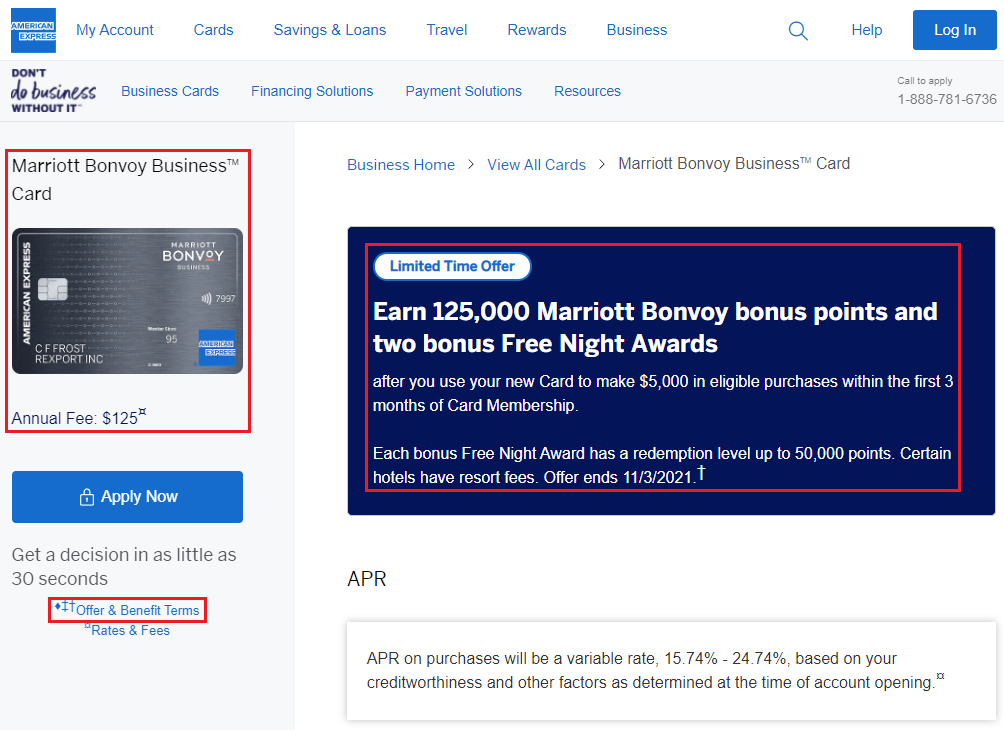

Good afternoon everyone, I hope you had a great weekend. A few weeks ago, I was planning on applying for the American Express Marriott Bonvoy Business Credit Card. As of October 18, the current sign up bonus is 125,000 Marriott Bonvoy Points plus 2 Free Night Certificates (up to 50K Points / Night) after spending $5,000 in 3 months. I have never had this specific credit card before, so now seemed like a great time to pick up this credit card with an increased sign up bonus. Before I applied, I reached out to American Express via their online AMEX Chat feature to see if I was eligible. I will explain more below, but long story short, the AMEX Chat rep said I was eligible, but the AMEX popup said I was not eligible.

In the above image, there is a small link for Offer & Benefit Terms that explains the eligibility requirements for this credit card. Here is what the first 2 paragraphs say:

Welcome offer not available to applicants who have or have had this product or the Starwood Preferred Guest® Business Credit Card from American Express. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Welcome offer not available to applicants who (i) have or have had the Marriott BonvoyTM Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy BusinessTM Credit Card from Chase, or the Marriott Rewards® Business Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy BoundlessTM Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy BoldTM Credit Card from Chase, the Marriott BonvoyTM Premier Credit Card from Chase or the Marriott Rewards® Premier Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus offer in the last 24 months on the Marriott Bonvoy BoundlessTM Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy BoldTM Credit Card from Chase, the Marriott BonvoyTM Premier Plus Credit Card from Chase or the Marriott Rewards® Premier Credit Card from Chase.

The second paragraph is pretty confusing, but the first line of the first paragraph is important to me because I had an AMEX SPG Business Credit Card from March 2017 to April 2018. I was hoping that AMEX would still approve me even though I closed that credit card more than 3 years ago. I was skeptical, so I reached out to AMEX Chat to see if they could give me a definitive yes or no. Here is my AMEX Chat conversation:

- Grant: Good morning AMEX Rep.

- AMEX: Hello Grant, good morning! I hope you’re having a good day.

- Grant: Yes, so far so good. Hope your day is going well too.

- AMEX: I am doing great today too! Thanks.

- Grant: I’m interested in the American Express Marriott Bonvoy Business Credit Card, but I want to see if I am eligible for the card and bonus.

- AMEX: Given that you do not have that kind of card before yes, you are eligible for the bonus. And when you apply online it will be indicated there as well.

- Grant: That is great news. I had an AMEX SPG Business Card a few years ago, so I wanted to double check before applying.

- AMEX: I can understand. If that has been closed off long ago, and yes, you are eligible. The system will prompt as well before you continue with the application if you are eligible or not.

- Grant: OK, good to know. So if I go through the application and do not see a prompt telling me I have had the card before, I should be eligible for the card and bonus?

- AMEX: Yes!

- Grant: Thank you AMEX Rep, I appreciate your help looking into this issue for me. Have a great day.

- AMEX: You are most welcome!

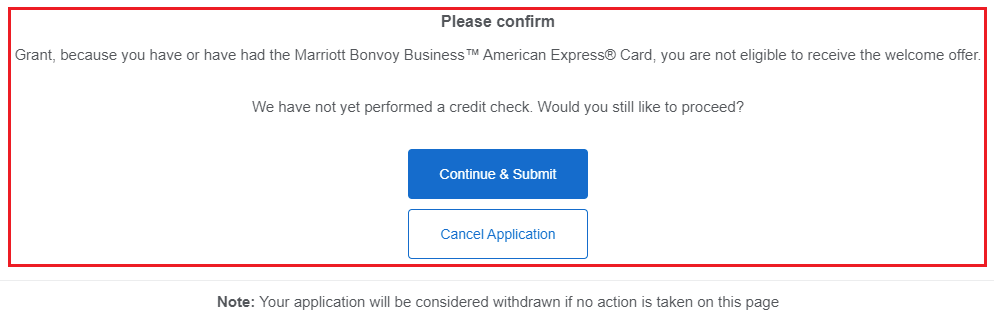

Based on the above conversation with the AMEX Chat rep, I decided to apply for the American Express Marriott Bonvoy Business Credit Card. Unfortunately, I got the dreaded AMEX popup stating that I have / had this credit card in the past and that I was not eligible for the sign up bonus. If I wasn’t eligible for the sign up bonus, I wasn’t interested in the credit card, so I clicked the Cancel Application button.

The moral of this story is that AMEX Chat reps cannot 100% confirm if you are eligible for a credit card sign up bonus, you will only find out if you see the dreaded AMEX popup on your credit card application. If you have any questions about AMEX Chat or card eligibility, please leave a comment below. Have a great day everyone!

I don’t see the point here. He covered himself by way of saying “…The system will prompt as well before you continue with the application if you are eligible or not.”

So while he personally thought that you should be okay he did say that you’d receive a message if you weren’t. And, well, you got the pop up. So…what’s the point you’re trying to make?

Hi Heavy, I agree that the AMEX Chat rep did cover himself by saying that “The system will prompt as well before you continue with the application if you are eligible or not.”

I was really hoping for a definitive yes or no from the rep, but the only thing I took away from the conversation was false hope.

I’m not sure I have much of a point, other than my disappointment.

It’s better to get the prompt than to take his word, apply anyway, and end up with nothing. Like you I had both personal and business versions of the SPG card would have loved to have cashed in on these new offers but no such luck.

I agree, I’m glad the prompt tells you before applying instead of finding out much later. I’m hoping one day AMEX SPG cardholders will be eligible for new AMEX Marriott bonuses.

FWIW: I called an Amex rep with a couple questions last month. This was one of them. I was told “maybe” by the rep…and just to apply to see what happens ♂️♂️

Hi Brett, it sounds like “maybe” is the standard response from AMEX reps. I don’t think they would ever want to say “no” since that could hurt their personal performance if they are wrong.

What the point of this article? Their computer is the ultimate decider who qualifies. The rep is just a rep, not the credit card decision officer.

Hi John, I debated if it was worth writing this post but ultimately decided that it might help someone who is in a similar position to me. I appreciate your feedback :)

I attempted to apply for the same card. I also had the spg card back in 2014, 7 years ago. I called rather than chat and the phone agent said I was eligible. Even if I get the pop up, I asked? Yes, you are eligible, disregard the pop up. So I applied got the pop up and applied anyway, approved, did the spend, didn’t get the bonus and amex said because I had the card 7 years ago. I mentioned the phone agent and they simply said the phone agent was wrong. The crazy thing is the card I had 7 years ago, I also didn’t get the bonus because this was right when amex instituted the lifetime rule. I had the same card years prior and got the bonus back then. Tried churning 3 years later and got zonked, pre pop up. So it’s been about 10 years since I actually got the bonus on the spg card. I thought and mentioned to amex that it was from the date of the bonus not having the card, which in my case is now twice with no bonus in 10 years.

Hi Frank, thanks for sharing your experience calling AMEX to check your eligibility. Bummer that the rep told you bad information and that AMEX wouldn’t give you the bonus even though you haven’t gotten a bonus on “that card” in the last 10 years. We can only hope that AMEX relaxes the requirements on this card in the future so we can pick up the sign up bonus.