Good morning everyone. I know what you’re thinking… another Hilton post!? Yes, I’m sorry for all the Hilton love lately, but I promise this post is worth it. As you know, I was recently approved for the American Express Hilton Business Credit Card during my Mini July App-O-Rama. I was refreshing my Award Wallet account this afternoon and noticed that my Hilton account balance went up 100,000 Hilton Points. I logged into my Hilton account and saw that the 100,000 Hilton Points from my American Express Hilton Business Credit Card had just posted. Wippie! That was fast. I then logged into my American Express online account to see just how fast the 100,000 Hilton Points posted to my account.

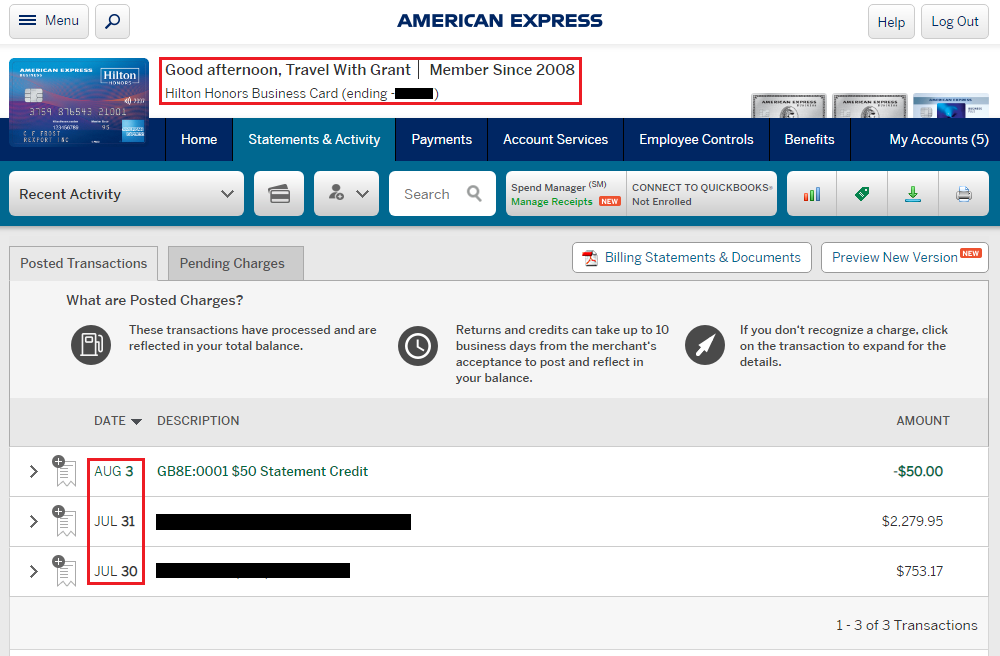

I completed the $3,000 minimum spend requirement on July 31 and received my $50 statement credit after my first purchase on August 3. It looks like the 100,000 Hilton Points posted 4 days after meeting the minimum spend requirement. Wow, that was fast!

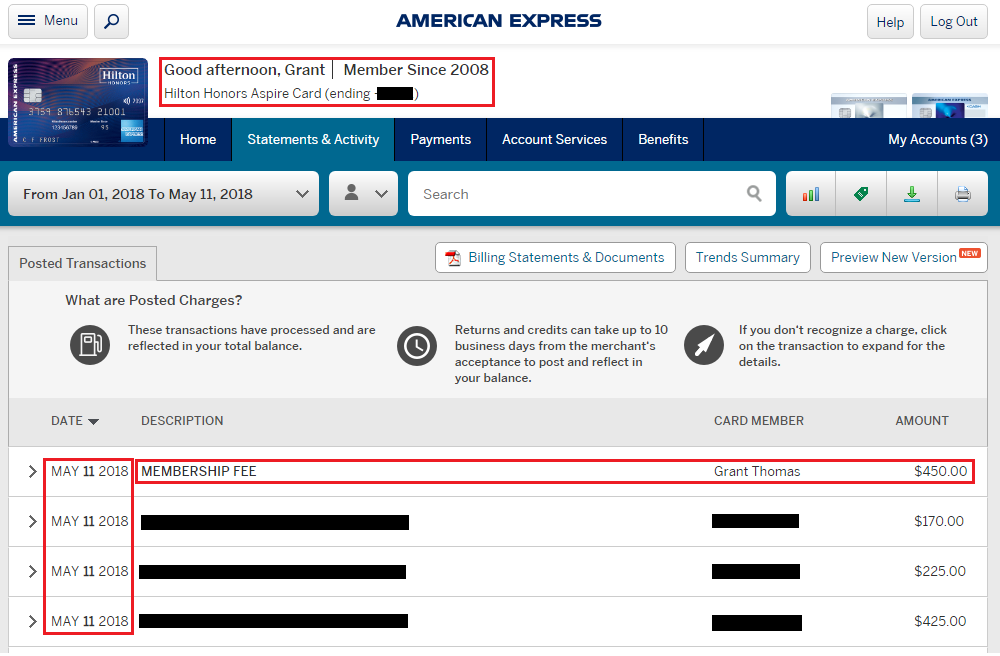

A few months ago, I also picked up another 100,000 Hilton Points when I got the American Express Hilton Aspire Credit Card. Those 100,000 Hilton Points posted on May 15. How many days before then did I meet the minimum spend requirement?

I checked my American Express online account and found out that my first statement closed on May 11, the same day I completed the $4,000 minimum spending requirement. It looks like the 100,000 Hilton Points posted 4 days after meeting the minimum spend requirement. Wow, that was fast!

Based on these 2 data points, it looks like you should receive your sign up bonus Hilton Points 4 days after you complete the minimum spend requirement. It might be +/- 1 day, if there are weekends or holidays in there too, but definitely within a week. That is much faster than other hotel sign up bonuses. Have you noticed anything similar with your American Express Hilton credit cards? If you have any questions about the American Express Hilton credit cards, please leave a comment below. Have a great day everyone!

I get a few cards and then get declined by all for too many. How do you get around that?

I wait 3+ months between applications and have good relationships with the credit card companies. I keep most new CCs around 11-12 months before closing, or pay the AF if the CC is worth keeping long term.

Have you closed your cards before a year, or only meet minimum spend? I’ve kept a no fee Hilton card and put a spend on it once in awhile. I also don’t cancel before a year, when fee comes. Think now I may need to make more than minimum spend on these cards. Every bank is cracking down on churners.

Mine posted about 4 days after I met the minimum spend on Aspire. Statement doesn’t close until 17th. Nice!

Gotta love fast posting sign up bonuses!