Good morning everyone. I wrote a similar post in 2019 but I thought it was worth a refresher (Easily Request a Credit Limit Increase (No Hard Pull) via the Citi App). If you have a Citi credit card and use the Citi App, you can quickly and easily request a credit limit increase through the Citi App. I will walk you through the steps and share the results of my 4 Citi credit limit increase requests. Having larger credit limits help with your credit utilization ratio and there are no hard pulls or credit checks (all 3 of my credit reports are currently frozen and I didn’t receive any credit monitoring alerts after making the credit limit increase requests).

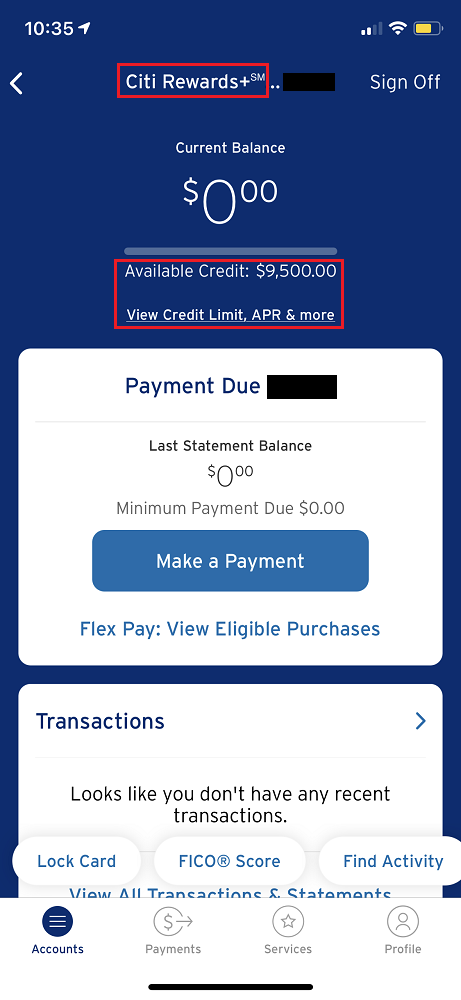

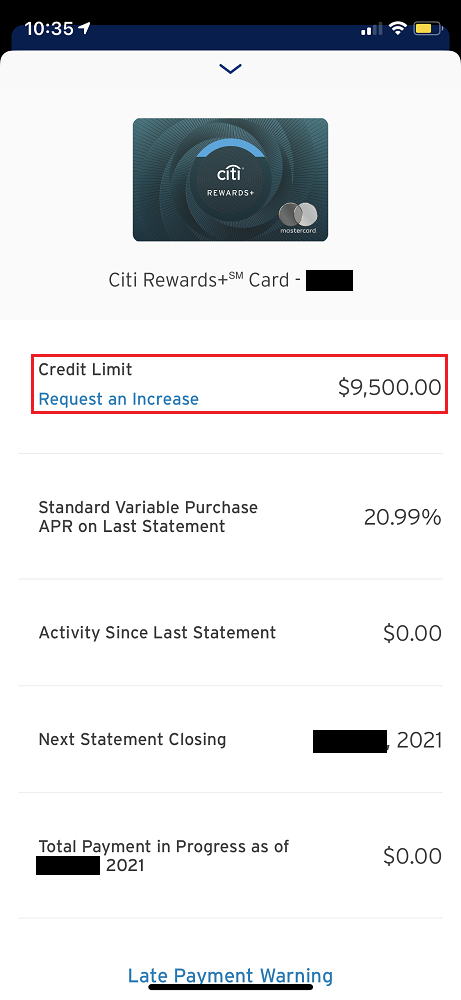

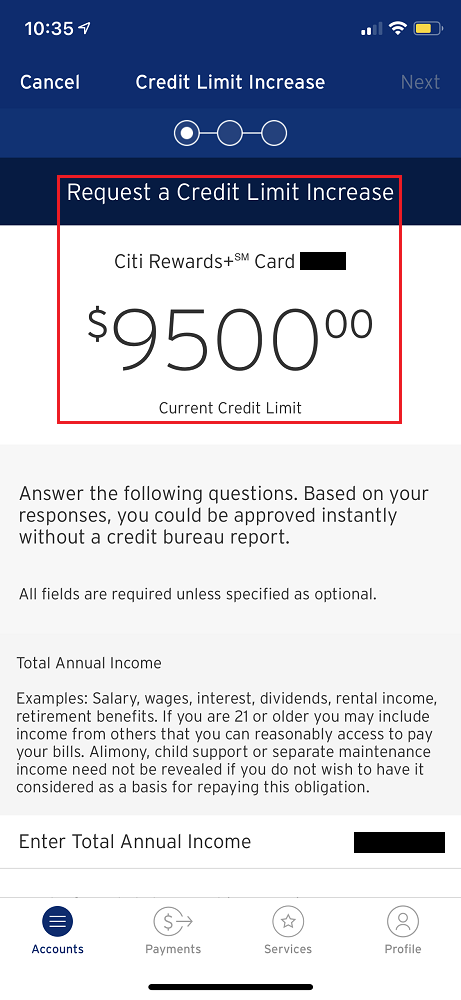

I will go through the steps on my Citi Rewards+ Credit Card, but the steps are the same for any Citi credit card. To get started, sign into the Citi App and click on the credit card you want to do a credit limit increase on. Then click the View Credit Limit, APR & More link. Then click the Request an Increase link.

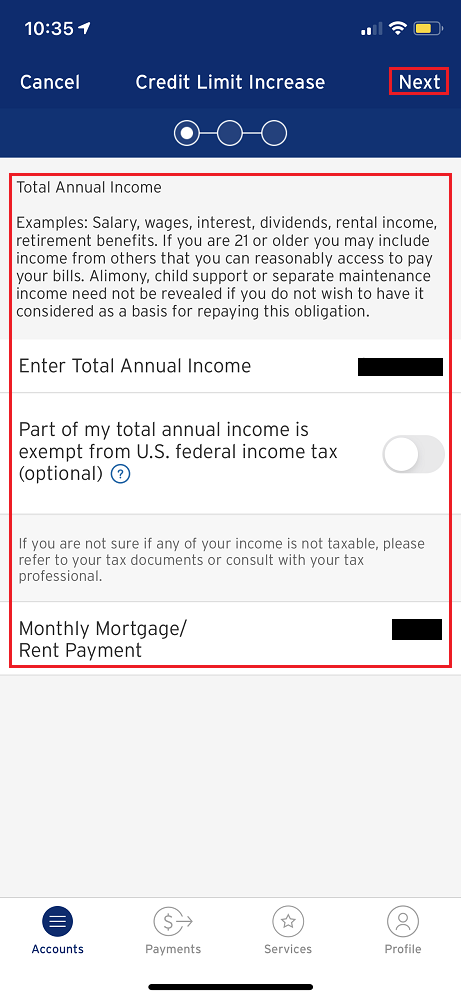

Scroll down the screen and enter your total annual income and monthly mortgage / rent payment. I believe if you are married, you can list your combined income with your spouse. Then click the Next link in the upper right corner.

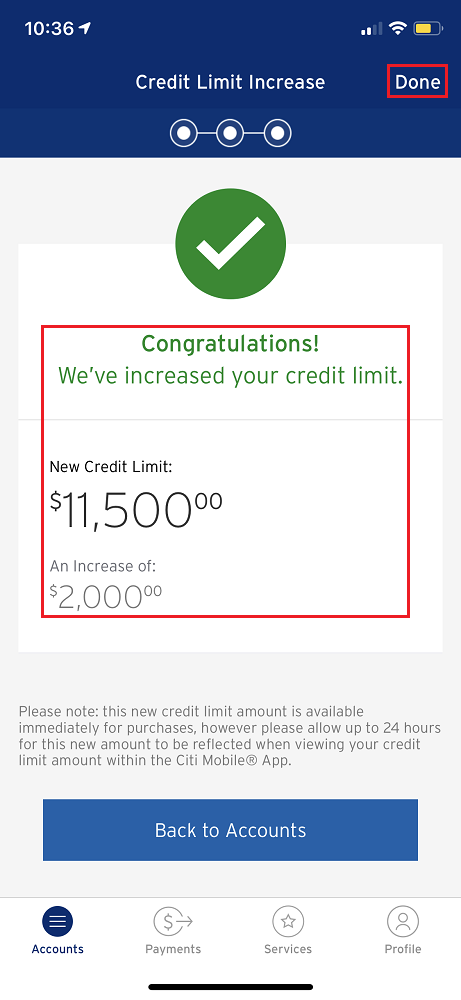

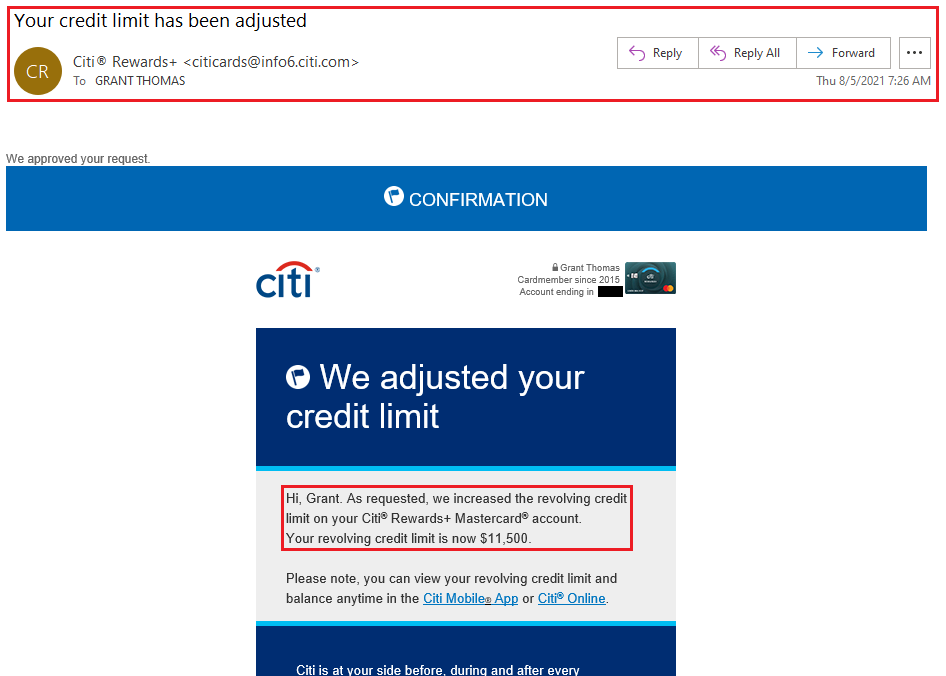

Review the information and click the Submit link in the upper right corner. If your credit limit increase request is successful, you will see your new credit limit. For my credit card, I was able to increase my credit limit $2,000 from $9,500 to $11,500. Then click the Done link in the upper right corner.

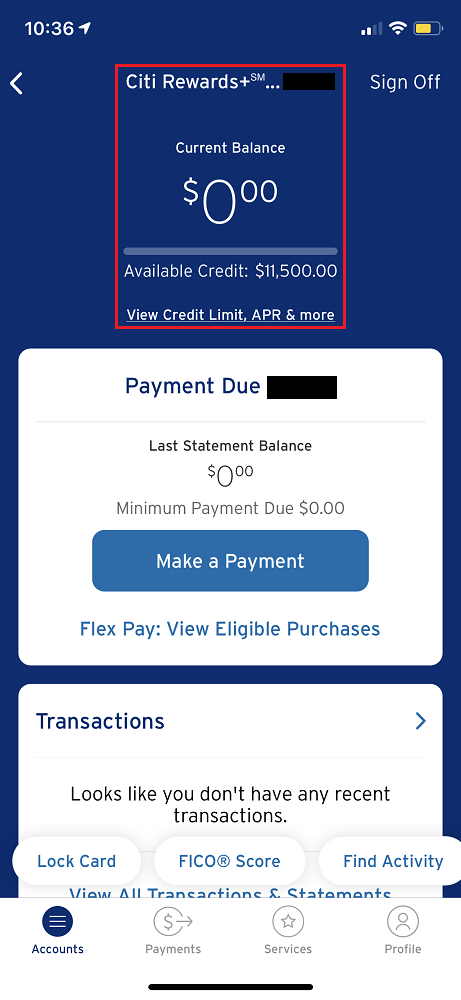

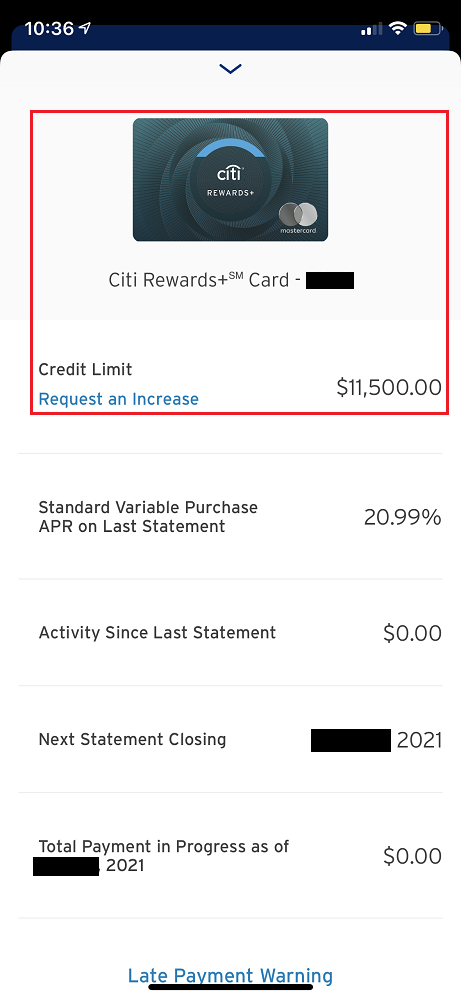

Your credit limit increase is instant and you can see the new credit limit under your current balance and on the View Credit Limit, APR & More link.

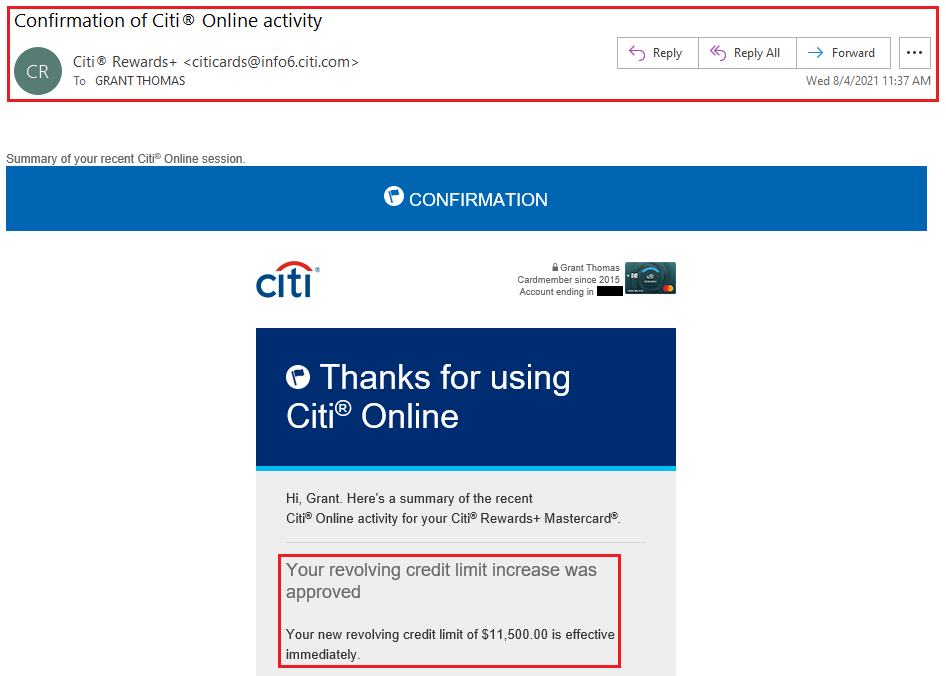

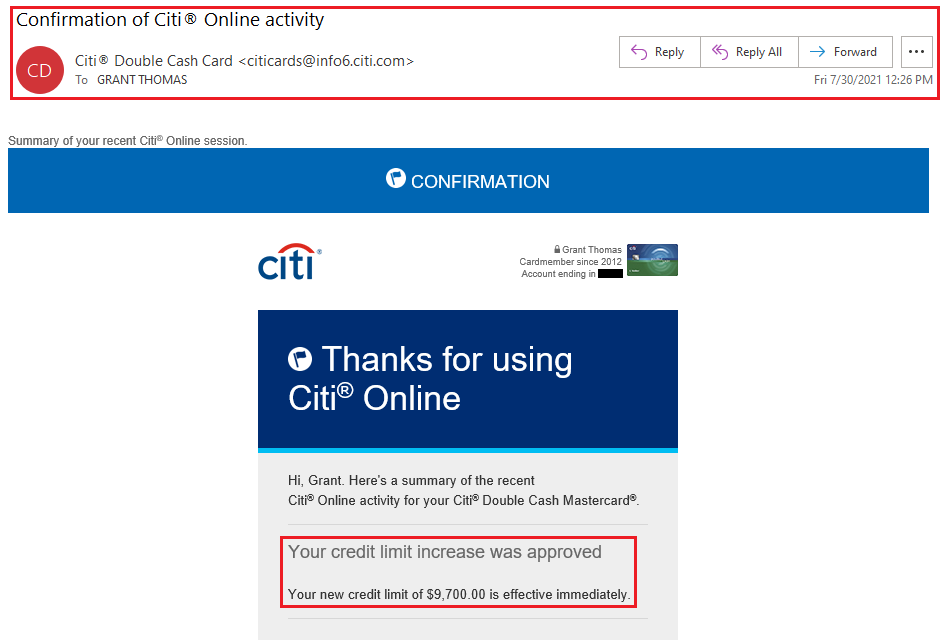

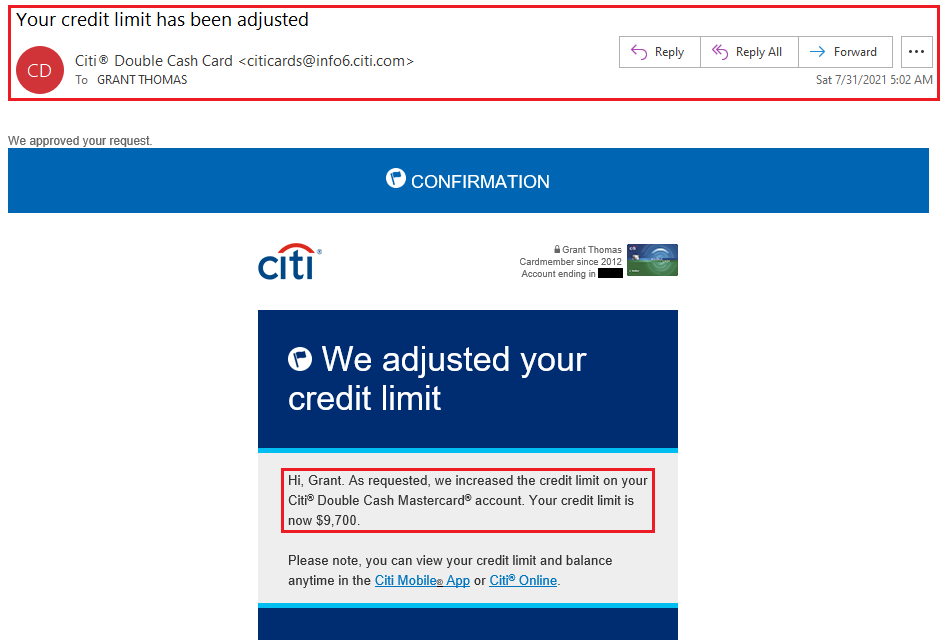

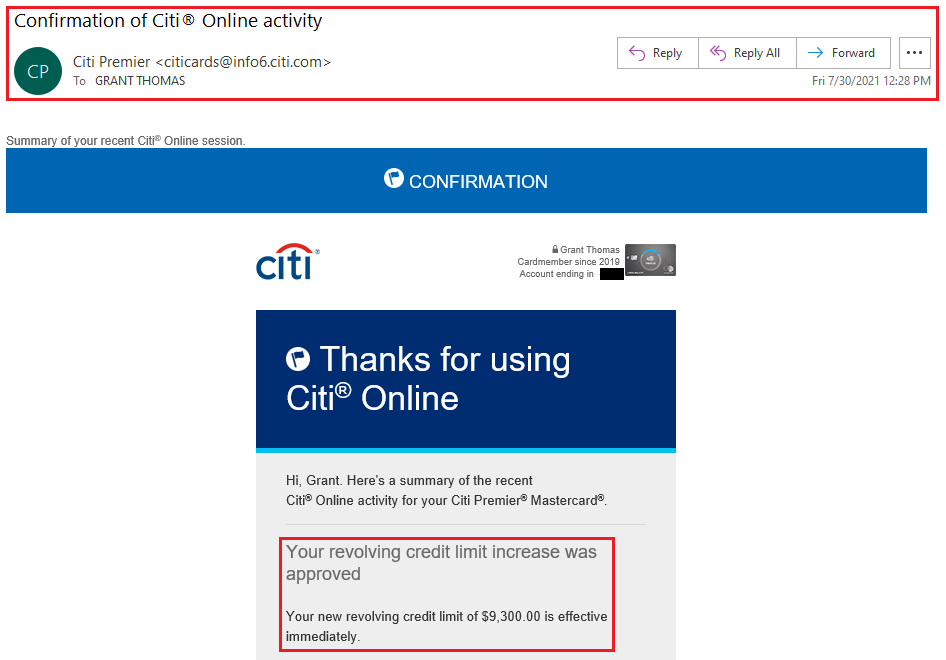

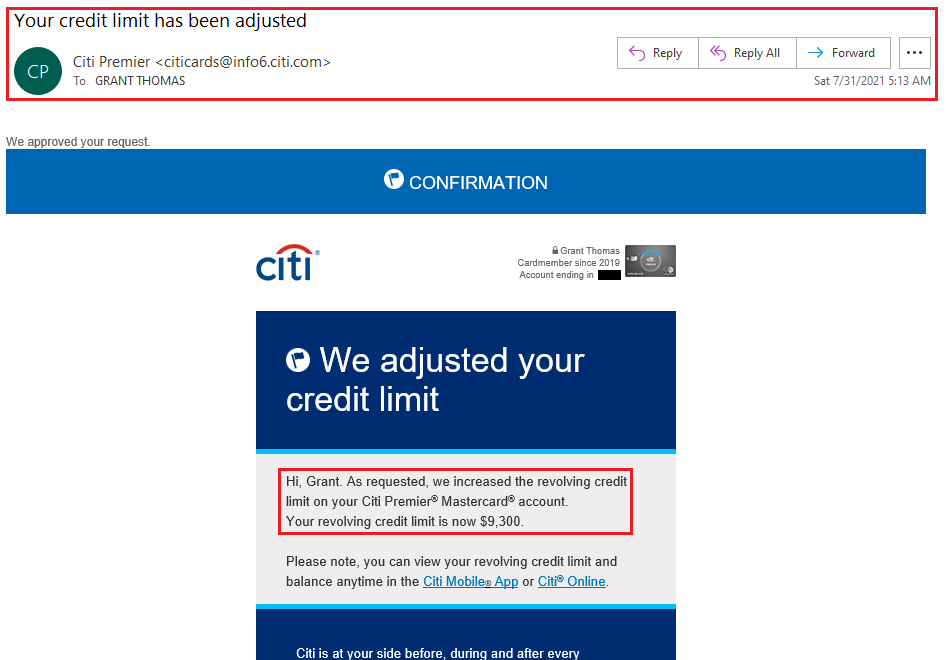

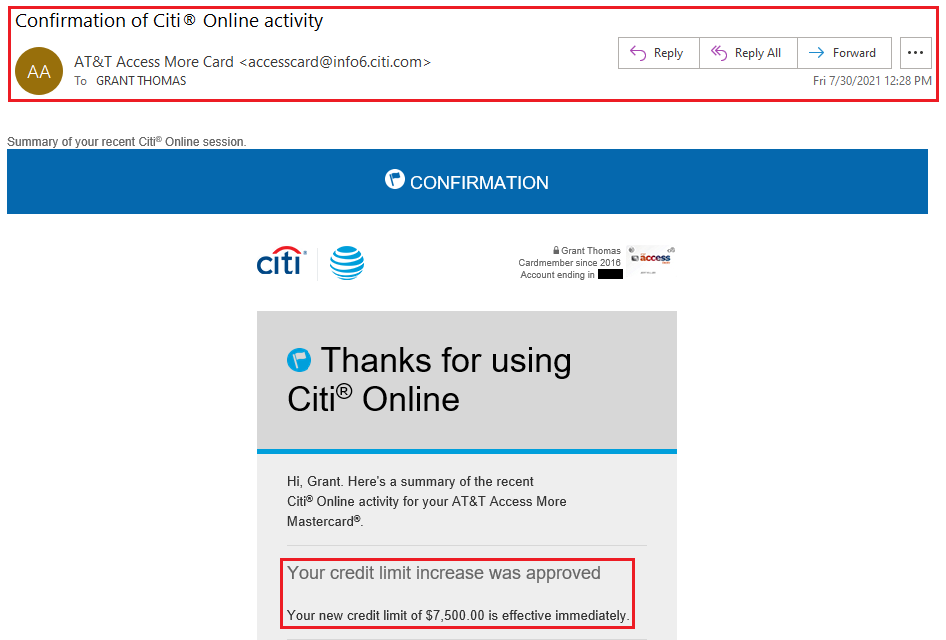

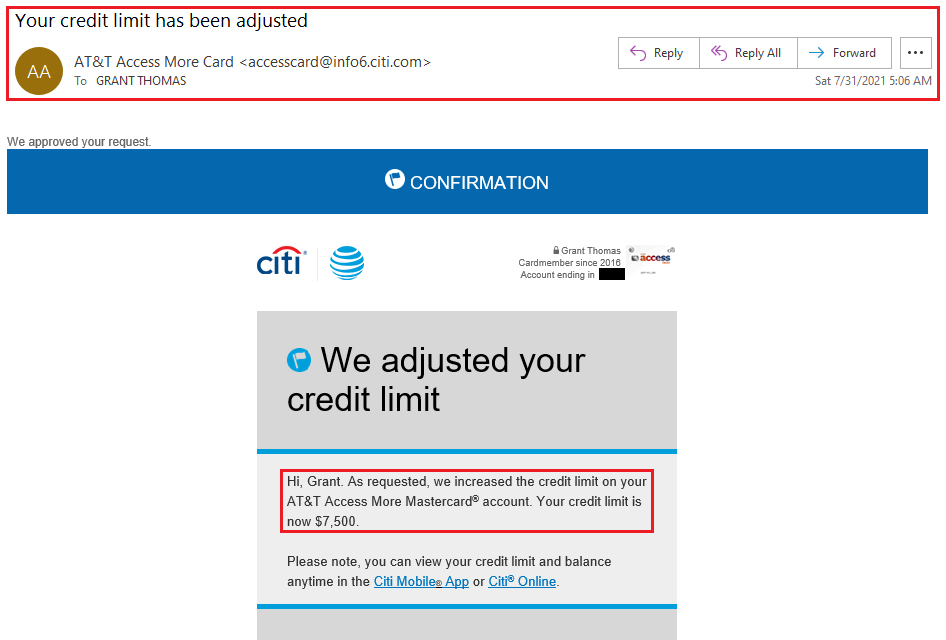

You will receive 2 emails from Citi for each credit limit increase request: Confirmation of Citi Online Activity and then a second email 12+ hours later with the subject line: Your Credit Limit Has Been Adjusted.

I was able to increase the credit limit on my Citi Double Cash Credit Card by $2,000 from $7,700 to $9,700.

I was able to increase the credit limit on my Citi Premier Credit Card by $2,000 from $7,300 to $9,300.

I was able to increase the credit limit on my old Citi AT&T Access More Credit Card by $2,000 from $4,000 to $6,000.

I’m not sure how often you can make a credit limit increase request, maybe once every 6 months or once every 12 months. Since there is no hard pull or credit check, there is really no downside in requesting a credit limit increase. I would recommend starting with the credit cards that you use the most and that have the smallest credit limits, and then repeating the process for any other Citi credit cards you have. If you have any questions about the process, please leave a comment below. Have a great day everyone!

Tried and denied increase with 832 score

Hi Peter, that’s a bummer. Did you change your income or housing costs when requesting the credit limit increase?

No change in housing, bumped up income to reflect last tax return.

That’s what I did too.

The one thing I was wondering is whether them extended more credit on current cards would prevent instant approvals on new applications? I’m assuming it would as the amount of credit increases. Is there anywhere that shows how much credit they will extend to a person based on income level, etc?

Hi Dave, that is a great point. Yes, if you plan on applying for more Citi credit cards in the future, you may not get instantly approved if Citi has already given you all the credit limit they will give you. This is usually a pretty easy reconsideration call where you can transfer part of your credit limit from different cards in order to get approved. I don’t think there is anywhere where you can see how much credit limit Citi will give you. I think it is a complicated formula that includes your credit score, your credit history with Citi, and current income.

Should I have a “Zero” balance before requesting a CLI? I pay off my statement balance in full every month but use about 60% of my credit limit. Had the Citi Premier card for 3 months now.

Hi Steve, I think you might need to wait a few months before requesting the credit limit increase since your account is only 3 months old. I don’t think you need a $0 balance since some of my accounts had recent charges and the credit limit increase was still approved.

Hi Grant! Thanks for the reply. Good to know I can have a balance on there and still apply for the CLI. You’re right though, I was planning on waiting until November – which would be my six month mark. I’m just hoping Citi may auto increase my limit before then. If not, I will ask for a CLI one day after the six month anniversary of my Premier card. Thanks again for the info!

I don’t think I’ve ever received a credit limit increase from Citi without requesting. I think you should be fine waiting 6 months. Good luck on the request!

My husband is an independent contractor and has many write offs, as a result. Is it beneficial to enter the non-taxable income when updating income? Or will that have a negative impact on limit increase chances?

Hi Alexis, that is a good question. Whatever he considers his income should be fine. Maybe split the difference between non-taxable and taxable income?

I followed your steps and got a 5k increase on a soft pull, so thank you.

Hi Eric, that is great to hear, congratulations on the credit limit increase :)

I requested an increase on my Citi Double Cash card from 13.5k to 20k. After about 3 days, I was approved – but they did a hard pull without my authorization.

Hi Lucifer, how did you request the credit limit increase? Did you do it through the app or by calling Citi?