Good morning everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or credit card drawer). In today’s post, I will share my thoughts regarding my Citi AT&T Access More Credit Card. I actually have 3 different Citi AT&T Access More Credit Cards, but my decision to keep, cancel, or convert all 3 credit cards is the same. A few weeks ago, the $95 annual fee posted to my account. This credit card is no longer available for direct applications, but you can convert from other Citi credit cards to the Citi AT&T Access Credit Card (no annual fee) and then upgrade to the Citi AT&T Access More Credit Card ($95 annual fee). I love these Citi AT&T Access More Credit Cards and I will show you why I keep these credit cards year after year.

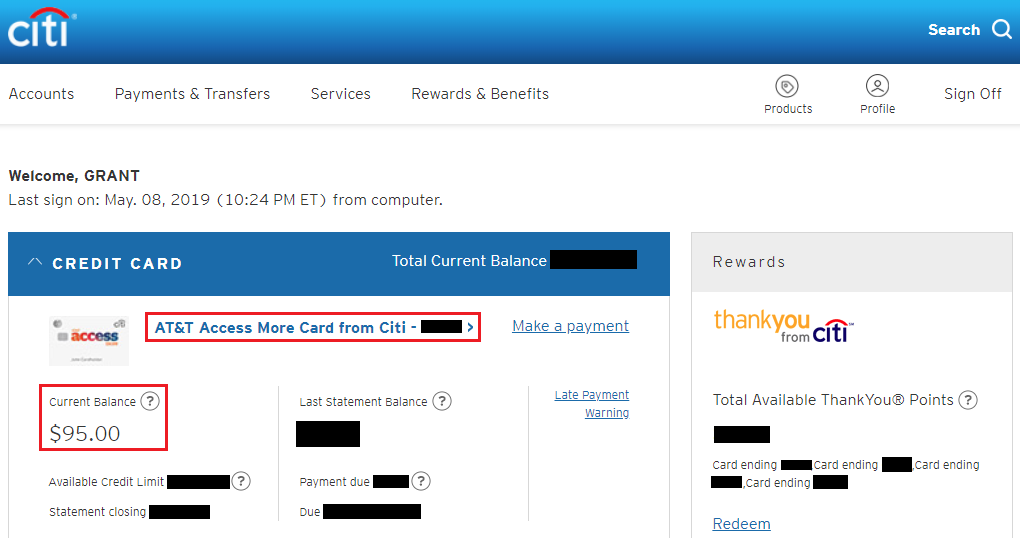

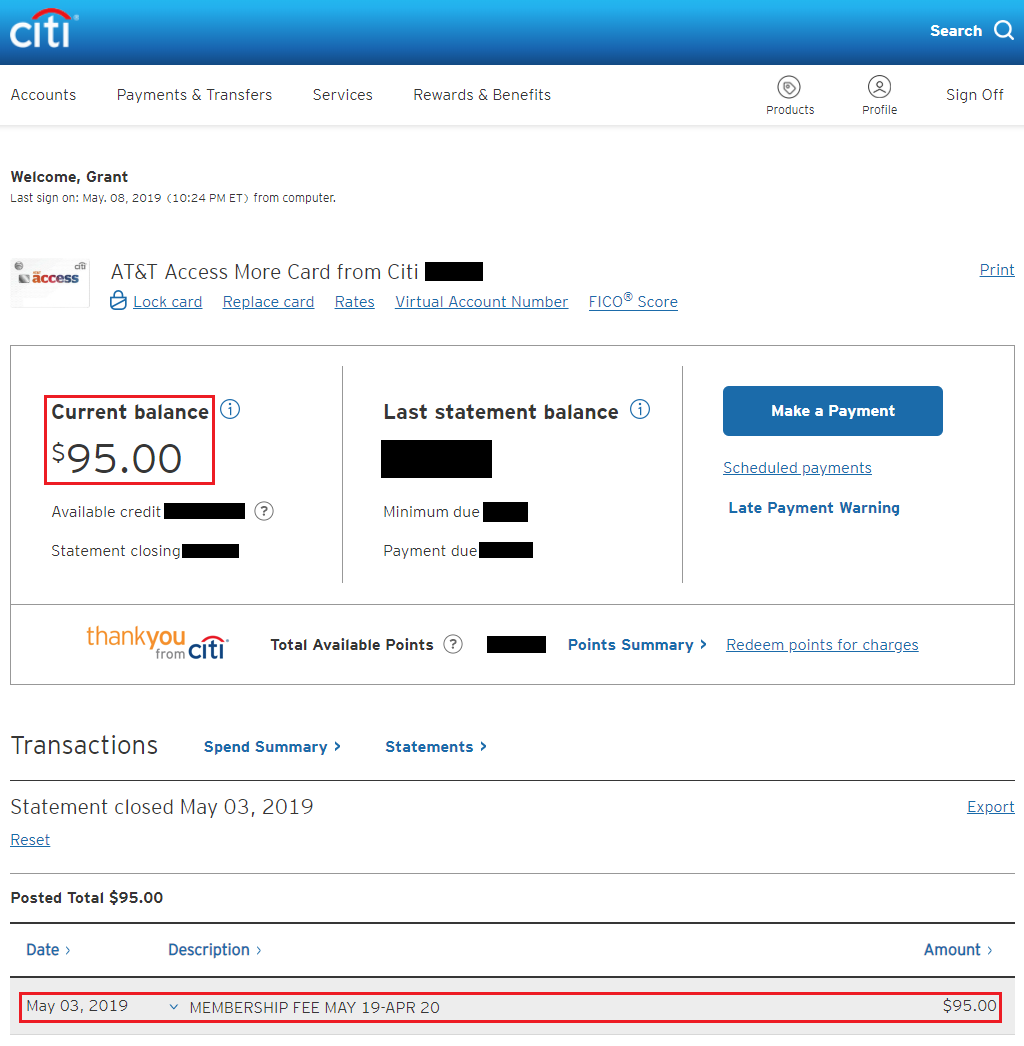

My $95 annual fee posted on May 3, 2019.

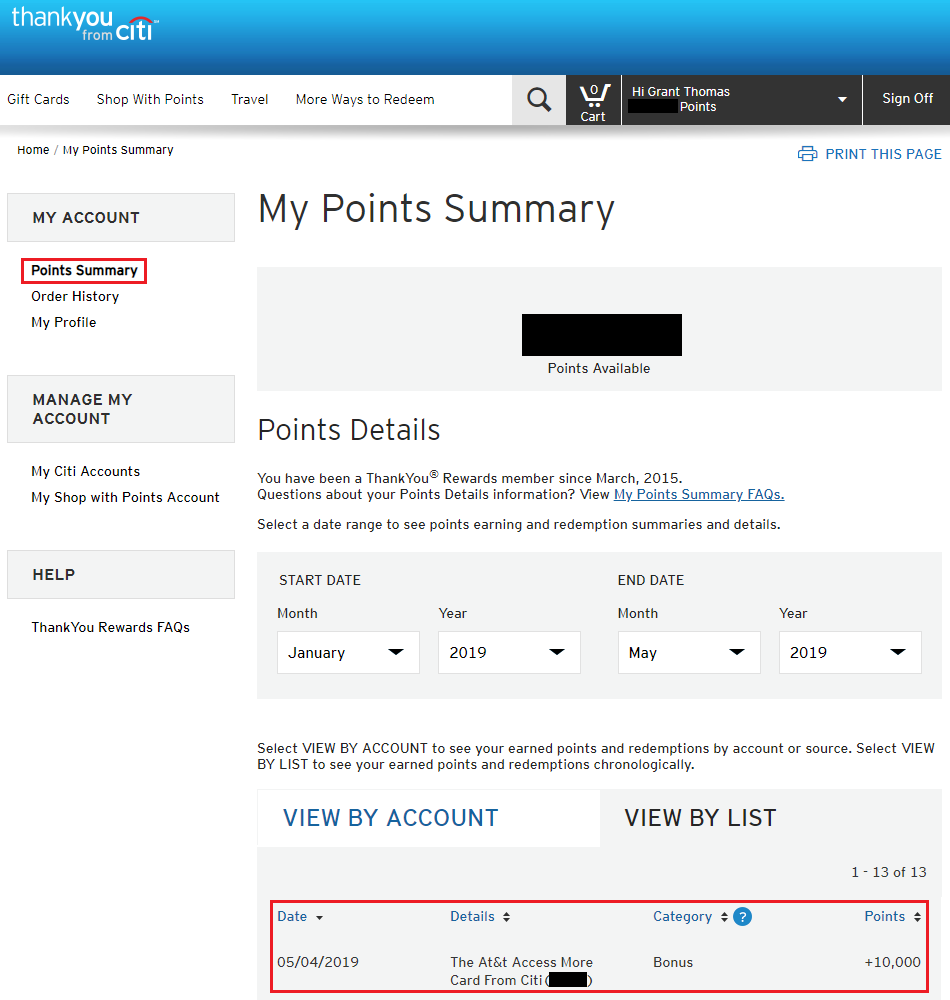

Every year when you spend $10,000+ on your Citi AT&T Access More Credit Card, you get 10,000 bonus anniversary Citi Thank You Points. My 10,000 bonus Citi Thank You Points posted on May 4, 2019.

I spend a little more than $10,000 every cardmember year (not calendar year) on my Citi AT&T Access More Credit Card and earn 3x for my online purchases. That credit card spend earns 30,000 Citi Thank You Points. With the 10,000 bonus Citi Thank You Points I earn every anniversary, I earn 40,000 Citi Thank You Points every year on every Citi AT&T Access More Credit Card and it only costs me a $95 annual fee. $95 annual fee / 40,000 Citi Thank You Points = 0.24 cents per point (CPP). That is a great deal for Citi Thank You Points and I usually transfer the points to my Avianca LifeMiles account to book award tickets.

I already planned on keeping this credit card open, but I called Citi to see if they could waive the annual fee or provide a decent retention offer. My argument was that I have 3 Citi AT&T Access More Credit Cards and I would love to get the annual fee waived on one of the credit cards. Unfortunately, that didn’t reason didn’t work, so I thanked the agent for checking my account and told her that I would keep the credit card open. If you spend significantly more than $10,000 on the Citi AT&T Access More Credit Card, you might get a decent retention offer like my friend Craig at Middle Age Miles.

If you have any questions about the annual fee or anniversary bonus Citi Thank You Points, please leave a comment below. Have a great day everyone!

I finally canceled this card after having it for few years. We used to own a business which requires us spending $50k a month at local Costco. I used to buy $20k worth of costco cash cards online to earn 3x but after selling the business I can hardly put $10k on this card yearly. Plus I have a US Bank Altitude card which earns 3x points using apple pay at the costco store, for personal use it seems it’s less hassle than buying cash cards online and then use at the store. Plus I never can figure out which online stores will get you 3x. It’s certainly not anything you buy online. I don’t want to guess and take chances. Flex points can’t be transferred to airlines like premier TY points are but they can be redeemed for fixed 1.5 cent per point on any travel expenses. But if you are buy ton of stuff online for reselling and getting 3x points, you should keep it.

The US Bank Altitude Reserve CC 3x on ApplePay is a great feature and I’ve used it a few times at Costco too.

Hey Grant – Thanks for the link! I’m sorry you didn’t get a retention offer on the card. I was hoping that a little over $10k spend would be enough to get a good one. Our spend was indeed much higher, although a lot of it was inorganic. Fingers crossed for when your next ATTAM card comes up for renewal!

It’s a little tricky since I spend $10k on each ATTAM CC, so at least $30k across those 3 CCs. I can try spending a few thousand more on the next ATTAM CC and see what happens.

The other option is the BoA Cash Rewards with Preferred Rewards.

Also a good option, thank you Jeremy.

I love this card. I took your advice and did a PC to it and it’s been a fabulous card. I did get a retention offer of extra 2 TY pts up to 35k (sorry you didn’t get one).

The quirks just take some getting used to. I do check that flyertalk page about this card to see what qualifies and what doesnt. That helps me understand when certain things don’t work. Of course there are always a few that don’t work, but hard to argue with the 3 TY pts + cashback portal. Gives me very little incentive to ever buy stuff in store.

Combining this card with the Mileage X App also yields some extra United miles since you can sometimes buy a gc for exactly the amount you need if that store is available.

I’m glad you were able to product change to the ATTAM CC. I agree, the 3x online purchase category is a bit confusing, but overall, the CC is great.

I have been to Spain many times and this is the first time that when I use my credit cards it asks me if I want it in euros or dollars. I have been checking off euros thinking that the credit card company will convert it to dollars without a fee like it always has done. My friend says no. That I should check dollars Any opinion on this?

Always use the local currency (Euros) when traveling. You will get the best exchange rate on your CC.

Pingback: Citi AT&T Access More Card Seems to Be Completely Unavailable for Product Changes – Middle Age Miles