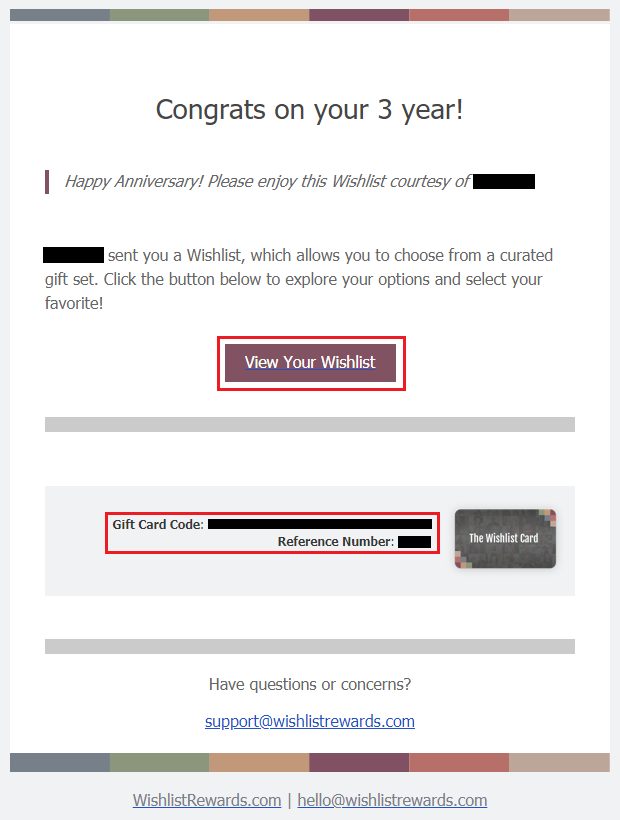

Good morning everyone. This post will not be very useful to most people, but if I can help 1-2 people, I will be happy. Wishlist Rewards is a service that companies use to thank their employees (employee appreciation gifted experiences). For example, my company provides gifts to employees on their work anniversary. Instead of giving the same gift to everyone, they hired Wishlist Rewards to fulfill experience gifts (intangible gifts like show tickets, massages, sunset sailboat rides, whitewater rafting and much more). In this post, I will show you how to maximize the value you get from Wishlist Rewards. Here is the email I received from my company congratulating me on my 3 year work anniversary. I clicked the View Your Wishlist link to explore the possible experiences.

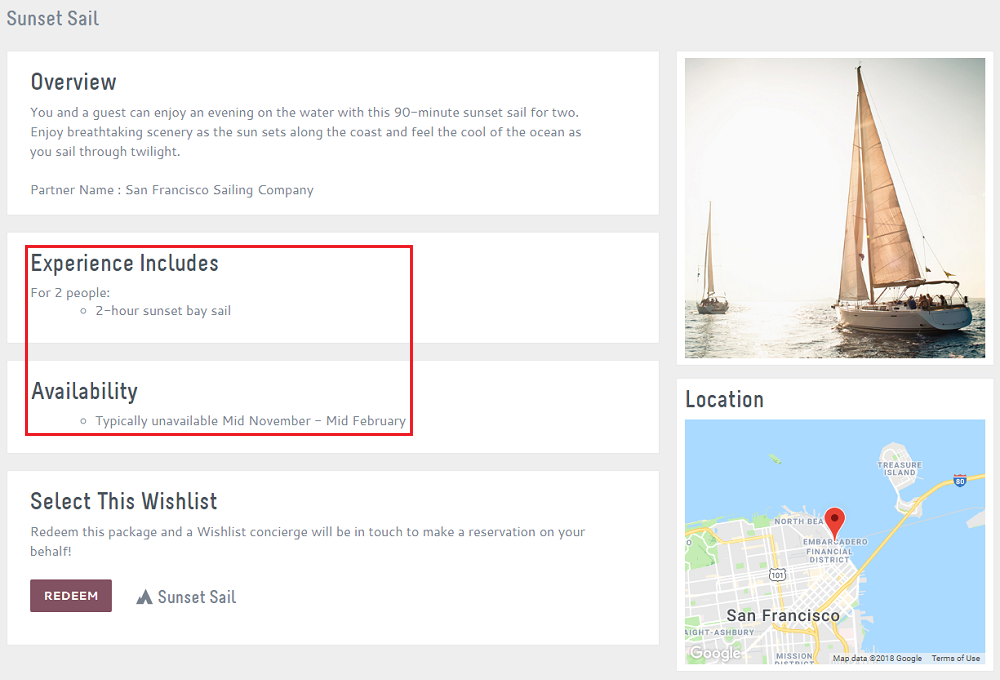

There was a wide variety of experiences, but my top 2 choices were a sunset sail with my girlfriend around the San Francisco Bay or whitewater rafting with my brother. Both were good experience gifts, but I was hoping to find a gift that I was going to buy anyway. I searched on Wishlist Rewards for several cities around the US, but I couldn’t find anything that would be an amazing gift. I decided to hold off booking anything until I found the perfect gift.

Then last month, I received an email from my HR department stating that Wishlist Rewards was taxable:

Hello,

You are receiving this email because you have received a gift from Wishlist Rewards sometime between January 1 – March 31, 2018. Your Wishlist gift is taxable income, and you will see the value of your Wishlist gift on the next payroll, 4/30/18, with an earning description of “Service Award” and an offsetting deduction of the same amount with a description of “Service Award Offset.” Please note that the calculated tax applicable to your award will be withheld from your regular pay to cover the tax liability of the Wishlist gift and will be appropriately recorded as part of your 2018 taxable earnings.

If you have not yet redeemed your Wishlist gift, please make sure to do so! For any questions regarding your actual Wishlist gift, please reach out to support@wishlistrewards.com.

We hope you have been enjoying the service recognition and experiences provided by Wishlist!

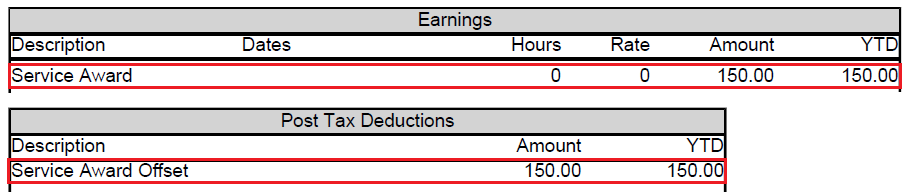

I then viewed my latest paycheck online. I saw a $150 Service Award (taxable) and an offsetting Service Award Offset amount. I don’t really know what the tax implications are, but I found out that the value of the gift was equal to $150.

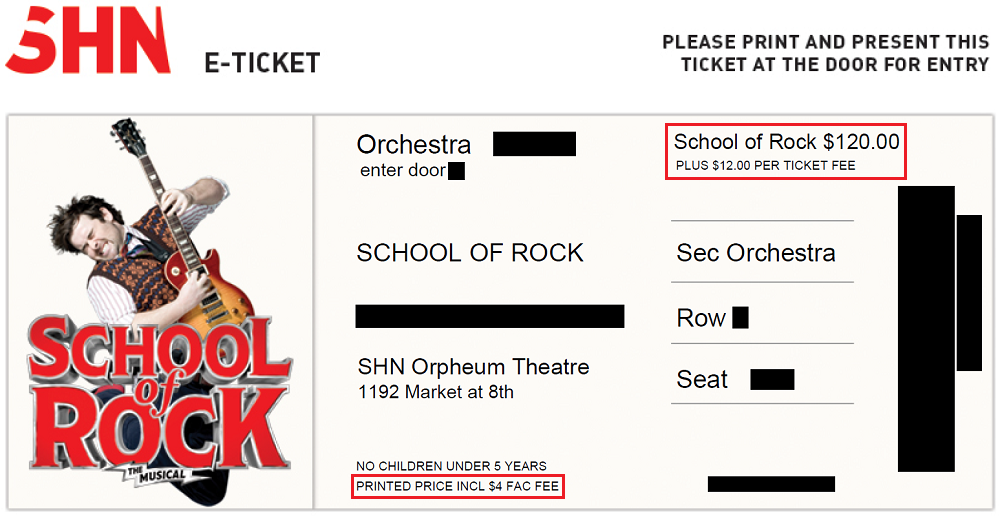

I then contacted Wishlist Rewards (support@wishlistrewards.com) and asked if I could redeem my gift for a $150 gift card (perhaps Amazon?), but they said no. I then asked if I could find an experience under $150 and send them the link to purchase the experience. Yes, that was possible. Now, I just had to figure out what experience I wanted that was under $150. San Francisco has a ton of experiences, but I finally decided on seeing “School of Rock the musical” at the SHN Orpheum theatre in SF. Orchestra seats were $136 all in after fees. I found 2 seats together and emailed the link to Wishlist Rewards. I told them to purchase 1 of those seats (for me) and I would pay for the other seat (for my girlfriend). After a short phone call to Wishlist Rewards to confirm all the details, my ticket was purchased. I then immediately bought the seat next to me for my girlfriend. The agent was very friendly and forwarded the PDF ticket to me. I would have purchased both seats, since I really wanted to see this musical, so Wishlist Rewards saved me $136. Sweet!

If your company uses Wishlist Rewards or a similar employee appreciation gifted experience, see if you can book an experience that is not listed on the website. If you have any questions, please leave a comment below. Have a great day everyone!