shy away from online banking. Maybe when I’ve applied for credit cards, there were never better offers to match to. But this time there were!

When I heard about the Chase IHG Rewards Credit Card and the 100,000 point sign up offer, I asked Grant how to get it. Here’s how the conversation went.

- Me: How do I get Chase to match that offer?

- Grant: Send a request. Use SM.

- Me: You mean I send snail mail?

- Grant: No, SM is secure messaging!

- Me: Oops!

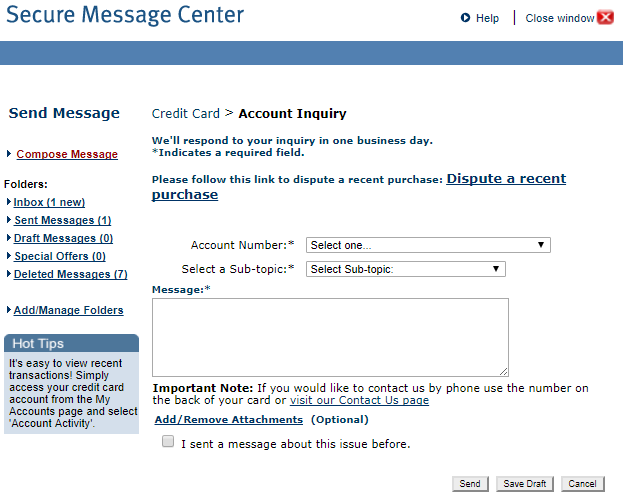

I don’t want to know what Grant was thinking after that :) I knew what secure messaging was and figured I could learn how to actually do it, but then I realized I had no idea what to say to get the best possible result, which meant Chase saying YES to matching the 100,000 point sign up offer. From what I’d read, it was a YMMV (your mileage may vary) situation, and I wanted my YMMV to result in a yes. I looked around for what the Boarding Area bloggers had to say about secure messaging best practices, but wasn’t satisfied with what I read. So I decided to personally reach out to some bloggers and see what advice they could give me to increase my chances of getting a favorable outcome.

Will at Doctor of Credit, Stefan at Rapid Travel Chai, and Adam at Point Me to the Plane taught me a lot. Here is some of their advice for when you ask to be matched to a much better credit card offer:

- It often depends on the bank. Will mentioned that American Express doesn’t match bonuses via secure messaging, so I was glad it was a Chase credit card I was looking to match. Apparently, most successful requests are with Chase. Will has a post about matching here.

- Act fast. Apparently everyone but me DOES use secure messaging, so banks can stop honoring matches without notice.

- Keep those requests short. Like two sentences or less. Just ask for what you want.

- Let them know when you applied for the credit card, and if you can attach a screenshot of the current higher sign up offer, do so.

- Always try to match, as you have nothing to lose.

These gems of advice got me ready to send my first secure message. I did as they suggested (but I did not attach a screenshot), added a few pleases and thank you’s, and sent my first SM. I got the message they had received my SM and that they’d get back to me. Grant said to be prepared to wait 8-12 hours for a reply. Within about two hours, I got a response to my SM. Boy howdy, I was nervous! I knew I’d be writing a post and letting you know either way about my result.

Success!! I got a yes :) I’d been matched to that offer, which meant a bit more spend in three months for the 100,000 points. Great news. I was also told to secure message Chase again when I completed my spend for them to match the offer. Now, I’m psyched as I’ll get to send my second SM soon!

Do you have any secure messaging best practices of your own? Have you had success matching to the better IHG offer? How about other credit card better offers, had success with those? I’m curious about the American Express ones too, if you’d ever tried to match those. Do you think the personal touch of calling gets better results than sending a secure message? I’m looking forward to hearing about your experiences!

Pingback: Daily Points: No More Boarding Passes Through TSA, Try Secure Message For A Higher Bonus, Free Lufthansa Miles and More! - Travel Miles 101

Pingback: Which Hotels Should I Book with my 100,000 IHG Points?

Pingback: IHG Flash Sale: 100% Bonus on Purchased Points (Expires September 29)

Pingback: Purchase IHG Points Before November 3 to Earn a 100% Bonus

Pingback: IHG Flash Sale: 100% Bonus on Purchased Points (Expires December 21)

Pingback: Get Matched to the New Chase IHG Rewards Premier 100,000 Point Sign Up Bonus