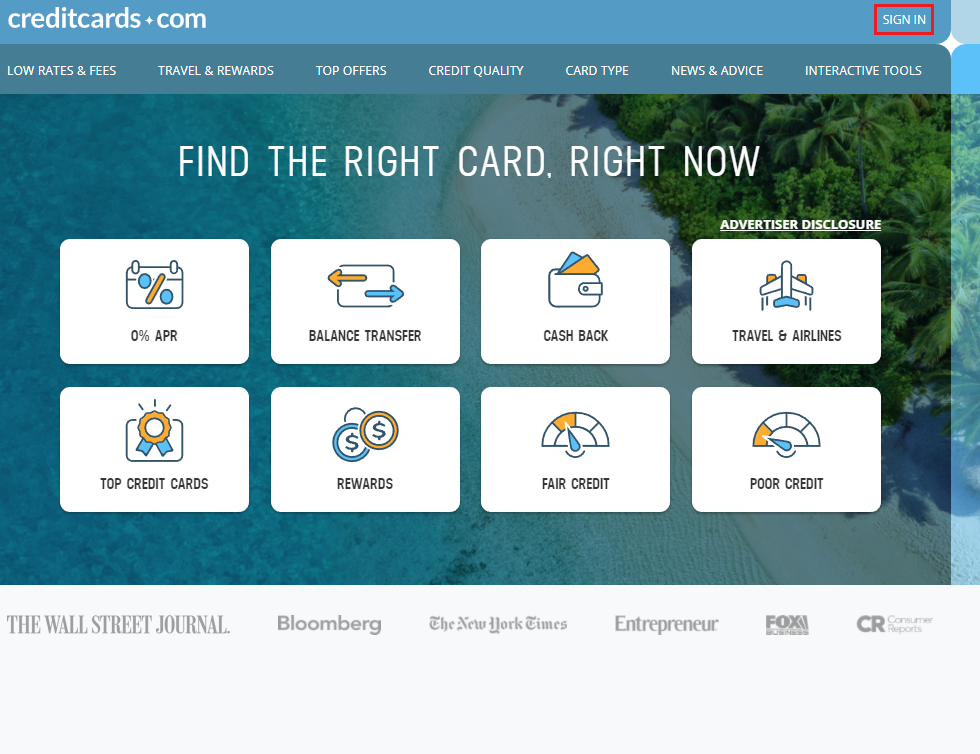

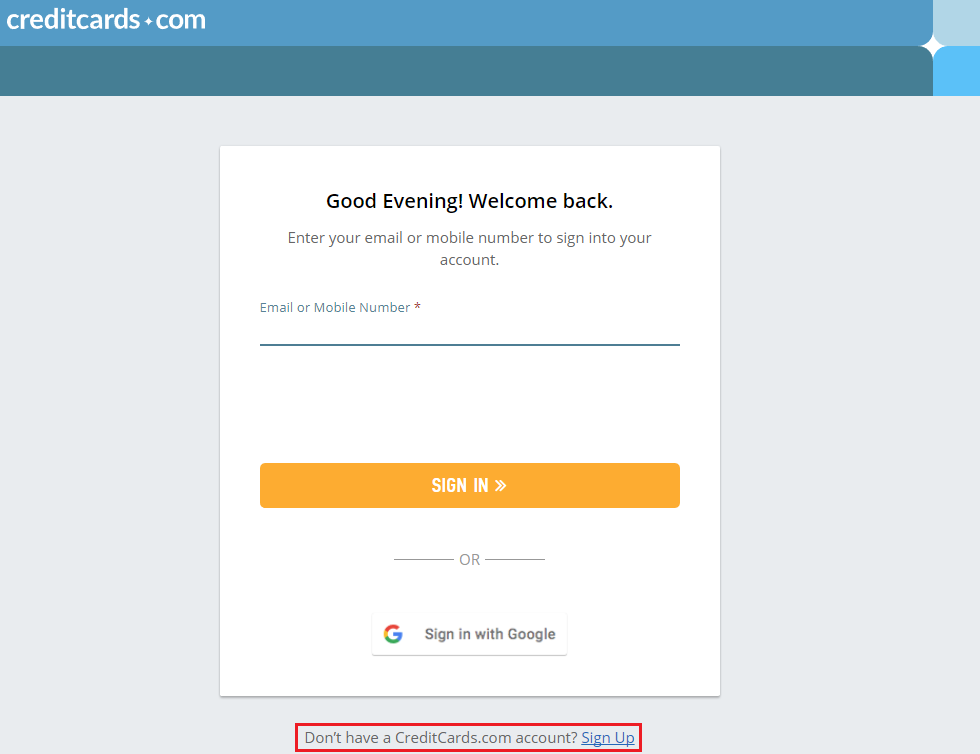

Good morning everyone. I’m not sure how long this has been around for, but CreditCards.com just launched their own free credit monitoring / credit scoring / credit reporting service. I decided to sign up for the free service and see how it worked (and compare the service to Credit Sesame, Credit Karma, and free Experian credit monitoring). If you want to create a free account, click here. To get started, click the Sign In link in the upper left corner of the page. Then click the Sign Up link at the bottom of the page.

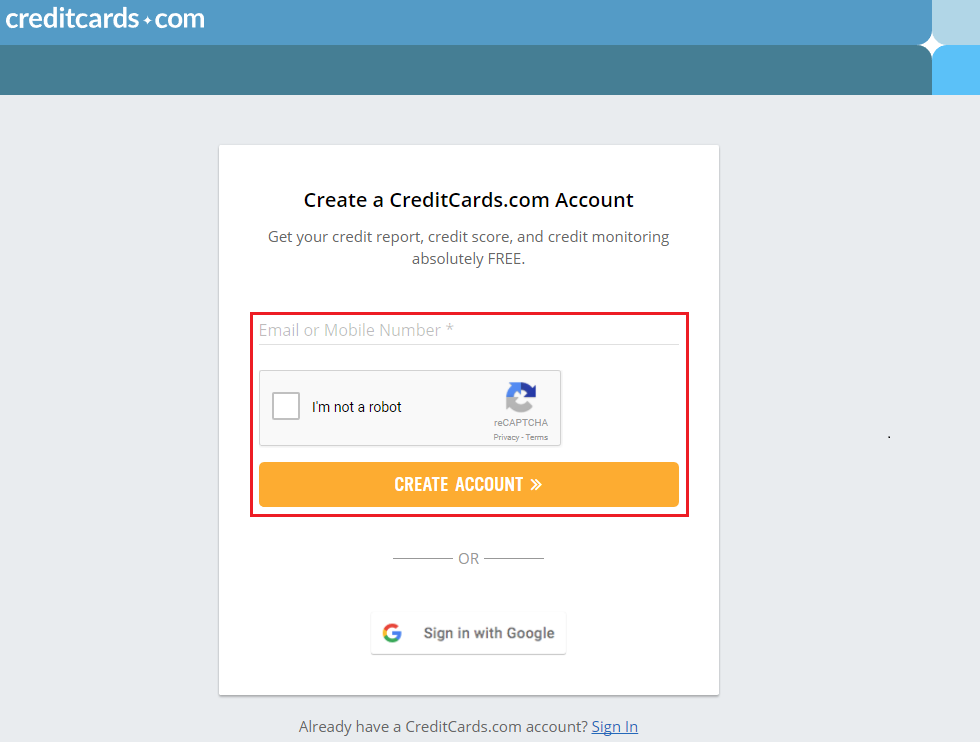

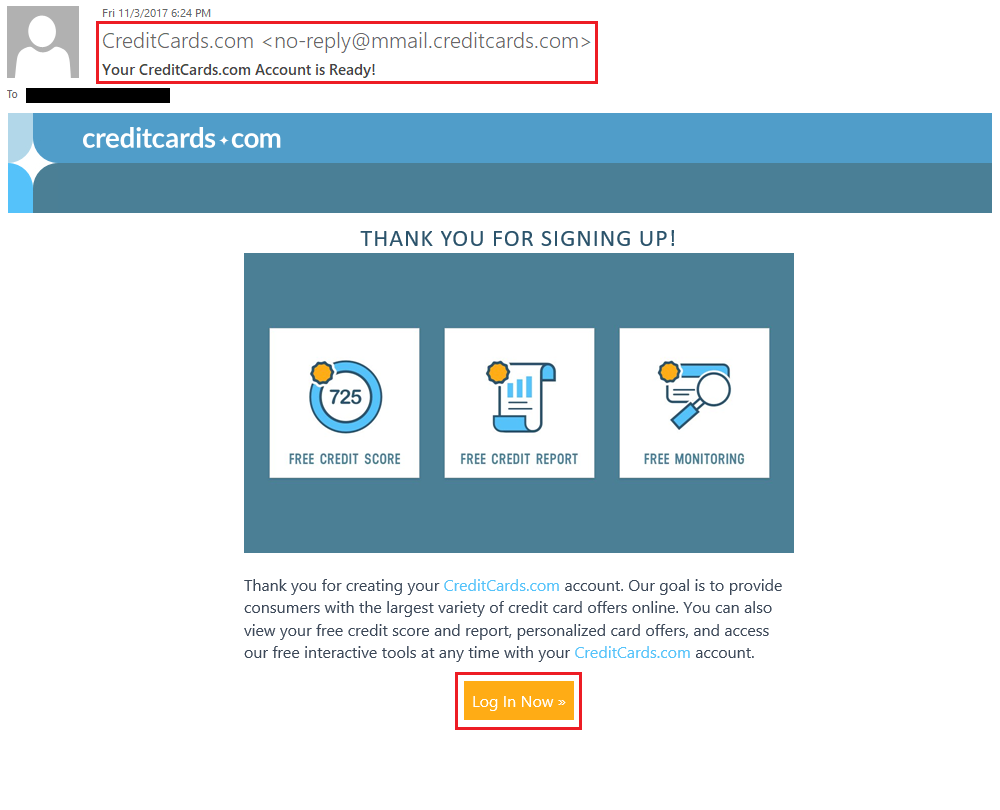

Enter your email address, check the box and click the Create Account button. Then check your email, enter the verification code from your email, and click the Verify Code button.

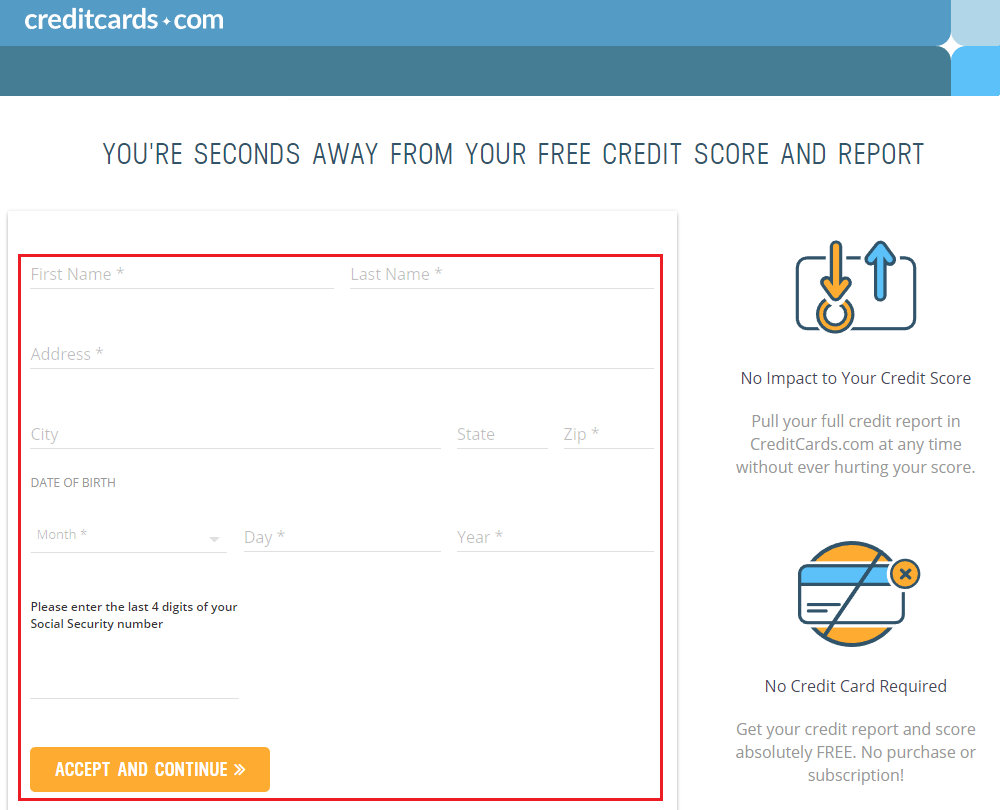

Fill in your personal information and click the Accept and Continue button. Congratulations, you just signed up for free credit monitoring service with CreditCards.com.

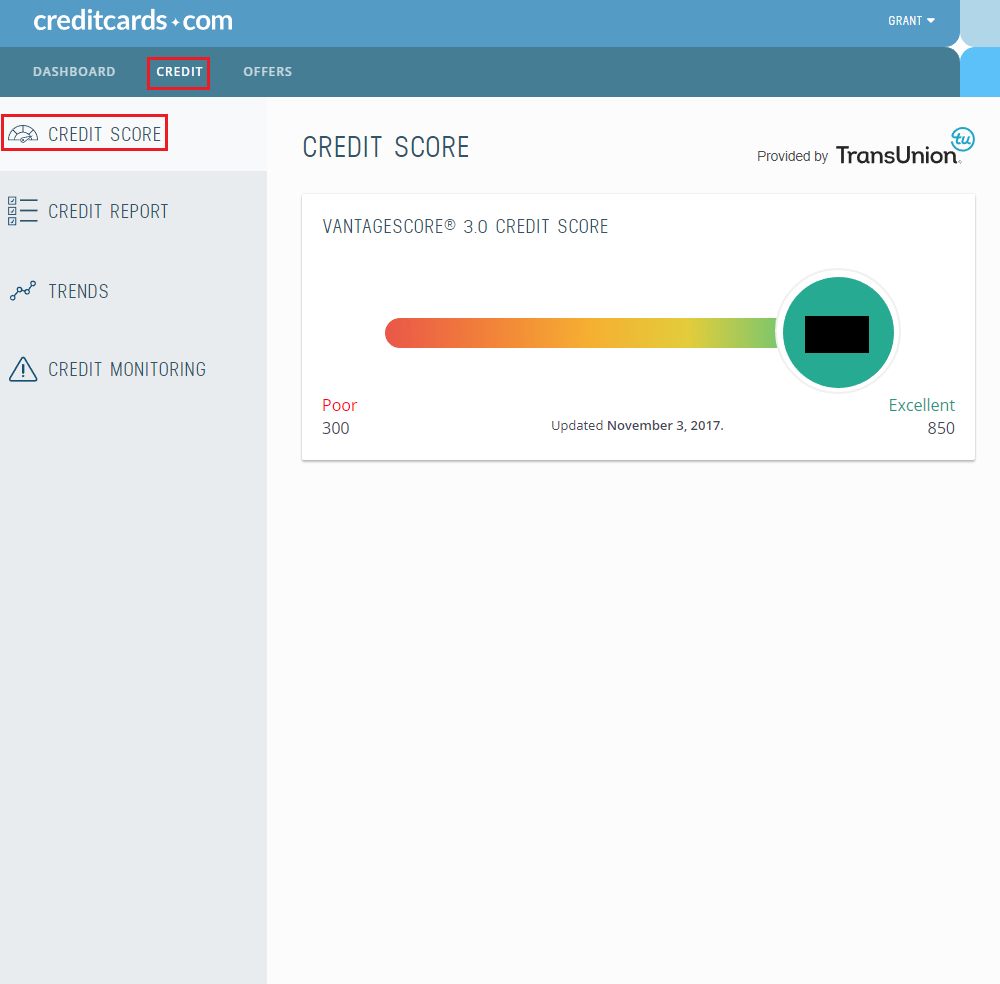

On your dashboard, you can see your TransUnion VantageScore 3.0 Credit Score, along with a few other pieces of information about your credit score. If you click the Credit link and then click the Credit Score header, you can see your current credit score. This will only show your current credit score.

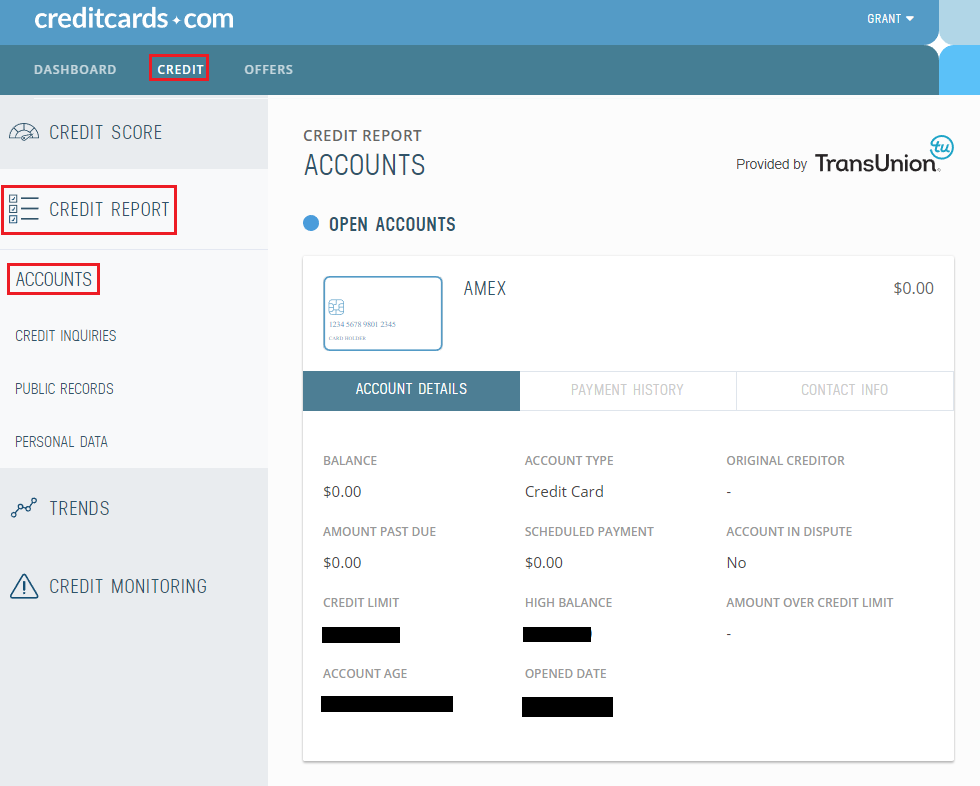

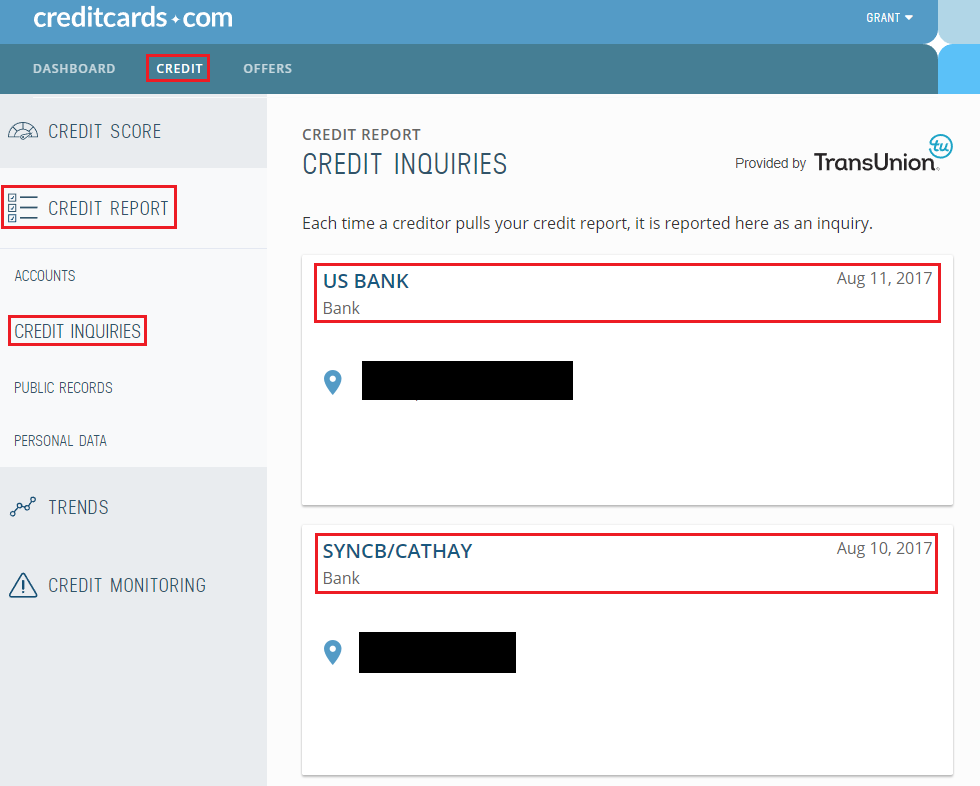

If you click the Accounts link under the Credit Report header, you can see all the credit card information on your credit report. You can view recent credit inquiries by clicking the Credit Inquiries link under the Credit Report header.

If you have any public records, you can view them by clicking the Public Records link under the Credit Report header. You can also view what personal data is attached to your credit report (names, aliases, addresses, and jobs) by clicking the Personal Data link under the Credit Report header.

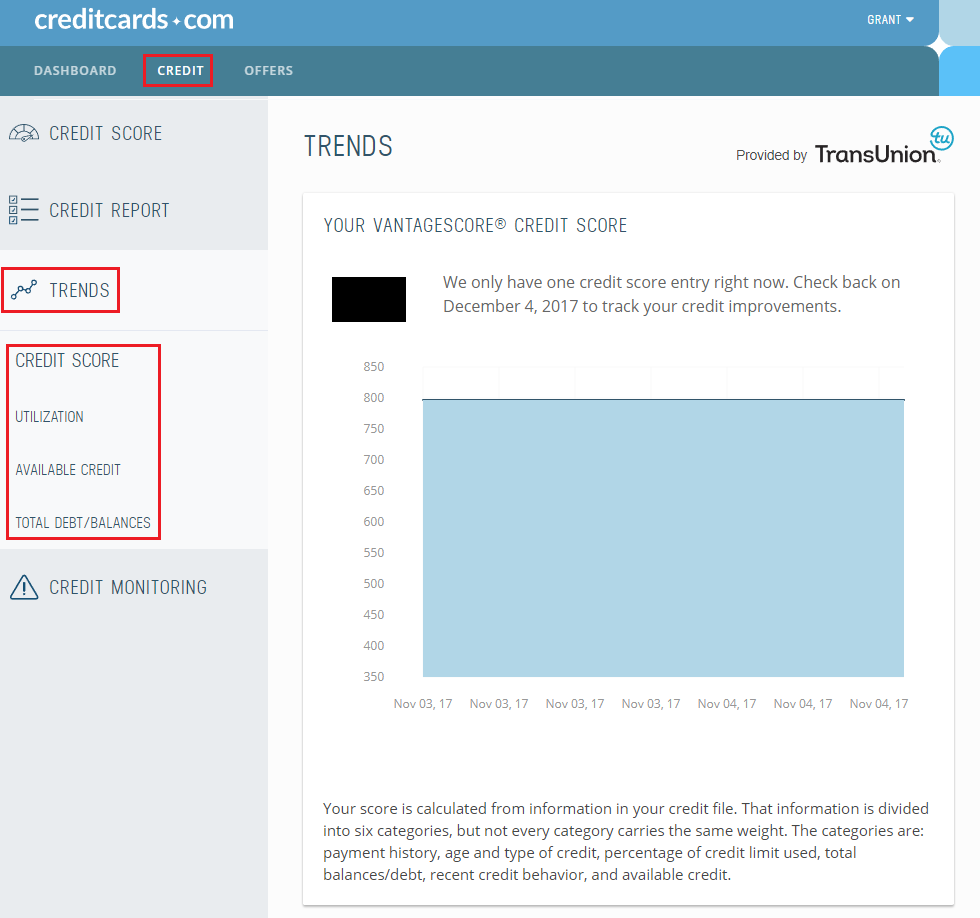

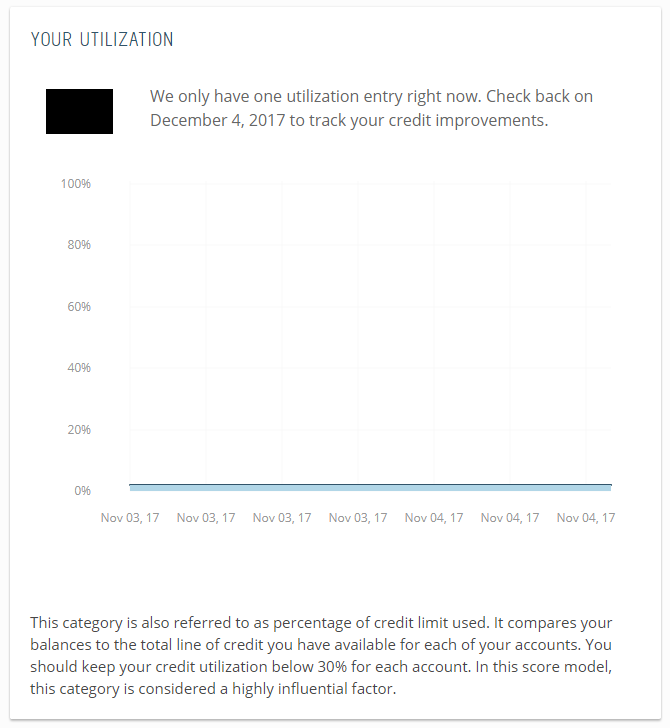

Moving on to the Trends header, you can view your credit score, credit utilization ratio, total available credit, and total debt/balance changes over time. A high credit score is good and a low credit utilization ratio is good (what percent of credit you use divided by the total credit given to you by all banks).

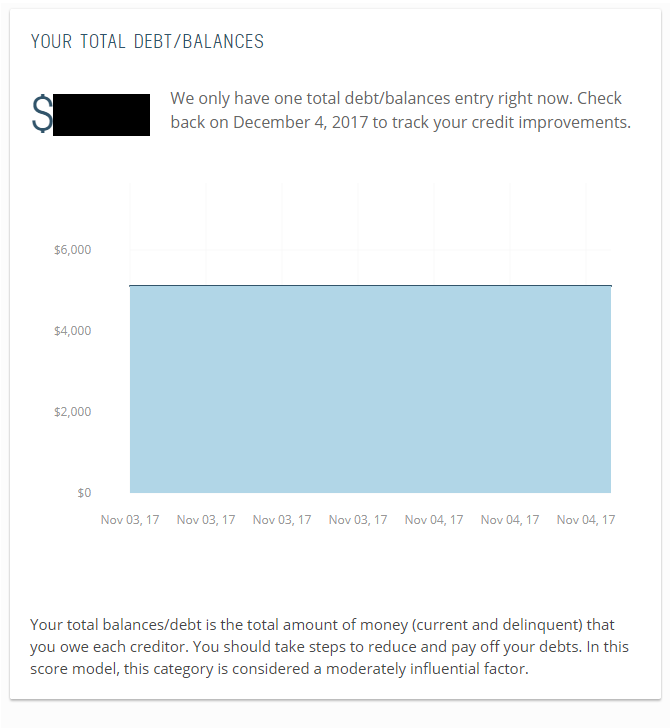

Your total available credit is what is used to calculate your credit utilization ratio, so a higher number is better. You can also see how much “debt” or balance you have on your credit cards. If you pay all your credit card bills in full every month, you do not need to worry about this section.

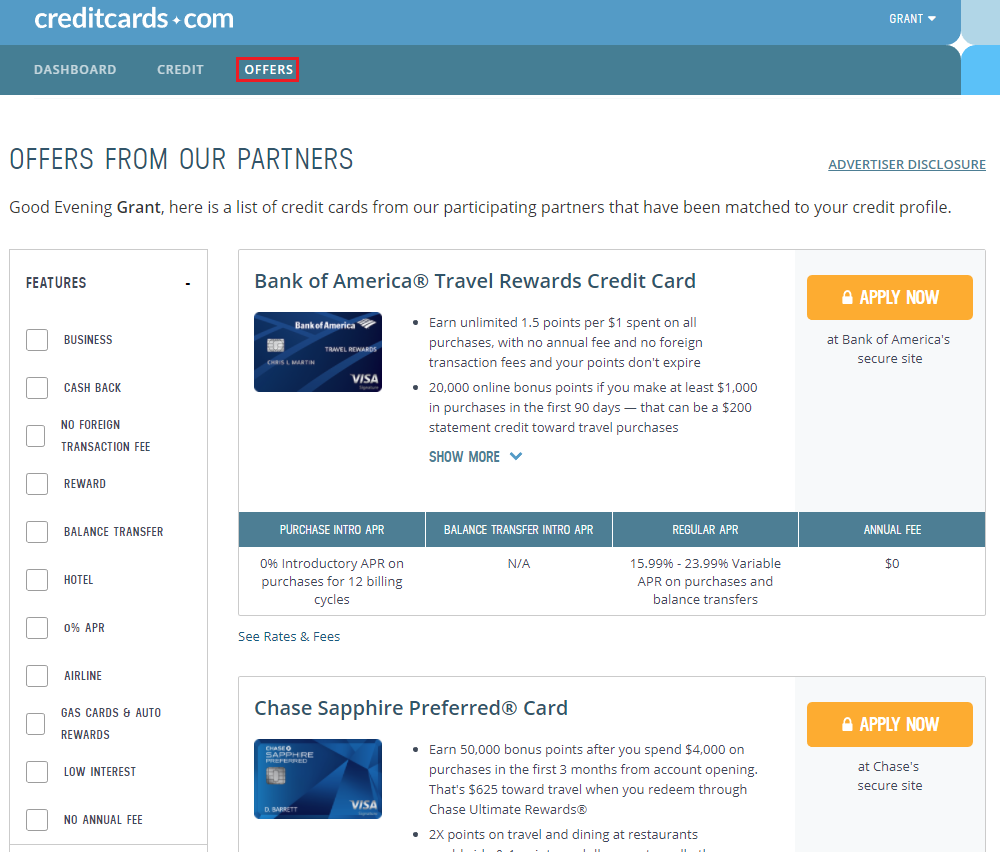

If you have any credit monitoring alerts, you will see those by clicking the Credit Monitoring header. Lastly, if you click the Offers link, you will see credit card offers. You may see targeted credit card offers, but I am not 100% sure.

As far as a comparison to Credit Sesame, Credit Karma, and free Experian credit monitoring, it looks like CreditCards.com offers the same type of credit reporting and credit monitoring data. The layout is a little cleaner, in my opinion, but there is nothing amazing here. If you have any questions about the service, please leave a comment below. Have a great day everyone.