Good afternoon everyone, happy Labor Day Weekend! This post may not be very exciting, but the principles behind this post are useful. Let me explain…

When US Bank converted my US Bank Radisson Rewards Credit Card into the US Bank Altitude Go Credit Card, I used it for a few weeks before deciding that I wanted to product change to another US Bank Cash+ Credit Card (for the 5% cash back categories). At the time, I had 31 points on my Altitude Go, so if I had decided to close my credit card instead, I would have lost those 31 points (worth 31 cents). But instead, by product changing from one card to another, US Bank converted my unredeemed rewards into statement credit (31 points = 31 cents).

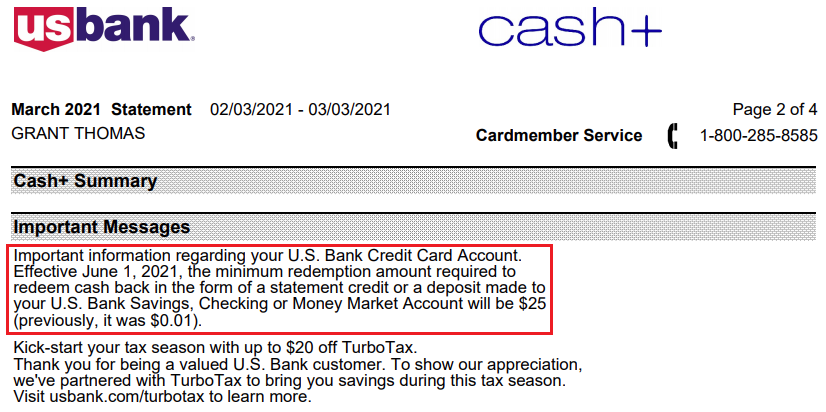

This is noteworthy because of the minimum redemption threshold normally required for the Altitude Go: “U.S. Bank points are worth a penny each when redeemed for options like cash back, travel, gift cards or merchandise, although minimum redemption requirements apply. (You need at least 2,500 points for cash back or gift cards; 1,000 points for travel or merchandise.)” US Bank has a similar minimum redemption threshold on the Cash Plus that went into effect on June 1, 2021.

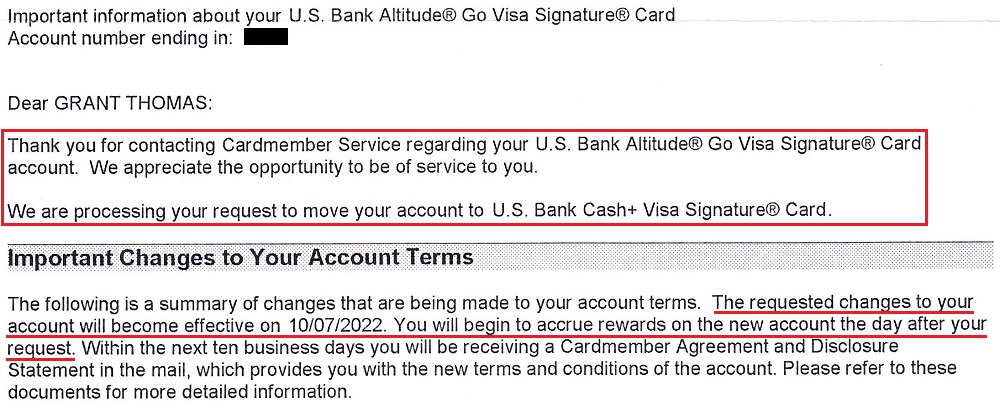

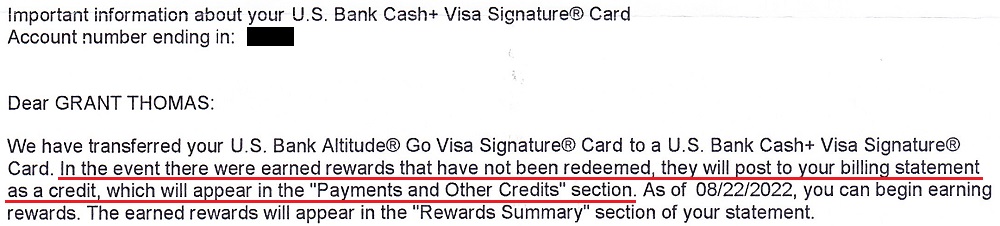

About a week after calling US Bank to process the product changed, I received 3 letters about the conversion. I’m not sure why US Bank didn’t include all of the details in the same letter, but here are the relevant parts of each letter. The first letter dated August 22 said that the change will become effective on October 7 but that I will start earning rewards the day after my request (August 23).

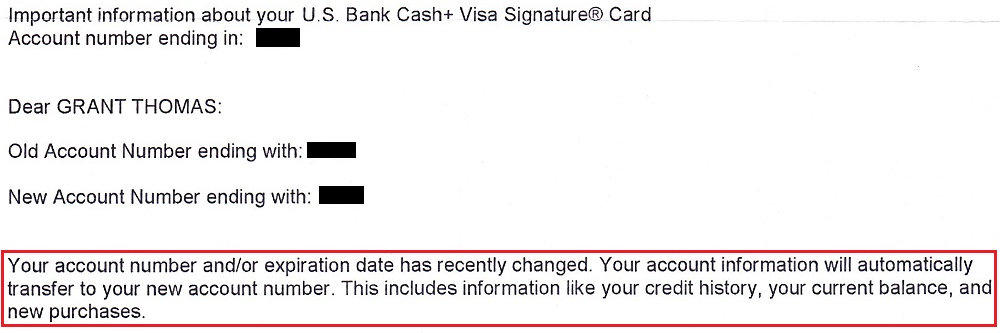

The second letter says my card number and expiration date have changed, but my account activity (like credit history) will transfer to the new account, which will benefit my credit score.

The last letter says that any unredeemed rewards will post as a statement credit.

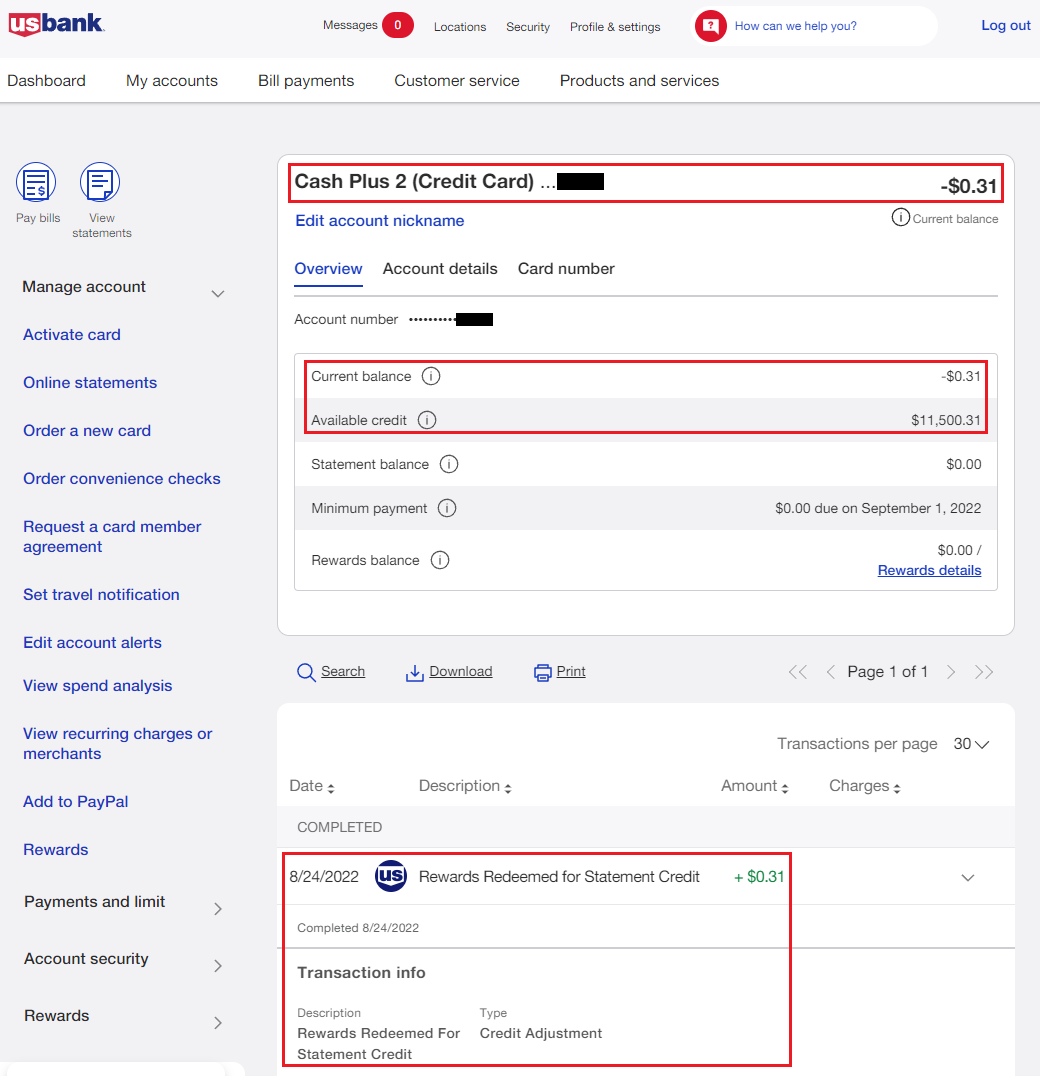

Indeed, the 31 points from my Altitude Go were redeemed for a 31 cent statement credit.

I understand 31 cents is a pretty small amount, but imagine you had 2,499 Altitude Go points instead. You wouldn’t have enough points to redeem for a rewards, so if you closed the credit card, you would have lost those points. But, if you product changed to a different US Bank credit card, your 2,499 points would have been redeemed and you would have a $24.99 statement credit on your account. I believe other credit card companies have similar processes for product changes, so if you have a small balance of unused rewards, you may be better off product changing to a different credit card in the hopes that your rewards can be redeemed toward a statement credit.

Please let me know if this post was useful. If you have any questions, please leave a comment below. Have a great weekend everyone!

I experienced something similar when I product changed my Altitude Reserve card to Altitude Go. I had 1271 points and they were automatically redeemed for $.01 each.

Hi BW, thanks for sharing your experience. I’m glad your leftover Altitude Rewards points were converted to a statement credit on your Altitude Go.

Just the right post I am looking for. I am trying to product change Altitude to Cash+. Another tip, You can add US bank to Paypal. Paypal allow you to pay with reward points without any minimum point redemption requirements.

Good tip Ryan, thanks for sharing. Hopefully your product change went smoothly.