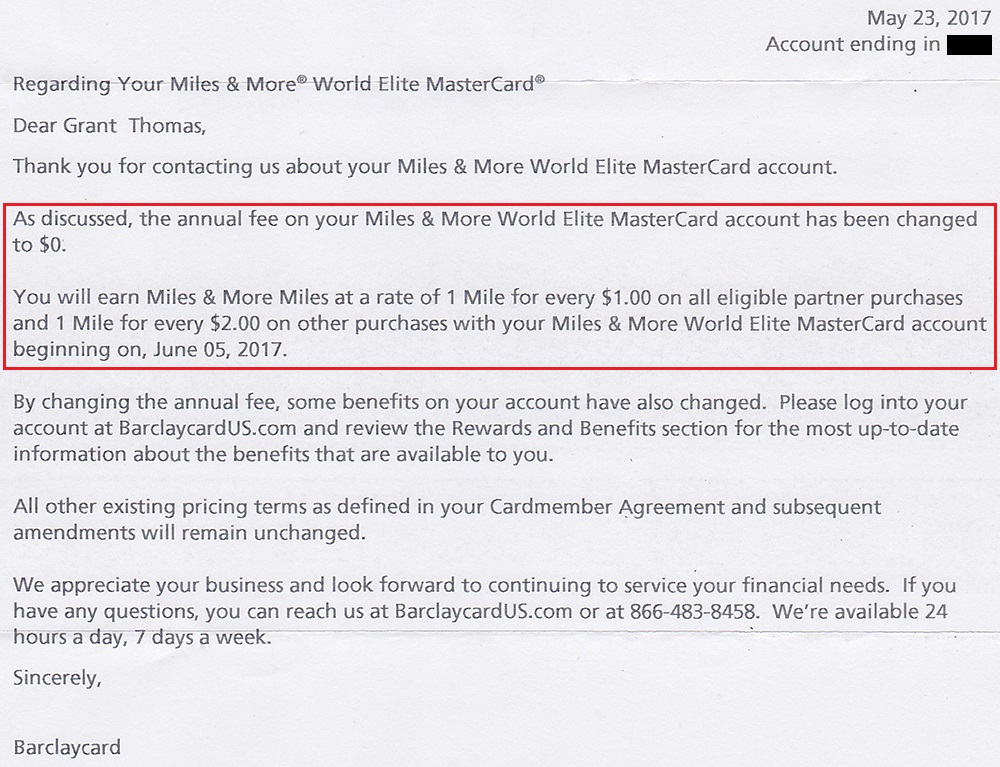

Good morning everyone, happy Memorial Day! A few days ago, I called Barclays to close my Barclays Lufthansa Miles & More World Elite MasterCard. The $79 annual fee was coming due soon and I barely spent any money on the credit card after completing the minimum spending requirements last year. After calling the number on the back of the credit card and explaining that I wanted to close the credit card because the annual fee was posting soon, the rep transferred me to a different department (I don’t remember the department name, but let’s call it the Barclays retention department). After explaining my situation to the second rep, she asked me if I would be willing to downgrading the credit card to a no annual fee version of the Barclays Lufthansa Miles & More Credit Card. Sure, I said, that sounds good to me. The downgraded credit card will earn 1 Lufthansa mile for every $2 spent and the conversion would be completed on June 5.

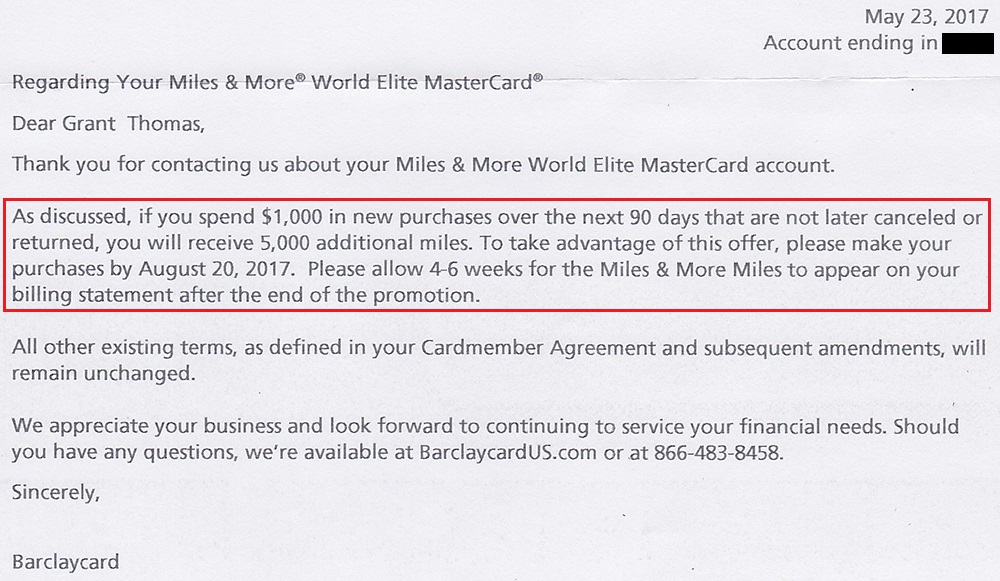

After downgrading my credit card, the rep told me that I had a targeted spending offer (similar to a retention offer). If I spent $1,000 or more in the next 90 days, I would get 5,000 bonus Lufthansa miles. So if I spent exactly $1,000, I would earn a total of 6,000 Lufthansa miles or 6 Lufthansa miles per dollar. I happily accepted the offer.

Since the targeted spending offer was effective immediately and the downgrade process would not be completed until June 5, I made sure to spend the full $1,000 before June 5, so I would earn 1,000 Lufthansa miles instead of only 500 Lufthansa miles if I made the purchases after June 5.

I already completed the $1,000 spending requirement, so now I just need to wait for my next statement to close and for the bonus Lufthansa miles to post. If I want to get another Barclays credit card in the future, I can always transfer some or all of the credit line from my Lufthansa credit card over to get the new credit card approved.

Have you received a targeted offer on your Lufthansa credit card? What about any other Barclays credit cards? Please share your data points below. If you have any questions, please leave a comment below. Have a great Memorial Day everyone!

Does the downgraded card also allow your LH miles to never expire with LH…like the regular card?

Good question, I believe so. As long as I keep earning miles with that credit card it should keep resetting the expiration date.

According to the first mail, the benefits of the cards change, and you can log in to review the updated benefits. Can you please check them out, to see the differences?

Since you didn’t know that you would be offered a spending bonus, why not just close the card, rather than having another card to keep track of and tying up available credit with Barclays?

That is a good point, but I had good luck last time when Barclays called me proactively and recommended that I move credit lines around to get approved for my recent Barclays Arrival Credit Card.

Lufthansa miles do not expire if you have the Premier Miles & More® World MasterCard® (or their co-branded credit card issued in select other countries) for at least three months, and make a minimum of one eligible purchase per month. If you cancel the credit card, the original expiration date applies again, though you do have until the end of the quarter to redeem them. – “FROM Lucky”

I have found that Barclay’s is usually willing to play “Let’s Make a Deal…” The key as you pointed out is to get to the “2nd rep.”

About 2 months ago, I called wanting a fee waived on one of my cards – I believe it was Jet Blue. The first rep was like – “…nothing we can do. Want to cancel? We can cancel.” He couldn’t care less. It wasn’t until I asked to speak to a supervisor that things changed for the better. While she was not willing to cancel the fee on the JBlue, she WAS willing to waive the up-and-coming fee on my Aviator Red. I think that I’ve waived the Aviator $89 fee now about 3 times. PLUS she gave me the JBlue promo, spend $1000, get 5000 JBlue points.

I always call every quarter and ask for the promo’s. It is always “Spend $1000 in 90-days and get 5000 (miles, points, etc.). And – if they give you the promo on one of your Barclay cards, they usually will give it to you on any other Barclay cards that you may have. They will also send a follow up letter confirming the promo.

The points or miles will not be awarded until the promo period has ENDED. It doesn’t go by whenever you make your spend – you still have to wait until the 90 day window has elapsed. It goes from the date on the letter. Read the wording in their confirmation letter very carefully; that explains it all. You should also be able to see the 5000 bonus miles post in the online Barclay account.

I’m really starting to like Barclay. They also have an “online” savings account that pays 1.05% interest, I think.

That’s awesome. I’m planning on putting my Barclays credit cards in the sock drawer for a few months and call to see what offers are available. Thanks for the tip :)

I’ve built up a small stash of JBlue; I hope to use them up to try the Mint class (when I don’t know). I really didn’t mind paying the annual fee because Barclays has given me a good bang for the buck. Let’s hope it continues. Have you ever flown Mint?

No Mint for me either. I can’t justify the price in points compared to a cheaper economy ticket.

I got the Miles & More card in October 2021. There was a promotional offer of 50 Thousand miles if I spent $3000 in three months. I completed that requirement in December and still have not received the 50,000 miles promo credit. I’ve called them twice, the last time being in March I believe. What gives? Who can I take this to?

Hi Harvey, something is definitely wrong. Can you double check that you spent more than $3,000 in the first 3 months excluding the annual fee and any returns? I would keep contacting Barclays until you get this issue resolved.