Good afternoon everyone, I hope your weekend is going well. Much has already been written about the new-ish Citi Strata Premier Credit Card, but I wanted to do a deep dive into the earning categories and travel protections on this credit card, mostly so I could compare this credit card to the US Bank Altitude Reserve Credit Card.

This post has many links to the various pages on the Citi card benefits website, but you will need to sign into your Citi account first before clicking any of the links below. Let’s get started by covering the various travel-related earning categories on the Citi Strata Premier.

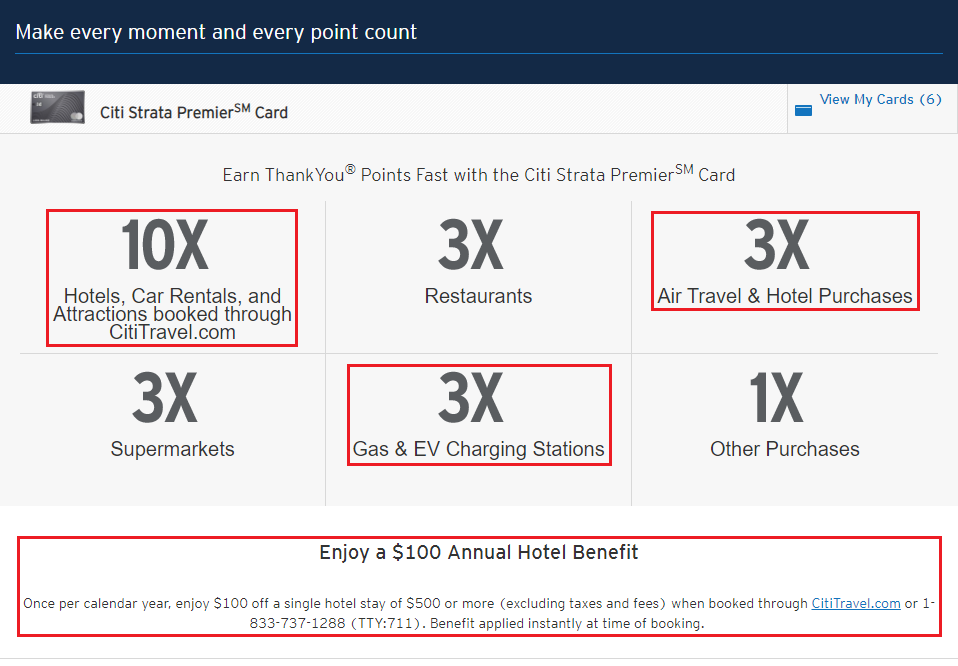

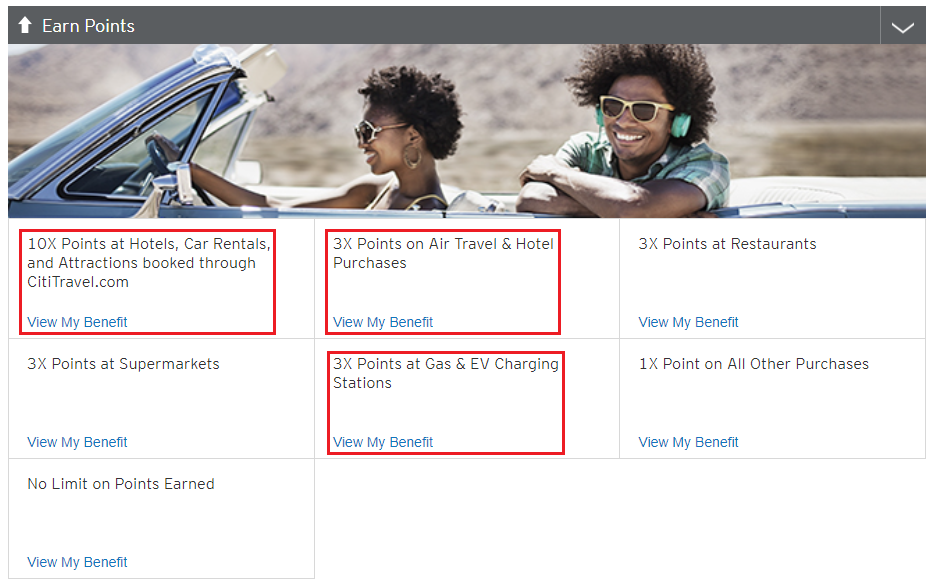

These are the 4 main travel-related earning categories:

-

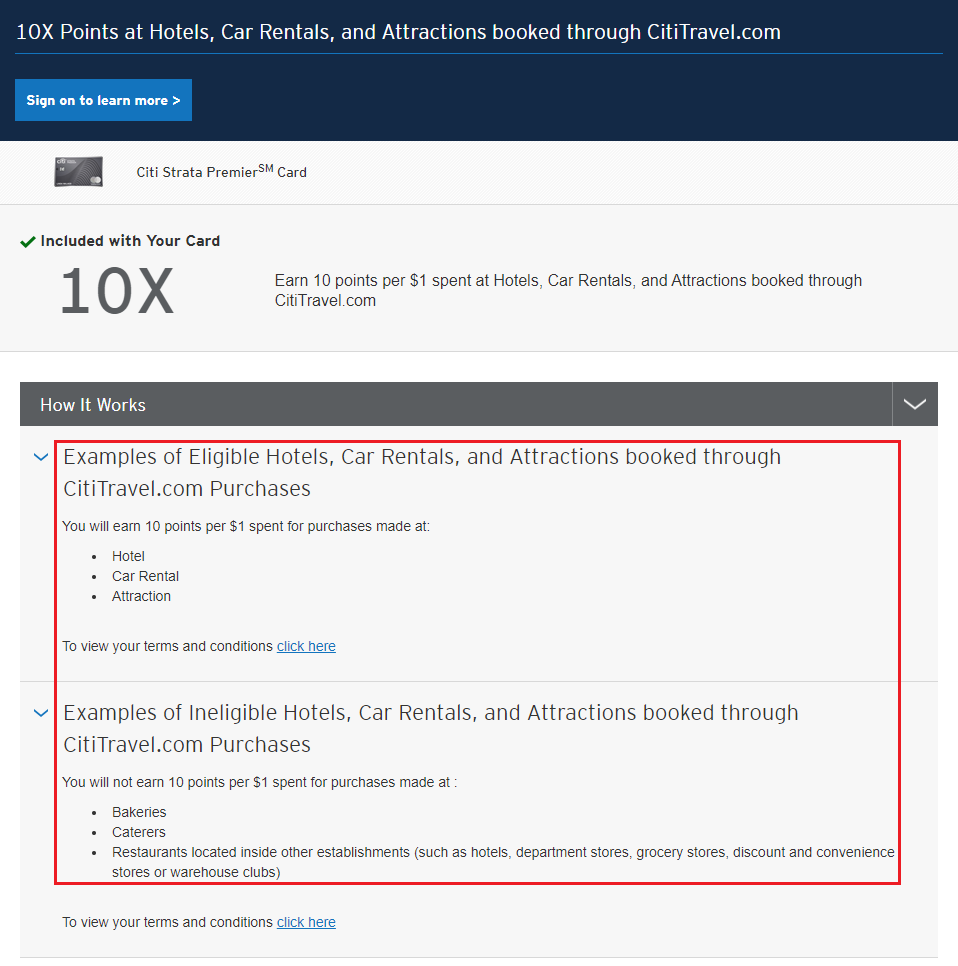

- 10X Points at Hotels, Car Rentals, and Attractions booked through CitiTravel.com

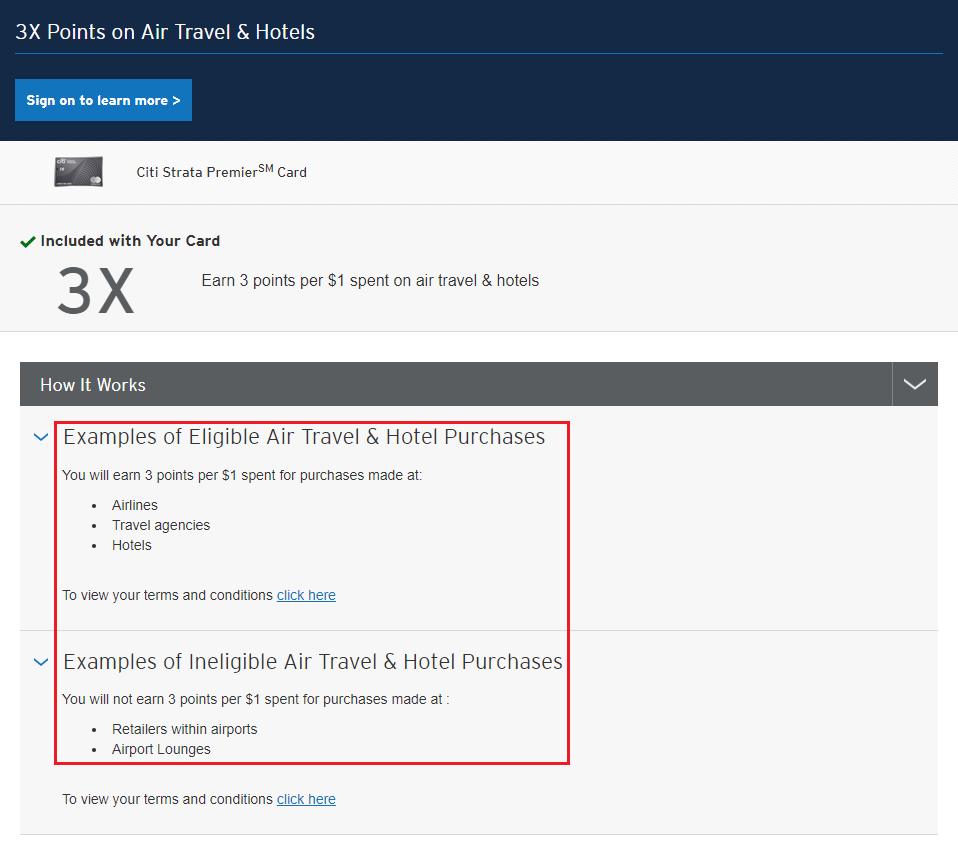

- 3X Points on Air Travel & Hotels

- 3X Points at Gas & EV Charging Stations

- $100 Annual Hotel Benefit

10X Points at Hotels, Car Rentals, and Attractions booked through CitiTravel.com – if you make hotel reservations, car rental reservations, and purchase attractions through the Citi Travel Portal, you will earn 10x Citi ThankYou Points (TYPs). Bakeries, caterers, and restaurants located inside other establishments are not eligible for the 10x TYPs.

3X Points on Air Travel & Hotels – you can earn 3x TYPs for making purchases directly at airlines, travel agencies, and hotels. This category will not stack with the 10x category above. You will not earn 3x at retailers within airports and at airport lounges (which are free if you have a Priority Pass membership).

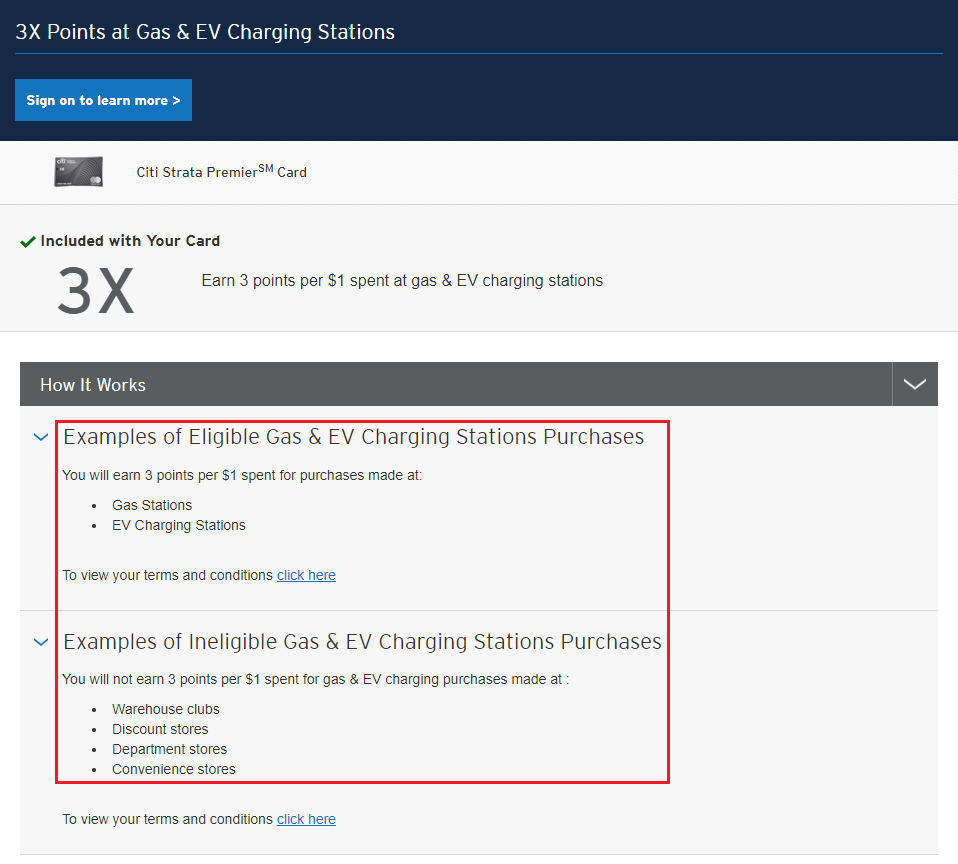

3X Points at Gas & EV Charging Stations – you can earn 3x TYPs at gas stations and at EV charging stations, but you will not earn 3x if you purchase gas or use EV charging stations attached to warehouse clubs, discount stores, department stores, or convenience stores.

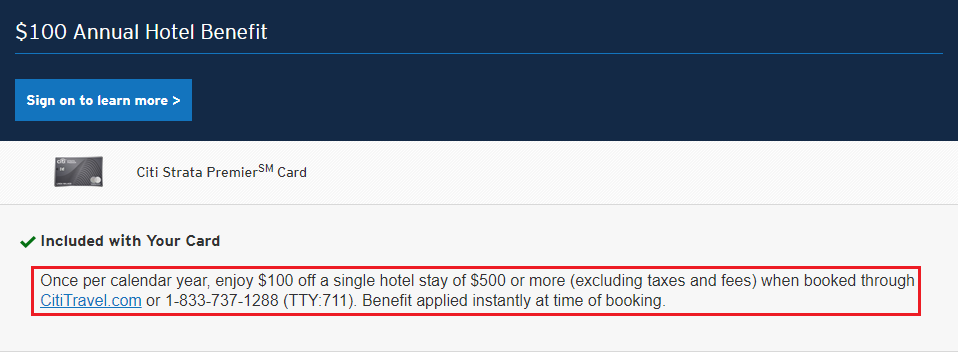

$100 Annual Hotel Benefit – lastly, you can use the $100 annual hotel benefit once per calendar year on a $500+ hotel stay booked through the Citi Travel Portal. I used this benefit last year which you can read about here: How to Book Hotel with Citi Premier Credit Card $100 Hotel Credit & Citi ThankYou Points.

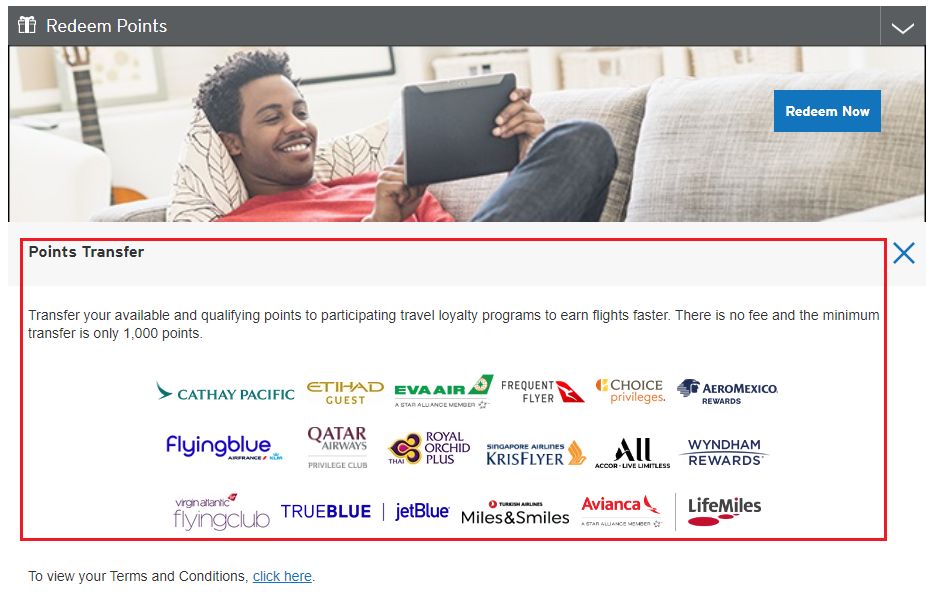

In my opinion, the best uses for Citi TYPs is by transferring them to travel partners. Currently, Citi partners with these 16 airlines and hotels.

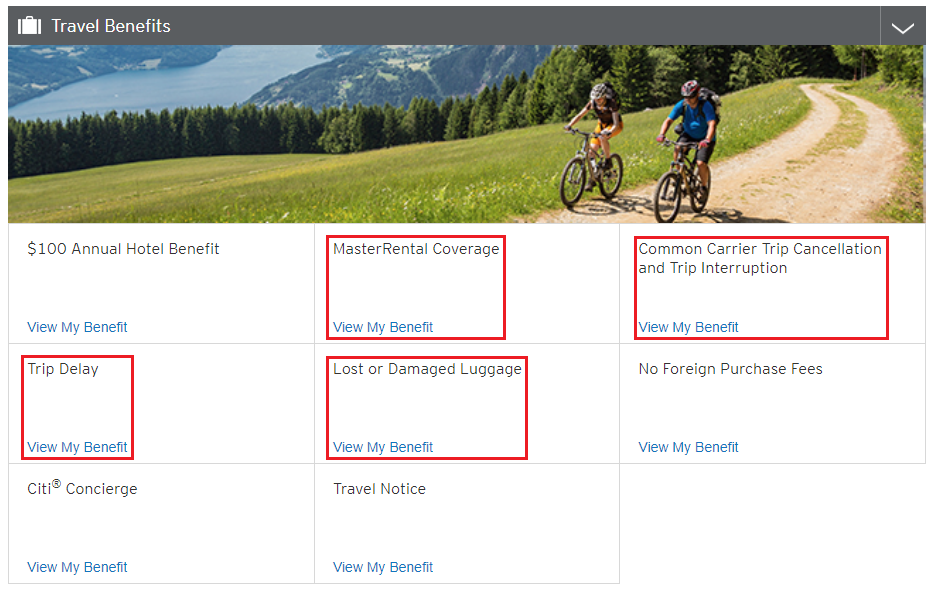

Let’s get into the nitty gritty of the Travel Benefits. I will cover these 4 benefits below:

-

- MasterRental Coverage

- Common Carrier Trip Cancellation and Trip Interruption

- Trip Delay

- Lost or Damaged Luggage

All 4 of these benefits went into affect on Monday, May 12, 2024. Purchases made prior to May 12, 2024, are not eligible for these travel benefits.

MasterRental Coverage – rental car collision damage waiver (CDW) coverage is secondary in the United States, but primary outside the United States. The entire cost of the rental car must be paid for with the Citi Strata Premier and cannot exceed 31 consecutive days. There are a few exclusions to be aware of. Certain types of vehicles (like full-size vans, pickup trucks, etc.) are not covered.

Common Carrier Trip Cancellation and Trip Interruption – you must charge the entire cost of the trip, or a combination of Citi TYPs + Citi Strata Premier to be eligible for this benefit, up to a maximum of $5,000 per covered trip. Coverage is secondary and in excess to other applicable insurance and benefits available (like refunds, credits, and vouchers from an airline). There are a few exclusions, including pre-existing conditions, non-emergency surgery, and one way travel that does not have a return destination.

Trip Delay – you must charge the entire cost of the trip, or a combination of Citi TYPs + Citi Strata Premier to be eligible for this benefit. If you experience a delay of 6+ hours, you are eligible for up to $500 per covered trip to cover certain expenses like meals, lodging, toiletries, medication, and personal use items. You are not eligible for this benefit if the common carrier is a helicopter or for one way travel that does not have a return destination.

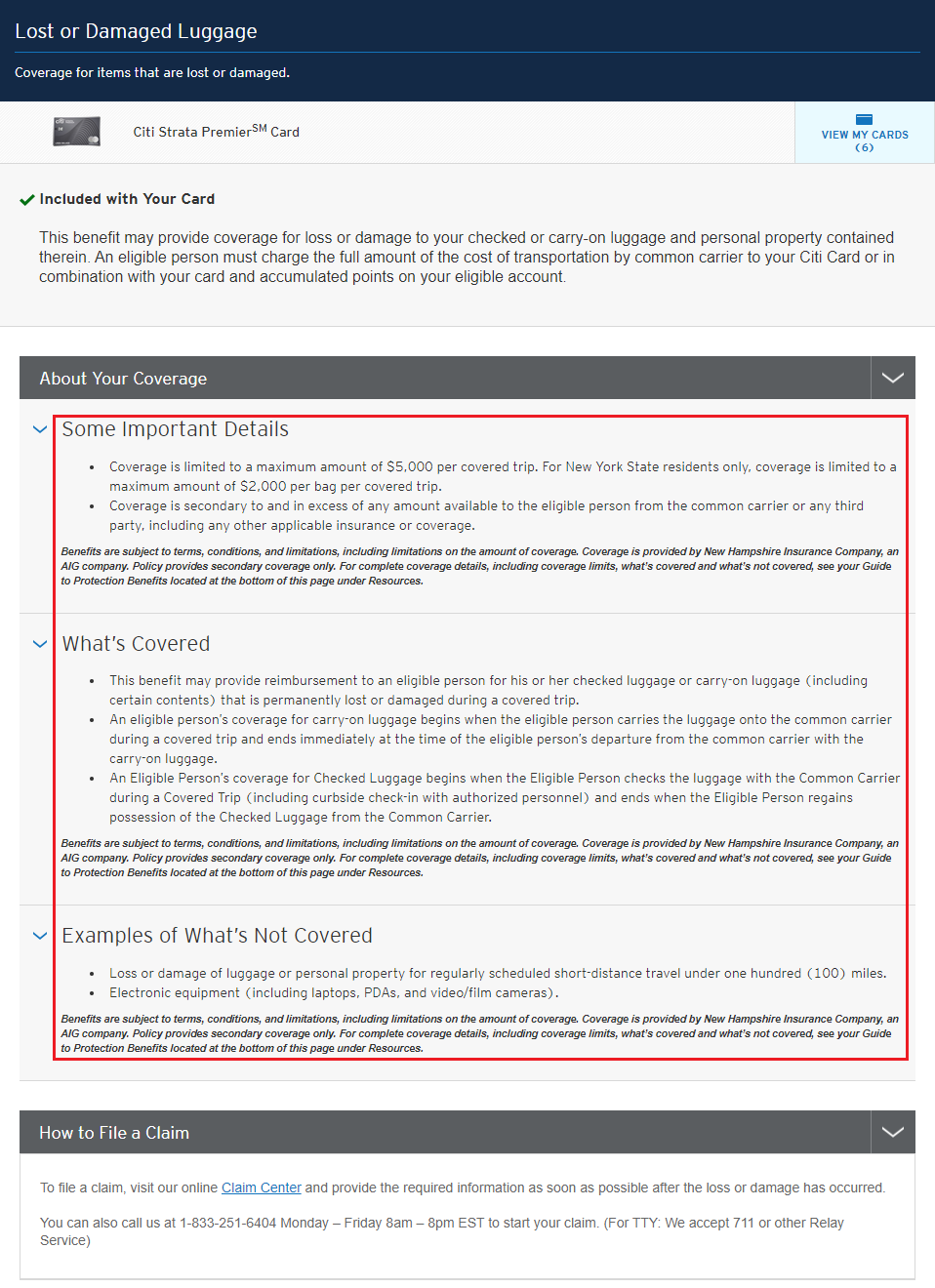

Lost or Damaged Luggage – you must charge the entire cost of the trip, or a combination of Citi TYPs + Citi Strata Premier to be eligible for this benefit. There is a $5,000 maximum amount per covered trip. If you are a New York resident, there is a $2,000 maximum per bag per covered trip. This covers checked bags and carry-on bags that are permanently lost or damaged during a trip. Electronic equipment, including laptops, PDAs, and video/film cameras are not eligible for this coverage.

I like the earning categories and the travel protections are better than nothing (like there was prior to May 12, 2024). If you have any questions about the Citi Strata Premier Credit Card earning categories or travel protections, please leave a comment below. Have a great weekend everyone!

Are award tickets where taxes are charged on Citi card covered?

I think this one way thing is really annoying. I do buy a lot of one ways and combine it with award tickets. My guess is that I won’t be able to use the insurance for the one way restrictions. How about the round the world ticket? Is it covered?

Hi Ken, those are all great questions, but I unfortunately do not have first hand experience with filing insurance claims with Citi. To play it safe, if it doesn’t 100% follow the rules listed, I would assume that the coverage does not apply. But I’m sure you could argue a case that buying 2 one way flights might count as a round trip flight. I’m not sure about award tickets either where just the taxes/fees are charged to the Citi Strata Premier.

I think an important question is how does Citi travel hotel bookings compare with using company site or 3rd party booking sites?

I think the Citi Travel Portal uses the Booking.com backend, so the prices should be the same as Booking.com and other OTAs.