Good morning everyone, happy Friday! I just received my Wells Fargo checking account statement and noticed a few changes to how the $10 monthly service fee will be waived on the Wells Fargo Everyday Checking account, effective October 8, 2020. Here is what the statement says:

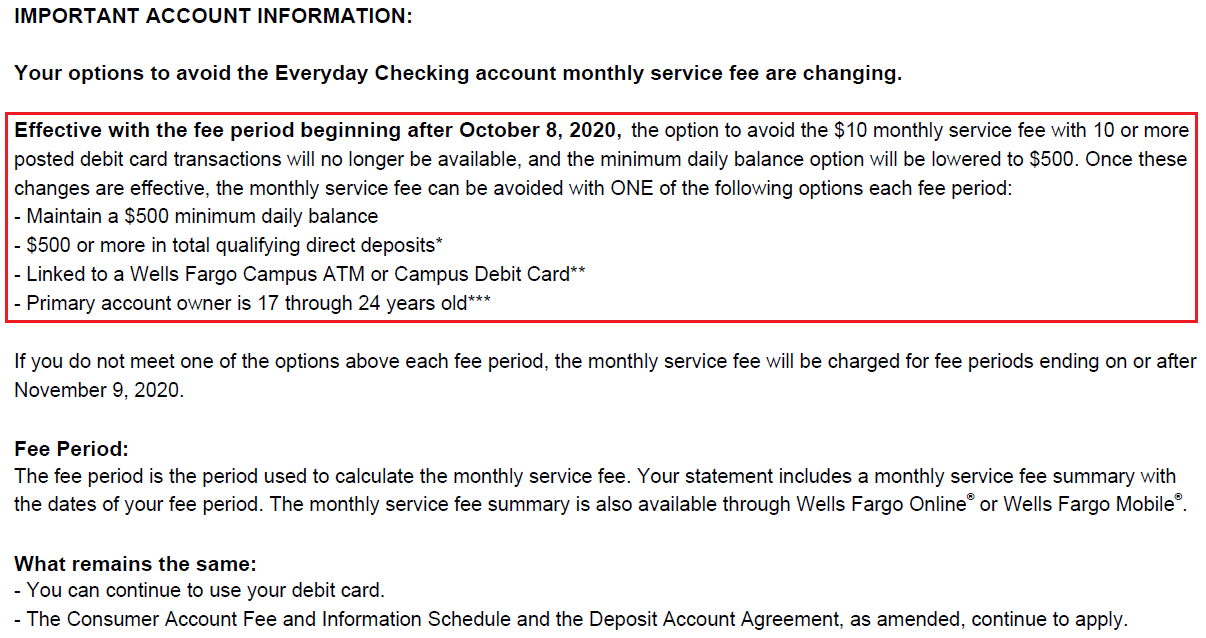

Effective with the fee period beginning after October 8, 2020, the option to avoid the $10 monthly service fee with 10 or more posted debit card transactions will no longer be available, and the minimum daily balance option will be lowered to $500. Once these changes are effective, the monthly service fee can be avoided with ONE of the following options each fee period:

– Maintain a $500 minimum daily balance

– $500 or more in total qualifying direct deposits*

– Linked to a Wells Fargo Campus ATM or Campus Debit

Here is a screenshot of the new changes:

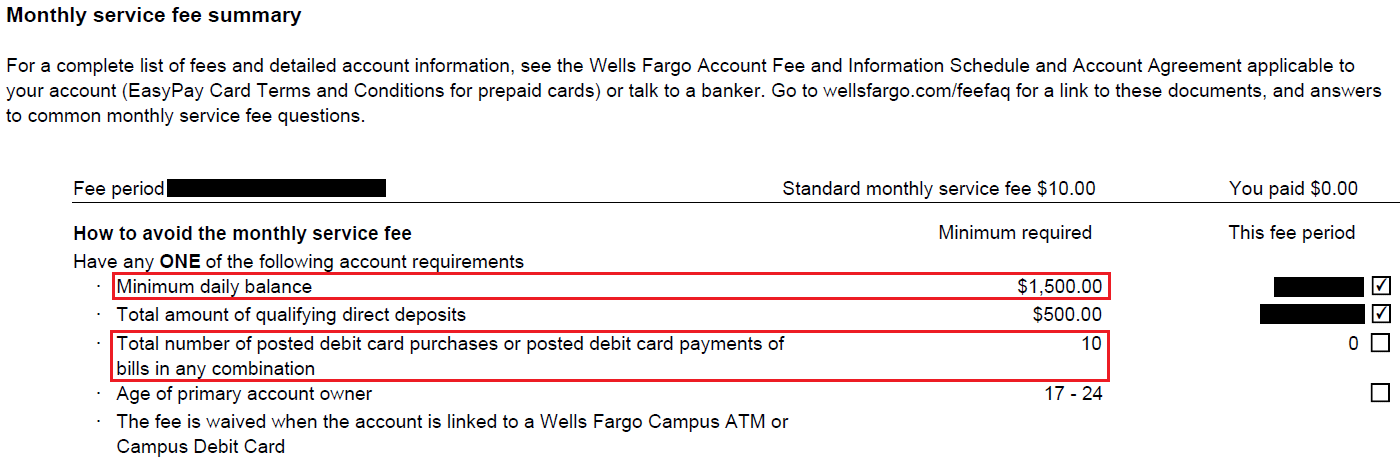

By comparison, here is a screenshot of the current requirements to waive the $10 monthly service fee. The current minimum daily balance is $1,500. That is going to drop down to $500, which is very good news if you want to park $500 in the checking account and leave it alone. The $500 direct deposit requirement is not changing. The 10 debit card purchases requirement is going away. I never use my Wells Fargo debit card for anything, other than ATM cash withdrawals, so this is not a loss to me, but I have some friends that use their Wells Fargo debit card as they everyday card. If the primary account owner is between 17-24 years old or the account is linked to a Wells Fargo Campus ATM or Campus debit card, those requirements are not changing.

So these changes are either good news or bad news, depending on how you currently get the $10 monthly service fee waived. If you are paying the $10 monthly service fee on a regular basis, see if you can change your habits / behavior to waive the monthly service fee, or consider switching to another bank or credit union that has no or lower monthly fees. If you have any questions about these changes, please leave a comment below. Have a great weekend everyone!

Grant, this is why I love your blog. You cover issues no one else does. Like you, I have a WF Everyday Checking a/c, don’t use my debit card, and just park $1,500 for free checking. I get e-statements which I never read, so I didn’t know I’ll be able to use the extra $1K in my acct effective 10/8! Thank you for the good news! (Lesson learned: read my statements.)

Hi Rick, thank you for the compliment. My motto for the blog is to write about stuff that I would want to read about and I often find nuggets of good info in credit card and bank statements. The banks and credit card companies like to sneak in changes in their statements and that is usually the first place changes are announced. Glad I could free up $1,000 for you to put elsewhere :)

In almost the exact same boat as Rick, though my lesson is to make sure you follow the blogs and never read your statement. Thanks, Grant.

Happy to help Rob, have a good evening :)

Pingback: Recap: Wells Fargo Checking Changes, DoorDash IPO & More - Doctor Of Credit

Good news! Frees up $1,000. Now they need to do the $400 promo again… P2’s 12-month churn came just after they pulled it a few weeks ago.

The $400 Wells Fargo checking account bonus was pretty easy, hopefully they bring back that offer soon.

I don’t have a P2, but I’d have to cancel my Wells Fargo account and then wait a year to get the offer again right? I kind of like the $500 minimum balance and WF location convenience.

I would check with Doctor of Credit to see what the requirements are for getting the bonus again in the future. You may need to wait a year between getting bonuses.

Why anyone would do business with WF is beyond belief. They are a crooked, cheating, sham of a business. Literally being sued for BILLIONS in fines by the USG. Thats YOUR money!

To get at least a thousand dollars a year in net bonuses from the complete and utter crooks? Seems pretty simple logic to me.

Or to have a throw-away bank in which to deposit certain money orders.

Just got my statement with the notice. It also says that I’ll be getting a fee waiver for nine months beginning on 11/08.Anybody else?

That’s interesting, I wonder why. Were you ever charged the monthly service charge?

Yes. That one month i only did 9 debit card transactions.

Got it, maybe Wells Fargo wanted to give you plenty of time to see the new change to the monthly service fee waiver requirements.

Same here but i like the swipe 10x option better

For me it’s bad news. I use the account as my everyday account. I have it as a joint account and i don’t do much on it except use it to pay bills. So i try to make 10 transactions to make sure i don’t pay the service fee but now I’ll have to be parking $500 that I’ll be needing until the billing cycle closes

Would you be able to do a $500 monthly direct deposit and then move the funds to your primary checking account at a different bank? That will avoid tying up the funds with Wells Fargo.

I have no extra money. Right now $10/month is a fortune. I’m only with WF because of zelle and how easy it is to move money around in the family for groceries they pick up for me, etc. I depend on the 10 transactions to get my fee waived. I’m disabled and don’t drive, and have no clue why I’m going to do. I bet the guys at the top never thought $10 would make someone cry, even if they gave a rat’s rear about it at all.

I’m very sorry to hear that this change will be hard for you to manage. Zelle works with 924 different banks and credit unions, so maybe there is a different bank that has easy monthly fee waiver requirements you could use. Check out the list here: https://www.zellepay.com/get-started

I know I could look it up, but this is easier. Sorry. Can Zelle work between banks? If my family stays with WF and I switch banks could that still work?

Yes, that is the entire point of Zelle. It doesn’t matter what bank everyone has, it will still work!

Yes, VeeRob is correct. Zelle works across all 924 different banks and credit unions, so it doesn’t matter what bank / credit union you use and what your friends / relatives use.

A couple of months ago, even though I had made more than 10 debit card purchases or debit card payments of bills in combination, I still was charged a monthly service fee. I tried to dispute it, referring to my checking account statement document; in response, I received “our records indicate 1 debit card purchase/payment posted to the account” …What the heck is that?

Hi Liah, that is strange, it sounds like you completed the requirements to waive the monthly service fee. Has this happened to you more than once?

The first time I noticed that type of actions back in 2016, as I always did/do my Bill Paying online with them and check my monthly statement(s) on a regular basis. At that time, they blamed their system and said that it had been a technical error; then, they apologized and refunded the disputed amount.

This year, they charged my checking account a monthly service fee two months in a raw, for two periods. After I had asked Wells Fargo online to provide an explanation why the monthly fee was charged for [period 1], one of the representative wrote “Because we value our relationship with you, I reimbursed your account in the amount of [$]. A fee was assessed on [date] because the account didn’t meet the requirements to waive the monthly service fee,” when it actually did according to my checking account statement document, “our records indicate 1 debit card purchase/payment posted to the account during [period 1]”.

As to [period 2], they have not refunded the disputed amount; their written response was, “our records show that there are only one debit card transactions posted to your account for the month of October (?) statement cycle starting from 08/11/2020 through 09/09/2020 (?)”, when I actually was speaking about the period from 07/11/2020 through 08/09/2020 (August 2020 Statement) in my disputing letter.

Hi Leah, that sounds really frustrating dealing with Wells Fargo. It’s like there is a language barrier between the questions / comments you are making and what the WF rep is hearing.

It’s Unethical Business Practices, this is what it is. Let’s call things by their true names, Grant. …Ultimately, I received my refunds and switched to another bank.

Hi Leah, I’m glad you got your refunds and switched to a new (hopefully better) bank. Have a great day :)

Pingback: Wells Fargo May Close Accounts with Zero Balance or Charge Monthly Service Fee (Effective August 9)

I lost income from my direct deposit, so the logical thing is to charge me $10 a month? Plus, if I use an out of network , I pay the fee and then Wells Fargo charges an additional $2.50. So I’m DONE. Check out Capital One 360 account. No fees for anything! Loving it so far!

Hi Anna, I’m glad you are liking Capital One 360 checking. Have a great weekend.